This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. The art of the turnaround: investing in companies at a crossroads

- Magellan in the Know podcast discusses consumer sector turnaround opportunities

- Definition of a successful turnaround and examples of companies that do and do not meet the criteria

- Importance of consistent investment philosophy and focus on protecting against permanent capital loss

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

2. EM Fixed Income: Summer catch-up as spreads catch-down

- EM sovereign credit markets are a key focus

- Overall risk environment for EM is being closely monitored, with a more neutral stance on EMFX rates and corporates

- Tariffs and ongoing tariff uncertainty are major drivers in the coming weeks, with markets having ground better despite potential downside risks in growth

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

3. Opec: Twist Or Stick?

- The further acceleration by ‘Opec+ eight’ in unwinding the second package of voluntary output cuts was a surprise, albeit one that left markets unmoved.

- The cartel now appears to be firmly on track to complete its unwinding in September, even though its stated justifications for increasing output remain highly questionable.

- Despite downside global growth risks, the Saudis in particular may press to start unwinding the first package, a move which may be announced as early as next week.

4. Ep. 318: Brad Setser on Trump Tariffs, China’s Surging Surplus and Dollar Policy

- Brad Setzer is an expert in global trade, capital flows, and sovereign debt restructuring

- He has been involved in various government positions related to international economic analysis

- Setzer discusses the rapid rollout of tariffs under the Trump administration and their potential impact on the economy

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

5. ECB Job Tightened By Jobs

- The EA labour market proved tighter than the ECB expected in Q2 as the unemployment rate held at a downwardly revised 6.2%. That is hawkish news to its neutral stance.

- Most countries still face falling unemployment, suggesting monetary conditions were slightly loose, and avoiding pressure to lower underlying inflation further.

- A hawkish domestic surprise should keep the ECB on hold, especially with the US trade policy risk fading. Passthrough of past cuts may mean the ECB needs to hike later.

6. EA: Sticky Summer Inflation

- The ECB’s victory party can continue for another month, as inflation proved surprisingly sticky at the target. But the hangover is disappointing, amid broad-based upside news.

- Two-thirds of national outcomes exceeded our expectations, with a slight skew higher, and pressures concentrated in services. Seasonal travel parts would be payback-prone.

- Another upside surprise to the ECB’s forecast makes the profile likely to shift higher in September. The news is the opposite of what is needed for another rate cut.

7. Activity’s Tariff Hangover In Q2

- GDP growth broadly beat expectations again in Q2 on both sides of the tariff disruption. Euro area growth slowed by less, while the US rebounded vigorously.

- Temporal distortions to demand didn’t open up slack as European supply growth stays stagnant. Surveys suggest it won’t appear in Q3 either as demand growth rebounds.

- Underlying US GDP growth may have slowed, but the extent is modest and questionable. Rolling resilience should keep delaying rate cuts, preventing them from occurring.

8. Disappointing New Korean Tax Policies (Dividends, Capital Gains, and Corporate Taxes)

- The Korean government announced disappointing new tax polices for dividends, capital gains, corporate, and higher transaction taxes on securities transactions.

- The new tax policies announced today is likely to have the biggest negative impact on the Korean financials with high dividend yields.

- They will also likely to negatively impact other high dividend yielding stocks in Korea.

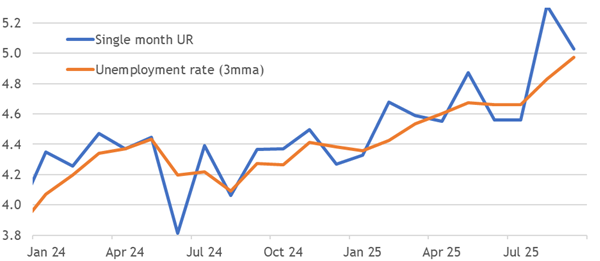

9. HEW: Atlantic Jobs Divide

- Depressing revisions to US payroll data clash with the resilience seen in other data, and compare poorly with the bullish revisions to the Euro area’s labour market.

- Jobs data challenge the Fed’s patient posture, while the Euro area’s sticky inflation and tighter labour markets should encourage it to keep rolling rate cuts later.

- Thursday’s BoE decision sets unemployment’s rise against inflation persistence, leaving the outcome uncertain, yet it is likely to yield another split vote for a rate cut.

10. UK: Loans Secured Despite Tax Hike

- Credit extended its rebound far beyond expectations in June. Reformed stamp duty raises costs and housing tenure, but it hasn’t broken the housing or mortgage markets.

- Demand for loans looks more resilient than banks expected amid easing monetary conditions. Refinancing may not have much effect on cash flow anymore.

- Higher transaction costs probably won’t break expectations into a downwards spiral, but are now widely cited as a major hurdle, contributing to slower UK activity growth.