In today’s briefing:

- Japan Weekly | JR East, Matsukiyo, IHI

- About the CXO Plunge After Biden Signed National Biotechnology and Biomanufacturing Initiative

- Weekly Stock Bullfinder – Week of 9/19

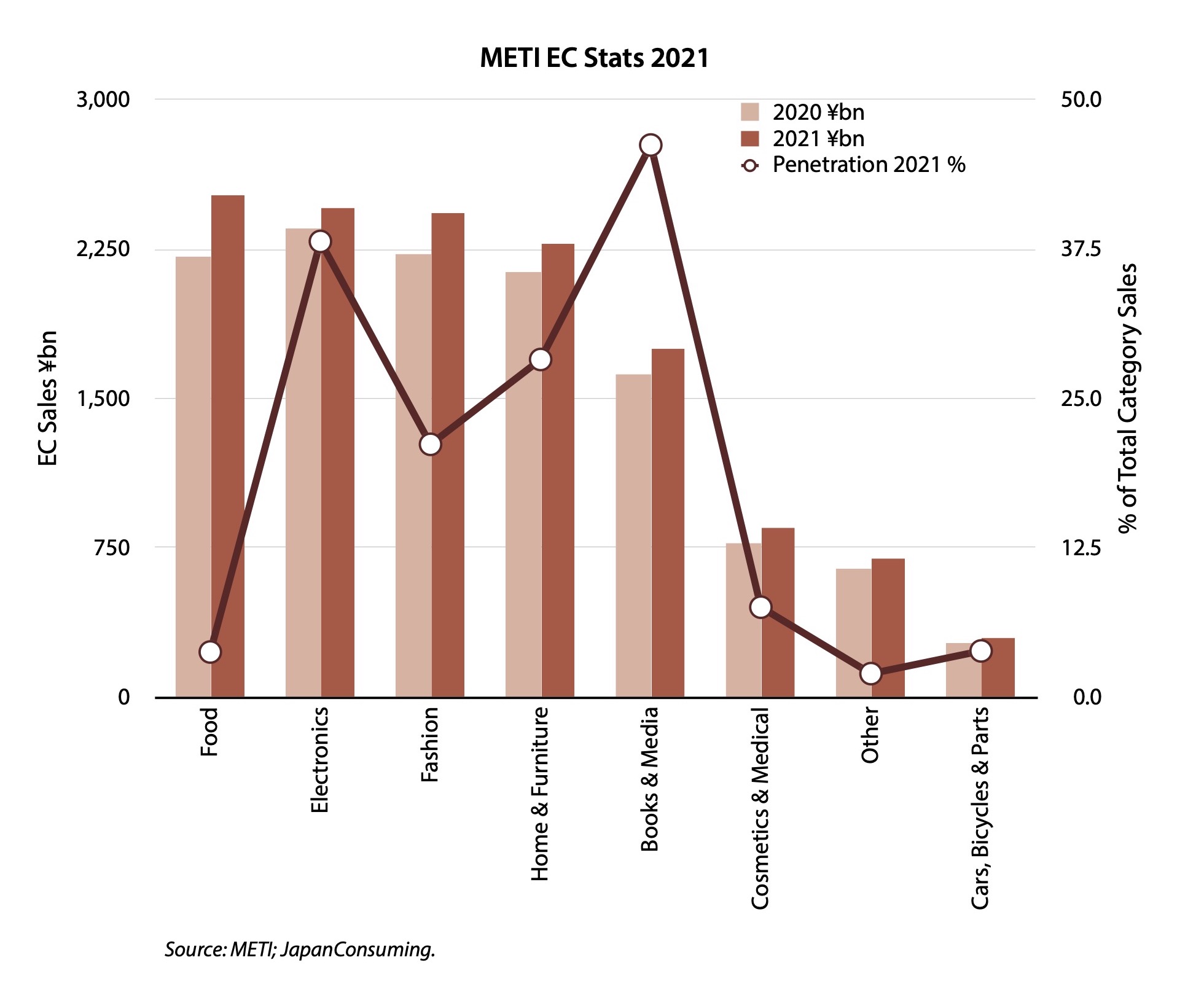

Japan Weekly | JR East, Matsukiyo, IHI

- The Nikkei was down -3.4% over the past week (-4.3% YTD); the yen was flat at ¥142/$ (-24.1% YTD)

- Shares of travel and tourism related companies advanced on hopes for a rebound in inbound tourism as Japan aims to ease travel restrictions in October

- Shares of IHI slumped 9% in the week. We are interested in the energy segment that is geared to nuclear re-starts and longer-term, ammonia.

About the CXO Plunge After Biden Signed National Biotechnology and Biomanufacturing Initiative

- CXO sector plummeted after Biden has officially signed the National Biotechnology and Biomanufacturing Initiative. In our impression, all sharp declines of CXO were mostly due to geographical conflicts/overseas policy disturbances.

- We remain conservative about CXO’s outlook. If investors still choose to invest in CXO, there are some questions to ponder based on the general environment of Sino-US confrontation.

- As tensions between China and the US escalate, it may no longer be possible to think on the basis of “common sense”. Investors are advised to think “outside the box”.

Weekly Stock Bullfinder – Week of 9/19

- This upcoming week, stock market and business news is anticipated to be dominated by the U.S. Federal Reserve and global central banks racing to hike interest rates in coordinated fashion in attempts to constrain demand and reel in inflation back to central bank target levels.

- Already, Wall St. Journal reported and Fed “whisperer” Nick Timiraos has indicated that yet another outsized interest rate hike of 75bps appears to be on the way as the Fed plays catch up to the 2 year Treasury yield.

- Fed Chair Jay Powell’s press conference commentary on Wednesday will again be scrutinized for any hints of the Fed’s plans to either slow or stop the pace of the current monetary policy tightening cycle.

💡 Before it’s here, it’s on Smartkarma

Sign Up for Free

The Smartkarma Preview Pass is your entry to the Independent Investment Research Network

- ✓ Unlimited Research Summaries

- ✓ Personalised Alerts

- ✓ Custom Watchlists

- ✓ Company Data and News

- ✓ Events & Webinars