This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

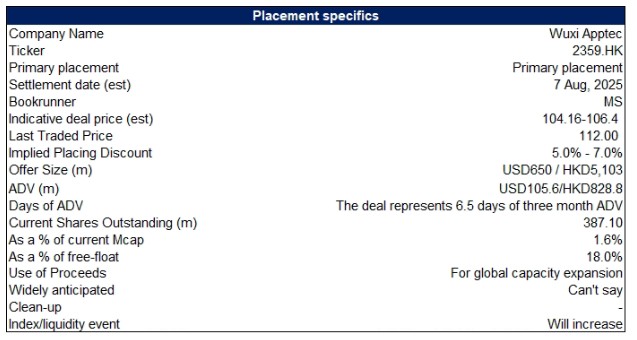

1. Wuxi AppTec Placement – Momentum Is Very Strong, Though It Is a Bit Opportunistic

- WuXi AppTec (2359 HK) aims to raise around US$650m via its H-share placement.

- The stock has been on a roll this year and recently announced strong earnings as well. Although it’s now trading at its 52-week highs.

- In this note, we will talk about the placement and run the deal through our ECM framework.

2. National Securities Depository Limited (NSDL) IPO – Peer Comparison and Thoughts on Valuation

- NSDL (NSDL IN) is looking to raise around US$460m in its upcoming India IPO.

- It is the largest depository in India in terms of number of issuers, number of active instruments, market share in demat value of settlement volume and value of assets.

- In this note, we undertake a peer comparison and talk about valuations.

3. ECM Weekly (28 July 2025) – MMC, Pine Lags, Prestige, Veritas, Daehan, Kasumigaseki, NSDL, GNI

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, we had a look at a number of deals that are in the pipeline.

- On the placements front, it was a relatively quiet week with a few primary raisings.

4. Kasumigaseki Hotel REIT IPO: Lags in Size but Priced at a Discount

- Kasumigaseki Hotel REIT (401A JP) is looking to raise up to US$192m in its upcoming Japan IPO.

- It is a REIT with hotel assets sponsored by affiliated developer, Kasumigaseki Capital (3498 JP).

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

5. Figma Inc (FIG): Range Boosted As Blow-Out Demand Comes in for High-Profile Software IPO

- Figma increased its range from $25-$28 to $30-$32 on Monday morning. The company is still offering 36.9mm shares and is scheduled to debut on July 31st.

- One of our sources stated that the amount of orders in this software IPO exceed 30-times the offering size.

- The large customer base, excellent margins and revenue growth in combination with management that continues to reinvest in the business gives us strong conviction on this IPO.

6. Firefly Aerospace Inc. (FLY): Space & Defense Company Sets Terms for IPO Seeking $5.5b Valuation

- They will be offering 16.2mm shares at $35-$39 with an expected market cap between $4.9b and $5.5b and to debut on August 7th.

- The company’s principal stockholder is private-equity firm AE Industrial which made its initial investment in Firefly Aerospace in 2022 and is a 47.4% stakeholder.

- Revenue in Q2 is up more around 140% versus the same period in 2024 but the company’s net losses continue to mount.

7. NSDL – New Management, Revised Strategy — The Battle for Market Share Continues

- This insight describes about NSDL (NSDL IN) ‘s complete overhaul in top management team over the last 12 months.

- The mandate for new team is to arrest the market share loss with new age/ discount brokers. The revised strategy seems to be working.

- The IPO provides investors a front-row seat opportunity to witness this turnaround.

8. Samyang Comtech IPO Book Building Results Analysis

- Samyang Comtech completed solid book building results. The IPO price has been finalized at 7,700 won per share, which was at the high end of the IPO price range.

- A 48.4% of the total IPO shares are under various lock-up periods lasting from 15 days to 6 months. This is a bullish signal.

- Our valuation analysis suggests target price of 13,187 won, which represents a 71% upside from IPO price. Given the excellent upside, we have a Positive view of this IPO.

9. National Securities Depository Limited (NSDL) IPO – RHP Updates – Revenue Slowing, Margins Growing

- NSDL (NSDL IN) is looking to raise around US$460m in its upcoming India IPO.

- It is the largest depository in India in terms of number of issuers, number of active instruments, market share in demat value of settlement volume and value of assets.

- In this note, we talk about the updates from its RHP filing.

10. Ab&B Bio-Tech (中慧生物) Pre-IPO: PHIP Updates Suggest Competition Intensifying

- China-Based vaccine biopharmaceutical company Ab&B is looking to raise at least US$100 million via a Hong Kong listing. The joint book runners are CITIC and CMBI.

- In our previous insight, we looked at the story that the company is trying to sell and the influenza vaccine market.

- In this insight, we look at the latest updates in its PHIP filing.