In this briefing:

- The Two Flavours of Kool-Aid

- Singapore Property – Luxury Segment Leads Price Decline in 1Q; Property Outlook Remains Shaky

- China’s New Semiconductor Thrust – Part 1: Why and How?

- Bulgaria Travel Note

- 🇯🇵 Japan • Internet Sector Review – ‘Japan Passing’

1. The Two Flavours of Kool-Aid

Suning, Alibaba, & Tencent Holdings join forces with three state-owned auto co’s to challenge Didi on ridesharing in China. LYFT Kool-Aid becomes more toxic with five new strategic developments in the past week. lululemon’s DTC reaches nearly 30% of sales in Q4.

- lululemon: lululemon is looking to further leverage its cult-like following by investing in its digital ecosystem and launching a nationwide membership program as DTC reaches nearly 30% of sales in Q4.

- Dollarama & Sleep Country Canada: We continue to caution against these value traps as Dollarama is still focusing on the base of the value pyramid and Sleep Country’s structural risk continues to rise with Casper looking to IPO.

- Lyft: In the past week, there have been five new major strategic developments that add to the toxicity of the LYFT Kool-Aid.

My heart pounded as I sat in the WeWork conference room on Thursday, staring at the Skype screen, waiting to be interviewed live on Yahoo! Finance’s morning show by its host, Alexis Christofouros, on why I wasn’t drinking the LYFT Kool-Aid. I wish I could go back on the show as since I published my report just a week ago, there have been five major strategic developments, adding to the toxicity of the LYFT Kool-Aid. But I’m excited about the upcoming stampede of unicorns as my mindset is what Heidi Grant Halvorson and E. Tory Higgins call “promotion focus”, as they describe in their book Focus: Use Different Ways of Seeing the World for Success and Influence: “Promotion focus is about maximizing gains and avoiding missed opportunities. Prevention focus, on the other hand, is about minimizing losses” Just like we saw with the dotcoms nearly two decades ago, promotion-focused investors are now in danger of getting caught up in the “cult-like following” of these unicorns and drinking what I call the “pink Kool-Aid”.

Prevention-focused investors are also at risk of drinking the Kool-Aid. But the Kool-Aid in this case is blue, not pink, and the danger is the toxicity of “blue Kool-Aid” increases as the rate of structural disruption increases. For example, back in January 2008, I warned investors to stop drinking Yellow Pages’ “blue Kool-Aid” as I was worried the accelerating shift to online and emergence of the then new online disruptors like Facebook and Craigslist would increase its business risk profile. And I continue to caution investors against drinking the “blue Kool-Aid” of Canadian retailers like Dollarama and Sleep Country Canada as they still operate mainly at the base of the value pyramid.

