This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

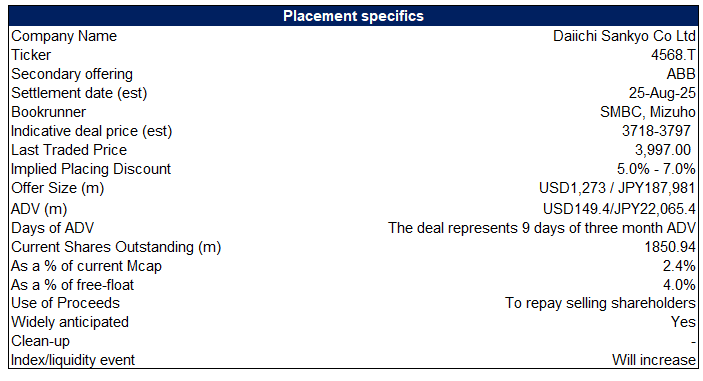

1. Daiichi Sankyo Placement – US$1.2bn Deal but Momentum Isn’t the Best, Last Deal Didn’t Do Well

- A group of shareholders are looking to raise up to US$1.2bn via selling most of their stake in Daiichi Sankyo (4568 JP) .

- While the deal shouldn’t come as a surprise, given the ongoing cross-shareholding unwind, the last deal in the stock didn’t do well.

- In this note, we will talk about the placement and run the deal through our ECM framework.

2. Hansoh Pharma Placement – Somewhat Expected but Still Opportunistic

- Hansoh Pharmaceutical Group (3692 HK) aims to raise around US$500m via a primary placement.

- The stock has done exceptionally well this year but is now trading at near its all-time highs and it doesn’t really need the cash.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

3. [Japan ECM/Index] Japan Business Systems (5036) Offering Triggers Move to TOPIX

- Japan Business Systems (5036 JP) today announced a couple of interesting things. First, admission to TOPIX (contingent on a successful secondary offering of shares, also announced today).

- Then a ¥5/share special commemorative dividend (0.4%) and a “gift” of 4% of the company to a J-ESOP Trust for employees, where the company gifts the shares.

- The latter looks aggressive/generous, but the modalities here are interesting.

4. IFAST Placement – Great Track Record but the Stock Is Toppish

- Temasek aims to raise around US$104m via selling nearly half of its stake in iFAST (IFAST SP).

- The stock has done exceptionally well over the past few years, however, it is now trading at its all time highs.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

5. ECM Weekly (18 August 2025)- Eve Energy, CNGR, Will Semi, 52 Toys, JSW, Bluestone, Tuas, Hexaware

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, a number of companies are lining up to start 2H listing season, which is likely to be one of the busiest over the past few years.

- On the placements front as well, given ongoing earnings annoucement there were only one large placement last week.

6. Hansoh Pharmaceutical (3692 HK): Placing Shares to Fund R&D Amid Stellar 1H Performance

- Hansoh Pharmaceutical Group (3692 HK) is placing 108M shares at the price of HK$36.30 per share. 65% of the proceeds will be used for the R&D of new innovative drugs.

- Hansoh’s late-stage pipeline seems to be interesting, as its key focus areas being oncology and metabolic diseases, which are among the fast-growing therapeutic areas, with huge addressable patient population.

- Hansoh has announced better-than-expected 1H25 result, with both revenue and net profit beating consensus. Innovative drugs revenue increased 22% YoY to RMB6B, contributing 82.7% of total revenue.

7. Shuangdeng Group IPO: Weak Earnings This Year but Potentially Hot Data Centre Trade

- Shuangdeng Group Co Ltd (JISHUZ CH) is looking to raise around US$109m in its upcoming Hong Kong IPO.

- It’s a global leader in energy storage business for big-data and telecommunication industries with a diverse customer base comprising telecom base station operations, data centers, power stations and power grids.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

8. Aux Electric Pre-IPO: Competitive Niche

- Aux Electric Co Ltd (0917839D HK) is looking to raise up to US$600m in its upcoming Hong Kong IPO.

- It is one of the global top five air conditioner providers, with capabilities covering the design, R&D, production, sales and related services of household and central air conditioners.

- In this note, we look at the firm’s past performance.

9. Guzman IPO Lockup – Last of the Lockups for a US$750m+ Release

- Guzman Y Gomez (GYG AU) raised around US$221m in its Australian IPO. Its final IPO linked lockup expiry is due soon.

- GYG is a quick service restaurant business with more than 200 restaurants globally. It mainly focuses on fresh, made-to-order, Mexican-inspired food.

- In this note, we will talk about the lockup dynamics and possible placement.

10. SICC A/H Trading – Strong Retail, Lukewarm Insti Demand

- SICC (688234 CH), a manufacturer of high-quality SiC substrates, raised around US$260m in its H-share listing.

- In terms of market share, as per Frost & Sullivan, based on 2024 sales, its market share was at 16.7%.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the trading dynamics.