In this briefing:

- Las Vegas Sands: Singapore Expansion Impacts Our Valuation Now, Long Before Projected 2025 Debut

- ECM Weekly (6 April 2019) – Bilibili, Huya, Qutoutiao, Polycab, PNB Metlife, CIMC Vehicle

- Japan Post Insurance Placement – 3x the IPO Size – Basics and Index Impact

- Shanghai/Shenzhen Connect – Inflow Turned Cautious in March but MSCI Adjustment Ahead

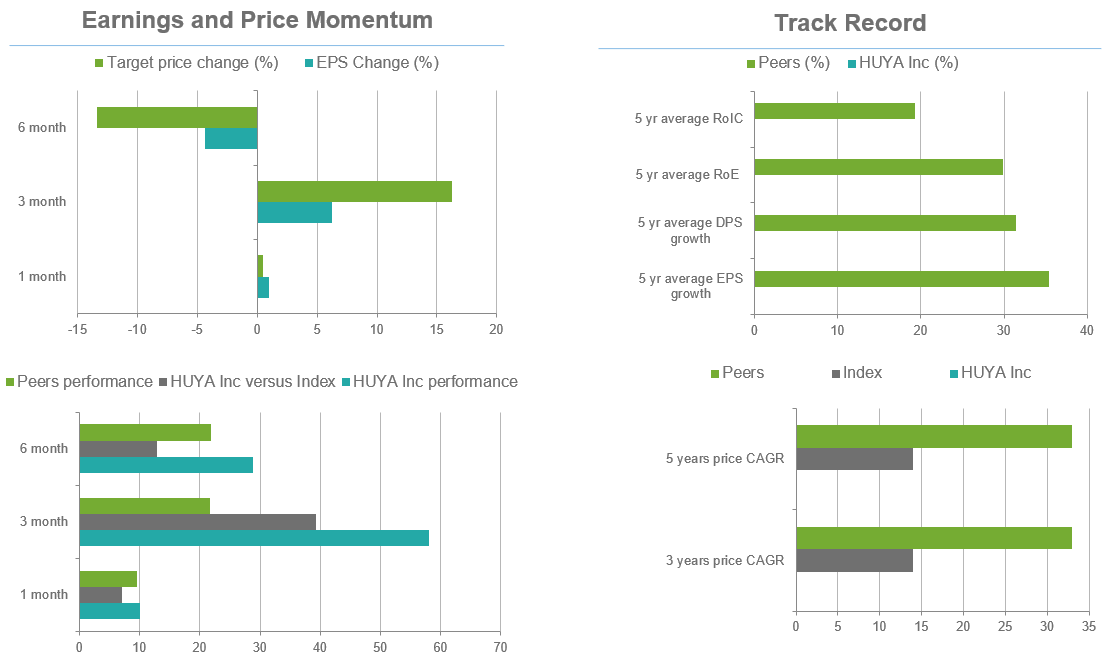

- Huya Placement: Best Performing Live Streaming Stock but Beware Douyu Is Catching Up

1. Las Vegas Sands: Singapore Expansion Impacts Our Valuation Now, Long Before Projected 2025 Debut

- LVS at $64 has runway to $80 by Q4 this year with more core catalysts than many peers.

- Just announced Singapore expansion solidifies LVS first mover MICE advantage as developer of choice in other jurisdictions.

- Singapore outlook adds credibility to LVS pole position in race for Japan IR license before year’s end, adding ballast to our PT.

2. ECM Weekly (6 April 2019) – Bilibili, Huya, Qutoutiao, Polycab, PNB Metlife, CIMC Vehicle

Aequitas Research puts out a weekly update on the deals that have been covered by Smartkarma Insight Providers recently, along with updates for upcoming IPOs.

Placements activity picked up momentum this week as evidenced by the number of follow-on offerings launched by a handful of US-listed Chinese tech companies. It all started with Qutoutiao Inc (QTT US) ‘s follow-on offering, then followed by Bilibili Inc (BILI US)‘s equity + convertible note placement, and ending the week with HUYA Inc (HUYA US)‘s follow-on offering and Baozun Inc. (BZUN US)‘s convertible bond and placement.

On the other hand, Ruhnn Holding Ltd (RUHN US)‘s debut this week had been a total disaster. It closed 37% below its IPO price on the first day. This is the worst first-day performance among Chinese ADRs (deal size >US$100m) in the past six months.

Back in Hong Kong, Dongzheng Automotive Finance (2718 HK) also broke its IPO price on the first day after relaunching at a much lower price. As per our trading update note, considering that there will be greenshoe support, we thought that the risk to reward could be favorable for a trade (from its first day mid-day price of HK$2.57).

As for placements, Ronshine China Holdings (3301 HK) seems to have made its equity raise a yearly affair. The company is back to tap the equity market through a top-up placement and it has done the same in 2017 and 2018. The initial deal size was small, US$122m, but was upsized later on. The share price traded well post-placement, closing 9.5% above its deal price of HK$10.95 on Thursday.