2. Singapore Property – Luxury Segment Leads Price Decline in 1Q; Property Outlook Remains Shaky

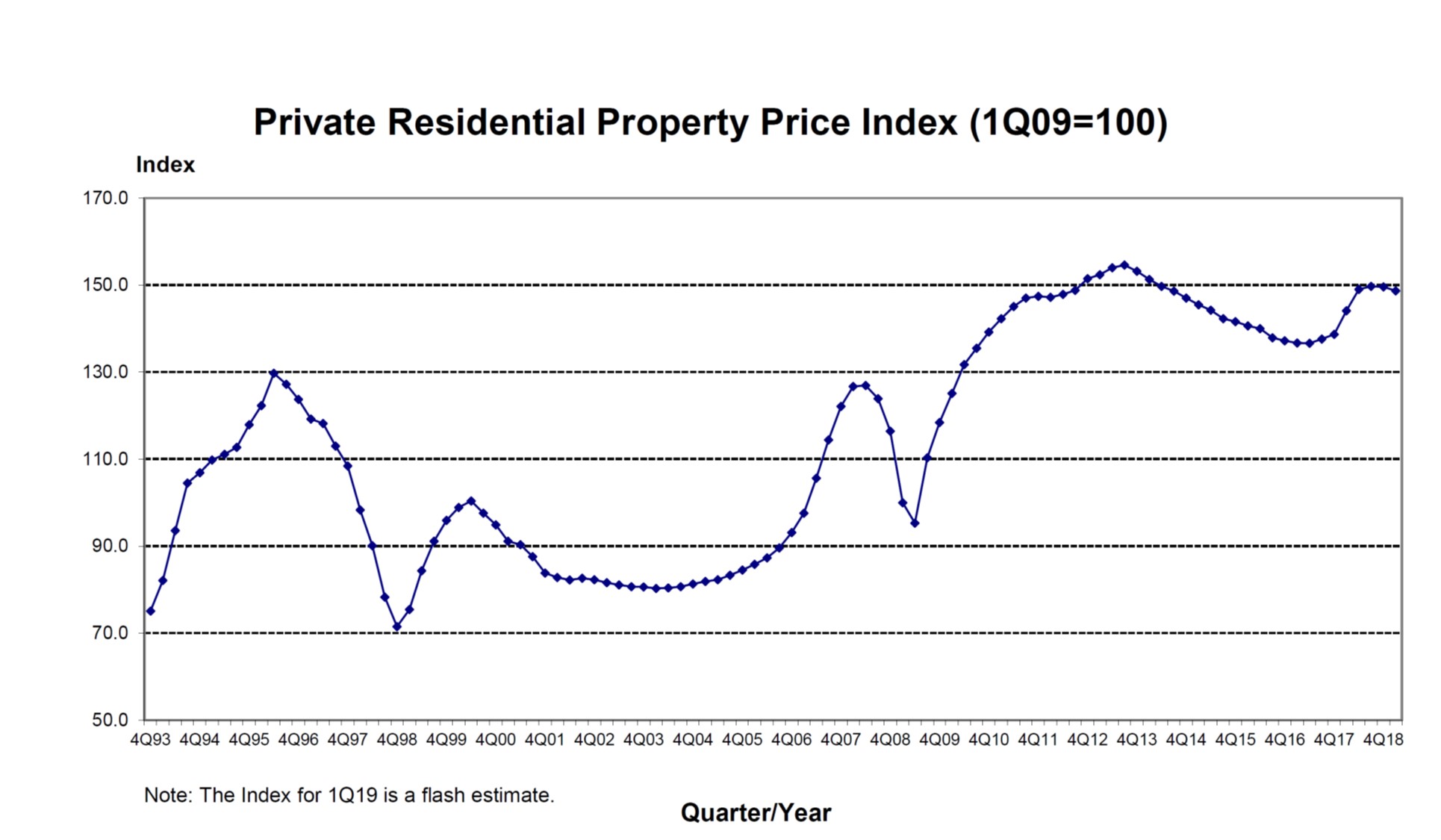

Singapore’s Urban Redevelopment Authority (“URA”) announced the flash estimate of the private residential Property Price Index (“PPI”) for 1Q 2019 yesterday.

Flash estimate for private residential PPI indicated an acceleration in price decline in the Singapore residential market in general. Private residential PPI decreased 0.9 percentage point from 149.6 points in 4th Quarter 2018 to 148.7 points in 1st Quarter 2019.

Non-landed private residential properties in the Core Central Region (“CCR”) were the worst performing segment, with prices decreased by 2.9% QoQ, compared to the 1.0% decrease in the previous quarter.

The softening of prices in the luxury residential segment did not come as any surprise. If weak sales persist, developers may eventually be forced to write-down the value of their high-end development properties, reduce selling prices to clear their luxury inventories.

Mass-market residential property segment has always been relatively more defensive in comparison to the mid-range and high-end property segment but in recent times, some signs of weakness have been observed in the mass market segment.

In view of the current outlook in the Singapore residential market, I reiterate my BUY recommendation on Sing Holdings (SING SP) (due to its defensive traits and growth prospects) with a target price of S$0.66 per share.

