In this briefing:

- ECM Weekly (16 March 2019) – Embassy Office REIT, Tiger Brokers, Dongzheng Auto, Koolearn, CanSino

- Isetan-Mitsukoshi Unveils Digital Strategy

- Tesla – Now We Know The Y, But Not the How

- Indonesia Property – In Search of the End of the Rainbow – Part 4 – Alam Sutera Realty (ASRI IJ)

- Koolearn (新东方在线) IPO Review – Yet to See Results from Increased Spending

1. ECM Weekly (16 March 2019) – Embassy Office REIT, Tiger Brokers, Dongzheng Auto, Koolearn, CanSino

Aequitas Research puts out a weekly update on the deals that have been covered by Smartkarma Insight Providers recently, along with updates for upcoming IPOs.

Starting with bad news in Korea, Homeplus REIT (HREIT KS)‘s IPO was pulled on the 14th of March which when it was supposed to price. The reason cited was weak demand which stemmed from growth concerns and difficulty in valuing this business.

On the other hand, Hong Kong’s IPO market is getting busier. This week alone, we had Dongzheng Automotive Finance (2718 HK) and Koolearn (1797 HK) that have already opened for bookbuilding and will price next week. We also heard that Sun Car Insurance is already started pre-marketing and it will likely open its books next week. The company had only just re-filed their draft prospectus last week.

Another upcoming Hong Kong IPOs would be Tianjin CanSino Biotechnology Inc (1337013D HK) which we heard had already started pre-marketing. Ke Yan, CFA, FRM updated his assumptions and valuation of the company in his insight, CanSino Biologics (康希诺) IPO: Valuation Update (Part 3).

In India, the focus is on Embassy Office Parks REIT (EOP IN) as this is the country’s first ever REIT IPO. It is also the first time there is a strategic tranche in an Indian IPO which has been taken up by Capital Group. Sumeet Singh has pointed out in his insight that with cost of debt of the REIT being at 9 – 9.25%, it is hard to fathom buying equity at a FY2020E dividend yield of 8.25%. This yield had already been inflated by the lack of interest payments. For detailed explanation, read his insight, Embassy Office Parks REIT IPO – FY19 Revised Down, Yield Propped up by Zero Coupon Bond.

In other countries, we heard that Leong Hup International (LEHUP MK) is aiming to pre-market next month whereas, in Australia, there had been chatter that Prospa Advance Pty (PGL AU) may be back for an IPO again after it had beaten its own estimates from the IPO prospectus.

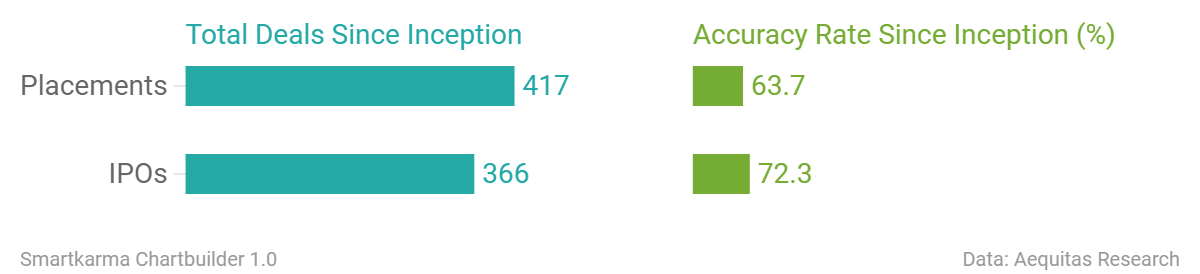

Accuracy Rate:

Our overall accuracy rate is 72.4% for IPOs and 63.7% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings

- FriendTimes Inc. (Hong Kong, >US$100m)

- Frontage (Hong Kong, re-filed)

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- UBS and Rivals to Pay $100 Million to Settle Hong Kong IPO Cases

- Chinese Luxury Car Finance Firm Seeks $428 Million in Hong Kong IPO

- Online Educator Koolearn to Raise up to $233 Million in Hong Kong IPO

- Resurgence in Indian IPO market likely only after general elections

- Homeplus K-REIT Withdraws $1.5 Billion Korean IPO on Weak Demand

- Prospa may revive listing plan after beating prospectus forecasts

- Luckin Coffee chairman said to tap banks for $200m loan in exchange for IPO role

This week Analysis on Upcoming IPO

- Homeplus REIT IPO: A Key Landmark Deal in the History of the Korean REIT Market

- Up Fintech (Tiger Brokers) IPO Quick Take – It’s Not like Futu, Won’t Perform like It Either

- Embassy Office Parks REIT IPO – FY19 Revised Down, Yield Propped up by Zero Coupon Bond

- CanSino Biologics (康希诺) IPO: Valuation Update (Part 3)

- Dongzheng Auto Finance (东正汽车金融) IPO Review – Better off Buying the Parent

- Koolearn (新东方在线) IPO Review – Yet to See Results from Increased Spending

2. Isetan-Mitsukoshi Unveils Digital Strategy

Three years ago, Isetan-Mitsukoshi attempted to reverse a strategy of shifting to small format retailing.

At the same time, the department store operator made a final ditch effort to avoid closing department stores and sacked its CEO who had had the temerity to suggest closure was the only way to revive the business.

Last year new management finally realised the old CEO had been right and that culling stores was the only way to improve profit growth.

Now the company is diversifying again but, instead of just small stores, it is planning a big investment into e-commerce with a projected ¥145 billion in sales from personal styling alone.

