In this briefing:

- Apple (AAPL): Reduces Prices in Mainland China – Right Action, But Not Enough

- China Kepei Edu (科培教育) IPO – Regulation Poses Significant Near-Term Risks

- Ten Years On – Asia’s Time Is Coming, Don’t Miss The Boat

- HK Connect Discovery Weekly: China Tower, Tencent, New China Life (2019-01-11)

- Screening the Silk Road: Q1-2019 Small-Mid Cap GARP (Zulu Warrior Screening)

1. Apple (AAPL): Reduces Prices in Mainland China – Right Action, But Not Enough

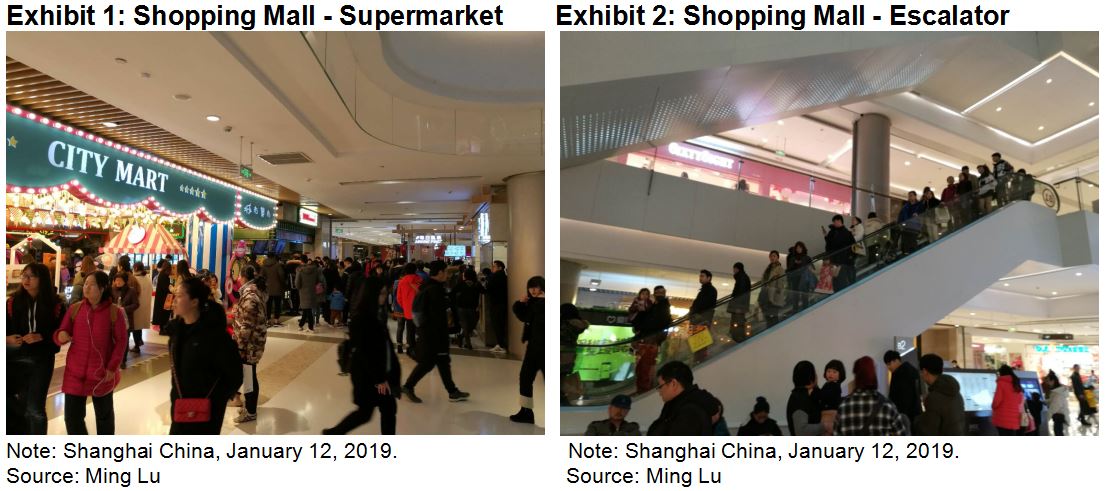

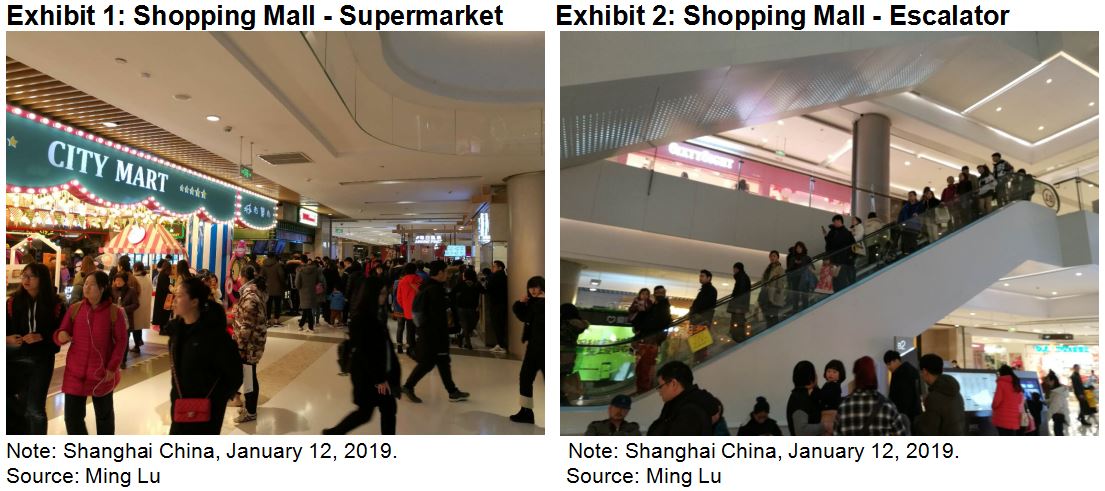

- Tim Cook passed the buck to the weak sales in China. However, we believe China’s retailing is running well based on our visits to shopping malls with Apple stores.

