In this briefing:

- Dali Foods (3799:HK): Short to HK$4.18 on Expected Cost Increases (Full Note)

- Aeon Credit Service (Asia) – Giant Yield and ROA, but at Low Price

- Dali Foods (3799:HK): Short on Expected Cost Increases (Summary Note)

- A Huge Wave of New LNG Projects Coming in the Next 18 Months: Positive for The E&C Companies

1. Dali Foods (3799:HK): Short to HK$4.18 on Expected Cost Increases (Full Note)

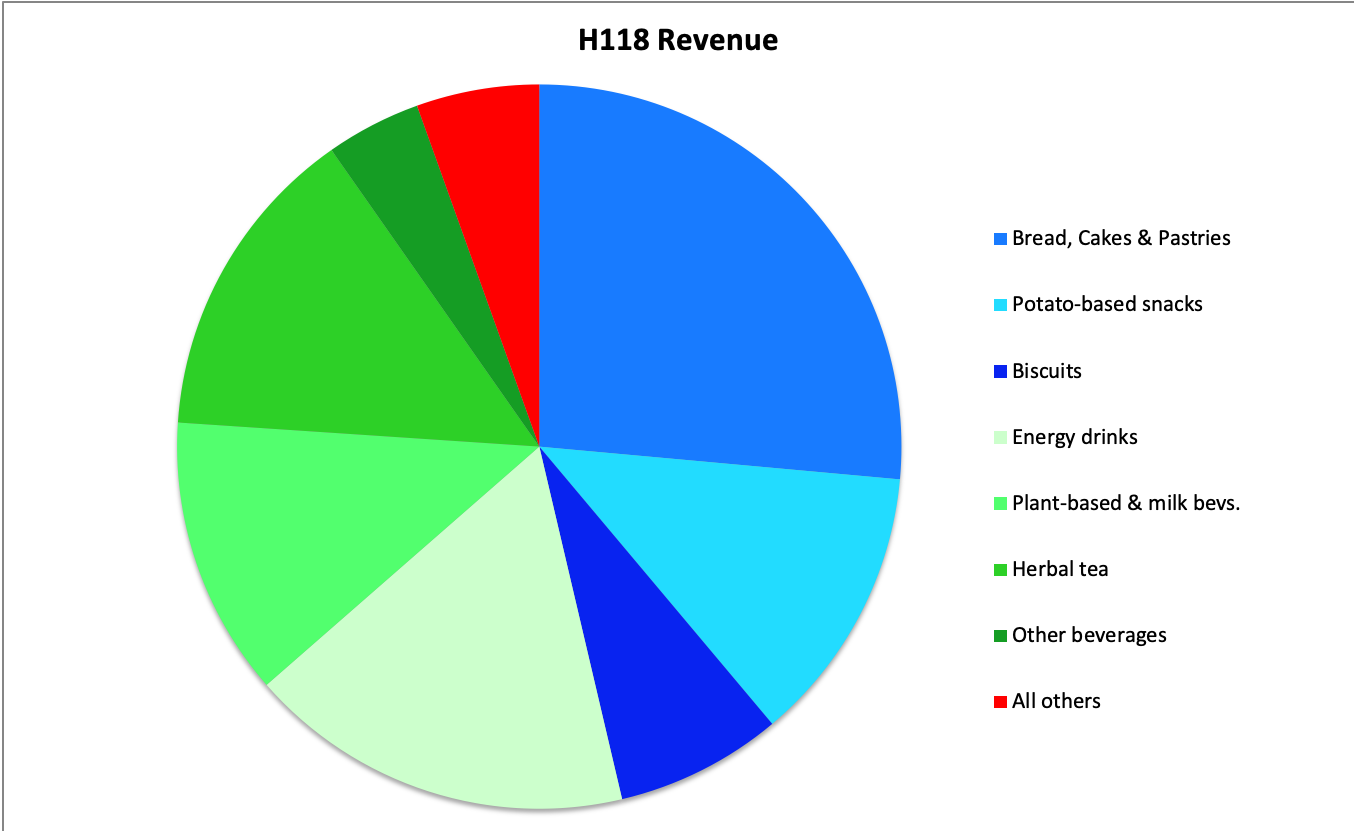

Chinese snack food and beverage maker Dali Foods Group (3799 HK) is well-loved by sell-side analysts, with 18 of 20 analysts rating the stock ‘Buy’ or ‘Overweight’.