3. China’s New Semiconductor Thrust – Part 1: Why and How?

![]()

China’s current efforts to gain prominence in the semiconductor market targets memory chips – large commodities. This three-part series of insights examines how China determined its strategy and explains which companies are the most threatened by it.

In the first part of this series we will see what motivated China to enter the market and how it plans to do so.

4. Bulgaria Travel Note

Bulgaria has some stand out features compared to other frontier and emerging markets in Europe, including its lower wages, select favorable macro characteristics (notably the CA surplus, low debt and favorable RX reserves) and relatively stable political environment. However, challenges within this market include the high level of poverty and unemployment and most notably the extremely poor demographics. Another key risk for the market includes the country’s relatively high level of external debt. The country’s external debt current stands at over 61% of GDP (as of November 2018), which is a notable risk for the country.

The key issue with Bulgaria is the country’s low youth population and the fact that a large amount of Bulgarians are working outside the country. However, the unemployment rate has declined drastically and is well below the peak of over 10% experienced during 2013-2015. Sofia itself has a much more favorable economic environment, as it is an excellent centre for businesses involved in software and IT to set up shop to reap the benefits of talented, low cost labour.

Growth has declined slightly from the higher levels experienced during 2016-2017 and is largely being driven by domestic consumption and real estate growth. Export growth has been declining in recent years given that most of its trade partners are European countries. The World Bank projects that growth will be around 3.6% in 2019 and 2020, which is around the average level of growth experienced within countries in MSCI Frontier Markets.

Other favorable characteristics of the economy includes its high level of foreign exchange reserves and lower level of debt compared to that of other frontier and emerging markets. Furthermore, wages in Bulgaria are extremely low compared to that of its peers in Europe, which leaves room for further consumption oriented growth in the coming years if wages continue to rise. Tourism could be an additional catalyst, mainly because the 8 million visitors it receives annual is significant given that it exceeds the country’s total population.

Overall, the macroeconomic picture is hazy and the country’s exposure to Europe is also an area of concern. Furthermore, some of the largest companies listed on the stock market are either overly diversified in operations, have had lackluster growth and have strong exposure to markets such as Russia and the Ukraine. The annual turnover of the stock market during 2018 was only $315.8 million, which means the ADTV was only slightly above $1 million. The market was removed from MSCI Frontier Markets in 2016 and moved to the standalone index due to the small size and low liquidity of the market. MSCI Bulgaria (only 2 companies) currently trades at 9.5x PE and 0.56x PB. The most notable name to follow is Sopharma, which is a pharmaceutical company that also exports its products to other markets. Participation in the local stock market is not ideal at the moment.

