This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Toyota Motor (7203 JP) Outlook Amid Uncertainty Over Toyota Industries Privatization Bid

- Travis Lundy and Arun George have recently written extensively about Toyota Industries (6201 JP) proposed takeover. Read the details in their insights.

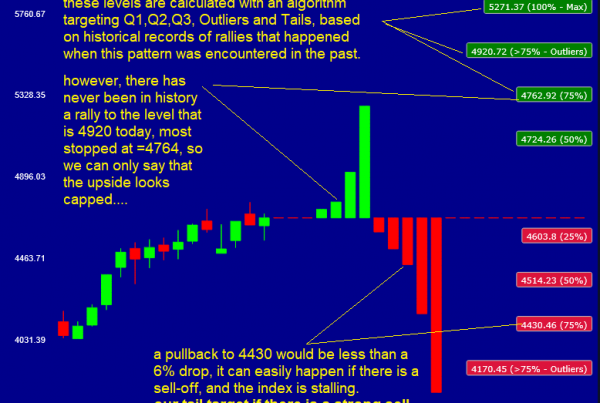

- Toyota Motor (7203 JP) is involved: 2 weeks ago we predicted a rally, and the rally did happen and went past our suggested profit target – time for an update.

- Toyota Motor (7203 JP) at the end of last week was overbought, according to our model. Any catalyst could trigger a sell off from here but let’s analyze the models….

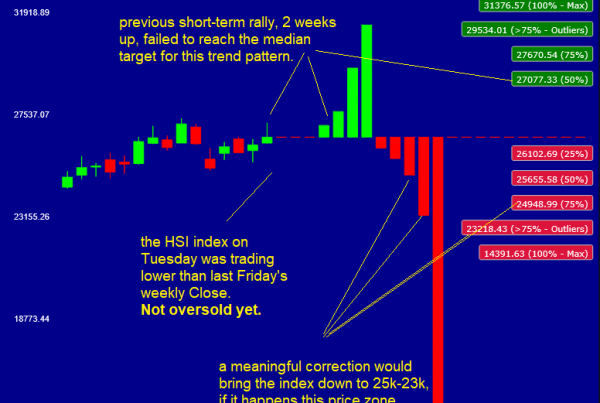

2. HSI Tactical Outlook: Buy This Dip

- After a 7-week rally the Hang Seng Index (HSI INDEX) last week gave up and close the week down (CC=-1 on our WEEKLY LONG model).

- The pullback continued on Monday, reaching 22668 and in our WEEKLY LONG model this price support zone is oversold.

- The pullback may continue, so in this insight we are going to offer some perspective on possible support zones where to buy. We think this setback is a buy opportunity.

3. KOSPI 200 Update: Market Moves After Lee Jae-Myung’s Victory

- Lee Jae-myung’s is projected to win the Presidential Elections in South Korea. The Democratic Party of Korea candidate said he wants to revive the economy and stabilize the stock market.

- At the moment of writing (around midnight Singapore time) the KOSPI 200 INDEX‘s reaction is positive, the futures are rising towards the most recent, last week highs (363).

- This is a quick review of our most recent KOSPI 200’s tactical setups, in light of the political news coming out of the polls.

4. TSMC (2330.TT) Outlook: Bullish After Shareholders Meetings

- As reported by Patrick Liao ,Taiwan Semiconductor (TSMC) (2330 TT) held its shareholders meetings on June 3rd, read the insight for the details.

- The bottom lines emerging from the meeting are: no fear of tariffs, no fear of appreciation of the NT dollar, no fear of having their tech stolen in foreogn-based factories.

- The stock rallied from June 3rd, closing at 998 on Thursday. Our model say the stock is not yet overbought, could rally higher.

5. Global Macro Outlook (June): From Rally to Reversal? Macro Trends Shift as June Unfolds

- Most major indices extended their April rally through May, but seasonal patterns suggest caution from here.

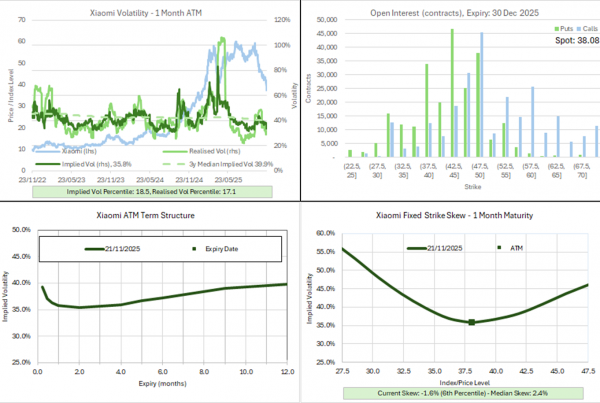

- Implied volatility declined across most markets, but remains above historical medians in several key regions.

- Vol premium analysis highlights a few standouts where short vol has historically outperformed.

6. Hong Kong Single Stock Options Weekly (June 02 – 06): Broad Gains as Option Activity Fades

- A weekly roundup of key option and price metrics for Hong Kong single stocks.

- Option volumes on par with the lowest levels seen over the past 6 months.

- Implied volatility appears to have broadly settled around current levels.

7. Nifty 50 Tactical Outlook After RBI’s Steep Rate Cut

- The NIFTY Index rallied after RBI cuts key policy rate by 50 bps to 5.50%(but RBI governor said there is limited policy space from here).

- Inflation forecast was cut to 3.7%; GDP growth forecast retained at 6.5, but Trump’s trade tariffs and the prospect of a global economic slowdown are generating uncertainty.

- The NIFTY was already moving up in the last 2 days and accelerated sharply on Friday. But our model signals that the index is not overbought, it can go higher.