This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

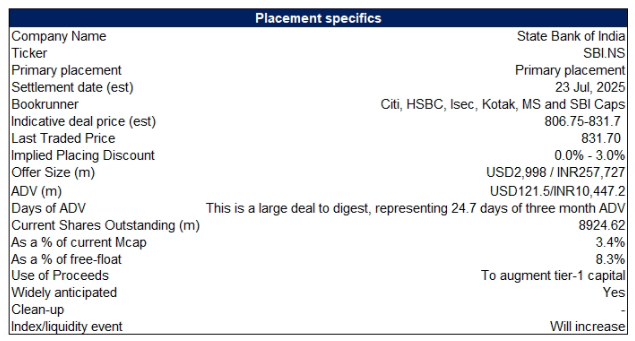

1. SBI US$3bn QIP – No Surprises – Not the World’s Best Kept Secret

- State Bank Of India (SBIN IN) plans to raise around US$3bn via a QIP. The deal is very well flagged and we wrote on it last week.

- Although the stock has been running up a bit going into the deal and the previous deal didn’t do well.

- In this note, we will talk about the placement and run the deal through our ECM framework.

2. Muyuan Foods A/H Listing – Long Term Growth with Short-Term Volatility

- Muyuan Foodstuff Co Ltd A (002714 CH), a leader in the hog farming industry, aims to raise around US$2bn in its H-share listing.

- MF is a leading pork company with over 30 years of expertise in the hog farming industry.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

3. NTT DC REIT IPO Trading – Decent Demand, High Yield and Discount Should Help

- NTT DC REIT (NTTDCR SP), a data center REIT, raised around US$772m in its Singapore IPO.

- The IPO portfolio comprises six mainly freehold data centres in the U.S., Austria and Singapore with an aggregate appraised valuation of US$1.6bn

- We have looked at the past performance in our earlier notes. In this note, we will talk about the trading dynamics.

4. SM Investments Placement: Large Deal to Digest

- An undisclosed seller is looking to raise US$142m via selling some/all of their stake in SM Investments (SM PM).

- The deal is a large one to digest, representing 33.1 days of the stock’s three month ADV, and 0.7% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

5. Leads Biolabs (维立志生物) IPO: A Duality Repeat?

- Leads Biolabs, a China-based clinical-stage biotechnology company, launched its IPO to raise up to US$144m via a Hong Kong listing.

- We look at the deal dynamics and compare the listing with the Duality listing.

- The deal values the companies fairly but we see strong sentiment towards quality biotech names.

6. Ascentage Pharma (6855.HK) Placement – Thoughts on The Placing Price and the Outlook

- Our forecast is sales of olverembatinib in 2025 could reach RMB500mn. APG-2575 is better than Sonrotoclax in ORR/safety profile, but global commercialization success is not simply determined by clinical data.

- Placing price of HK$68.6/share has priced in the successful licensing deal of APG-2575 to some extent, which however is not a done deal. US$1.5-2.375bn is a more reasonable valuation range.

- The big rally in biotech sector is not based on fundamental inflection point. The driving mentality behind the valuation bubble this time has a more obvious nature of “short-term gambling”.

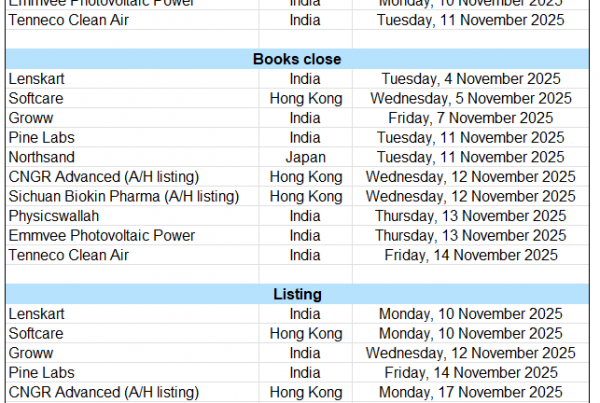

7. ECM Weekly (14 July 2025) – Meituan, SBI, Kokusai, NTT, Daehan, Anthem, SICC, CIG, FWD

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, the previous week was another busy week for listings, with mixed results.

- On the placements front, we looked at the possible placements for Meituan (3690 HK) and State Bank Of India (SBIN IN).

8. Ascentage Pharma Top-Up Placement – Past Deals Didn’t Done Well, Stock up a Lot but Sector Is Strong

- Ascentage Pharma Group Corp (6855 HK) (AP) aims to raise around US$196m via top-up placement.

- The company has undertaken a number of deals in the past, with none of the deals having done well. Although stock momentum has been strong this year.

- In this note, we will talk about the deal dynamics and run the deal through our ECM framework.

9. Nanjing Leads Biolabs IPO: Lead Asset Targets Niche Market; Path to Success Still Long

- Nanjing Leads Biolabs has launched HK$1.1B IPO to fund its ongoing and planned clinical development and regulatory affairs of pipeline assets. The company has fetched cornerstone investment of ~HK$ 542M.

- Lead product candidate, LBL-024 is being evaluated for extra-pulmonary neuroendocrine carcinoma. Leads Biolabs expects to file the first BLA for LBL-024 by 3Q26 and anticipate obtaining conditional approval by 2Q27.

- Positive investor sentiment toward Chinese biotech companies and near-term catalyst being Phase 3 data readout for LBL-024 in early 2026 are the main reasons to subscribe.

10. United Lab Placement – Industry Momentum Strong, Although Stock Has Run-Up Quite a Bit

- The United Laboratories International Holdings Limited (3933 HK) is looking to raise up to US$262m from a primary placement.

- The company intends to use about 60% of the proceeds to build production capacity and expand its international business, with the rest to be used for R&D purposes.

- In this note, we will talk about the placement and run the deal through our ECM framework.