- Luxury goods sold better in China than all other major markets in the world in 2018.

- We believe that the price reduction in Mainland China is just taking market share from Apple Stores in Hong Kong, but not from competitors.

- We also believe that the app review process is the fatal shortcoming for AAPL.

2. China Kepei Edu (科培教育) IPO – Regulation Poses Significant Near-Term Risks

China Kepei Education (1890 HK) is looking to raise up to US$122m in its upcoming IPO.

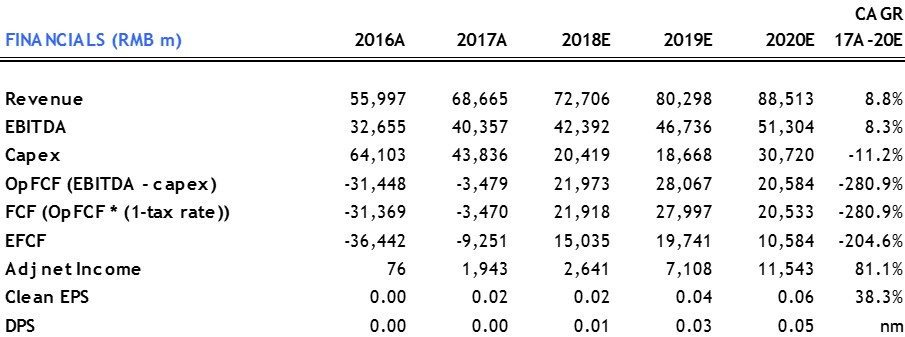

Overall, the company has continued to show that its undergraduate program is the driver behind its growth. It grew its 8M 2018 revenue and gross profit both by about 24% YoY. However, there are significant near-term risks if the MOJ Draft for Comments gets implemented. It may result in Kepei registering its schools as for-profit private schools which would shrink its net profit margin.

In this insight, we will provide updates on the company’s 8M 2018 financials and operating performance, the potential impact of policy change and compare its valuation to other listed education peers. We will also run the deal through our framework.

