In this briefing:

- Metropolis IPO: Priced to Leave Limited Upside

- Japan Mobile: MVNO Data for Q3 Includes Slowest Growth Since 2014 but that Makes Sense for Rakuten

- India Bulls Housing Finance- Can It Become Another HDFC? Signs Are Encouraging!!

- SBS (2384) A Great Third Party Logistics Company Seeing Good Organic Growth as Well as Via M&A.

- Drill Results Confirm High-Grade Mineralisation (Flash Note)

1. Metropolis IPO: Priced to Leave Limited Upside

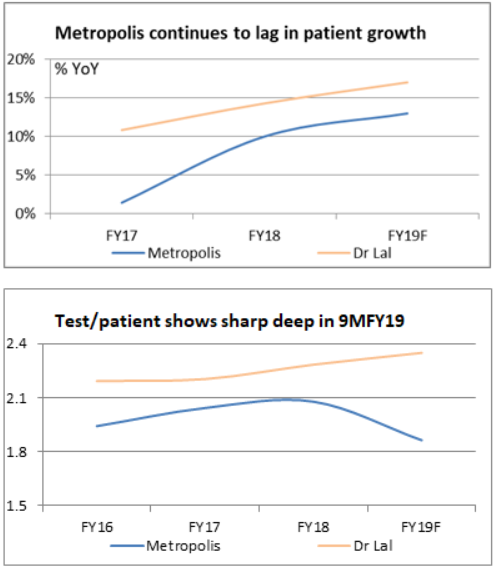

We like Metropolis Health Services Limited (MHL IN) ’ track record of growing revenue/patient despite competition, premium pricing and strong margin defence. Margins have however, come under some pressure in 9MFY19. Its patient growth lags that of Dr Lal Pathlabs (DLPL IN)’s despite rapid network expansion. It is also at the highest risk from any government instituted pricing cap on pathology tests owing to (1) high share of institutional business and (2) premium pricing. Also, 51.6% of promoter stake will be pledged with lenders after the IPO. At the upper end of its price band, Metropolis is valued at 20.9x FY20F EV/EBITDA and 33.3x FY20F PE- at ~15% discount to Dr Lal. We see EPS compounding at 12% Cagr over FY18-21, lower than the 16% EPS Cagr of Dr Lal’s. We feel valuation leaves limited upside.

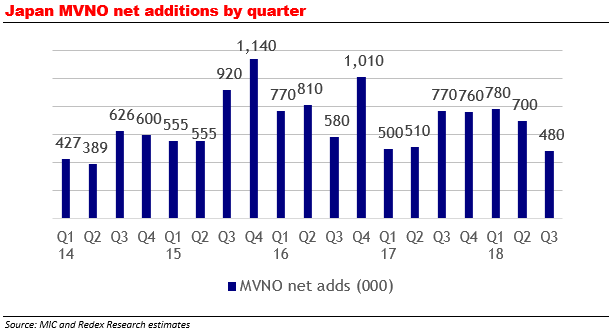

2. Japan Mobile: MVNO Data for Q3 Includes Slowest Growth Since 2014 but that Makes Sense for Rakuten

The Ministry of Industry Affairs and Communications (MIC, the regulator) released Q3 (Dec 2018) data for industry mobile virtual network operator (MVNO) subs today (29 March) characterized by continued declines in growth YoY (+15% in Q3 v 18% in Q2) and the lowest absolute net adds (+480K) since Q2 2014. Growth for the largest consumer-focused MVNO Rakuten Inc (4755 JP) also appears to be the lowest since data has become available but that is not necessarily a sign of strength for the existing network operators as it makes sense for Rakuten to slow MVNO growth before its October real network launch.

3. India Bulls Housing Finance- Can It Become Another HDFC? Signs Are Encouraging!!

This is the concluding part of our Housing Finance Companies (HFC) series where we elaborated the outlook of the mortgage industry in India along with initiating coverage on the best HFCs who we believe may continue to be the key beneficiaries of a long term secular growth in the Indian mortgage industry. (please click here, here and here ).

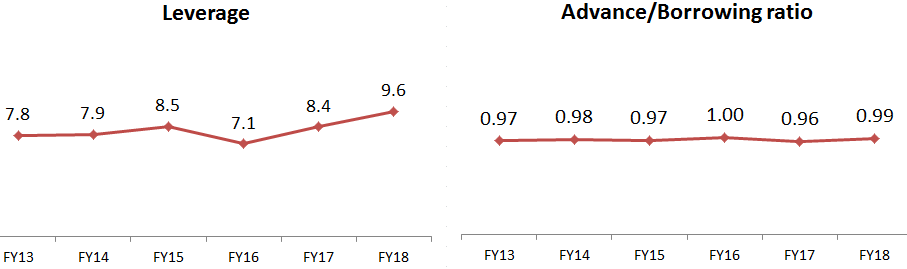

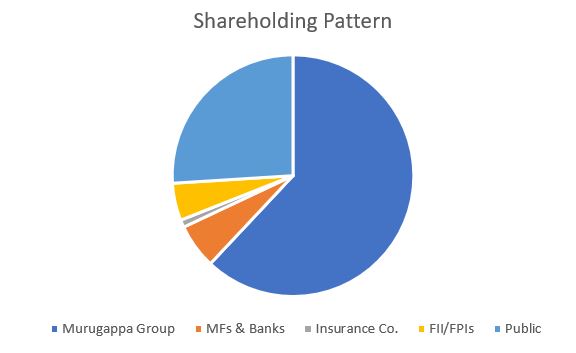

In this report we cover Indiabulls Housing Finance (IHFL IN) , the third largest HFC in the country. The company is among the fastest growing HFCs whose loan portfolio has grown at a CAGR of 29% in the last 5 years ending FY18. And in spite of robust growth, the asset quality has remained steady.

Due to a strong track record of high capital adequacy, high liquidity coverage, high asset quality, improving operational efficiency and high return ratios, the company was recently awarded AAA rating by ICRA and CRISIL, the top 2 credit rating agencies in India.

From the parameters that are analyzed in detail in this report, we believe that the company in the long term has the potential to be in the league of HDFC Ltd., a benchmark in terms of corporate governance, robust asset management and wealth creation for shareholders.

4. SBS (2384) A Great Third Party Logistics Company Seeing Good Organic Growth as Well as Via M&A.

It is seeing decent organic growth, led by a focus on third party logistics (3PL). This will carry on. The recently acquired Ricoh Logistics should eventually see margins improve as it is integrated into SBS. This year’s operating profit forecast of Y9bn (+10%) is conservative. An increase of Y1bn this year will come from Ricoh Logistics alone, and then we have organic growth. In our view operating profit will be at least Y10bn. There is the unrealised profit on land, which add some Y85bn to a company whose market cap is Y71bn. Despite the outperformance over the last 12 months, this remains a decent long-term domestic buy, and one in which foreigners still own only 12%. The shares trade on 13x 12/19 assuming an operating profit of Y10bn.

5. Drill Results Confirm High-Grade Mineralisation (Flash Note)

- Significant thick, high-grade Zn/Pb intersections with substantial by-products

- X-sections highlight ore thickness variability

- On schedule for maiden Resource mid-June incorporating both S. Nights and Wagga Tank

- Current drill programmes to be completed within a month

- Employing VMS structural and geochemical specialists for future exploration vectoring

- Maintain Speculative Buy Recommendation

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.