In this briefing:

- Re-Launching Coverage of ZTO Express with Sell Rating and US$13.31 Target Price

- Foreign Investment Law/Trade War/Huawei/Eu Vs PRC

- GDS Holdings (GDS US): Placing a Good Opportunity to Gain Exposure to a High Growth Story

- LNG: What Matters This Week? Prices Fall Further in Asia but New Projects Continue to Progress

- ECM Weekly (16 March 2019) – Embassy Office REIT, Tiger Brokers, Dongzheng Auto, Koolearn, CanSino

1. Re-Launching Coverage of ZTO Express with Sell Rating and US$13.31 Target Price

ZTO Express (ZTO US)‘s earnings will fail to meet the high expectations of sell-side analysts and investors who seeit as a cheap proxy for Chinese e-commerce activity.

China’s express sector revenue grew 43.5% YoY in 2016, the year ZTO went public. Last year, revenue growth was just half that (21.8%), and we expect the sector’s growth to continue to moderate over the next few years.

The express sector is also evolving in ways that will put downward pressure on profitability and require greater investment from the express companies.

We expect the profitability of ZTO’s express business to decline in the medium-term as the company adjusts to slowing demand and emerging sector trends. Our earnings estimates, which are far below consensus figures, reflect these challenges.

ZTO suffers from declining earnings quality and two accounting issues that we feel make it a risky, unattractive investment. Our 12-month target price for ZTO is US$13.31, based on 16 times our blended 2019-20 EPS estimates. We rate the stock Sell.

2. Foreign Investment Law/Trade War/Huawei/Eu Vs PRC

China News That Matters

- NPC approves “rushed” foreign investment law

- Trump in no hurry as “China threat” grows

- Huawei struggles to build trust

- EU takes a stand: China as “systemic rival”

In my weekly digest China News That Matters, I will give you selected summaries, sourced from a variety of local Chinese-language and international news outlets, and highlight why I think the news is significant. These posts are meant to neither be bullish nor bearish, but help you separate the signal from the noise.

3. GDS Holdings (GDS US): Placing a Good Opportunity to Gain Exposure to a High Growth Story

Last Friday, Gds Holdings (Adr) (GDS US), the largest third-party data centre operator in China, announced the placing price of its public offering of 11.9 million ADS. At the placing price of $33.50 per share, GDS will raise net proceeds of $385.5 million which will be used for the development and acquisition of new data centres.

We are positive on GDS as the business remains in rude health due to strong revenue growth, rising margins and high revenue visibility. Overall, we would participate in the public offering at the placing price.

4. LNG: What Matters This Week? Prices Fall Further in Asia but New Projects Continue to Progress

LNG prices have dropped to a seasonal low, as we flagged in our outlook piece for this year (2019 Energy Market Themes & Stocks with Exposure: Focus on Oil, Refining, LNG, M&A & Renewables) but this hasn’t dampened enthusiasm to push new projects forward (see A Huge Wave of New LNG Projects Coming in the Next 18 Months: Positive for The E&C Companies). We continue to see this as positive for the LNG contractors and negative for the LNG developers. We discuss recent LNG prices, European LNG demand and the FID outlook including project updates from Venture Global, Alaska and Cyprus.

5. ECM Weekly (16 March 2019) – Embassy Office REIT, Tiger Brokers, Dongzheng Auto, Koolearn, CanSino

Aequitas Research puts out a weekly update on the deals that have been covered by Smartkarma Insight Providers recently, along with updates for upcoming IPOs.

Starting with bad news in Korea, Homeplus REIT (HREIT KS)‘s IPO was pulled on the 14th of March which when it was supposed to price. The reason cited was weak demand which stemmed from growth concerns and difficulty in valuing this business.

On the other hand, Hong Kong’s IPO market is getting busier. This week alone, we had Dongzheng Automotive Finance (2718 HK) and Koolearn (1797 HK) that have already opened for bookbuilding and will price next week. We also heard that Sun Car Insurance is already started pre-marketing and it will likely open its books next week. The company had only just re-filed their draft prospectus last week.

Another upcoming Hong Kong IPOs would be Tianjin CanSino Biotechnology Inc (1337013D HK) which we heard had already started pre-marketing. Ke Yan, CFA, FRM updated his assumptions and valuation of the company in his insight, CanSino Biologics (康希诺) IPO: Valuation Update (Part 3).

In India, the focus is on Embassy Office Parks REIT (EOP IN) as this is the country’s first ever REIT IPO. It is also the first time there is a strategic tranche in an Indian IPO which has been taken up by Capital Group. Sumeet Singh has pointed out in his insight that with cost of debt of the REIT being at 9 – 9.25%, it is hard to fathom buying equity at a FY2020E dividend yield of 8.25%. This yield had already been inflated by the lack of interest payments. For detailed explanation, read his insight, Embassy Office Parks REIT IPO – FY19 Revised Down, Yield Propped up by Zero Coupon Bond.

In other countries, we heard that Leong Hup International (LEHUP MK) is aiming to pre-market next month whereas, in Australia, there had been chatter that Prospa Advance Pty (PGL AU) may be back for an IPO again after it had beaten its own estimates from the IPO prospectus.

Accuracy Rate:

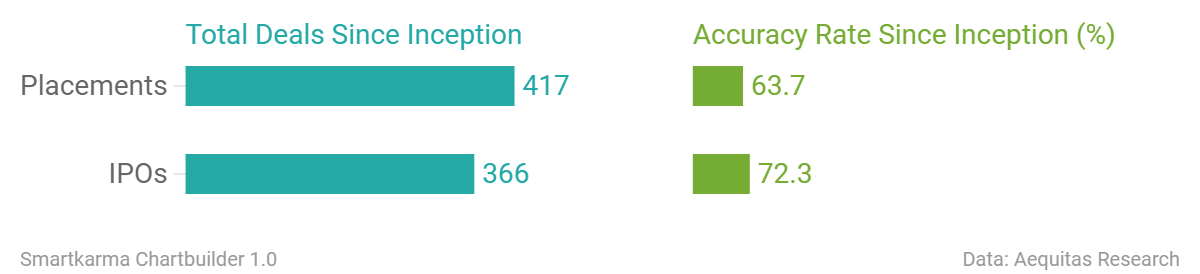

Our overall accuracy rate is 72.4% for IPOs and 63.7% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings

- FriendTimes Inc. (Hong Kong, >US$100m)

- Frontage (Hong Kong, re-filed)

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- UBS and Rivals to Pay $100 Million to Settle Hong Kong IPO Cases

- Chinese Luxury Car Finance Firm Seeks $428 Million in Hong Kong IPO

- Online Educator Koolearn to Raise up to $233 Million in Hong Kong IPO

- Resurgence in Indian IPO market likely only after general elections

- Homeplus K-REIT Withdraws $1.5 Billion Korean IPO on Weak Demand

- Prospa may revive listing plan after beating prospectus forecasts

- Luckin Coffee chairman said to tap banks for $200m loan in exchange for IPO role

This week Analysis on Upcoming IPO

- Homeplus REIT IPO: A Key Landmark Deal in the History of the Korean REIT Market

- Up Fintech (Tiger Brokers) IPO Quick Take – It’s Not like Futu, Won’t Perform like It Either

- Embassy Office Parks REIT IPO – FY19 Revised Down, Yield Propped up by Zero Coupon Bond

- CanSino Biologics (康希诺) IPO: Valuation Update (Part 3)

- Dongzheng Auto Finance (东正汽车金融) IPO Review – Better off Buying the Parent

- Koolearn (新东方在线) IPO Review – Yet to See Results from Increased Spending

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.