This weekly newsletter pulls together summaries of the top ten most-read Insights across Macro and Cross Asset Strategy on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK CPI Trips Into The Fall

- UK inflation’s march higher ended early as expectations tripped over a drop in airfares to slow slightly in September, ahead of slightly falling back through the Fall seasonal.

- Weakness elsewhere cut the annualised median rate below 2% for the first time since March. That is likely to be a small soft spot relative to the worrying cumulative upside.

- Our forecasts remain close to or below the consensus until June, after other forecasts rose in last month’s survey. We still see wages stoking an excessive underlying trend.

2. Credit Cockroaches Incubating

- Write-downs at two regional banks follow the cockroaches of First Brands and Tricolor bankruptcies, and should not be dismissed as isolated idiosyncratic events.

- Overly accommodative monetary conditions are stimulating markets to incubate cockroach eggs that may spawn as private credit malinvestment in the next recession.

- It is too early for these eggs to hatch, aided by the warm support of further Fed rate cuts. So, risk assets will probably keep on rising in the void of economic data releases.

3. EMERGING THEMES: China’s Next 5 Year Plan

- China will roll out its 2026 – 2030 five-year plan this month, which outline the economic and social roadmap until the end of the decade.

- Historically the five-year plans have been a roadmap for investors to look for tailwinds for economic sector performance. We believe the high-tech industries will remain the main focus for investment.

- Exporters of high-end equipment and machinery will continue to benefit with the consumption sector being a focus for international investors.

4. A Sharp Increase in Short Selling Balance in the Korean Stock Market Past Seven Months

- The net short selling balance in KOSPI reached 12.6 trillion won as of 20 October. This is the largest amount ever.

- The top 5 companies in KOSPI with highest short selling balance/market cap ratio include Kakaopay, L&F, Hanmi Semiconductor, Cosmax, and LG H&H.

- Net short position In KOSDAQ as a percentage of total KOSDAQ market cap more than doubled from 0.5% as of 31 March to 1.1% as of 21 October 2025.

5. A Fragile Bull

- The narrow U.S. market leadership presents fragility challenges for investors.

- The economy is becoming increasingly dependent on the top 20% of consumers, and the market is dependent on Magnificent Seven and AI stocks to lead the market.

- While there are no signs that these trends are about to break, the market is overextended in the short run and can correct at any time.

6. The Heat Is On: News Flow and Sentiment in CHINA / HONG KONG (October 20)

- The materials sector continues its outperformance in Hong Kong, however the recent sharp pullback showed a weakening in strength and momentum.

- Mainland investors continued to buy Hong Kong listed stocks heavily during the market pullback earlier this month.

- Zhejiang Sanhua Intelligent Controls (2050 HK) quashed market rumors about a large robotic order from Tesla (TSLA US); however, it continues discussions on cooperation opportunities.

7. Technically Speaking Breakouts & Breakdowns – HONG KONG (October 18)

- Hong Kong has pulled back this month as the U.S. trade war intensifies, however it remains in a Secular Bull Market.

- Materials and Healthcare sectors continue to outperform YTD, with Technology coming in a distant 3rd place.

- Hengan International Group (1044 HK) had multiple breakouts relative to MSCI Asian indexes and on an absolute basis. Analysts’ recommendations are split as the shares trade at their target price.

8. The Art of the Trade War: THE END OF THE BEGINNING

- The meeting next week between Presidents Trump and Xi will mark the beginning of a resolution to trade and other issues between the two countries.

- The most difficult tech and rare earth elements issues will probably not be resolved. Increased tariff rates will be delayed again.

- TikTok and Taiwan are key issues and will set the tone for the U.S.-China relationship during President Trump’s remaining term.

9. EM Active Funds: What’s Driving Performance in 2025?

- Active EM funds average +26.0% YTD, their strongest year since 2017, though still underperforming the benchmark by -1.8%. Fewer than 40% have outpaced the iShares MSCI EM ETF.

- Style and regional positioning drove dispersion. Value managers and South Korea exposure supported gains, while Aggressive Growth styles and India-heavy allocations weighed on returns. High Active Share strategies also trailed.

- Active EM outperformance remains consistent long-term. Active funds have beaten the benchmark in 14 of the past 22 years, with the ETF often ranking near the peer group median.

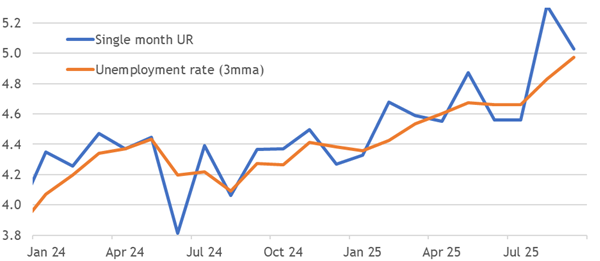

10. HEW: Heavy Hitters Pulling Punches

- Sentiment stabilised this week as credit issues are realised to be more of a long-term problem than an imminent issue. Indonesia and Korea hawkishly held their policy rates.

- Inflation undershot final expectations in the UK and US, yet constitutes less excess rather than outright weakness, and merely aligns with slightly earlier forecasts.

- Next week’s release calendar has some heavy hitters, but pulling their punches. The Fed cut and ECB hold are widely expected, as is a marginal slowing in EA inflation.