In this briefing:

- Time-Out Not Time up for Trade War

- Semiconductor WFE Outlook. Things Just Got Really Ugly

- AsiaInfo Tech (亚信科技) IPO: What You Need to Know Before the Trading Debut

- Harbin Electric Expected To Be Privatised

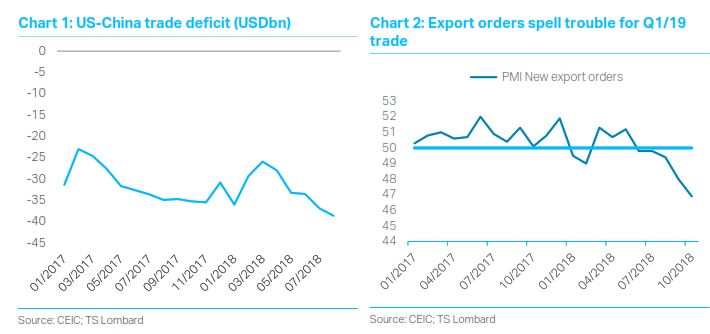

1. Time-Out Not Time up for Trade War

- Xi and Trump walk away from Buenos Aires with something to sell at home

- But trade negotiations will be dominated by fraught disagreements

- After 90-day negotiations, further delays to tariff escalation are likely

2. Semiconductor WFE Outlook. Things Just Got Really Ugly

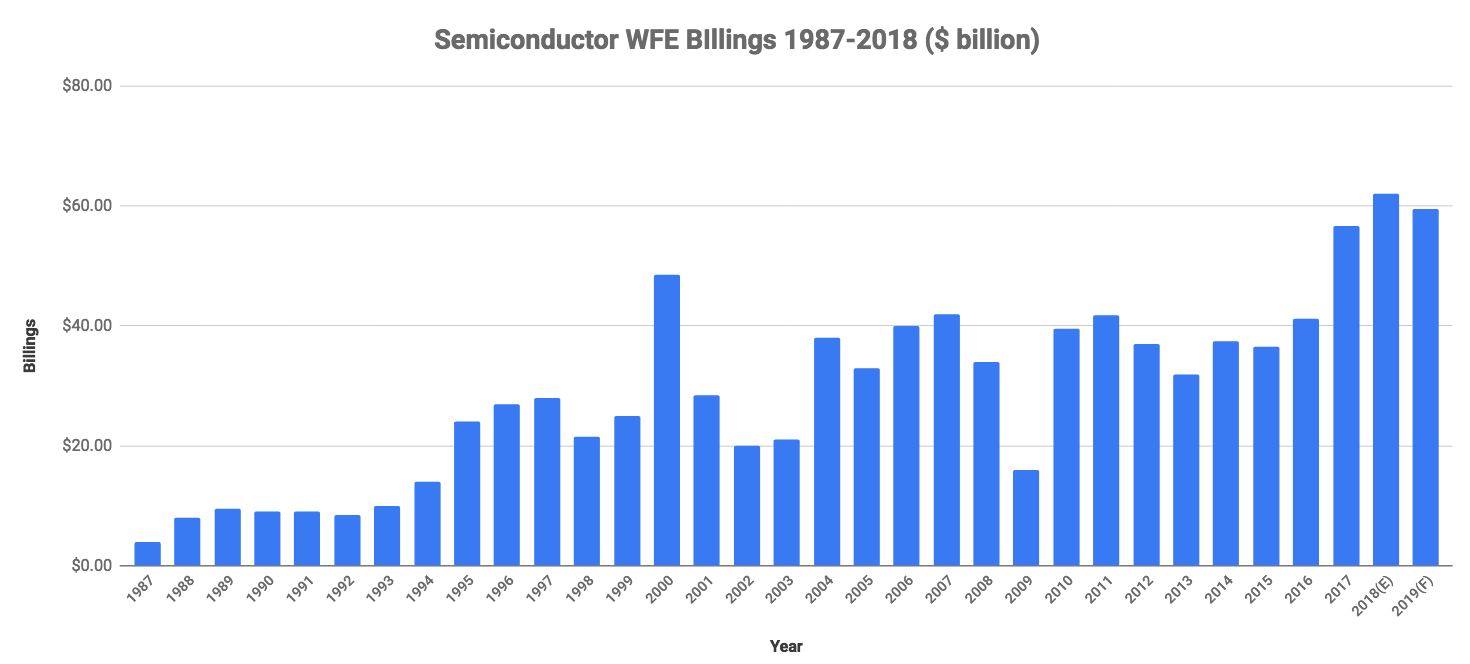

SEMI, the global industry association serving the manufacturing supply chain for the electronics industry, published three different forecasts for wafer fab equipment (WFE) sales in the past week. While the forecasts differ in approach and detail, they all agree on one thing, WFE revenues are continuing to fall and the outlook for 2019 is sharply down on previous estimates.

