In this briefing:

- ECM Weekly (12 January 2019) – Futu, China East Education, China Kepei Education, Viva Biotech

- Chinese Telcos: 5G Launches in 2019. Buy the 5G Beneficiary (China Tower).

- Are Chip Oligopolies Real?

- Global Banks: Some New Year Pointers

- Extraordinary Fiscal and Monetary Policies Have Disrupted the Global Economy

1. ECM Weekly (12 January 2019) – Futu, China East Education, China Kepei Education, Viva Biotech

Aequitas Research puts out a weekly update on the deals that have been covered by Smartkarma Insight Providers recently, along with updates for upcoming IPOs.

Despite a shaky 2018 Q4 market and the disappointing Softbank Corp (9434 JP)‘s IPO, we have been getting a steady stream of newsflow on upcoming IPOs.

Starting with upcoming IPOs, Chengdu Expressway Company Limited (1785 HK) and Weimob.com (2013 HK) will be listing next week on Tuesday, 15th January. Weimob was priced at the low end of its price range while Chengdu Expressway’s IPO was at a fixed price of HK$2.20. We are bearish on both IPOs. Weimob is overly reliant on Tencent for its SaaS and Ads business and, at the same time, Tencent will only own less than 3% stake after listing. Whereas Chengdu Expressway has been a well-managed company but valuation implies limited upside. Trading liquidity will likely remain tepid as like Qilu Expressway Co Ltd (1576 HK) which listed mid last year.

In the pipeline, we are hearing that Kepei Education (KEPEI HK) will likely open its book next Monday. We will be following up with a note on valuation. In other IPOs that are coming in this quarter, Helenbergh China and Zhongliang, both property developers, are looking to IPO in this quarter. Viva Biotech Shanghai Ltd (1577881D HK) is also looking to list in Hong Kong Q2 while Urban Commons, a US property developer, is planning a US$500m REIT IPO in Singapore.

Activity seems healthy for the ECM space, but sentiment has not been the best as seen from Xiaomi’s high profile IPO that took a hit just as its lockup expired. Its share price has corrected from a high of HK$22.20 to just above HK$10.34 this Friday. This should not have been a big surprise since many have already pointed out that its valuation should really have been closer to that of a hardware business and we pointed out that the IPO’s trajectory would likely be similar to Razer.

This reminds us of a particular listing last year, Razer Inc (1337 HK) , and, in fact, both bear quite a handful of similarities. Strong portfolio of investors, hardware business with software capabilities, expensive valuations, and etc. The stock did well at first but has come back down to earth since then.

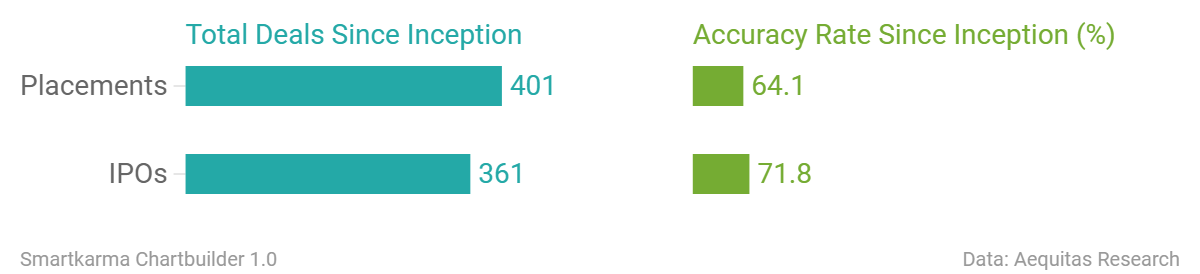

Accuracy Rate:

Our overall accuracy rate is 72% for IPOs and 64% for Placements

(Performance measurement criteria is explained at the end of the note)

New IPO filings

- China Tobacco International (Hong Kong, US$100m)

- China East Education (Hong Kong, US$400m)

- Ebang International (Hong Kong, re-filed)

- MicuRx Pharma (Hong Kong, re-filed)

