This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Nikkei 225 (NKY) Outlook After Surprise Nov 5 Rebalance

- As reported by Brian Freitas, the JPX on Oct 27 suddenly announced that Nidec Corp (6594 JP) would be deleted from the Nikkei 225 and replaced by Ibiden (4062 JP).

- The date of replacement is November 5, the Nikkei will experience passive flows, in this insight we want to have a look at the possible moves caused by this catalyst.

- At the moment the index is overbought, according to our models.

2. A Special Cross Asset Morning Update: Nidec, Ibiden, and BoJ This Week

- Japanese markets are seeing significant developments, including Nikkei 225 rebalancing with Nidec’s removal due to alert and Ibiden’s addition, impacting tracking funds, delta one trading strategies, and investors with position.

- The BoJ’s cautious normalization path continues to shape the JGB curve, with a notable steepening in the long end affecting asset-liability management.

- We detail the trades and execution of the trade idea, which may require special attention this week especially on the rebalance.

3. GOLD Tactical Outlook: Correcting After the Run — Where to Step In

- After a 9 weeks rally, Gold (GOLD COMDTY) started to pullback, last week, and the pullback continued into this week.

- Some market watchers argue US retail investors piled into Gold ETFs following the Fed’s late-August shift to rate cuts, potentially fueling the metal’s recent upside exhaustion.

- If Gold (GOLD COMDTY) was fueled by retail buying and is now correcting, retail investors will likely chase the dip—a textbook example of herd behavior, potentially driving a rebound.

4. Advantest Earnings… TPXC30, and Murata…

- Advantest saw a 34% upside after earnings, aligning with previous buy recommendations and its inclusion in the Value Seeker Japan basket for long-term growth.

- A small inclusion into TPXC30 occurs today at the close, with Advantest’s fundamental outlook remaining in line with our recent insights.

- Murata seeing some flows as well today in at the close, and moves to the TPX 70 Large.

5. COMEX Gold: Trading Gold’s Moment in the Options Market Spotlight

- Global monetary shifts and diversification from the U.S. dollar are creating a favorable environment for gold, supported by central bank activity and strong physical demand.

- The market is showing signs of declining volatility after a recent price drop, suggesting an opportune moment for strategic options trading.

- Careful consideration of resistance levels and downside risks is key to optimizing this particular market strategy.

6. Silver: A Fifty-Year Perspective on Bull Markets and Sizing Up the Recent Correction

- After an extraordinary run, SLV’s pullback appears orderly as implied volatility cools yet remains high by historical standards.

- We examine how this bull market in Silver compares with previous bull market spanning 50 years.

- We also look at market participation to identify what’s been driving the recent price action.

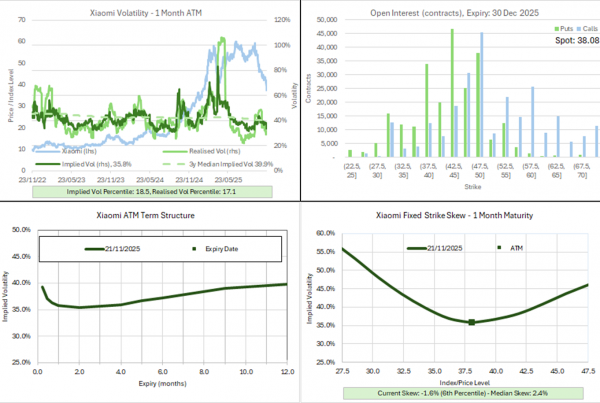

7. Selective Volatility Picks Emerge Across HSI Stocks

- Context: Volatility cones provide a straightforward framework to evaluate whether options are trading cheap or rich. This Insight provides volatility analysis for the Hang Seng and eight prominent Hong Kong stocks

- Highlight: With a dense earnings calendar ahead, volatility dispersion is widening — BYD trades rich into results, while Tencent and Xiaomi remain notably cheap relative to history.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

8. CBA, ANZ, Westpac, NAB: Volatility Runs High Ahead of Imminent Catalysts

- Context: Volatility cones provide a straightforward framework to evaluate whether options are trading cheap or rich. This Insight provides volatility analysis for the S&P/ASX 200 and ten prominent Australian stocks.

- Highlights: Implied volatility across Australia’s major banks remains rich ahead of earnings and the RBA decision.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

9. HKEX Adds Five New Weekly Options on 10 Nov: AIA, China Mobile, Xiaomi Join Fast-Growing Line-Up

- HKEX Expands Weekly Options: Five new single-stock weeklies debut on 10 November, broadening Hong Kong’s fast-growing short-dated options market.

- Why It Matters: Weeklies let traders and investors hedge or speculate around key events with precision, lower premiums, and higher gamma exposure.

- Momentum: Trading volumes in existing weeklies have surged—up nearly fourfold since launch—underscoring rising investor adoption and liquidity.

10. Hong Kong Single Stock Options Weekly (Oct 27 – 31): Market Cools After Busy News Week

- Busy news week with trade and deal headlines taking center stage.

- Stock have been treading water aside from the Materials Sector with breadth reversing from last week’s rebound.

- The thick of earnings season is past with only 15 companies reporting in the next week.