In this briefing:

- Singapore REIT – Preferred Picks 2019

- Micron’s Guidance Bombshell Signals Troubled Times Ahead For Beleaguered Semiconductor Segment

- TRACKING TRAFFIC/Chinese Express & Logistics: Parcel Pricing Weak, Again

- Overview of My Winners and Losers in 2018…and 5 High Conviction Ideas Going into 2019

- Universal, SegaSammy & Dynam Sit Best Positioned Among Japan Companies in Race for IR Partnerships

1. Singapore REIT – Preferred Picks 2019

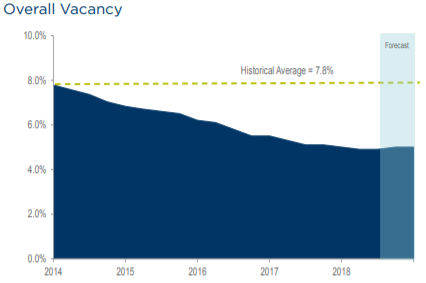

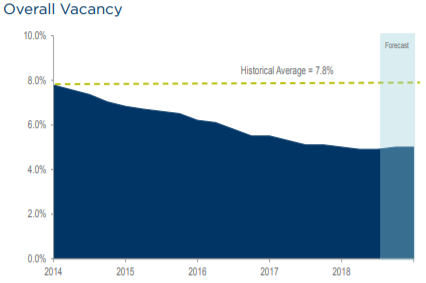

With the FTSE ST REIT index’s decline of 9.3% year-to-date, value has emerged for some of the bellwether names in the Singapore REITs sector. The forward yield spread between these REITs and the Singapore government 10-year bond yield (2.13%) currently stand at least 390 basis points. In view of the increasing concerns over global economic growth, rising interest rates and the ongoing trade tension between the US and China, I present three quality REITs with fortified portfolios that are well-positioned to weather the near-term market uncertainties. They possess growth potential from acquisitions, positive rental reversions and deliver resilient forward distribution yield of more than 6%. Some of the bellwether names in the more resilient retail REIT sector, while offering lower yield of around 5.0% – 5.7%, are also in my buy list.

2. Micron’s Guidance Bombshell Signals Troubled Times Ahead For Beleaguered Semiconductor Segment

After months of skirting around inventory build-up and a weakening demand outlook, Micron used their latest earnings report to call closing time on a revenue and profitability party that began in Q4 2016 and just got better and better with each passing quarter.

Micron reported Q1 FY2019 results on December 18’th and while revenues were largely in line with recently lowered guidance from the company, their outlook for both Q2 and 2019 as a whole was worse than even the most bearish of expectations.

