In this briefing:

- 2019 M&A/IPO Preview: Chinese Express Sector Quickly Building Out ‘Last-Mile’ & Int’l Capabilities

- Trade Talks/Commercial Spying/Cars ‘N Consumers/Easier Credit/Yuan Rise

- AAC Tech (2018): Damage Is Done While Business Remain Intact – BUY

- Screening the Silk Road: Q1-2019 Small-Mid Cap GARP (Zulu Warrior Screening)

- ECM Weekly (12 January 2019) – Futu, China East Education, China Kepei Education, Viva Biotech

1. 2019 M&A/IPO Preview: Chinese Express Sector Quickly Building Out ‘Last-Mile’ & Int’l Capabilities

A year ago we published a note that described how we expected corporate activity in China’s domestic express sector to play out in 2018 (see 2018 M&A/IPO Activity Preview: Chinese Express, Logistics Sectors Hit by Slower Growth & BABA Vs JD). In this new piece, we look back at how things actually played out in the sector last year and look forward to 2019 and beyond.

We’ve divided this year’s piece into four sections:

- A quick review of our expectations from 2018, and how things actually played out

- New (and ongoing) trends we expect to see in express sector M&A this year

- The continued battle for leadership between Alibaba Group Holding (BABA US) and JD.com Inc (ADR) (JD US)

- Potential IPO candidates for 2019 and beyond

We expect Chinese domestic express demand to continue to moderate in 2019, and in response we expect the express companies to increase their investments in ‘last-mile’ and international delivery, which will probably create a drag on profitability in the medium-term. Although we believe e-commerce giants Alibaba and JD.com would like their growing portfolios of logistics investments to become self-funding sooner rather than later, we foresee somewhat limited investor appetite for more large Chinese logistics IPOs in 2019, since many high-profile offerings have faltered since going public.

2. Trade Talks/Commercial Spying/Cars ‘N Consumers/Easier Credit/Yuan Rise

China News That Matters

- Progress, yet trade war still morphing into tech war

- Economic espionage: US targets Chinese spying

- Tesla dreams big in China despite consumption fears

- Bank funding beckons for SMEs

- Yuan leaps as hopes fade for US rate hikes

In my weekly digest China News That Matters, I will give you selected summaries, sourced from a variety of local Chinese-language and international news outlets, and highlight why I think the news is significant. These posts are meant to neither be bullish nor bearish, but help you separate the signal from the noise.

3. AAC Tech (2018): Damage Is Done While Business Remain Intact – BUY

The recent trade talk meeting between the US and Chinese government went into an extended unplanned third day which could be seen as a positive development – a sign that both sides are serious on getting a deal done. President Trump’s recent tweet citing “”Talks with China are going very well!” has been responded positively in Asian equities market. Is it all just that or are there more in the company?

4. Screening the Silk Road: Q1-2019 Small-Mid Cap GARP (Zulu Warrior Screening)

- Value made a comeback, but growth remains core: In May 2018, we examined the divide between value and growth stocks, ( Notes from the Silk Road: Small-Mid Cap Screening for Zulu Warriors). As Q3 unfolded, this eventuated with a +7.5% reversal in favour of value stocks, only to see growth resume dominance in October and November.

- The optimal value/growth style dynamic: We feel exposure to growth at a reasonable price (GARP) coupled with a healthy FCF yield (via our amended Zulu Screen) should provide some healthy medium to long term returns for investors.

- The Screen’s Risk: The Zulu Screen relies on analyst estimates. When market sentiment is weak and forecasts are not amended in a timely manner, the screen is susceptible to mis-selection.

- Q2 2018 screening list succumbed to volatile markets: This was seen in our May screen with our list posting on average a 30% decline in share price, relative to the broader Asia-Pacific Ex-Japan declining 13.6% and the Asia Pacific index by 11.8%.

- Are there reasons for the underperformance? 10 of the 19 stocks in the May screen were from Hong Kong, which saw the Hang Seng Index (HIS) decline 16% over the same period. The decrease seems due to concern over trade wars and doubts about the China economy. Our key approach to stock selection is to take a medium-to-long-term view as well as focus on quality ranked stocks relative to their peers. This is highlighted via the average stock rank of the group declining only 15.8% from 89.6 to 75.5 points.

- Our Q1 2019 screen selected only 9 stocks. Of the 9 stocks identified, the average PEG Ratio was 0.4x, the price to FCF yield was 11% and ROCE was 25%. Stocks were selected from Australia, New Zealand, India, Korea, Japan, Hong Kong, Taiwan and Singapore. Cowell Fashion Company from Korea was the only remaining stock from our May screening.

5. ECM Weekly (12 January 2019) – Futu, China East Education, China Kepei Education, Viva Biotech

Aequitas Research puts out a weekly update on the deals that have been covered by Smartkarma Insight Providers recently, along with updates for upcoming IPOs.

Despite a shaky 2018 Q4 market and the disappointing Softbank Corp (9434 JP)‘s IPO, we have been getting a steady stream of newsflow on upcoming IPOs.

