In this briefing:

- Bank of Tianjin: 太好了, 不可能是真的

- Weekly Oil Views: Another Crude Rally Fails to Stick as Technicals Signal a Pivot Point

- Dongzheng Auto Finance (东正汽车金融) IPO Review – Relaunched at Lower Price

- US Monetary Policy After The ‘Great U-Turn’

- ECM Weekly (23 March 2019) – ESR, Sun Car, Ruhnn, CanSino, Frontage, Wuxi Bio, WiseTech,

1. Bank of Tianjin: 太好了, 不可能是真的

Bank Of Tianjin (1578 HK) results at first look quite encouraging with firmer profitability, enhanced efficiency, improved capital adequacy, and increased provisioning.

Valuations are optically attractive: p/book of 0.5x, franchise valuation of 7%, earnings yield of 17%, and a total return ratio of 2.5x. These metrics are within the bargain hunter space.

However, optimism fades fast on closer inspection.

“Underlying” Income decreased by 21% YoY as the bank was squeezed by higher funding costs and non-interest expenses. Expenses on wholesale funding increased by 30% YoY. Debt funding now represents 71% of Gross Loans. Debt now stands at 4.3x SH. Funds. This type of funding has exploded by 10x since 2014. At the same time, deposits declined YoY. Deposits have increased by a more sedate 18% since 2014.

PT Profit would have been CNY1.4bn rather than CNY5.2bn but for hefty gains on securities. Loan loss provisions almost tripled YoY.

Regarding the Balance Sheet, Special Mention Loans rose sharply (+25% YoY) and represent 2.8x NPLs. A 127% and 108% YoY increase in “doubtful loans” and “loss loans” puts some perspective on a seemingly respectable NPL ratio of 1.64% and a LLR/NPLs of 250%.

Thus, Bank Of Tianjin (1578 HK) is cheap for a reason. We are reluctant to recommend taking a position at this juncture given the ongoing stresses in source of funding and asset quality.

2. Weekly Oil Views: Another Crude Rally Fails to Stick as Technicals Signal a Pivot Point

Oil remains in a tug-of-war between fundamentals and a fickle sentiment in the global financial markets.

Brent and WTI futures settled at fresh four-month-highs of $68.50/barrel and $59.98/barrel mid-week, but had erased all the gains — and some more — by Friday’s close. However, technicals point to a pivot point in crude futures, with the 50-day moving average crossing over the 100 DMA last week. That’s typically a buy signal, but a sustained rally from the current levels is hard to see in the near-term.

Meanwhile, there were some interesting and unexpected outcomes from a high-profile OPEC/non-OPEC monitoring committee meeting in Baku on March 18. Among them were signs of a divergence in the views of Saudi Arabia and Russia, de facto leaders of the 24-producer alliance curbing supply to rebalance the market.

What explains Saudi Energy Minister Khalid al-Falih’s new hawkish stance and is the OPEC and non-OPEC partnership under some strain? Our short answer: No. We lay out our perspective of the evolving dynamics in the producers’ alliance, which is important to understanding the likely path of their collaboration.

3. Dongzheng Auto Finance (东正汽车金融) IPO Review – Relaunched at Lower Price

Dongzheng Automotive Finance (2718 HK) (DAF) re-launched its IPO at a lower fixed price of HK$3.06 per share, expecting to raise about US$208m. We have covered the fundamentals and valuation of the company in:

- Dongzheng Auto Finance (东正汽车金融) Pre-IPO Review – Dependent on Dealership Network for Growth

- Dongzheng Auto Finance (东正汽车金融) IPO Review – Better off Buying the Parent

In this insight, we will only look at the company’s updated valuation and re-run the deal through IPO framework.

