This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

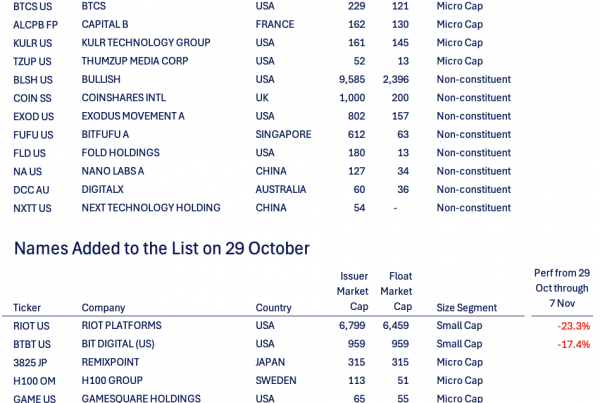

1. [Japan Activism/M&A] Thinking About the Partial Tender Trade Coming in Dec25

- A month ago I wrote [Japan Activism/M&A] – Closing In On the Tsuruha Partial Tender – Likely Needs To Be Higher. Now we are <2wks to the deal.

- At the time, I said the Partial Tender Offer Price needed to be higher than the mooted ¥2,280. Tsuruha Holdings (3391 JP) shares are up 10.0% in that month.

- The three largest peers are -2.0% on average in that period. The average of 8 peers is +0.5%. I still expect the partial offer price needs to be near ¥3,100

2. China Hongqiao (1378 HK): Index Impact of US$1.2bn Placement

- China Hongqiao (1378 HK) is looking to raise US$1.2bn via a top-up placement at an indicative price of HK$29.2/share, a 9.6% discount from the last close.

- There will be limited passive buying from global index trackers at the time of settlement of the placement shares. However, there are a couple of potential index inclusions in December.

- Then there will be more passive buying from trackers of a global index, Hang Seng Index (HSI INDEX) and Hang Seng China Enterprises Index (HSCEI INDEX) next year.

3. CATL IPO Lockup – US$5.3bn Lockup Release, with H-Shares at Significant Premium to A-Shares

- CATL (3750 HK) raised around US$5.2bn in its H-share listing in May 2025. The lockup on its cornerstone investors is set to expire soon.

- CATL is the global leader in new energy vehicle battery solutions, in China and globally, as per SNE Research.

- In this note, we will talk about the lockup dynamics and possible placement.

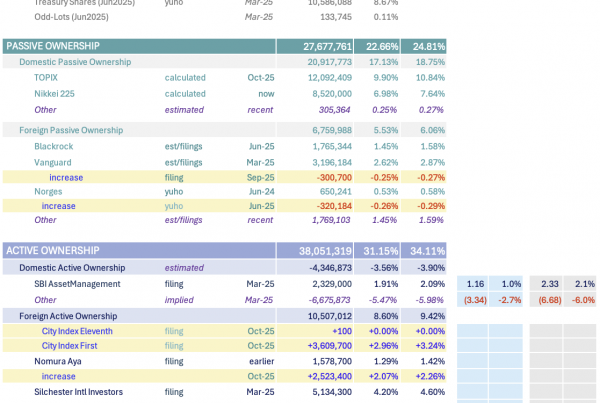

4. SBI Shinsei Bank (8303 JP) IPO: TPX Add in Jan; Global Index: One in May; One in June

- SBI Shinsei Bank (8303 JP)‘s listing has been approved by the JPX and the stock is expected to start trading on the Prime Market from 17 December.

- At the indicated IPO price of ¥1,440/share, the IPO will raise up to ¥367.6bn (US$2.38bn) and value SBI Shinsei Bank (8303 JP) up to ¥1,290bn (US$8.34bn).

- The stock should be added to the TOPIX INDEX at the close on 29 January while inclusion in global indices should take place in May and June.

5. [Japan Activism/M&A] Hakuhodo DY Lowers Digital Holdings (2389 JP) TOB Threshold, Bumps a Tiny 2.2%

- Today after the close, Hakuhodo Dy Holdings (2433 JP) announced changes to the terms of its Tender Offer for Digital Holdings Inc (2389 JP), which faces an overbidder in SilverCape.