Specifically, Q4 2018 WFE revenues are set to decline 20.8% or $3.3 billion QoQ and the forecast which had just six months ago predicted 7% growth in 2019 is now calling for an 8% decline next year.

These latest forecasts cast a dark shadow over the predictions of the leading WFE manufacturers that H1 2019 would be stronger than H2 2018 and we anticipate a strong downward revision of forward guidance in the upcoming earnings season.

There may be a glimmer of hope on the horizon however as SEMI forecasts a strong rebound in the second half of 2019 leading to a return to growth of ~20% in 2020. Let’s see.

3. AsiaInfo Tech (亚信科技) IPO: What You Need to Know Before the Trading Debut

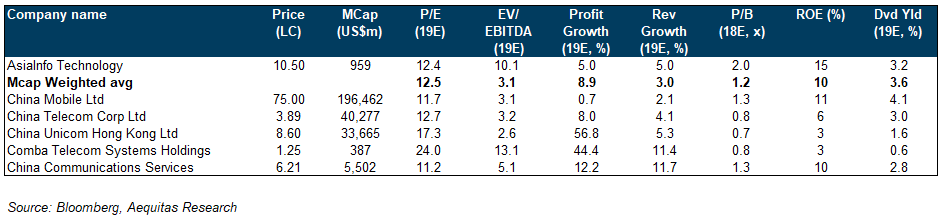

AsiaInfo Tech priced its IPO at HKD 10.50/share and will start trading today. Prior to the trading debut, in this short note, we summarize the latest information with updates on our valuation.

Our Previous Insight on AsiaInfo Tech:

- AsiaInfo Tech (亚信科技) IPO: Cost Control Is the Key (Part 1)

- AsiaInfo Tech (亚信科技) IPO: Lessons from Privatization and Three Bearish Trends (Part 2)

- AsiaInfo Tech (亚信科技) IPO: Latest Numbers Showcase the Company’s Questionable Expansion Plan

- AsiaInfo Tech (亚信科技) IPO: Valuation Rich Vs Delisting and Peers

4. Harbin Electric Expected To Be Privatised

Power generation equipment manufacturer Harbin Electric Co Ltd H (1133 HK) is currently suspended pursuant to Hong Kong’s Codes on Takeovers and Mergers and Share Buy-backs, suggesting a privatisation offer from parent Harbin Electric Corporation (“HEC”) is pending.

HE is PRC incorporated, therefore a privatisation by way of a merger by absorption may be proposed, similar to Advanced Semiconductor Mfg Corp Ltd. (3355 HK) as discussed in ASMC’s Merger By Absorption.

HE has perennially traded at discount to net cash. As at its last traded price, the discount to net cash (using the 2018 interim figure of HK$12.4bn or HK$7.27/share) was 65%.

HE issued 329mn domestic shares (~47.16% of the existing issued domestic shares and ~24.02% of the existing total issued shares) to its parent in January this year, at HK$4.56/share or a 60.9% discount to the June 2017 book value. A similar discount to the June 2018 book value backs out HK$4.15/share, or ~67% upside from the undisturbed price, in line with the premium to ASMC’s Offer.

A privatisation would require a scheme-like vote for the H-shares. HEC holds no H shares. There are 675mn H shares and no single shareholder controls a 10% (or more) blocking stake.

Dissension rights are available according to HE’s articles of association, although what constitutes a “fair price” under those rights, and the timing of the settlement under such rights, are not evident.

There are likely to be the customary PRC regulatory approvals required, however as HEC is already the controlling shareholder and an SOE, these conditions are not in doubt.

Should an offer emerge, expect completion in ~6 months from the initial announcement.