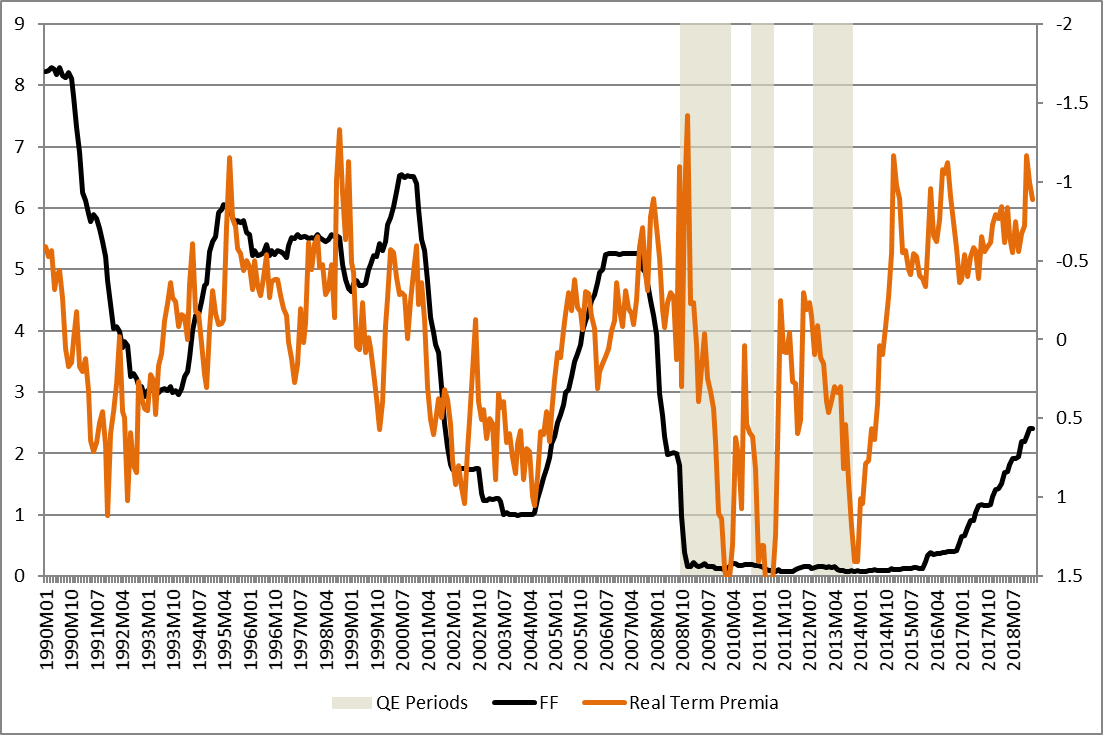

4. US Monetary Policy After The ‘Great U-Turn’

- ‘True’ Fed Funds policy rates (incorporating the effects of QT) are nearer 5-6% than the stated 2½%

- ‘Tight’ monetary stance is unsustainable and will be followed by a substantial monetary easing

- Structural shortage of ‘safe’ assets and soft economy will underpin bond returns

- Expect a yield curve steepening, led by falling near-term maturities, and rising bond market volatility

5. ECM Weekly (23 March 2019) – ESR, Sun Car, Ruhnn, CanSino, Frontage, Wuxi Bio, WiseTech,

Aequitas Research puts out a weekly update on the deals that have been covered by Smartkarma Insight Providers recently, along with updates for upcoming IPOs.

Theme of the week: Block trades/Placements + news flow on upcoming IPOs

Starting with placements, the shareholders of Wuxi Biologics (Cayman) Inc (2269 HK) are back on the market again to sell some shares. They been quite consistent with the selling and our team have covered the company the IPO each of the placements. Wisetech Global (WTC AU) and Platinum Asset Management (PTM AU) also had blocks that were sold earlier this week. The former did excceedingly well post-placement, currently more than 10% above its deal price while the latter had struggled as a result of Kerr and his ex-wife selling a portion of their shares in the company.

As for upcoming IPOs, Hong Kong ECM activity is ramping up. Megvii, the Chinese AI startup is looking to list in Hong Kong or US whereas China Feihe (FEIHE HK) is said to be revisit its US$1bn HK IPO. Ke Yan, CFA, FRM has covered the latter in this insight almost two years ago.

We also heard that Frontage had already met investors and Ke Yan, CFA, FRM has provided preliminary thoughts on valuation in:

Mulsanne Group (previously known as Alpha Smart (GXG)), Xinyi Energy Holdings, CMGE Tech, and 360 ludashi (鲁大师) re-filed their draft prospectuses. We have covered Mulsanne and Xinyi Energy in:

- Alpha Smart Pre-IPO – PE Investors Recovered 56% of Their Cost in Two Years but Left It in Debt

- Xinyi Energy (信义能源) IPO: High Dividend Yield but Depreciating Asset

- CMGE Tech (中手游) Pre-IPO Review – Unfortunate Timing

360 ludashi’s previous filing indicated that its IPO deal size will be small (<US$100m). However, the updated financials shown an almost 50% YoY PATMI growth which could put its IPO at a borderline deal size of US$100m if growth maintains at 50%.

In the U.S, Yunji Inc. (YJ US) filed for a US$200m IPO. The company runs a Chinese e-commerce site that uses a social platform to promote its products. We will be writing an early note on the company next week.

In Singapore, Eagle Hospitality REIT is said to have started investor education for its IPO while Lendlease is planning to raise up to US$500m for its retail REIT according to media reports.

In other ASEAN markets, there are also a handful of IPOs to watch out for.

- In Indonesia, Lion Air is said to be targeting US$1bn listing in the third quarter of this year and it is starting to gauge investor interest. MAP Actif has already started pre-marketing its IPO.

- In Thailand, Kerry Express Thailand is said to have hired banks to prepare for a >US$100m IPO.

- In Malaysia, QSR Brands (QSR MY) has started to pre-market for its US$500m IPO. Sumeet Singh had previously written an early note:

Accuracy Rate:

Our overall accuracy rate is 72.3% for IPOs and 64.3% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings

- Yunji (the U.S, ~US$200m)

- 360 LuDaShi (Hong Kong, potentially >US$100m)

- CMGE Tech (Hong Kong, re-filed)

- Mulsanne Group – FKA Alpha Smart – AKA GXG (Hong Kong, re-filed)

- Xinyi Energy (Hong Kong, re-filed)

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- Chinese AI start-up Megvii mulls IPO in either Hong Kong or New York to raise US$800m

- Lendlease planning to raise up to US$500m with retail Reit listing on SGX

- Indonesia’s Lion Air Starts Work on $1 Billion IPO

- Chinese Tower Operator Guodong Is Said to Plan Hong Kong IPO

- Feihe International ‘revisits plan for Hong Kong IPO’

- Solar co Xinyi Energy revives Hong Kong IPO plan

This week Analysis on Upcoming IPO

- Ruhnn (如涵) Pre-IPO Review- Significant Concentration Risk

- Frontage Holding (方达控股) IPO: Updates from 2018 Numbers

- Sun Car Insurance Agency (盛世大联) IPO: Over Valued Vs P&C Companies

- ESR Cayman Pre-IPO – Earnings and Segment Analysis

- CanSino Biologics (康希诺) IPO: Valuation Attractive, Lilly Asia Doubling Up (Part 4)

- PagerDuty IPO Preview

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.