This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Suzuki Motor Placement – Not the Best Time for a US$1.15bn Deal. It Will Be a Long Week.

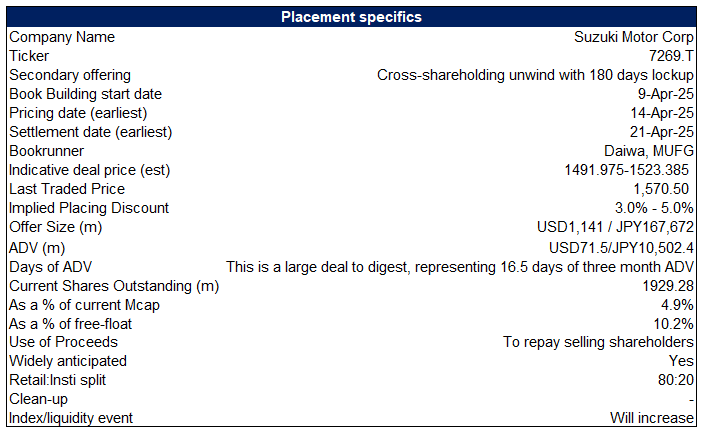

- Tokio Marine Holdings (8766 JP) and Sompo Holdings (8630 JP) aim to raise around US1.15bn (including over-allotment) via selling around 5% of Suzuki Motor (7269 JP).

- While Suzuki doesn’t have much direct exposure to the US markets, its shares have still corrected in line with other auto players.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

2. Suzuki Motor (7269 JP): A US$1.1 Billion Secondary Offering

- Suzuki Motor (7269 JP) has announced a secondary offering of up to 95.7 million shares (110.1 million including overallotment), worth around US$1.1 billion (US$1.3 billion including overallotment).

- Suzuki’s goal with the secondary offering is (i) to reduce cross-shareholdings and (ii) to expand and diversify the shareholder base, which should further enhance liquidity.

- Looking at recent large Japanese placements is instructive for understanding the potential offer price. The pricing date will fall between 21 and 23 April (likely 21 April).

3. Chagee IPO: Peer Comp and Thoughts on Valuation

- Chagee Holdings (CHA US) is planning to raise up to US$500m through its upcoming US IPO.

- It is a leading premium tea drinks brand, serving healthy and delicious freshly-made tea drinks.

- We have looked at the company’s past performance in our earlier notes. In this note, we discuss latest industry dynamics, conduct a quick peer comparison and discuss the company’s valuation.

4. Chagee Holdings (CHA US) IPO: The Bear Case

- Chagee Holdings (CHA US), a leading premium tea drinks brand, is seeking to raise US$400-500 million through a Nasdaq IPO.

- In Chagee Holdings (CHA US) IPO: The Bull Case, we highlighted the key elements of the bull case. In this note, we outline the bear case.

- The bear case rests on unsustainable growth rates, pressure on KPIs, signs of margin pressure, increasing S&M expenses and weakening forward growth indicators.

5. Key Takeaways from the Updated Filing on Hanwha Aero’s Rights Offering

- Hanwha shot down any merger talks between Hanwha Corp and Hanwha Energy, saying they’re just going to funnel Energy’s cash straight into Hanwha Aero via a third-party allotment.

- These confirm no price manipulation for Hanwha Corp; Hanwha Energy will inject cash into Aero at market value, likely driving bullish short-term price action for both Hanwha Corp and Aero.

- Despite tighter arb opportunities, doubts remain whether Hanwha Aero can raise the remaining KRW 1.6 trillion given a volatile market and the tight timeline.

6. Samsung SDI: Rights Offering Capital Raise Amount Lowered by 14% to 1.7 Trillion Won

- Samsung SDI (006400 KS) has lowered the rights offering capital raise amount by 14% to 1.7 trillion won, mainly due to the recent carnage in the global equity markets.

- The expected rights offering price has been lowered to 146,200 won, which is 14.9% lower than current price.

- We remain negative on Samsung SDI’s rights offering capital raise mainly due to shares dilution risk. We also remain concerned that the weak demand for EVs globally could last longer.

7. Hanwha Aerospace – Lowers Rights Offering Capital Raise Amount To 2.3 Trillion Won

- On 8 April, Hanwha Aerospace (012450 KS) announced that it plans to lower its rights offering capital raise amount from 3.6 trillion won to 2.3 trillion won (US$1.6 billion).

- The remaining 1.3 trillion won will be secured through a third-party allocation paid-in capital increase targeting three companies, including Hanwha Energy, Hanwha Impact Partners, and Hanwha Energy Singapore.

- Hanwha Aerospace disclosed today that it expects sales of 30 trillion won (58% higher than consensus) and operating profit of 3 trillion won (20% higher than consensus) in 2025.

8. Chagee Holdings IPO Valuation Analysis

- Our base case valuation of Chagee Holdings is target price of $46.7 per share, representing 67% higher than the high end of the IPO price range ($28 per share).

- Our base case valuation is based on a P/E of 21.4x on our estimated net profit of 2.9 billion RMB in 2025.

- We used a very conservative valuation multiple, mainly due to the extremely high macro risks related to the ongoing tariff dispute between China and the United States.

9. Duality Biotherapeutics (映恩生物) IPO: Valuation Upside at Risk

- Duality, a China-based clinical-stage biotechnology company, launched its IPO to raise up to US$200m via a Hong Kong listing.

- We look at the deal dynamics and latest developments in the biotech sector.

- The deal initially presented upside for investors but there’s a portion of its valuation now at risk due to the latest development.

10. Suzuki Motor (7269 JP): The Current Playbook

- Since the announcement of the US$1.1 billion secondary offering, Suzuki Motor (7269 JP)’s shares have remained broadly unchanged at the undisturbed price of JPY1570.5 per share (7 April).

- It is instructive to look at recent large Japanese placements to understand the potential trading pattern. Suzuki’s share performance is the joint best among recent large placements.

- However, the shares have underperformed the Nikkei 225 index (up 7.9%). The offering will likely be priced on 14 April. The average large Japanese placement tends to generate positive returns.