This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Toyota Motor (7203 JP) Tactical View: Privatization Momentum Builds — Ready to Rally?

- Since April 28th we traced a path for Toyota Motor (7203 JP)‘s stock price, first here (forecast: going down) and then here (forecast: potential 2-week pullback to 2578).

- Last week Toyota Motor (7203 JP)pulled back to 2598 (pretty close to our 2578 target). The stocks closed down for 2 weeks, as predicted. A rally may be starting.

- Rumors of an acceleratingof privatization bid for Toyota Industries (6201 JP)could act as a fresh catalyst for the stock—aligning with our model’s forecast from May 8th.

2. Fast Retailing (9983 JP)Tactical Setup: Buy-This-Dip

- Fast Retailing (9983 JP) presents a mixed outlook characterized by strong earnings momentum tempered by some geopolitical and macroeconomic challenges. Analyst opinions are mixed but consensus is mostly = “Hold”.

- The stock started a pullback this week and is reaching a support zone that offers the possibility of entering LONG positions at a discounted price.

- This is a short-term tactical setup but the stock can be hold for the long run if the rally continues in the coming weeks.

3. Samsung Electronics (005930 KS) Tactical Outlook Amid Rumored Phase 2 Buyback Confirmation

- As reported by Sanghyun Park, Samsung Electronics (005930 KS) ‘s phase 2 buyback disposal plan appears to be virtually finalized (or will be finalized soon – not official yet).

- As always, we’ll assess what our tactical models suggest about the trend from here—interpreted alongside the latest catalysts.

- We have been monitoring Samsung Electronics (005930 KS) for a while: the stock has been bottoming, then flat for a while, rallied modestly, now a minor pullback… time to BUY?

4. BYD (1211 HK) Outlook: Near-Term Upside Still Possible, but Rally Looks Stretched…

- BYD (1211 HK) has been rallying hard since its 309.80 bottom in early april, the stock closed at 465.20 last Friday, a +50% rally! Probably well deserved.

- This insight analyzes the short-term tactical outlook on a WEEKLY time period basis. Our model finds that the stock is currently very overbought, however some upside is still possible.

- You may want to consider hedging your bets with some puts (probably cheap at this point), 1-2 weeks expiry, to protect against a (probably mild), upcoming pullback.

5. Tencent (700 HK): Strategic Insights and Top Trades from HKEX Options Trading

- Over the past five trading days, Tencent (700 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Calendar and Diagonal Spreads make up a quarter of all strategies. Several examples are presented incorporating upfront cost, upfront credit, or zero-cost combinations.

- While there is a bias towards bullish strategies, 26% of all strategies express a market-neutral view in the form of Straddles, Strangles, Butterflies or Condors.

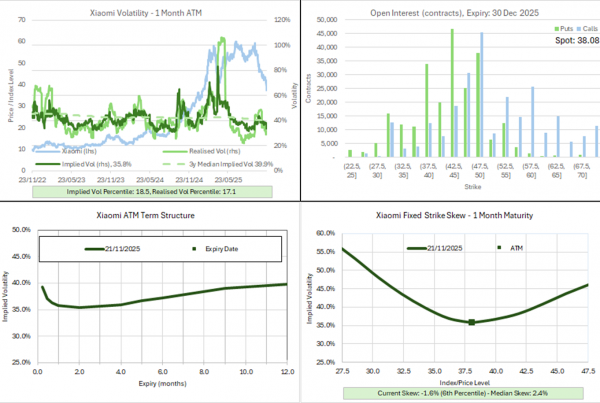

6. Tencent (700 HK): Strategies to Navigate Low Volatility and A Flat Term Structure

- Implied Volatility Trends: One-month implied volatility is currently cheap, trading in its 14th percentile, while Tencent (700 HK) approaches its twelve-months high.

- Skew and Term Structure Dynamics: A pronounced skew smile and a relatively flat term structure make spreads and calendar / diagonal spreads attractive strategies.

- Open Interest Distribution: Liquidity can be found in the monthly May expiry and the Quarterly expiries. The historically low implied volatility facilitates longer term positions.

7. 10Y US Treasury Futures Rally: Tactical Outlook & Key Profit Zones

- 10Y US Treasury Futures started to rally on Thursday, after the House of Reps approved Trump’s Big, Beautiful Bill

- The Trump administration has dismissed concerns that the latest bill will harm the nation’s financial standing, even after the U.S. lost its top-tier credit rating last week.

- This is a brief insight to try to identify potential profit targets and duration of this rally.

8. NSE NIFTY50/ Vol Update / Indo-Pak Ceasefire! Large Markdowns in IV-Skew-Smile Triggered

- Indo-Pak ceasefire triggers risk-premia markdowns – Monthly IVs -4.0 vols lower, Skew & Smile get compressed

- Vol-Regime stays in “High & Up” state with high likelihood of switching to “High & Down” in the upcoming week.

- IV term-structure flattened as the week progressed. Leaving front-end vol-differentials in Contango & Back-end Backwardation now eased to +0.60 vols.