This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

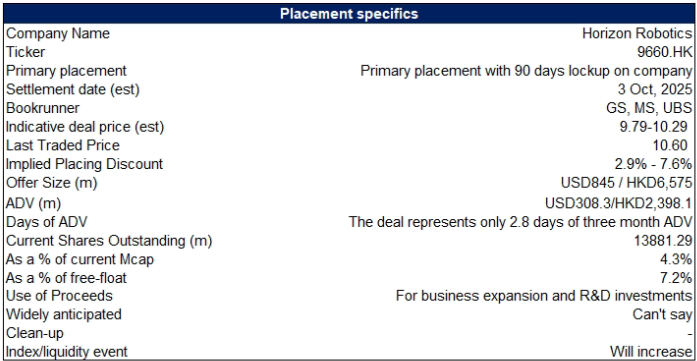

1. Horizon Robotics Placement – Another Opportunistic Raising

- Horizon Robotics (9660 HK) raised around US$800m in its Oct’24 IPO and another US$600m via a placement in June’25. It’s back again to raise another US$834m via a top-up placement.

- Horizon Robotics (HR) is a provider of advanced driver assistance systems (ADAS) and autonomous driving (AD) solutions for passenger vehicles, empowered by its proprietary software and hardware technologies.

- In this note we talk about the deal dynamics and run the deal through our ECM framework.

2. Trading Strategy of Zijin Gold on the First Day of IPO

- Zijin Gold IPO will start trading on 30 September. Zijin Gold is aiming to raise US$3.2 billion (HK$24.98 billion) from its IPO, offering 349 million shares at HK$71.59 each.

- Our base case valuation of Zijin Gold is HK$124.7 per share (74.2% higher than the IPO price). We expect a sharply higher pop on the first day of trading.

- If its share price appreciates more than 30-50% or more, we think it is prudent to take some profits off the table (at least 25%-30% of total investment).

3. Berkshire Hathaway Dumps All Its Stake in BYD – Impact on the Chery Auto IPO

- Warren Buffett’s Berkshire Hathaway completely exited its stake in BYD (1211 HK).

- We highlight four major reasons why Berkshire may have exited its entire position including valuations, tariffs, competition and lower profit margins, and greater risk prospects on economic stagnation in China.

- Berkshire selling all its stake in BYD is likely to have a slightly negative impact on the Chery Auto IPO. However, we maintain a Positive view of Chery Auto IPO.

4. Tekscend Photomask (429A JP) IPO: The Bull Case

- Tekscend Photomask (429A JP) is a global leader in semiconductor photomasks. It is seeking to raise up to JPY123 billion (US$832 million). Pricing is on 30 September.

- Tekscend, which was carved out of Toppan Printing (7911 JP) in 2022, is owned by Toppan (with a 50.1% stake) and Integral (5842 JP) (with a 49.9% stake).

- The bull case rests on its leading market position, attractive market opportunity, stable underlying margins, net cash position, and attractive dividend policy.

5. Zijin Gold IPO: The Good, The Bad and Valuations. For the Gold Bulls.

- Zijin Gold (2259 HK) IPO offers investors with a bullish outlook on gold prices a timely entry into a pure play gold miner with a globally diversified asset base.

- At HKD71.59/share, Zijin Gold IPO is set to raise US$3.2 billion with cornerstone investors already committing about half the deal (US$1.6 billion).

- At current gold prices, IPO valuations leave a reasonable buffer; however, a pullback toward year-ago levels would pose significant downside.

6. Fermi Inc. (FRMI): Pre-Revenue Data Center REIT Sets Terms Seeking $13.2b Valuation

- Fermi set terms for its IPO on Wednesday afternoon and will offer 25 million shares at $18-$22 and to debut on Wednesday, 10/1.

- One of Fermi’s founders is former energy sector director, Rick Perry.

- The underwriters have reserved for sale at the initial public offering price up to 5% of the shares of common stock for sale through a directed share program.

7. KCC Corp – To Issue 430 Billion Won in EB Using Its Treasury Shares?

- On 23 September, Hankyung Business Daily reported that Kcc Corp (002380 KS) plans to issue about 430 billion won worth of exchangeable bonds (EB) based on its own treasury shares.

- We believe the overall impact on this EB issue on KCC is likely to be more negative as compared to the EB issue it conducted in July 2025.

- Our NAV valuation of KCC Corp suggests NAV per share of 508,467 won, which is 22% higher than current price.

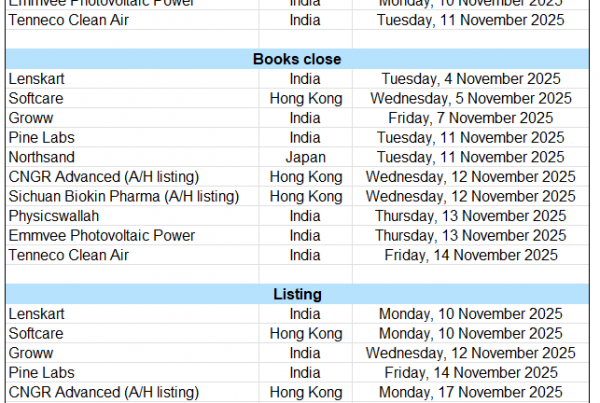

8. ECM Weekly (22 September 2025)- Chery, Zijin Gold, Orion, Myungin, Urban, Avepoint, Dongfang

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Zijin Gold appears to be shining bright.

- On the placements front, it was a relatively quiter week, as compared to some of the more recent weekly flows.

9. Zijin Gold IPO: Gold Price Sensitivity Analysis. A High Beta Proxy for Gold

- Zijin Gold (2259 HK) ’s US$3.2 billion IPO closes tomorrow, Wednesday, September 29.

- The pure-play gold miner, backed by Zijin Mining, is priced at an EV/Reserves multiple in the top quartile of global peers.

- With high sensitivity to gold price movements, Zijin Gold offers amplified upside potential — and downside risk — versus bullion itself.

10. Chery Auto IPO (9973.HK): Modest Potential Upside, Geely Auto Screens As a Good Comparison

- Chery Auto, the second largest Chinese domestic brand passenger vehicle company, priced its IPO at the high end of the range at HK$30.75/share.

- High demand for the stock was predictable. Cornerstone investors collectively agreed to acquire ~$588M worth of Chery Auto shares in this offering.

- The Chery Auto stock is set to start trading on Thursday. I see modest potential upside vs. IPO offer price as growth is slowing down and margins compressed.