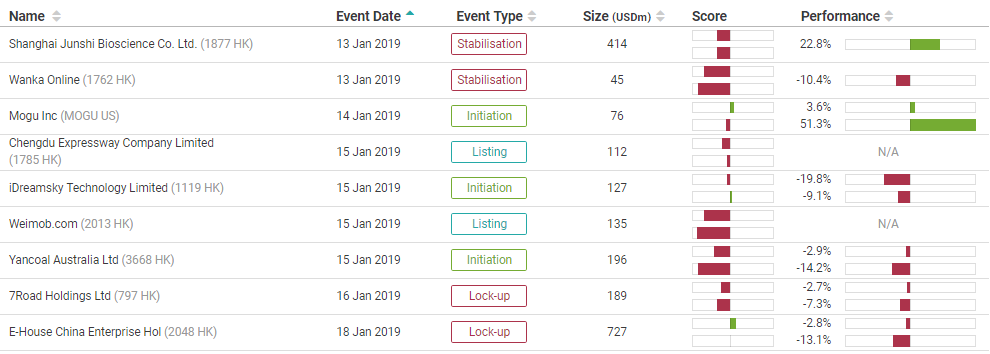

Starting with upcoming IPOs, Chengdu Expressway Company Limited (1785 HK) and Weimob.com (2013 HK) will be listing next week on Tuesday, 15th January. Weimob was priced at the low end of its price range while Chengdu Expressway’s IPO was at a fixed price of HK$2.20. We are bearish on both IPOs. Weimob is overly reliant on Tencent for its SaaS and Ads business and, at the same time, Tencent will only own less than 3% stake after listing. Whereas Chengdu Expressway has been a well-managed company but valuation implies limited upside. Trading liquidity will likely remain tepid as like Qilu Expressway Co Ltd (1576 HK) which listed mid last year.

In the pipeline, we are hearing that Kepei Education (KEPEI HK) will likely open its book next Monday. We will be following up with a note on valuation. In other IPOs that are coming in this quarter, Helenbergh China and Zhongliang, both property developers, are looking to IPO in this quarter. Viva Biotech Shanghai Ltd (1577881D HK) is also looking to list in Hong Kong Q2 while Urban Commons, a US property developer, is planning a US$500m REIT IPO in Singapore.

Activity seems healthy for the ECM space, but sentiment has not been the best as seen from Xiaomi’s high profile IPO that took a hit just as its lockup expired. Its share price has corrected from a high of HK$22.20 to just above HK$10.34 this Friday. This should not have been a big surprise since many have already pointed out that its valuation should really have been closer to that of a hardware business and we pointed out that the IPO’s trajectory would likely be similar to Razer.

This reminds us of a particular listing last year, Razer Inc (1337 HK) , and, in fact, both bear quite a handful of similarities. Strong portfolio of investors, hardware business with software capabilities, expensive valuations, and etc. The stock did well at first but has come back down to earth since then.

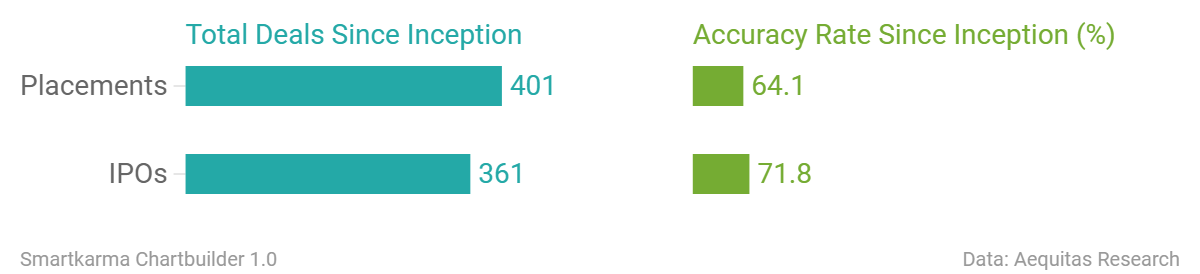

Accuracy Rate:

Our overall accuracy rate is 72% for IPOs and 64% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings

- China Tobacco International (Hong Kong, US$100m)

- China East Education (Hong Kong, US$400m)

- Ebang International (Hong Kong, re-filed)

- MicuRx Pharma (Hong Kong, re-filed)

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- Urban Commons plans IPO of up to US$500m at Q1-end

- Viva Biotech plans IPO in the second quarter

- CStone Pharma plans US$400m IPO in Feb

- Global Switch plans about US$1bn HK IPO

- China’s Wanda files for US IPO of sports unit to raise up to US$500m

Smartkarma Community’s this week Analysis on Upcoming IPO

- Futu Holdings IPO Preview: Running Out of Steam

- Futu Holdings Pre-IPO – Great Metrics but in a Commoditised Industry

- China Tobacco International (IPO): The Monopolist Will Not Recover

- China Tobacco International IPO: Heavy Regulation, Declining Margins – A Bit Late to IPO Party

- IPO Radar: AutoCorp, Honda’s Avatar in Thailand

List of pre-IPO Coverage on Smartkarma

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.