This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Horizon Robotics (9660 HK): Southbound Stock Connect Inclusion Today & Upcoming Index Flows

- Horizon Robotics (9660 HK) will be added to Southbound Stock Connect from the start of trading today. Then there will be passive buying at the close on 20 June.

- The lock up expiry in April will result in large buying from trackers of the Hang Seng TECH Index (HSTECH INDEX) and HSIII Index in September.

- The stock will also be added to another large global index, though the timing on inclusion is not certain at the moment.

2. Zomato/Eternal: The BIG Passive Selling Starts

- Following shareholder approval of the proposal to reduce the Foreign Ownership Limit from 100% to 49.5%, NSDL has updated the FOL. This starts the process of passive selling in Zomato.

- Passives will sell US$350m at the close on Tuesday. There is a low probability of more selling later in the week. There will be bigger selling in August.

- The size of the selling in August and beyond will depend on what foreign investors do in the stock till the end of June. Watch the red flag/ breach list.

3. [Japan Activism/M&A] Taiyo Holdings (4626) Now an MBO Target? KKR and One More Bidding

- Taiyo Holdings (4626 JP) has an interesting background, embroiled in a separate activist event via its equity affiliate sponsor Dic Corp (4631 JP), and recently an activist target itself.

- Today a Bloomberg article said KKR and one other PE fund had made acquisition proposals via TOB. Taiyo confirmed, establishing a Special Committee. A deal is months away, at earliest.

- Shares shot up to limit up, opened briefly, then resumed at limit up. The question here and now is valuation.

4. [Japan M&A] Makino Milling (6135) – MBK as White Knight Appears To Have Made a Binding Bid

- In December, Nidec Corp (6594 JP) made an unsolicited bid for Makino Milling Machine Co (6135 JP). Makino wanted more time. Nidec wanted to squeeze. Makino proposed a poison pill.

- Makino appeared to act slowly but white knight bidders were mooted in the media. Nidec launched, but apparently approvals may have been hard. They withdrew. Makino cancelled the poison pill.

- Shares fell sharply. Yesterday, they rose because it appears Effissimo owns 3%. Today, we got news post-close that MBK may be close to making an ¥11,000+ bid.

5. [Japan M&A] NTT To Buy Out SBI Sumishin Net Bank (7163) At a HUGE Price for Minorities

- Late Nov-2024, SBI Sumishin Net Bank (7163 JP) was trading ¥2,900, weekly mag Bunshun scooped a possible NTT Docomo deal. The stock popped, I was skeptical. It popped more.

- At Q3 earnings, NTT seemed to downplay the possibility saying they wouldn’t overpay. SBI Sumshin fell. Then fell some more.

- Today we get a deal whereby NTT buys out SBI Holdings (8473 JP)‘s 34% stake, and minorities, and partners with Sumitomo Mitsui Trust. Then a side deal with SBI.

6. Tsuruha (3391 JP)/Welcia (3141 JP): Vote Musings

- Leading proxies recommend that Tsuruha Holdings (3391 JP) shareholders vote against the Tsuruha/Welcia Holdings (3141 JP) merger on 26 May.

- The share exchange terms favour Welcia over Tsuruha shareholders. The Tsuruha vote will be close but likely to be approved. Long Tsuruha is the trade, irrespective of the vote.

- For a vote pass, you are long synergies and a likely partial offer bump. For a fail, you are long an undemanding multiple and the optionality of a new bid.

7. A/H Premium Tracker (To 23 May 2025): AH Premia Contract, H Premia Names Perform Best; Batteries!

- AH spreads are slightly narrower, but performance is concentrated in fewer names and broad spread volatility is up. BYD (1211 HK) now 5% through. CATL 10% through will help.

- It feels like there were some concentrated shorts on H vs A. BYD performance on CATL and Hang Seng upweight/inclusion exacerbate the issue. CATL H less liquid than people think.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Monitor are both there free for SK readers.

8. [Japan Activism/M&A] – Shareholders Approve Tsuruha/Welcia Merger – Now It’s Partial Offer+Synergies

- This morning the Nikkei reported shareholders of Welcia Holdings (3141 JP) and Tsuruha Holdings (3391 JP) approved their Merger. Activists opposed but it was going to be close at best.

- As expected, Welcia shares popped, and the spread converged to 2% with Tsuruha falling back to just below ¥11,400. Some of this is unwind of speculative interest in Tsuruha.

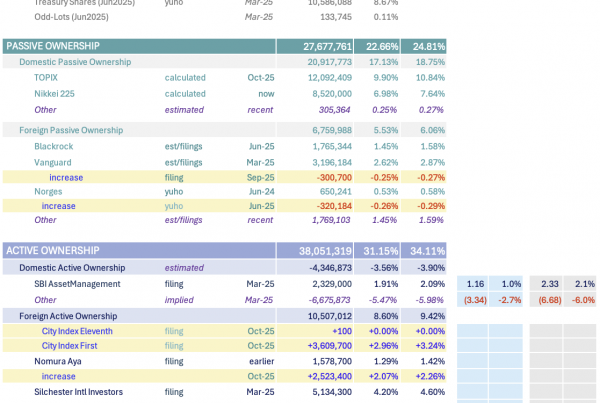

- The new yuhos are out, which shows roughly where we stand (as of end-Feb, and some updates). Now the trade is NEWCO vs Aeon’s interest and NEWCO vs World.

9. NIFTY Index Outlook (With an Eye on Zomato’s Passive Selling Starting…)

- As reported by Brian Freitas , one of the NIFTY Index (NIFTY INDEX) ‘s component (Zomato: Eternal (ETERNAL IN) ) will be subject to big passive selling beginning on Tuesday.

- Let’s have a look at the NIFTY Index (NIFTY INDEX) to evaluate the tactical outlook according to our model.

- Since our last BUY recommendation in a previous insight in early May, the index has made some progress uptrending, let’s see if the rally can continue…

10. [Quiddity Index] GMO (9449) Sub GMO Financial Gate (4051) Moves to TOPIX

- Today after the close, GMO Internet Group (9449 JP) subsidiary GMO Payment Gateway (3769 JP) announced its subsidiary GMO Financial Gate (4051 JP) would move to TSE Prime 5 June.

- That means it moves to TOPIX at the close of trading 30 July 2025.

- This growth stock appears to have “de-growthed” somewhat in stock price terms – trading near its IPO price from covid era, so it is worth a look.