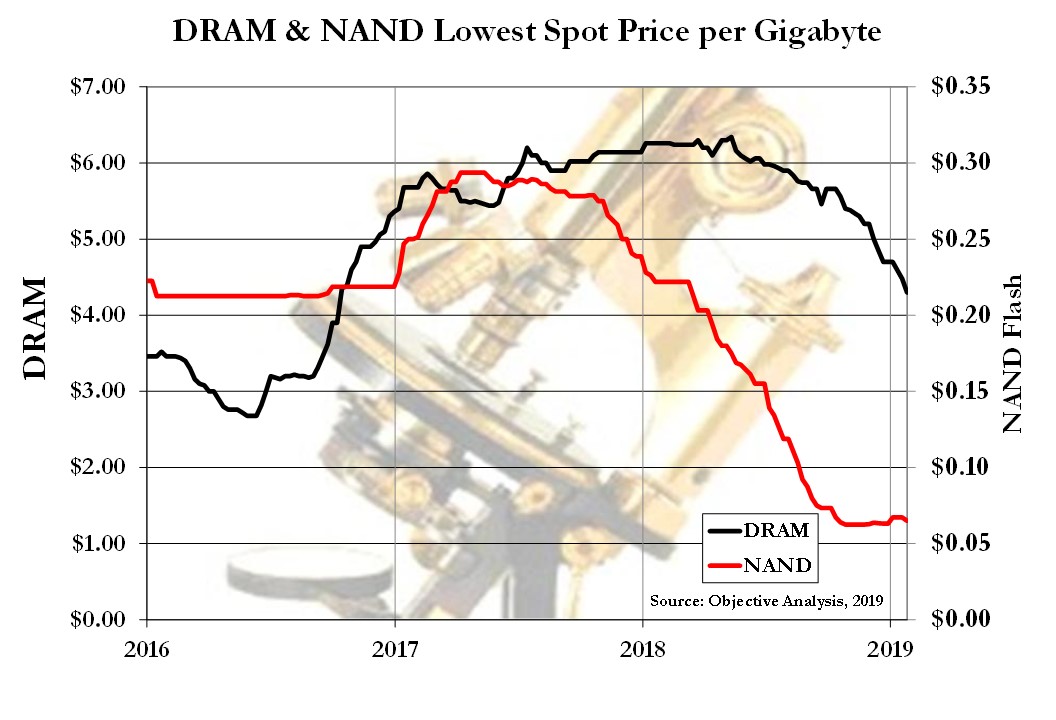

In contrast to the consensus ‘bull’ view of the company, we believe revenue growth is slowing and that core margins will soon come under intense pressure due to rising raw materials costs. As a result, our earnings estimates for Dali Foods are substantially lower than consensus.

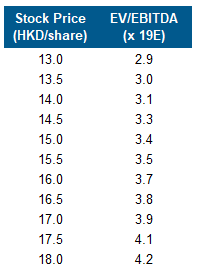

Based on 13.5 times our 2019 EPS estimate, our target price for Dali Foods’ shares is HK$4.18, about 23% below the closing price of HK$5.41 on February 1st.

