In this briefing:

- Weimob IPO Valuation: Optically Cheap

- Weimob IPO Quick Take – Less SaaS, More Ads -> Lower Valuation

- Jardine C&C (JCNC SP): Close the Stub Trade

- StubWorld: A 2018 Review In Charts

- Maoyan Entertainment IPO: The Trouble with Blockbusters

1. Weimob IPO Valuation: Optically Cheap

Weimob.com (1260480D CH) is a combination of a SaaS software and an adtech (targeted marketing) business which has started book building to raise gross proceeds of $108-135 million. According to press reports, Weimob is being viewed favourably by investors as it is being offered at a “cheap” valuation of 18-23x 2019 P/E.

However, the valuation of 18-23x 2019 P/E is optically cheap. Our analysis suggests that including capitalised R&D, Weimob is being offered at a material premium to a peer group of major Chinese internet companies. Notably, our forecasts do not adjust for the capitalised contract acquisition costs which would further increase Weimob’s P/E multiple. Consequently, we believe that the proposed IPO price range is unattractive and would sit out this IPO.

2. Weimob IPO Quick Take – Less SaaS, More Ads -> Lower Valuation

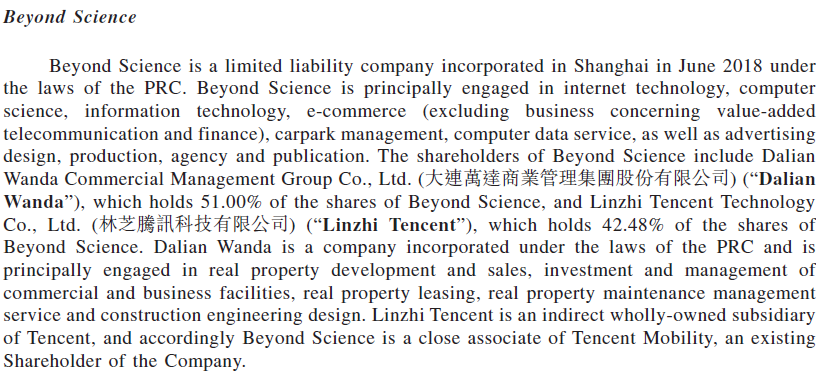

Weimob.com (1260480D CH), a Tencent Holdings (700 HK) and GIC investee company, plans to raise up to US$135m in its Hong Kong IPO.

I’ve covered most aspects of the deal in my earlier insight, Weimob Pre-IPO – Can Be Steamrolled by Tencent, Anytime, where I spoke about the over-reliance on Tencent, high attrition rates and acquisition costs for SMBs, and the increasing contribution of its ads business.

In this insight, I’ll provide an update from the latest filings, comment on valuations and run the deal through our IPO framework.

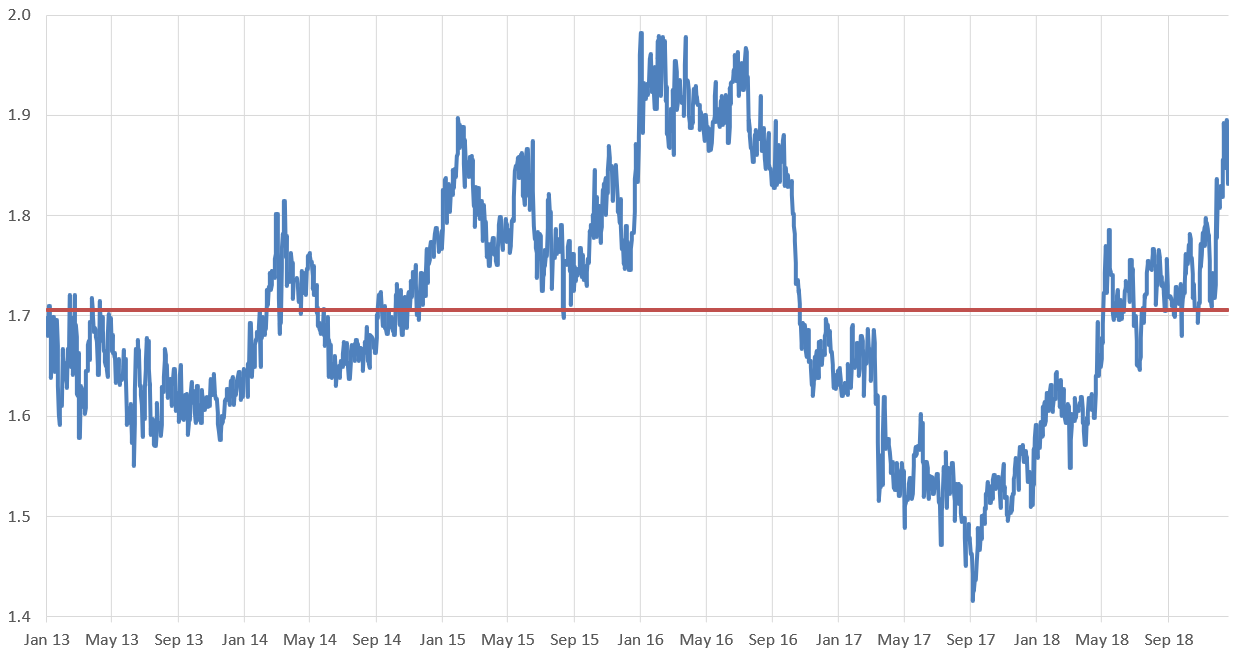

3. Jardine C&C (JCNC SP): Close the Stub Trade

In my original insight on October 17, 2018 TRADE IDEA – Jardine Cycle & Carriage (JCNC SP) Stub , I proposed setting up a stub trade to profit from volatility in the markets that caused the Jardine Cycle & Carriage (JCNC SP) stub to trade at a historically low discount to NAV. During the 78 calendar days that followed, Jardine Cycle & Carriage (JCNC SP) has gained 23% and the trade has made 5.03% on the gross notional. I now recommend closing the trade.