3. Tesla – Now We Know The Y, But Not the How

The eagerly awaited and long promised Model Y is out and it looks…like Model 3. That’s OK, just no shock and awe which Tesla really needed to jumpstart sales momentum–and a wave of sorely needed cash reservations.

Tesla Motors (TSLA US) unveiled Model Y on, perhaps not coincidentally, March 14th which also is Pi Day. Pi is the fundamental ratio which demonstrates that all circles are related–as Model Y is overwhelmingly related with the seminal Model 3 which contributes 75-80% of the newcomer’s platform and technology.

Which means Model Y may be originating with Model 3’s many inherent problems, as I discussed in Tesla’s Plan B 2.0; Y Not, just as Tesla also is juggling the ramp-up of the newly launched $35,000-base model of Model 3 along with sales expansion into Europe and China as well as building a new plant on a shoestring in Shanghai. All this just as the company also has lurched into a radical new online-only sales model with apparently little if any considered preparation (see Tesla’s New Plan: Buy Before You Try).

No wonder Tesla’s Vice President of Engineering Michael Schwekutsch just quit, an ominous signal.

Another is that Model Y won’t be available until late 2020–at best–which is much later than expected. It’s still not clear when or where Model Y will be in full production or, even more critical, when Tesla will make even a penny of profit on it. Model 3 only recently became marginally profitable, excluding the likely money-losing $35k version, and sales of more profitable but aging Models S and X are in accelerating decline.

And, as I observed last week, Tesla’s track record of long delays in delivering new models coupled with Model 3’s alarming quality and reliability may seriously diminish the hoped-for early bird reservation cash which the company sorely needs to ease its liquidity crunch. At the same time, the pending arrival of Model Y over the next year or so is likely to further dampen already waning demand for Model 3.

In any case, it’s too late for Tesla to preserve profitability in the calamitous first quarter, if not for the full year.

Continue reading for Bond Angle analysis.

4. Indonesia Property – In Search of the End of the Rainbow – Part 4 – Alam Sutera Realty (ASRI IJ)

In this series under Smartkarma Originals, CrossASEAN insight providers AngusMackintosh and Jessica Irene seek to determine whether or not we are close to the end of the rainbow and to a period of outperformance for the property sector. Our end conclusions will be based on a series of company visits to the major listed property companies in Indonesia, conversations with local banks, property agents, and other relevant channel checks.

The fourth company that we explore is township developer Alam Sutera Realty (ASRI IJ), which provides an interesting exposure to a mix of landed housing, high-rise and low-rise condominiums through its Alam Sutera Township near Serpong and its Pasir Kemis township 15 km further out on the toll road.

Given the diminishing area of high-value land bank in Alam Sutera, the company has shifted emphasis towards selling low-rise condominiums and commercial lots for shop houses, which has been a success story.

Alam Sutera Realty (ASRI IJ) also has a contract with a Chinese developer, China Fortune Land Development (CFLD), to develop a total of 500 ha over a five year period in its Pasir Kamis Township. This has provided a fillip for the company during a quiet period of marketing sales and will continue to underpin earnings for the next 2 years.

The company stands to benefit from the completion of two new toll-roads, one soon to be completed to the south connecting directly to BSD City and longer term a new toll to Soekarno Hatta Airport to the north.

It will start to utilise new land bank in North Serpong in 2021, which will extend the development potential in the area significantly longer-term.

Management is optimistic about marketing sales for 2019 and expects growth of +16% versus last year’s number, which already exceeded expectations.

Alam Sutera Realty (ASRI IJ) has less recurrent income than peers at around 10% of total revenue but has the potential to see better contributions from the Garuda Wisnu Kencana Cultural Centre (GWK) in Bali.

The new regulations on the booking of sales financed by mortgages introduced in August 2018 will benefit Alam Sutera Realty (ASRI IJ) from a cash flow perspective. Given that the company is consistently producing free cash flow, this is also a strong deleveraging story.

One of the biggest risks for the company is its US$ debt, which totals US$480m and is made up of two bonds expiring in 2020 and 2022.

From a valuation perspective, Alam Sutera Realty (ASRI IJ) looks very interesting, trading on 4.9x FY19E PER, at 0.67x PBV, and at a 71% discount to NAV. On all three measures, at 1 STD below its historical mean. Our target price of IDR600 takes a blended approach, based on the company trading at historical mean on all three measures implies upside of 91% from current levels. Catalysts include better marketing sales from its low-rise developments at its Alam Sutera township and further cluster sales there, a pick-up in sales and pricing at its Pasir Kemis township, a sale of its office inventory at The Tower, a pick up in recurrent income driven by improving tenant mix at GWK. Given that the company has high levels of US$ debt, a stable currency will also benefit the company. A more dovish outlook on interest rates will also be a positive, given a large and rising portion of buyers use a mortgage to buy its properties.

5. Koolearn (新东方在线) IPO Review – Yet to See Results from Increased Spending

Koolearn (1797 HK) is looking to raise up to US$S234m in its upcoming IPO. We have previously covered the company in:

- Koolearn (新东方在线) Pre-IPO – Profitable Online Edu Company but Poor Sentiment Weighs

- New Regulatory Tightening on Online Education Reads Badly on Koolearn IPO

In this insight, we will look at the updates on financials and operating metrics, compare it to other listed online education companies, and run the deal through our framework.

The increase in spending on marketing has not yielded the intended results as the growth rates of student enrollment and gross billings slowing down. Furthermore, aggressive spending behavior is similar to that of STG and LAIX and both companies did not perform well post listing.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.