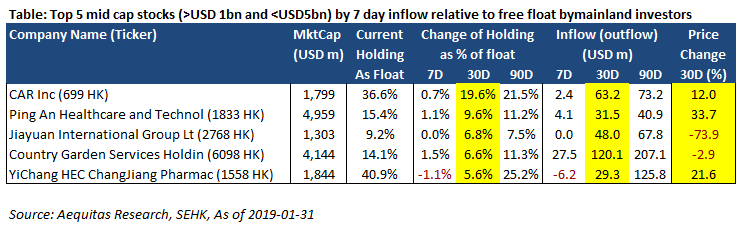

2. Aeon Credit Service (Asia) – Giant Yield and ROA, but at Low Price

As we expand over analysis of exceptionally high yield lenders, we continue to see interesting ideas outside of mainstream commercial banks. Aeon Credit Service Asia Co (900 HK) is another specialty lending that fits well with the several we have highlighted in our past research. There is one glaring difference though: value.

3. Dali Foods (3799:HK): Short on Expected Cost Increases (Summary Note)

Chinese snack food and non-alcoholic beverage maker Dali Foods Group (3799 HK) is well-loved by sell-side analysts. Fully 18 of twenty analysts (including all four of the ‘bulge bracket’ investment banks who cover it) rate the stock ‘Buy’ or ‘Overweight’, and only one analyst gives the shares an ‘Underweight’ rating.

The ‘bull’ case for Dali Foods includes continued strong revenue growth and further margin expansion over the next few years. In contrast, we believe revenue growth is already moderating and that core margins will soon come under pressure due to rising raw materials costs. As a result, our forward earnings estimates are substantially below consensus expectations.

Based on 13.5 times our 2019 EPS estimate, our target price for Dali Foods is HK$4.18, about 23% below its HK$5.41 closing price on February 1st. We suggest investors Short Dali Foods; current holders should consider exiting their positions, in our view.

A longer note that includes company and industry background, plus financial statements and forecasts for Dali Foods, can be found elsewhere here on Smartkarma using the company’s ticker.