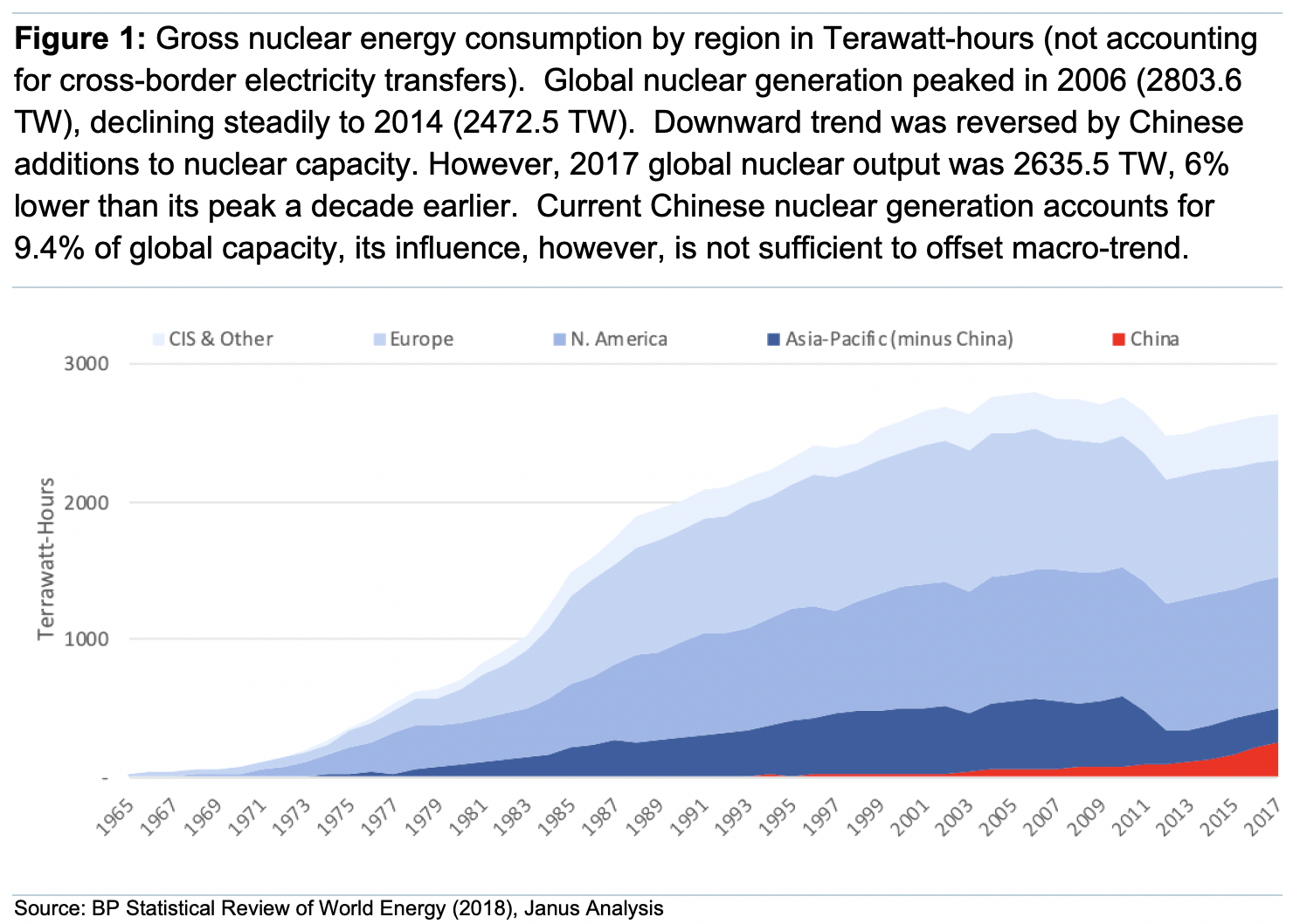

3. Ten Years On – Asia’s Time Is Coming, Don’t Miss The Boat

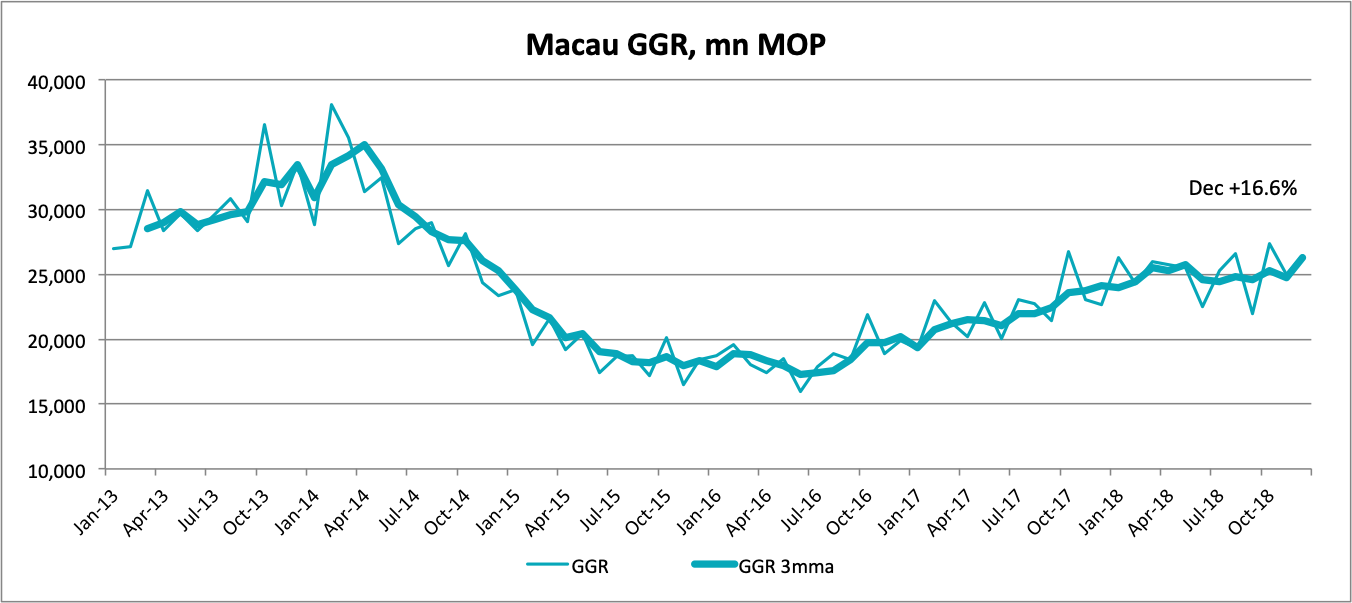

We noted in Ten Years On – Asia Outperforms Advanced Economies Asia’s economies and companies have outperformed advanced country peers in the ten years to 2017. Growing by 6.8%, real, through the crisis the region is 188% larger in US dollar terms while US dollar per capita incomes 170% higher compared with 2007. In this note we argue even though Asian stock markets have underperformed since 2010 and the bulk of global capital flows have gone to advanced countries, Asia’s time is coming. Valuations are cheap. Growth fundamentals strong. There are few external or internal imbalances. Macroeconomic management has been better than in advanced economies and the scope to ease policy to ward off headwinds in 2019 is greater. China has already started.

4. HK Connect Discovery Weekly: China Tower, Tencent, New China Life (2019-01-11)

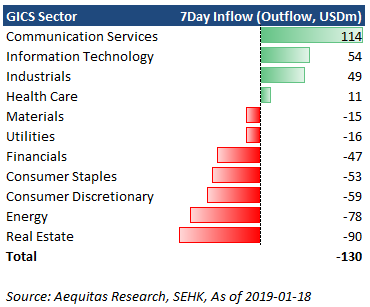

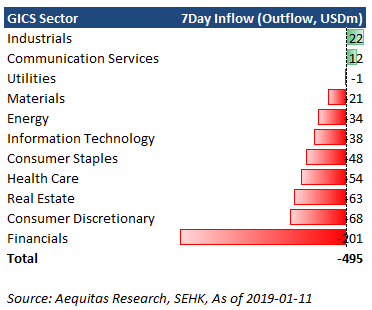

In our Discover HK Connect series, we aim to help our investors understand the flow of southbound trades via the Hong Kong Connect, as analyzed by our proprietary data engine. We will discuss the stocks that experienced the most inflow and outflow by mainland investors in the past seven days.

We split the stocks eligible for the Hong Kong Connect trade into three groups: those with a market capitalization of above USD 5 billion, those with a market capitalization between USD 1 billion and USD 5 billion, and those with a market capitalization between USD 500 million and USD 1 billion.

