In this briefing:

- ESR Cayman Pre-IPO- First Stab at Valuation

- China Zheshang Bank – A Look Beyond Doubling Impairment Costs

- Bank of Tianjin: 太好了, 不可能是真的

- Weekly Oil Views: Another Crude Rally Fails to Stick as Technicals Signal a Pivot Point

- Dongzheng Auto Finance (东正汽车金融) IPO Review – Relaunched at Lower Price

1. ESR Cayman Pre-IPO- First Stab at Valuation

ESR Cayman (ESR HK) aims to raise up to US$1.5bn in its planned Hong Kong listing, as per media reports. The company is backed by Warburg Pincus and counts APG, the Netherlands’ largest pension provider, as one of its main investors.

In my earlier insights: I touched upon the company’s business model and provided an overview of its operations, ESR Cayman Pre-IPO – A Giant in the Making and talk about the financials and the drivers for each of the three segments, ESR Cayman Pre-IPO – Earnings and Segment Analysis.

In this insight, I’ll look at valuing each of the segments.

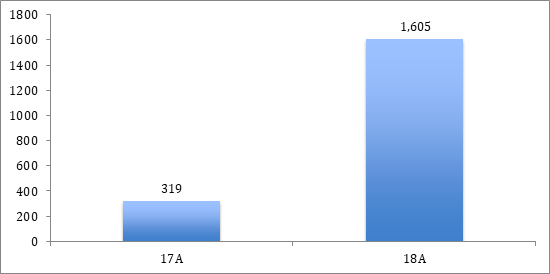

2. China Zheshang Bank – A Look Beyond Doubling Impairment Costs

It should be no surprise to see China Zheshang Bank (2016 HK; “CZB”) reveal a dramatic rise of impairment costs in 4Q18. It is one of only few China banks to yet announced quarterly results, and here it reported profit at -12% YoY in 4Q18. The doubling of impairment costs in the period goes to our long-standing concerns of continued credit tdeterioration in China and well more than headline figures suggest. This is partly based on our China corporate analysis of interest cover and debt/ebitda, which remain weak. It is also notable that CZB has been one of the faster growing banks in the country, putting its ‘unseasoned’ loans higher than many others; where we believe these banks are more likely to see higher impairment costs. Perhaps that is now coming through? And with RMB250bn of write-offs in December 2018 for China’s bank system, this suggests there will have to sizeable impairment costs to replenish balance sheet provisions.

3. Bank of Tianjin: 太好了, 不可能是真的

Bank Of Tianjin (1578 HK) results at first look quite encouraging with firmer profitability, enhanced efficiency, improved capital adequacy, and increased provisioning.

Valuations are optically attractive: p/book of 0.5x, franchise valuation of 7%, earnings yield of 17%, and a total return ratio of 2.5x. These metrics are within the bargain hunter space.

However, optimism fades fast on closer inspection.

“Underlying” Income decreased by 21% YoY as the bank was squeezed by higher funding costs and non-interest expenses. Expenses on wholesale funding increased by 30% YoY. Debt funding now represents 71% of Gross Loans. Debt now stands at 4.3x SH. Funds. This type of funding has exploded by 10x since 2014. At the same time, deposits declined YoY. Deposits have increased by a more sedate 18% since 2014.

PT Profit would have been CNY1.4bn rather than CNY5.2bn but for hefty gains on securities. Loan loss provisions almost tripled YoY.

Regarding the Balance Sheet, Special Mention Loans rose sharply (+25% YoY) and represent 2.8x NPLs. A 127% and 108% YoY increase in “doubtful loans” and “loss loans” puts some perspective on a seemingly respectable NPL ratio of 1.64% and a LLR/NPLs of 250%.

Thus, Bank Of Tianjin (1578 HK) is cheap for a reason. We are reluctant to recommend taking a position at this juncture given the ongoing stresses in source of funding and asset quality.

4. Weekly Oil Views: Another Crude Rally Fails to Stick as Technicals Signal a Pivot Point

Oil remains in a tug-of-war between fundamentals and a fickle sentiment in the global financial markets.

Brent and WTI futures settled at fresh four-month-highs of $68.50/barrel and $59.98/barrel mid-week, but had erased all the gains — and some more — by Friday’s close. However, technicals point to a pivot point in crude futures, with the 50-day moving average crossing over the 100 DMA last week. That’s typically a buy signal, but a sustained rally from the current levels is hard to see in the near-term.

Meanwhile, there were some interesting and unexpected outcomes from a high-profile OPEC/non-OPEC monitoring committee meeting in Baku on March 18. Among them were signs of a divergence in the views of Saudi Arabia and Russia, de facto leaders of the 24-producer alliance curbing supply to rebalance the market.

What explains Saudi Energy Minister Khalid al-Falih’s new hawkish stance and is the OPEC and non-OPEC partnership under some strain? Our short answer: No. We lay out our perspective of the evolving dynamics in the producers’ alliance, which is important to understanding the likely path of their collaboration.

5. Dongzheng Auto Finance (东正汽车金融) IPO Review – Relaunched at Lower Price

Dongzheng Automotive Finance (2718 HK) (DAF) re-launched its IPO at a lower fixed price of HK$3.06 per share, expecting to raise about US$208m. We have covered the fundamentals and valuation of the company in:

- Dongzheng Auto Finance (东正汽车金融) Pre-IPO Review – Dependent on Dealership Network for Growth

- Dongzheng Auto Finance (东正汽车金融) IPO Review – Better off Buying the Parent

In this insight, we will only look at the company’s updated valuation and re-run the deal through IPO framework.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.