For upcoming IPOs, we heard that Leong Hup International (LEHUP MK) has started pre-marketing and Sumeet Singh had already shared his early thoughts on the company in Leong Hup Pre-IPO – Hard to Pinpoint What’s Going to Be the Revenue Driver Going Forward.

We are also waiting for Shenwan Hongyuan Hk (218 HK) and CIMC Vehicle Group Co Ltd (1706044D HK) to launch their IPO since they already been approved on the HKEX. Ke Yan, CFA, FRM had also analyzed the two companies in his notes:

- Shenwan Hongyuan (申万宏源) A+H: A Commoditized Broker Business

- CIMC Vehicle (中集车辆): Market Leader of Semi-Trailers but Little Growth Ahead

Map Aktif Adiperkasa PT (MAPA IJ) will be closing its bookbuild for its follow-on offering next Tuesday (pricing on Wednesday). We heard that books are already covered as of Thursday.

Accuracy Rate:

Our overall accuracy rate is 72.4% for IPOs and 63.5% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings

- Changliao AKA 派派(Hong Kong, ~US$100m)

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- Leong Hup – comeback sunny side up

- Polycab India eyes to raise around Rs 1,345 crore through IPO

- Carlyle-backed Metropolis Healthcare’s IPO nears halfway mark on second day

- Eagle Hospitality Trust eyes Singapore IPO to raise up to US$575m

- Cancer Treatment Firm Plans Hong Kong IPO

- Goldman-Backed Chinese Online Pet Store Boqii Plans IPO

- China drone maker EHang delays IPO plan, eyes private funding-sources

This week Analysis on Upcoming IPO

- Map Aktif Follow-On Offering – Lace up for a Potential Long Run

- Zhongliang (中梁地产) Pre-IPO Review – Incredible Growth Bogged Down by Related Party Transactions

- CIMC Vehicle (中集车辆): Market Leader of Semi-Trailers but Little Growth Ahead

- PNB Metlife Pre-IPO Quick Take – Doesn’t Stack up Well Versus Its Larger Peers

- Polycab India Limited IPO – Probably Near Peak Margins, Improvements Unexplained

3. Japan Post Insurance Placement – 3x the IPO Size – Basics and Index Impact

Yesterday, post-market close, Japan Post Holdings (6178 JP)(JPH) announced that it will sell 185m shares (including over-allotment) or 30.8% of Japan Post Insurance (7181 JP)(JPI) amounting to US$4bn. JPI plans to buy back up to 50m shares out of these, leaving around US$3.1bn worth of stock to be placed. Out of these 185m shares, 30% will be placed with foreigners.

The selldown is part of the government’s plan for privatization under which JPH is supposed to reduce its stake in JPI and Japan Post Bank (7182 JP)(JPB) to around 50%. This was highlighted in the IPO of the three entities in 2015. Thus, the deal is not totally unexpected but the timing of it was never certain. For people interested in more about the history and background, we’ve covered the IPO and JPH sell down in the below series of insights:

- All three IPOs: When the bank is cheap and holdco discount makes the mothership cheaper, then who needs insurance?

- JPI IPO: Three’s a crowd – A minnow amongst giants risks getting lost in the chatter

- JPB IPO: Dividend yield looks enticing versus JGBs yield, while risks are similar

- JPH IPO: Final call to board the mothership. They don’t come much cheaper than this.

- JPH Placement: Japan Post Holdings Placement – Similar Reasons, Similar Price Will Probably Yield Similar Returns

In this insight, I’ll comment on some of the deal dynamics and index weighting impact.

4. Shanghai/Shenzhen Connect – Inflow Turned Cautious in March but MSCI Adjustment Ahead

In our Discover SZ/SH Connect series, we aim to help our investors understand the flow of northbound trades via the Shanghai Connect and Shenzhen Connect, as analyzed by our proprietary data engine. We will discuss the stocks that experienced the most inflow and outflow by offshore investors in the past seven days.

We split the stocks eligible for the northbound trade into three groups: those with a market capitalization of above USD 5 billion, and those with a market capitalization between USD 1 billion and USD 5 billion.

We note that in March, northbound inflows turned more cautious vs strong inflows in February (link to our Feb note) and January (link to our Jan note). Nevertheless we see strong inflows into Healthcare sector, led by Jiangsu Hengrui Medicine Co., (600276 CH). We also highlight Universal Scientific Industrial Shanghai (601231 CH 环旭电子) in the mid cap space that attracted strong northbound inflows.

5. Huya Placement: Best Performing Live Streaming Stock but Beware Douyu Is Catching Up

Huya, a leading live streaming player in China, announced share placement of USD 550 million after market close on April 3rd. In this insight, we will look at recent developments of Huya and score the deal in our ECM Framework.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.