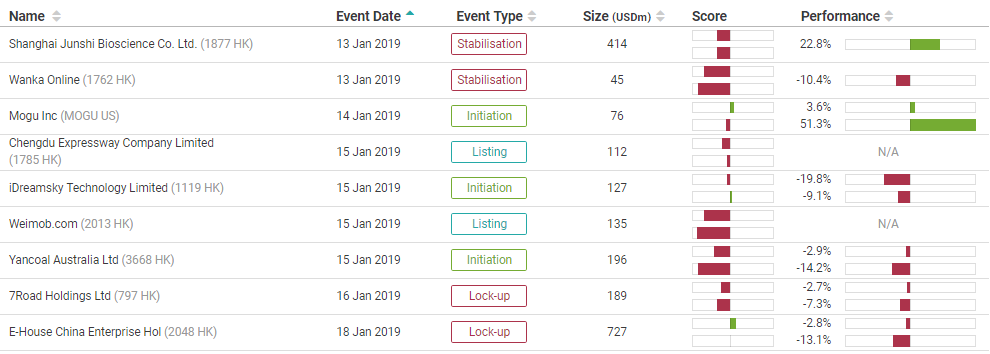

Below is a snippet of our IPO tool showing upcoming events for the next week. The IPO tool is designed to provide readers with timely information on all IPO related events (Book open/closing, listing, initiation, lock-up expiry, etc) for all the deals that we have worked on. You can access the tool here or through the tools menu.

News on Upcoming IPOs

- Urban Commons plans IPO of up to US$500m at Q1-end

- Viva Biotech plans IPO in the second quarter

- CStone Pharma plans US$400m IPO in Feb

- Global Switch plans about US$1bn HK IPO

- China’s Wanda files for US IPO of sports unit to raise up to US$500m

Smartkarma Community’s this week Analysis on Upcoming IPO

- Futu Holdings IPO Preview: Running Out of Steam

- Futu Holdings Pre-IPO – Great Metrics but in a Commoditised Industry

- China Tobacco International (IPO): The Monopolist Will Not Recover

- China Tobacco International IPO: Heavy Regulation, Declining Margins – A Bit Late to IPO Party

- IPO Radar: AutoCorp, Honda’s Avatar in Thailand

List of pre-IPO Coverage on Smartkarma

2. Chinese Telcos: 5G Launches in 2019. Buy the 5G Beneficiary (China Tower).

We highlighted in a recent note Chris Hoare‘s positive outlook for China Tower (788 HK). Our view takes into account the 5G build-out commencing this year, improved capex efficiency from using “social resources”, the rapid growth in non-tower businesses that lie outside the Master Services Agreement (MSA), and the valuation benefit from what looks like surprisingly investor friendly management.

This note focuses on four key issues facing the Chinese telcos in 2019:

- 5G capex (March) (this is by far the most important),

- Regulatory newsflow (February/ March),

- Operating trend improvements (August), and

- Emerging business opportunities driving future growth (August).

We remain positive on the telcos which trade at low multiples. China Unicom (762 HK) continues to trade at a discount, yet is most exposed to the positive story emerging at China Tower. We switch our top pick among the telcos from China Mobile (941 HK) back to China Unicom as a result. Alastair Jones thinks China Telecom’s (728 HK) premium multiple is at risk if management execution on the cost base doesn’t improve. It is our least preferred telco at this stage. Overall, we expect China Tower to outperform all telcos and it is our top pick. The upgrade to China Tower flows through the telcos (valuation and costs) and our new target prices are as follows: China Unicom to HK$14.4, China Telecom to HK$5.4 and China Mobile to HK$96.

3. Are Chip Oligopolies Real?

In the semiconductor industry, particularly in the DRAM sector, there has been significant consolidation leading some to hypothesize that there’s now an oligopoly that will cause prices to normalize and thus end the business’ notorious revenue cycles. Here we will take a critical look at this argument to explain its fallacy.

4. Global Banks: Some New Year Pointers

Here is a look at how regions fare regarding key indicators.

- PH Score = value-quality (10 variables)

- FV=Franchise Valuation

- RSI

- TRR= Dividend-adjusted PEG factor

- ROE

- EY=Earnings Yield

We have created a model that incorporates these components into a system that covers>1500 banks.

5. Extraordinary Fiscal and Monetary Policies Have Disrupted the Global Economy

In their public presentations, central banks seem to be contemplating the use of neutral interest rates (r*) in addition to unemployment/inflation theories. R* has the advantage of appearing to be subject to mathematical precision, yet it’s unobservable, and so unfalsifiable. Thus, it permits central banks to present any policy conclusion they want without fear of verifiable contradiction. R* is the policy rate that would equate the future supply of and demand for loans. It rises and falls as an economy strengthens and weakens. Long-term observation during the non-inflationary gold standard, period indicated that r* in an average economy was 2% plus, which would become 4% plus with today’s 2% inflation target. The Fed may soon end this tightening cycle with the fed funds rate at or near 2¾%, which would be r* if the rate of lending and borrowing in America remained stable thereafter. Rising (falling) lending would indicate a higher (lower) r*.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.