In this insight I will discuss:

- Performance of ALL my recommended stub trades

- a post-mortem trade analysis on the JCNC stub

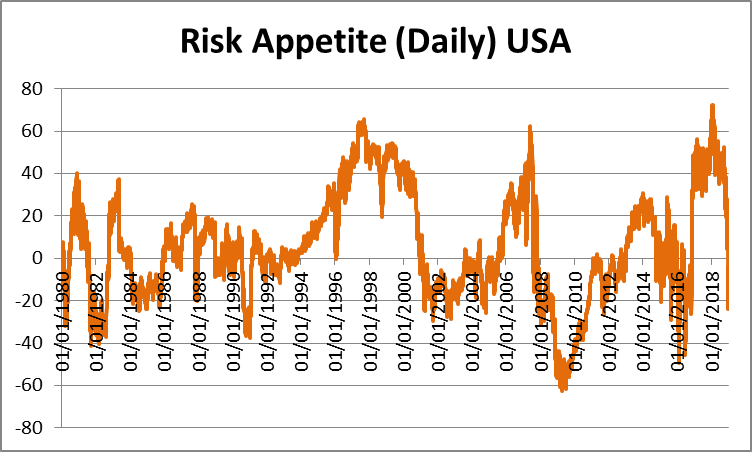

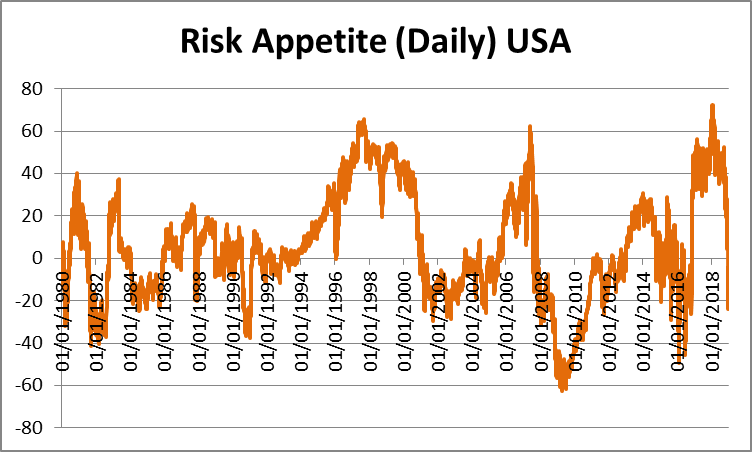

4. StubWorld: A 2018 Review In Charts

This week in StubWorld …

- The average NAV discount of a basket of 40 Holdcos steadily, and not altogether unsurprisingly, widened throughout the year.

- Passive, tech-related and illiquid Holdcos widened most; while cross-border and property Holdcos were the best of the worst.

- Illiquid, property, and passive Holdcos’ underperformance (or widening) was more pronounced in the first half. Tech Holdcos primarily widened in the second half.

- Worst performers (discount widening): In absolute % terms, United Co Rusal Plc (486 HK) and Asm International Nv (ASM NA) roughly shared the largest moves; while Dah Sing Financial (440 HK), First Pacific Co (142 HK), Genting Bhd (GENT MK) and Pasona Group (2168 JP) are trading at or near their 52-week wides and 52-week low prices.

- Best performers (discount narrowing): China Conch Venture Holdings Ltd (586 HK) is the only Holdco in positive territory; while Japan Post Holdings (6178 JP) is trading closest to its narrowest level in the last 12 months.

Below the various NAV discount chart summaries of various baskets are my weekly setup/unwind tables.

This, and other relationships discussed below, trade with: 1) a minimum liquidity threshold of US$1mn on a 90-day moving average; and 2) a minimum 20% ‘market capitalisation’ threshold, whereby the value of the holding/Opco held must be at least 20% of the parent’s market cap.

Comments on Jardine Matheson Hldgs (JM SP) / Jardine Strategic Hldgs (JS SP) also follow the setup/unwind tables.

5. Maoyan Entertainment IPO: The Trouble with Blockbusters

Maoyan Entertainment, formerly Entertainment Plus (EPLUS HK), is the largest online movie ticketing service provider in China. According to press reports, Maoyan has started pre-marketing to raise $0.3 billion (down from earlier indication of $0.5-1.0 billion) through a Hong Kong IPO. Maoyan is backed by Beijing Enlight Media (300251 CH) (20.0% shareholder), Tencent Holdings (700 HK) (16.3% shareholder) and Meituan Dianping (3690 HK) (8.6% shareholder).

Maoyan is yet another proxy in the battle between Tencent and Alibaba Group Holding (BABA US). However, we believe that challenges abound for Maoyan and would be cautious about participating in the IPO.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.