This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Defence Spending Is Not Stimulative

- NATO raised its target for defence spending to 5% of GDP, with Spain opting out. This increases pressure for tighter monetary conditions than were otherwise appropriate.

- Defence spending offers weak growth multipliers, so the policy is more likely to stoke deficits than productivity. Central banks may respond with a more hawkish stance.

- With debt levels already high, the move risks crowding out other spending and lifting sovereign risk premiums. Bond yields suffer from higher deficits and future rates.

2. Israel/Iran/US: Ten Pointers

- Recent events have highlighted the difficulty in predicting the progression of the Iran/Israel conflict.

- Despite this, the volatility caused by these headlines has not significantly impacted market perspectives.

- The supply/demand equation remains the primary influence on market thinking regarding oil.

3. Top 10 Korean Stock Picks and Key Catalysts Bi-Weekly (20 June to 4 July 2025)

- In this insight, we provide the top 10 stocks picks and key catalysts in the Korean stock market for the two weeks (20 June to 4 July 2025).

- Kakaopay was the best performing stock in KOSPI in the past two weeks. It could be a key potential beneficiary of the increased use of stablecoin based system in Korea.

- The top 10 picks in this bi-weekly include S&T Holdings, Samsung Life Insurance, Samsung SDS, Samsung Securities, Hyundai Elevator, SK Hynix, Paradise, Hanwha System, Hanwha Aerospace, and Korea Kolmar.

4. The New OS for Quant Finance: OpenBB, AI Agents & the Death of Legacy Terminals | New Barbarians …

- Isan Sarakil is the Chief Product Officer at OpenBB, a platform that provides advanced analytics to every investor.

- OpenBB is tearing down old walls of legacy market data systems and utilizing AI to change the way markets are understood and traded.

- Isan discusses OpenBB’s journey and how new tools can give investors an edge in analyzing complex financial data, such as the Fed’s communications.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

5. Asian Equities: Absolute and Relative Valuations – Spotting Mean Reversion Opportunities

- We take a detailed look at forward PE multiples, absolute and relative to Asia, of all Asia ex Japan markets. North Asia is in line with average valuations, India expensive.

- Juxtaposing valuations in comparison to history with the earnings environment of each market, we arrive at conclusions about which market should rerate and which should derate.

- We posit continued rerating for Korea and Philippines. India should derate. HK, Taiwan, Indonesia and Singapore could rerate modestly. Malaysia and Thailand are cheap but seem destined to remain so.

6. A Sharp Increase in the Lending Balance of Korean Stock Market Suggests A Pull-Back

- In our view, the sharp increase in the lending balance is one of the signs of many investors preparing for a pull-back in the Korean stock market.

- The lending balance of the Korean stock market surged from 47.3 trillion won on 2 January 2025 to 90.4 trillion won as of 20 June 2025.

- The rising lending balance in the Korean stock market could be construed as a bearish sign.

7. India – Reasons To Overweight

- Overweight, Indian equities with a bias towards industrials, property and consumer stocks.

- Trading Post hopes you took advantage of last year’s correction to buy into India, as recommended. If not, there is time.

- Investing in India is ultimately about the domestic story. Business cycle indicators are improving, and the multi-year structural growth narrative remains compelling.

8. Steno Signals #202 – Peak WW3 Fears Return!

- Over the weekend, oil traders dusted off their Strait of Hormuz crisis playbooks—and once again, they overplayed their hand.

- Saturday’s U.S. strike inside Iran sparked a sharp wave of geopolitical anxiety, turbocharged by Iran’s retaliatory missile barrage and the familiar threat from Tehran’s Parliament to shut down the Strait.

- Add a few “Hormuz closed?” headlines and prediction markets went into meltdown, briefly treating a full blockade as the base case.

9. Global Rates: Monthly Inflation Outlook

- U.S. inflation expected to accelerate over the next few months, with core inflation forecasted to rise to 3.8% by December

- Trade policy and geopolitical risks, such as the potential for oil prices to spike, are factors supporting front end tips breakevens

- Euro area inflation data shows softening trend, with core inflation falling to 2.3% in May, impacted by factors like timing of Easter holidays

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

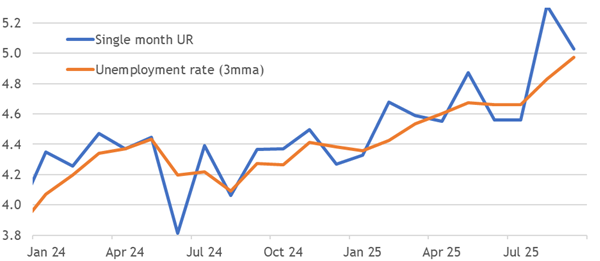

10. Growth Broadly Back In The Black

- PMI recoveries extended in June, taking averages above 50 as manufacturing is its strongest since Sep-22, and services almost align with its averages of recent years.

- The UK survey balances suffered from bad vibes, so they are the primary beneficiary of sentiment improving. Their recovery can extend further as vibes improve.

- Broad expansion helps labour demand to keep pace with supply, denying doves proof of a disinflationary demand shock. Without that, cuts roll later and may not resume.