This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan Event/Buyback] The Sony Financial Spinoff – ‘Maybe’ BUYBACK Complicates Planning

- The Sony Financial Holdings (8729 JP) (now called Sony Financial Group Inc (“SFGI”)) spinoff approaches. It will start trading 20 days from now.

- Yesterday, the TSE confirmed approval (outline, Securities Report (J), Corporate Governance Report (J). The company provided details of a possible ToSTNeT-3 buyback on Day 2 pre-open. That complicates things.

- The introduction of that type of buyback flexibility indicates that supply overhang may be managed better than buyers would hope. Means other strategies may be necessary.

2. [Japan M&A] Mandom (4917 JP) MBO – Light Price, Open-Ish Register, Tough to Take Over, Could Do Fun

- On 10 September, the founding Nishimura family, the PE Firm CVC, and Mandom Corp (4917 JP) agreed that the first two could take over the latter at 4.9x Mar28 EBITDA.

- A cocktail napkin calculation of expected leverage suggests the equity check is buying this at 5x average Mar27-28 free cash flow. That’s cheap for a growing company.

- The register is open enough to cause problems but not open enough to allow a clean hostile bid by a strategic. But still open enough for someone to have fun.

3. Dongfeng (489 HK): Questioning The EV Listing Valuation

- Back on the 22nd August, SOE-backed Dongfeng Motor (489 HK) announced a privatisation; together with a concurrent listing of its EV arm, VOYAH.

- The share price closed up 54% on the first day, ~15% adrift of the independently valued cash + scrip (into VOYAH) under the privatisation.

- Shares have pared back 5% since. VOYAH’s peer basket has fallen ~15% on average. The market is implying a price-to-trailing-sales of 1x for VOYAH versus the basket average of 1.9x.

4. Merger Arb Mondays (08 Sep) – Kangji, OneConnect, Ashimori, Pacific Ind, RPM, Santos, Zeekr

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Smart Share Global (EM US), ENN Energy (2688 HK), Dongfeng Motor (489 HK), Joy City Property (207 HK), Santos Ltd (STO AU).

- Lowest spreads: Bright Smart Securities (1428 HK), Pacific Industrial (7250 JP), Humm Group (HUM AU), Ainsworth Game Technology (AGI AU), Ashimori Industry (3526 JP), Toyota Industries (6201 JP).

5. Mandom (4917 JP): A Light CVC-Sponsored Preconditional MBO

- Mandom Corp (4917 JP) has recommended a CVC-sponsored preconditional MBO at JPY1,960, a 32.1% premium to the last close price.

- The offer is below the midpoint of the IFA DCF valuation range and the special committee’s requested price. It is unattractive compared to precedent transactions and peer multiples.

- The offer is unequivocally light. The setup has the potential for a bump, particularly if an activist emerges as a substantial shareholder.

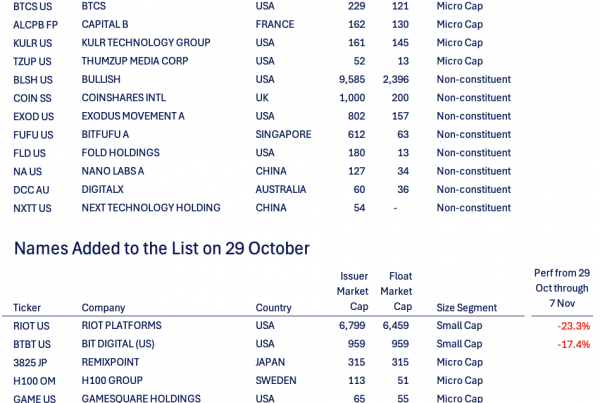

6. Regarding the Six KRX Sector Names that Ran Ahead of Friday’s Official Review Drop

- Six names stood out with simultaneous volume spikes and sharp pops last Friday; all Semis and Autos additions with big passive impact, while all others showed no tape action.

- Results likely leaked early, prompting front-running on Semis and Autos adds—high passive impact names—causing Friday’s sharp volume and price spikes.

- Early movers are mostly priced in; Thursday momentum plays still work, but Monday–Thursday morning requires caution. Focus on volume-driven flows before loading positions, long-short basket viable for other passive-impact names.

7. [Japan M&A] Pacific Industrial (7250) The MBO Is Extended After Effissimo Buys Above Terms

- Activist-Ish-Y investor Effissimo reported Friday they had a 6.68% stake as of the end of August.

- Their average price is ¥2,253 which is 10% through the price the family Bidco was bidding (¥2,050).

- As this hasn’t traded below terms at any point since announcement, an extension was likely. This morning, we got one. We’ll get another one before it’s done, BUT…

8. Timing the HHI–Mipo Spread Play Around the Passive Inflow Kick

- HHI–Mipo spread holds 3–4%; cancellation risk minimal. Market views HHI as the cleaner MASGA play vs. Mipo, keeping the spread sticky and unlikely to tighten soon.

- Potential kicker for widening comes from passive inflows when Mipo halts, as HHI gains weight in Global Standard vs. Mipo’s Small Cap.

- HHI may see ~4x DTV passive inflow as it absorbs Mipo; pre-announcement flows could start late October, potentially widening the swap spread ahead of the Nov 27 halt.

9. PointsBet (PBH AU) And Mixi Double Down Ahead Of Offer Closing

- On the 29th August, Mixi (2121 JP) cleared 50% of the voting power in PointsBet (PBH AU). It’s Offer was automatically extended, and will now close on the 12th September.

- Mixi has 51.59%. betr Entertainment (BBT AU) said it holds 20.45%, plus 6.5% in the IAF, the instructions for which can be withdrawn. betr said it won’t accept Mixi’s Offer.

- Mixi adds betr will have no PBH board representation “either now or in the future”; and betr will continue to be a clear competitor. Additionally, PBH questions betr’s buyback funding,

10. StubWorld: The Murdoch Succession Into News Corp, Fox & REA

- After a protracted succession stoush, Rupert Murdoch’s son Lachlan is set to take control of News Corp (NWS US) and Fox (FOXA US).

- Preceding my comments on News Corp and 62%-held REA Group Ltd (REA AU) are the current setup/unwind tables for Asia-Pacific Holdcos.

- These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.