This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

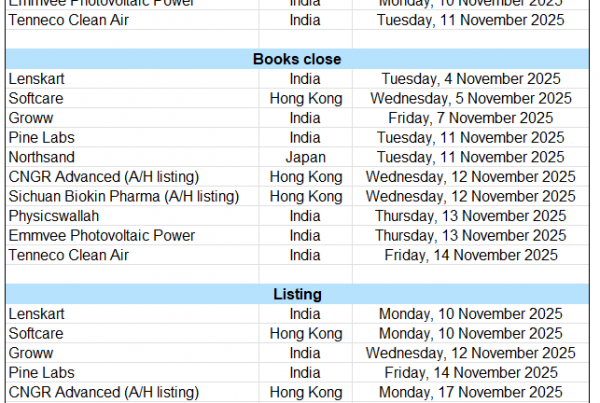

1. [Japan Offering] Bain Starting Kioxia (285A) Selldown; More to Come Soonish?

- After the close today, BCPE Pangea Cayman announced plans to sell a stake of 36mm shares of Kioxia Holdings (285A JP) in an overnight block. It trades tomorrow.

- This is 6.7% of shares out, 1.5x ADV. The discount is 7-9%. But it is 35% of Max Real World Float. And probably gets tradable shares to 34+%, not 35%.

- That means another offering is likely near-term. The lockup is only 30 days it appears. There is possibly a fair bit of long-dated index demand.

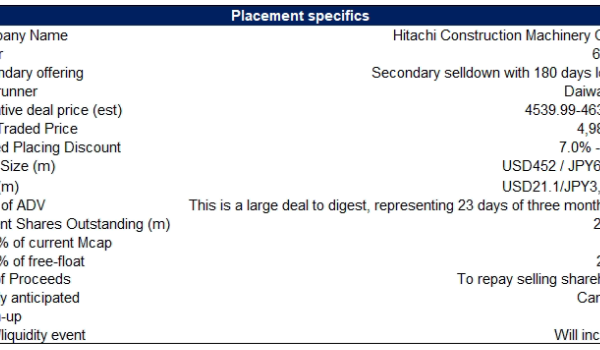

2. [Japan Offering] Toyota Selling Down Toyoda Gosei (7282) In BIG Offering; 85d ADV, 125% of Max RWF

- Last week, before the long weekend, Toyota Motor (7203 JP) and Sumitomo Mitsui Financial Group (8316 JP) announced a very big secondary selldown of shares in Toyoda Gosei (7282 JP).

- The selldown is 85x 3mo ADV, 27% of shares out. 125% of Max Real World Float. It’s a lot of stock at $750mm. One wonders where demand is.

- They also announced a big buyback, which is some of it, and there are index impacts, BUT this offering needs to find LOTS of new fundamental owners quickly.

3. Kioxia (285A JP): Bain’s US$2.1 Billion Selldown

- Bloomberg reports that Bain Capital is selling 36.0 million Kioxia Holdings (285A JP) shares through a block trade. IFR reports that the offering is worth up to JPY330 billion (US$2.1 billion).

- The offering is unsurprising given the shares are up around 7x since the IPO. The offering is easily digestible as it represents 2.7 days of the average ADV since listing.

- Kioxia is anticipated to return to growth in 3Q, and the underlying margin is recovering from recent lows. However, Kioxia’s EV/EBITDA multiple is full compared to peers and historical ranges.

4. [Japan Offering] Dear Life (3245 JP) – Unusual Offer Dynamics Are Bullish Despite Dilution

- Today after the close, Tokyo-based Dear Life (3245 JP) announced a primary offering to raise approximately ¥7bn through 15% dilution. Implying a 13+% price drop to protect PER.

- But the company plans on growing earnings. It has some projects in inventory, but it obviously plans a lot of turnover this year and needs to replenish.

- The MTMP “slogan” is “2028 – Ride the Wave!” This is a bit what investing in Tokyo real estate is like now. So one rides it until one doesn’t.

5. Kioxia Placement – US$2bn Deal, Relatively Small, Index Upweight but the Shares Have Runup

- Bain aims to raise around US$2bn via selling around 6% of its stake in Kioxia Holdings (285A JP). The IPO linked lockup on its shareholding had expired in Jun 2025.

- Kioxia is a manufacturer and a global leader in flash memory and solid state drives for smartphones, PCs, enterprise servers and data centers.

- In this note, we will talk about deal dynamics and run the deal through our ECM framework.

6. Suzhou Novosense A/H Listing – Growth Has Been Strong but Margins Weak

- Suzhou Novosense Microelectron (688052 CH), an analog chips producer, aims to raise around US$500m in its H-share listing.

- According to Frost & Sullivan, in terms of revenue from analog chips in 2024, SNM ranked fifth among Chinese analog chip companies in the Chinese analog chip market.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

7. Jingdong Industrials (JDI) IPO: The Investment Case

- JD Industrial Technology (2231713D CH), a leading industrial supply chain technology and service provider in China, is seeking to raise US$500 million.

- JDI is the largest industrial supply chain technology and service provider in China in terms of GMV, customer coverage and SKU offerings in 2024, according to CIC.

- The investment case is bearish due to weak market share gains, declining product revenue growth, margin pressures, declining cash generation and factoring of receivables.