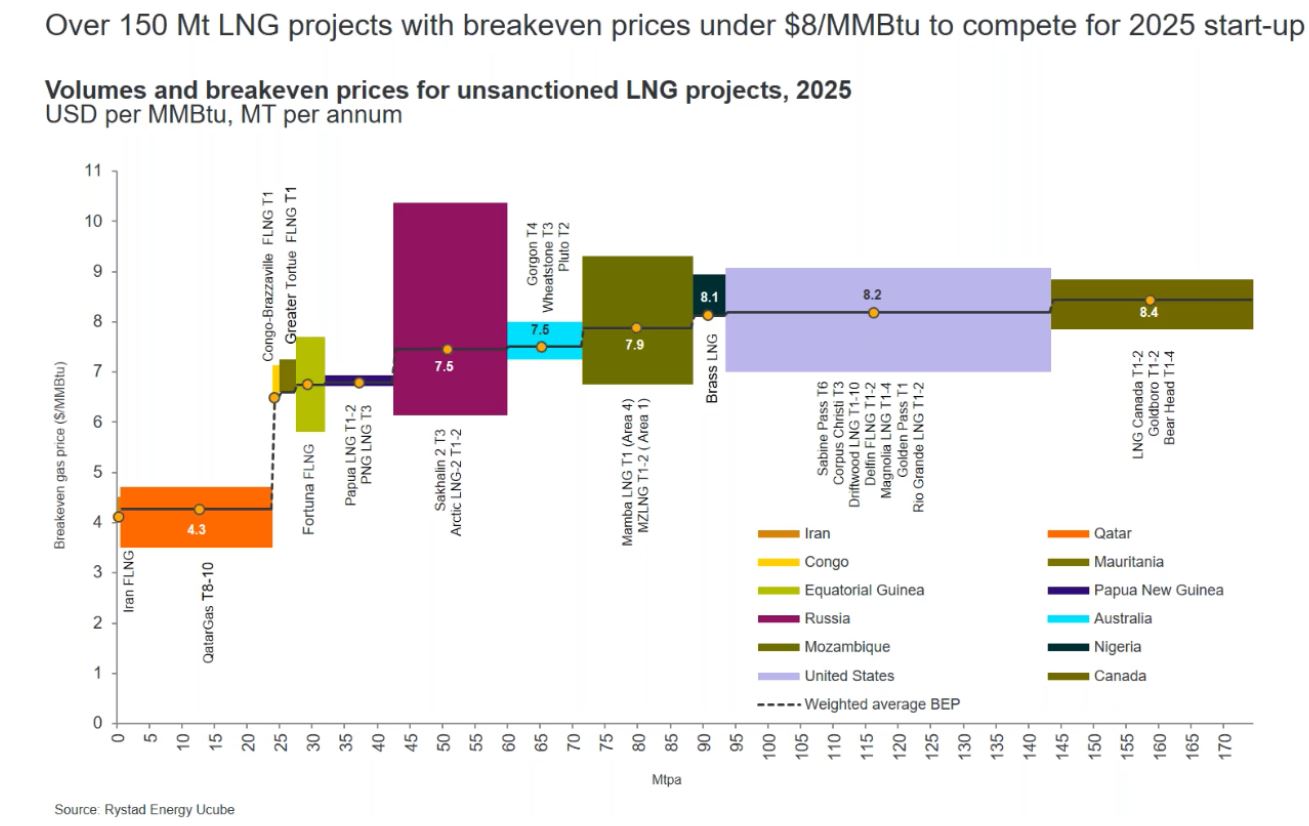

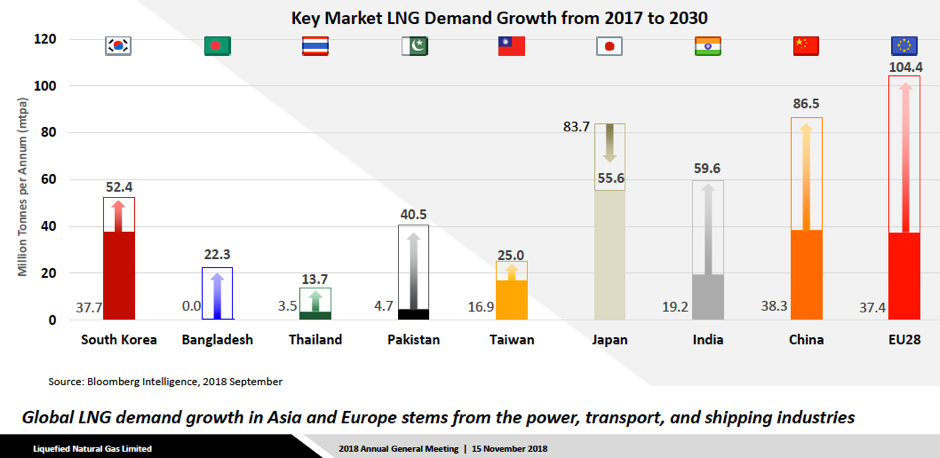

4. A Huge Wave of New LNG Projects Coming in the Next 18 Months: Positive for The E&C Companies

Our analysis shows that there are an unbelievable 25+ LNG developers that have stated (within the last year) they will take a final investment decision (FID) on their LNG liquefaction plants in 2019. Unless demand surprises to the upside, the expected LNG supply deficit in the mid-2020s could easily turn into a glut. In total there is almost 250 million tonnes per annum (mtpa) of capacity that plans to take FID this year – the equivalent of 80% of current global supply. In total there are ~US$180bn of contracts up for grabs – it should be a bumper year for the oil service (E&C) companies. This should be positive for the LNG contractors such as Mcdermott Intl (MDR US), TechnipFMC PLC (FTI FP), Chiyoda Corp (6366 JP) and Jgc Corp (1963 JP) .

Exxon Q4’18 conference call, “While we see a lot of high growth opportunities in LNG, capacity will come on in big chunks. It won’t be necessarily coordinated, so we’ll see, I suspect, periods of oversupply.”

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.