In this briefing:

- 2018 Was Not the Year for Value or Beta Names in Japan….

- Universal, SegaSammy & Dynam Sit Best Positioned Among Japan Companies in Race for IR Partnerships

- Singapore REIT – 4 Investment Themes for the S-REIT Sector in 2019

- Is China Losing the Soft Power Battle?

1. 2018 Was Not the Year for Value or Beta Names in Japan….

We looked back and identified which factors drove the Japanese market in 2018. We found that Value, which is historically strong in Japan, did poorly and really the only investment styles/factors that did well were large-cap and names with a high percent of retail investors.

2. Universal, SegaSammy & Dynam Sit Best Positioned Among Japan Companies in Race for IR Partnerships

- We’ve reviewed 10 companies in the sector. Of those, three are the consensus favorites of our Tokyo based panel of industry, financial and economics observers of the IR initiative over many years.

- Based on pachinko alone, the stocks of these companies are fully valued. Based on potential tailwind from a license award within 6 months, they could be vastly undervalued.

- Each of the three noted here brings strength to a bid less based on financials than corporate focus, outlook and experience in the field.

3. Singapore REIT – 4 Investment Themes for the S-REIT Sector in 2019

Singapore real estate investment trusts (“S-REITs”) have been one of the best performing sectors on the Singapore stock market in 2018. In view of the surge in selling activities by institutional investors this year, the resilience of the S-REIT sector came as a pleasant surprise to investors. Fundamentals of the S-REIT sector remain strong.

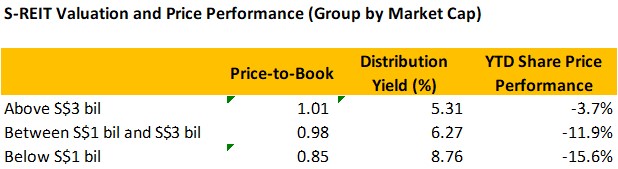

The bigger S-REITs continue to perform well, trading close to their book values and at low yields. The small-cap S-REITs (market capitalization below S$1 bil) tends to be worst performers. Whilst valuation may seem attractive, the low valuations are usually attributable to the additional risk premiums that investors require to compensate for the lack of scale, diversification and growth opportunities as well as the poor track record of some of these S-REITs.

In the coming year 2019, there are 4 investment themes for the S-REIT sector and below are ideas for investors to position their S-REITs portfolio for these themes:

Theme 1: “Safe-haven” asset class for investors

Theme 2: Merger and Acquisition

Theme 3: Growing Overseas Asset Exposure

Theme 4: The Rise of Alternative Property Asset Classes

4. Is China Losing the Soft Power Battle?

Recent figures show China slipping down the Soft Power Index while Chinese language learning in the USA is also in decline. Have tighter controls over education policy and restrictions on academic freedom in China spooked the crowd?