8. UltraGreen.ai IPO: High Growth and High Margins, Market Leader

- UltraGreen.AI (2594794D SP) is looking to raise US$400m in its upcoming Singapore IPO.

- UltraGreen is a global leader in Fluorescence Guided Surgery (FGS), a surgical approach that helps doctors see things inside the body that are normally invisible under regular white light.

- We have looked at the company’s past performance in our previous note. In this note, we talk about valuations.

9. SBI Shinsei Bank Pre-IPO – Thoughts on Valuations

- SBI Shinsei Bank (8303 JP), a Japanese financial institution, aims to raise around US$2bn in its Japan listing

- SBI Shinsei Bank (SBISB) is a Japanese financial institution providing a range of financial products and services to both individual and institutional customers.

- We have looked at past performance in our earlier notes. In this note, we talk about valuations.

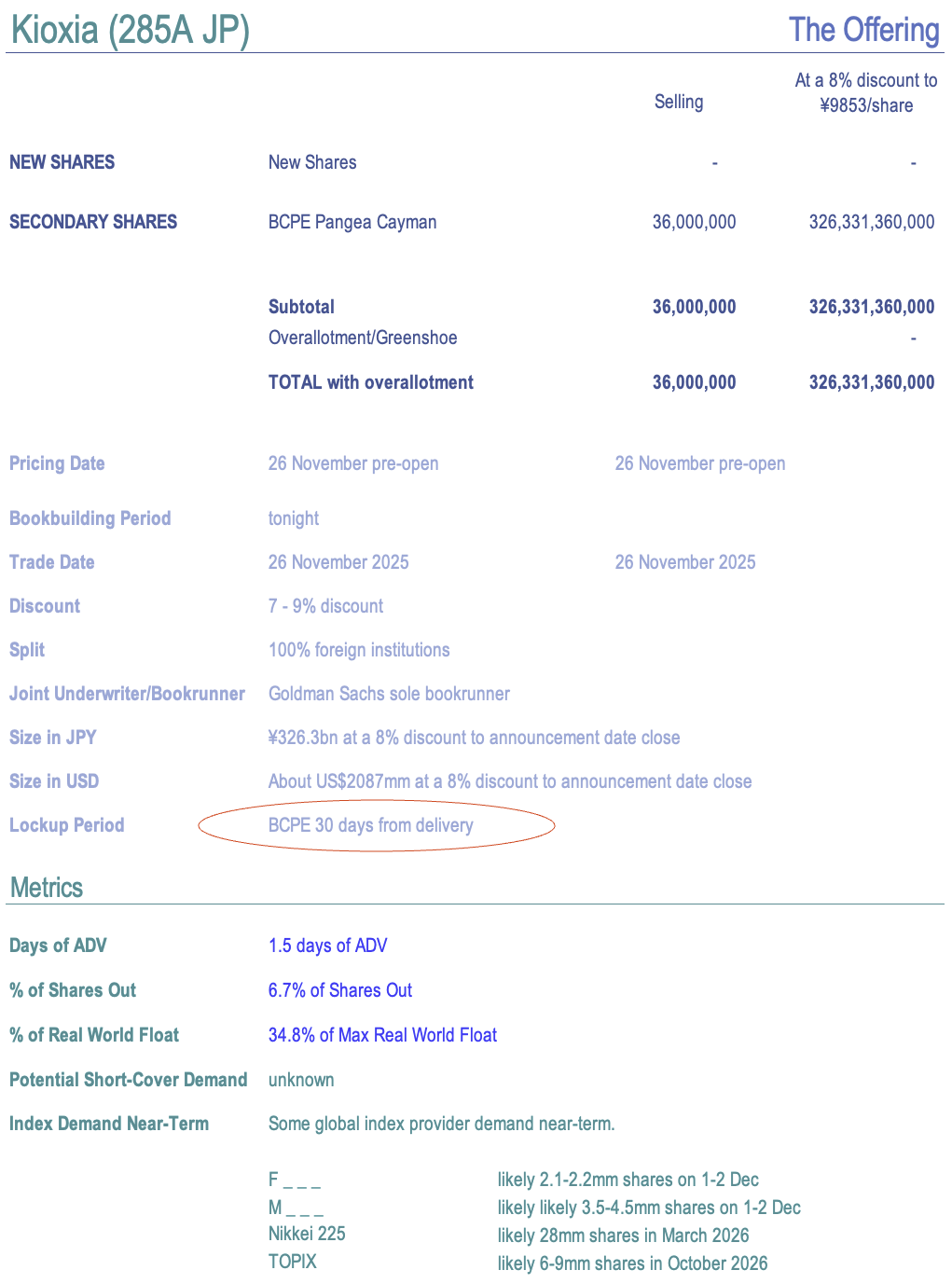

10. Hong Kong: IPO SPOTLIGHT – OVERVIEW 2025

- Hong Kong is the top global destination for IPOs in 2025, with over HK $280 billion raised so far. Large scale A+H dual listings have surged this year.

- Technology and healthcare sectors have dominated IPOs with the materials sector also floating several large listings. With nearly 300 listings in the pipeline, 2026 should be another banner year.

- Zijin Gold (2259 HK) , Chery Automobile (9973 HK) and Mixue Group (2097 HK) were the largest IPOs of the year while PegBio (2565 HK) has had the best return.