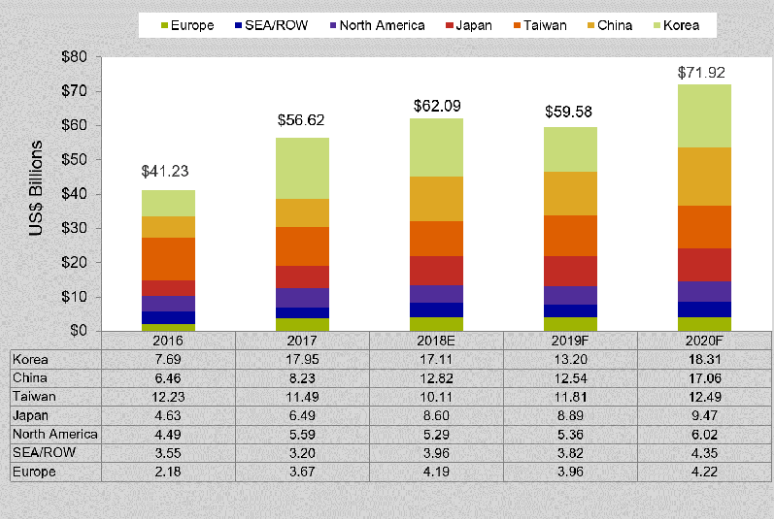

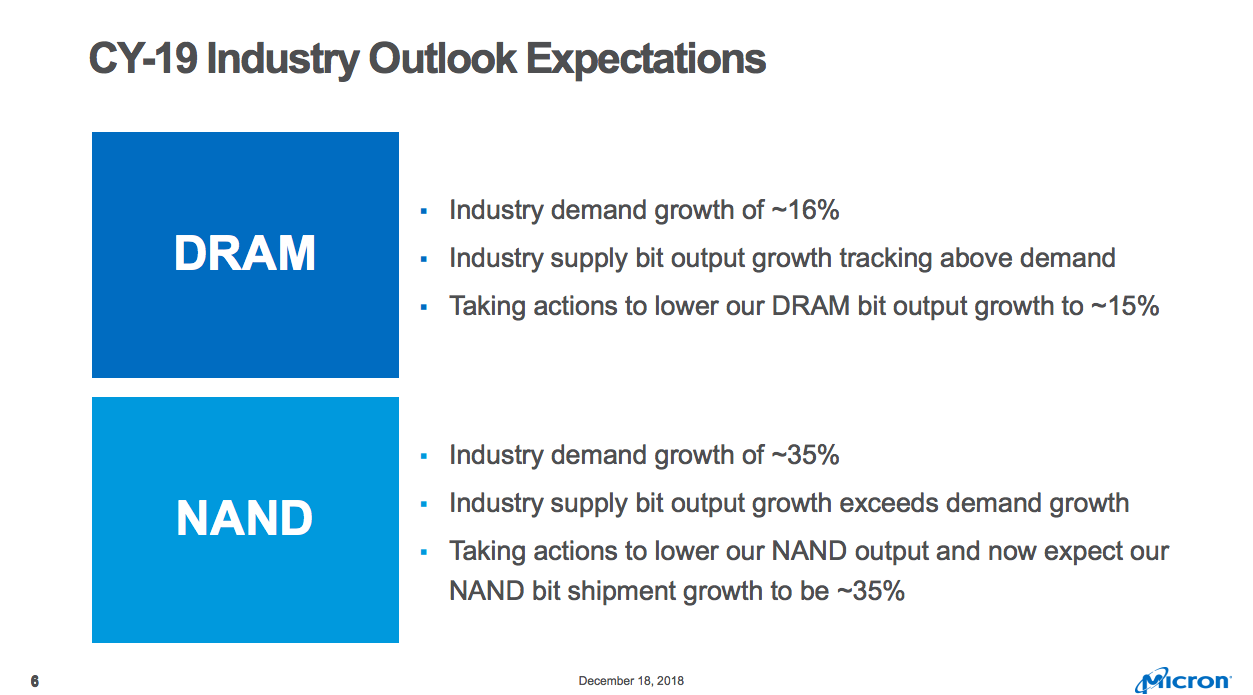

Citing high inventory levels at key customers, Micron guided Q2 FY2019 revenues for $6 billion at the midpoint, down a staggering $1.9 billion, 24% QoQ and 18% YoY. At the same time, Micron revised down their CY2019 bit demand growth forecast for both DRAM (from 20% to 16%) and NAND (35%, the bottom of the previously forecasted range). The company plans to adjust both CapEx and bit supply output downwards to match.

In the wake of their guidance bombshell, Micron’s share price closed down almost 8% the following day to end the session at $31.41, a level last seen in August 2017. Micron is unique in reporting out of sync with its industry peers, making it the proverbial canary in a coal mine. The company’s gloomy outlook and clarion call for further CapEx reductions in a bid to rebalance supply and demand spells troubled times ahead for an already beleaguered semiconductor segment ahead of the upcoming earnings season.

3. TRACKING TRAFFIC/Chinese Express & Logistics: Parcel Pricing Weak, Again

Tracking Traffic/Chinese Express & Logistics is the hub for our research on China’s express parcels and logistics sectors. Tracking Traffic/Chinese Express & Logistics features analysis of monthly Chinese express and logistics data, notes from our conversations with industry players, and links to company and thematic notes.

This month’s issue covers the following topics:

- November express parcel pricing remained weak. Average pricing per express parcel fell by 7.8% Y/Y to just 11.06 RMB per piece. November’s average price represents a new all-time low for the industry, and November’s Y/Y decline was the steepest monthly decline in over two years (excluding Lunar New Year months, which tend to be distorted by the timing of the holiday).

- Express parcel revenue growth dipped below 15% last month. Weak per-parcel pricing pulled express sector Y/Y revenue growth down to just 14.6% in November, the worst on record (again excluding distorted Lunar New Year comparisons). Chinese e-commerce demand has slowed and we suspect ‘O2O’ initiatives, under which online purchases are fulfilled via local stores, are also undermining express demand growth.