- Hakuhodo had bid ¥1,970. Silvercape came over the top with a proposed ¥2,380 but a delay for approvals. DH is fighting against SilverCape because of “remaining minority shareholder risk.”

- That’s garbage. Utter blatherskite. Trumpworthy trumpery. Now Hakuhodo DY has lowered the minimum threshold making it hard to miss, and raised the price 2.3% to ¥2,015.

6. Alibaba (9988 HK / BABA US): Brace for a Big Earnings Move

- Alibaba (9988 HK) / Alibaba (BABA US) will announce quarterly results on Tuesday, November 25, 8:30 p.m. HKT (7:30 a.m. U.S. Eastern Time)

- Options markets anticipate an above average move with a bearish bias in traders’ expectations. Implied volatility is expected to drop significantly after the event.

- Get ready for Alibaba‘s earnings announcement. Potential above-average volatility in Alibaba has the potential to impact the wider market and Chinese benchmark indices.

7. Merger Arb Mondays (17 Nov) – Mandom, Paramount Bed, Maruwn, Paris Miki, Mayne, AUB, Genting

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Smart Share Global (EM US), AUB Group Limited (AUB AU), Dongfeng Motor (489 HK), ENN Energy (2688 HK), Digital Holdings Inc (2389 JP).

- Lowest spreads: Bright Smart Securities (1428 HK), Mandom Corp (4917 JP), Seven West Media (SWM AU), Pacific Industrial (7250 JP), Toyota Industries (6201 JP), Jinke Smart Services (9666 HK).

8. Grindr (GRND US)’s Wide Spread As Majority Owners Court Delisting

- Back on the 24th October, Ray Zage (director) and James Lu (chairman), collectively holding ~60% in Grindr (GRND US), proposed to take the company private in a US$3.5bn deal.

- The non-binding cash Offer of $18/share, is a 51% premium to undisturbed. A condition to a firm Offer may incorporate a majority of minority vote.

- While the Special Committee considers the proposal, James Lu has unusually opted to step down. Currently trading at a ~30% gross spread to indicative terms.

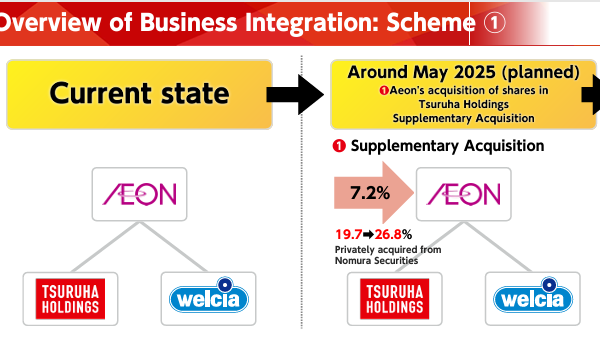

9. Tsuruha-Welcia Merger to Form Biggest Drugstore Alliance, +Aeon TOB

- The Tsuruha-Welcia merger creates Japan’s largest drugstore alliance, poised for long-term growth and market dominance, driven by an expected JPY 50B in synergies over three years.

- A two-step corporate action—share exchange (Dec 1, 2025) followed by an Aeon TOB—provides structural certainty and strategic backing, securing the combined entity’s market leadership.

- These catalysts establish a large market leader in the consumer staples space, suggesting a timely opportunity to gain exposure to the new entity.

10. Webjet (WJL AU): Helloworld Steps Up As Weiss/BGH Seek Board Spill

- In Webjet (WJL AU): Undisclosed Buyer Buying, rumours surfaced earlier this year of an undisclosed buyer with ~5%. On the 12th May, Helloworld (HLO AU) emerged with a 5.015% stake.

- On the same day, Gary Weiss/BGH, collectively holding 10.76%, launched a A$0.80/share NBIO, which was subsequently rejected. Undeterred, Weiss/BGH has called for an EGM (21st November) to spill the board.

- Helloworld has now tabled a A$0.90/share non-binding Offer, by way of Scheme. The 1H26 dividend of A$0.002/share will be added. Helloworld currently holds 17.27%. Weiss/BGH hold 17.75%.