This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Russia/Ukraine: What Now?

- A week after the event, it is clear that the Trump/Putin summit presented the latter with a big win at little, if any, cost.

- Donald Trump is unlikely to come up with anything that will bring Mr Putin to the negotiating table in good faith once his latest two-week ‘deadline’ expires.

- Furthermore, Mr Trump remains philosophically inclined to favour Russia, a leaning that probably poses a greater risk to Kyiv than Mr Putin himself does.

2. HEW: Policy Under Pressure

- President Trump’s attempt to fire Governor Cook, potentially gaining a supportive majority on the Fed, raises the risk that US policy overstimulates the economy.

- Policy peers should not be pressured to mirror mistakes. The ECB faces data that keep accumulating hawkish pressures, but others are more susceptible, like the BOK.

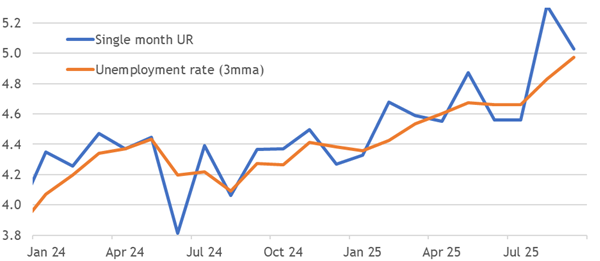

- Non-farm payroll data provide the last hope of blocking a Fed rate cut in September. Meanwhile, a rise in EA inflation to 2.1% should help rule out another ECB rate cut.

3. DeFi, On-Chain Truth, and the Petrodollar 2.0

- Founder of the DeFi Report and Web3 Strategist, NATO, shares his journey, advice for innovators, and trends shaping asset tokenization, venture capital, and AI convergence.

- Inflation report and Fed’s monetary policy decision discussed, with core inflation increasing 3.1% year over year and market pricing in a 92% chance of a rate cut in September.

- Summary of market performance, with crude falling, value rally in US equities, and Ray Dalio’s recommendation to invest in non US equities in local currency.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

4. A Monetary View on US Inflation

- The current neglect on the role played by money supply and the monetary base is, in our view a serious analytical gap

- In a nutshell, we think private money growth – defined as M2 minus monetary base- is right now in a Goldilocks phase. This augurs well for US inflation

- With the Fed inclined to ease rather than tighten, and with inflation shocks likely to prove one-off, risk assets remain supported

5. ECB Easing Transmits Need To Hold Rates

- ECB rate cuts are stimulating a trend rise in lending growth to levels consistent with no change in policy, as the monetary transmission mechanism delivers the easing.

- Activity surveys are less bullish, but reflect stagnant supply-side potential that can’t be fixed by stimulating demand, which would merely stoke the inflation problem.

- Potentially inappropriate Fed easing does not raise peer pressure like fundamental US weakness would. Domestic news dominates and supports our ECB call for no change.

6. Late 1990s Bubble Comparison to Current Cycle Requires Nuanced Analysis

- Despite the growing chorus of comparisons, the backdrop to the late 1990s equity bubble was fundamentally different from the current environment, notably in the manner of Fed policy conduct.

- During the late 1990s, Fed policy conduct was characterised by pivots, particularly after the Asian financial crisis and bailout of Long Term Capital Management, helping to prolong the equity bubble.

- Forward P/E multiples on US equities were more elevated in the late 1990s compared with current levels. Valuations have been more volatile in the current cycle, courtesy of Fed policy.

7. Proposed GST Reforms: Double Diwali Bonanza or Double Whammy?

- GST reforms are set to change with centre proposing a two-rate structure of 5 and 18 per cent

- The announcement is aimed at boosting consumption in the mid-long run, curtailing effects of current higher tariffs.

- However, timing is of utmost importance. Any delay or adverse stance on the rollout could have significant ramifications for the overall economy and the festive season.

8. To Tariff or Not to Tariff, That Is Not the Question

- How should investors judge Trumponomics? The question isn’t whether tariffs or anti-immigration policies should be imposed, but to judge their long run effects on growth, inflation and productivity.

- While it’s too early to render a full judgment of Trumponomics and his policies, it may be a case of short-term pain for long-term gain.

- The preliminary report card is mostly a case of pain and not gain.

9. Asian Equities: Eleven Robust Earnings Gainers Post Reporting Season

- Near the end of the earnings reporting season, our earnings estimate tracker identified 11 robust earnings estimate gainers – with consensus EPS estimates up across 3-month and 6-month time horizons.

- Onshore China communications and financials, HK technology, Korean and Singapore financials are the prominent “winner” sectors. Five other ASEAN sectors also figure on the list.

- Earlier, in June, we detected 16 “consistent winner” market-sectors. The earnings environment has deteriorated slightly. Of the prominent stocks, Tencent, Hana Financials and DBS Group figure in our Model Portfolio.

10. China Economics: Policy Confusion Risks Worsening Demand Slump

- Transitory factors that drove China’s stronger-than-expected growth in the first half of 2025 are starting to fade, with hits to investment and consumption demand imminent in 2H25.

- But Beijing is in a bind on its policy response: it is rolling out demand-supporting measures but it is also keen to cut excess capacity and enforce public sector frugality.

- The net impact is that economic growth to decelerate significantly in 2H25. More stimulus measures will be dribbled out but its impact will be stymied by conflicting aims and adverse