This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. The Week Ahead – Is Trump Winning?

- Recent tariff announcements reflect cautious optimism on the US Dollar and inflation risks

- Tariff rates of 16-17% could lead to gradual pass through to prices, impacting inflation in the coming months

- Q2 GDP growth rebounded, but domestic final demand slowed, suggesting a gradual economic slowdown in the US, while Canada faces economic challenges and BoC takes a dovish stance

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

2. BoE Cut Proves Finely Balanced

- Four MPC members refused to back the rate cut in August, and only one favoured a 50bp cut, but he was forced to vote for a 25bp cut to break the balanced 4:4 split.

- The group favouring a slower pace of easing may have expanded from 5:4 to 6:3, raising the hurdle to another cut. Four don’t even support the prevailing level.

- Inflation forecast revisions keep trending the profile higher. Rolling resilience in the broader data should keep the BoE on hold in November and beyond, like the ECB.

3. Briefing. Massive Jobs Restatement, Rates Go Nowhere, Apple M&A?, Earnings Updates

- New newsletter format called “The Briefing” provides quick market synopsis and company information, also available in podcast form on speedwellmemos.com

- Recent market events include S&P 500 reaching all-time high before job report and new tariffs cause market to drop, Fed considering rate cut in response to softening economy

- President Trump criticizes Fed Chair Powell for not lowering rates, Powell cautious on rate cuts to avoid inflation, history of rate mistakes highlighted

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

4. Jung Chung-Rae (New Head of Ruling DPK) – Likely To Push for CGT Changes, How About Other Taxes?

- Jung Chung-Rae, a four term lawmaker, has been appointed the new head of the ruling Democratic Party of Korea (DPK) in the past week.

- His appointment as the head of the DPK party signals that there could be some changes to the 2025 Tax Reform Plan announced by MOSF last week.

- The highest probability event is that the lower threshold for major shareholders for stock capital gains tax may NOT be lowered from 5 billion won to 1 billion won.

5. EA: Resilient Retail Rebound

- Consumers need to drive activity growth as tariffs and Euro strength harm export competitiveness. Reassuringly, retail sales returned to their trend after a trimmed fall.

- Growth was broad across countries and categories, taking the annual pace 0.5pp above consensus expectations. Non-food retail is critical and the strongest of them all.

- Surveys are gloomier, especially about the future, but rarely right. Resilient real wage and employment growth can sustain brisk retail trends, preserving economic expansion.

6. HEM: One-Touch Easing

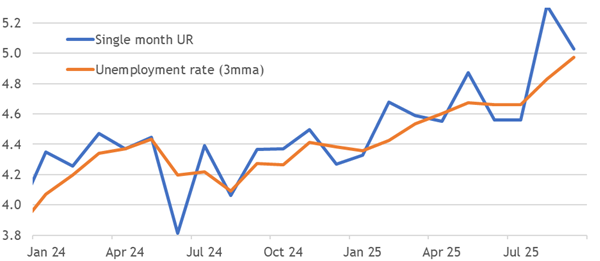

- Payrolls revisions challenge the rolling resilience seen in most other hard data releases, but seem over-weighted.

- Underlying price and wage inflation mostly track >2%, especially in the UK, which doesn’t need more rate cuts.

- Policymakers biased to ease will deliver it on a batch of bad outcomes, even if the evidence proves fleeting.

7. Separate Dividend Tax Plan in Korea: Devil Is In the Details

- A closer look at MOSF’s Tax Reform Plan for dividends suggests that it may not have a material impact on most listed companies unless the National Assembly drastically improves it.

- According to MOSF, it currently estimates that approximately 350 of the 2,500 listed companies, or 14%, could meet these requirements (two main dividend tax reduction requirements).

- We provide a list of 70 companies in the Korean stock market with 40% or higher dividend payouts (excluding companies with smaller market caps).

8. 80% Of Our 2025 Calls Are Working

- Only one of our non-consensus macro calls are not working and eight of eleven markets are moving our directions.

- Our latest business cycle indicator assessment points to a better second half.

- 2025 Investment Strategy maintained. We are overweight equities and underweight government bonds.

9. This Will Not End Well, But When?

- The U.S. stock market is undergoing a frothy advance. The intermediate trend is bullish but some technical warnings are appearing.

- We can’t predict the exact nature or timing of a possible market disruption.

- Investors may find it prudent to opportunistically take advantage of the relatively low implied volatility environment to buy cheap downside protection.

10. Rising Ringgit, Eroding Fundamentals

- BNM’s heavy reliance on FX forwards created $29 billion in off-balance sheet liabilities, masking true reserve strength and exposing future repayment risks if inflows weaken.

- This is further compounded by a narrowing current account surplus, while capital outflows and rising foreign currency deposits reflect persistent financial account weakness, undermining long-term support for the ringgit.

- While China is Malaysia’s largest trade partner, the U.S. is the main source of trade surpluses. Worryingly, the U.S. recently imposed a 19% tariff, threatening this critical surplus engine.