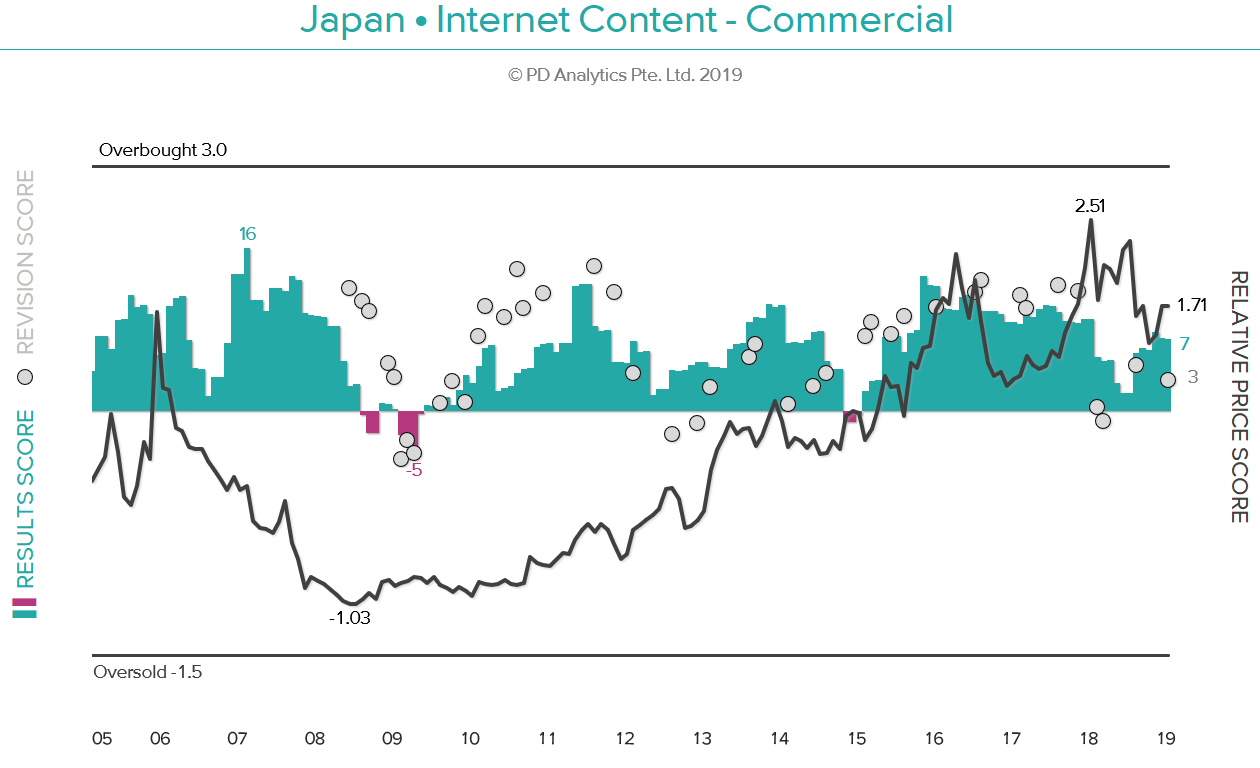

5. 🇯🇵 Japan • Internet Sector Review – ‘Japan Passing’

Source: Japan Analytics

There are currently 241 listed Japanese companies that can be categorised as Internet businesses. Our classification overlaps with the TOPIX-33 Information & Communication sub-Sector but is broader in that it encompasses all companies listed on all sections and exchanges but is also narrower in that we have excluded Telecommunications (including Softbank Group (9984 JP)) and Information Technology companies. We have adopted a ‘quantamental’ approach which covers the long-term and current trends for Japan’s Internet Sector as a whole, as well as eight sub-Sectors or Peer Groups and the Sectors’ leading companies by market capitalisation. Our focus is exclusively on the locally-listed universe and is based on disclosed financial and market data. We do not provide any forecasts, other than the companies’ own forecasts and we do not attempt to make any business model or strategic judgments. Our focus is purely on financial and market performance. We do not cover unlisted and defunct companies such as Livedoor and, therefore, there is implicit survivor bias in the data.

The broad themes that are developed in DETAIL below are grouped into six topics as follows: –

• SUMMARY •

• FUNDAMENTAL OVERVIEW •

• SCORING – RESULTS & REVISIONS / RELATIVE PRICE •

• RESULTS TRENDS •

• VALUATION •

• RECOMMENDATIONS •

OVERVIEW – As will be covered in greater DETAIL below, Japan has failed to evolve a substantial Internet Sector and, in many business models, has been passed by global competitors including in the home market. Although Internet Sector revenues have grown steadily and now account for close to 1% of the total for all listed companies, operating margins have declined by half in the last seven years and are now only four percentage points higher than the market average. Accordingly, as measured by our Results & Revision Score, the Sector is close to a twelve-year low. The market’s response is an unchanged Sector weight in the market composite despite the addition of 111 new companies in the last six years, and a Relative Price Score that has moved in a narrow range over that period. The Sector averages disguise the weak business and market performance of a handful of Sector leaders as well as the overvaluation of the Sector’s more successful business models, which is partly a result of a lack of alternatives. Despite the world’s most significant Internet investor – Softbank Group (9984 JP)‘s Vision Fund – being based in Japan, this fund and other global investors in Internet business have been right to give Japan a ‘pass’.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.