- Intra-city pricing (ie, local delivery) remains firm relative to inter-city. Relative to weak inter-city express pricing (where ZTO Express (ZTO US) and the other listed express companies compete), pricing for local, intra-city express deliveries remained firm. In the first 11 months of 2018, express pricing rose 1.7% Y/Y versus a -2.9% decline in inter-city shipments (international pricing fell sharply, -14.5% Y/Y). Relatively firm pricing on local shipments may make it hard for local food delivery companies like Meituan Dianping (3690 HK) and Alibaba Group Holding (BABA US) ‘s ele.me to beat down unit operating costs.

- Underlying domestic transport demand held up well again in November. Although demand for speedy, relatively expensive express service (and air freight) appears to be moderating, demand for rail and highway freight transport has held up well. The relative strength of rail and water transport (slow, cheap, industry-facing) versus express and air freight (fast, expensive, consumer-oriented) suggests a couple of things: a) upstream industrial activity is stronger than downstream retail activity and b) the people in charge of paying freight are shifting to cheaper modes of transport when possible.

We retain a negative view of China’s express industry’s fundamentals: demand growth is slowing and pricing appears to be falling faster than costs can be cut. Overall domestic transportation demand, however, remains solid and shows no signs of slowing.

4. Overview of My Winners and Losers in 2018…and 5 High Conviction Ideas Going into 2019

In a follow up to my note from last year Overview of My Winners and Losers in 2017…and 5 High Conviction Ideas Going into 2018 I again look at my stock ideas that have worked out in 2018, those that have not and those where the verdict is still pending.

Last year I provided 5 high conviction ideas and here is their performance in a brutal year for Asian Stock Markets:

Company | Share Price 27 Dec 2017 | Share Price 20 December 2018 | Dividends | % Total Return |

0.70 HKD | 0.88 HKD | 0.01 HKD | +27% | |

0.20 SGD | 0.27 SGD | 0.0 SGD | +35% | |

2.39 HKD | 2.82 HKD | 0.147 HKD | +24% | |

0.84 SGD | 0.85 SGD | 0.02 SGD | +3.5% | |

1.44 MYR | 0.32 MYR | 0.0 MYR | -79% |

4 out of 5 had a positive performance.

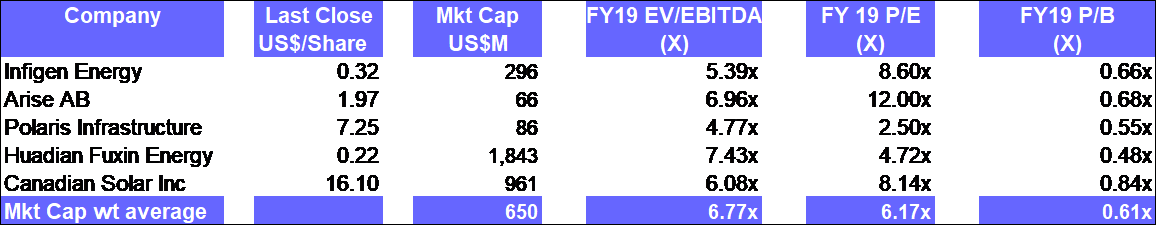

Below I will make a new attempt to provide five high conviction ideas going into 2019.

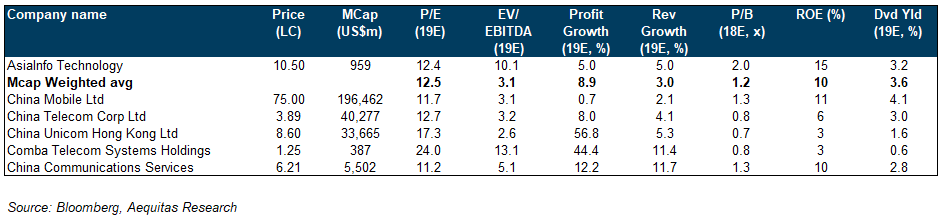

5. Universal, SegaSammy & Dynam Sit Best Positioned Among Japan Companies in Race for IR Partnerships

- We’ve reviewed 10 companies in the sector. Of those, three are the consensus favorites of our Tokyo based panel of industry, financial and economics observers of the IR initiative over many years.

- Based on pachinko alone, the stocks of these companies are fully valued. Based on potential tailwind from a license award within 6 months, they could be vastly undervalued.

- Each of the three noted here brings strength to a bid less based on financials than corporate focus, outlook and experience in the field.