We see the Financials sector led the outflow by mainland investors last week with 201 million USD of net selling. We also highlight a few companies this week: China Tower (788 HK), Tencent Holdings (700 HK), New China Life Insurance (1336 HK), and Ping An Good Doctor (1833 HK).

5. Screening the Silk Road: Q1-2019 Small-Mid Cap GARP (Zulu Warrior Screening)

- Value made a comeback, but growth remains core: In May 2018, we examined the divide between value and growth stocks, ( Notes from the Silk Road: Small-Mid Cap Screening for Zulu Warriors). As Q3 unfolded, this eventuated with a +7.5% reversal in favour of value stocks, only to see growth resume dominance in October and November.

- The optimal value/growth style dynamic: We feel exposure to growth at a reasonable price (GARP) coupled with a healthy FCF yield (via our amended Zulu Screen) should provide some healthy medium to long term returns for investors.

- The Screen’s Risk: The Zulu Screen relies on analyst estimates. When market sentiment is weak and forecasts are not amended in a timely manner, the screen is susceptible to mis-selection.

- Q2 2018 screening list succumbed to volatile markets: This was seen in our May screen with our list posting on average a 30% decline in share price, relative to the broader Asia-Pacific Ex-Japan declining 13.6% and the Asia Pacific index by 11.8%.

- Are there reasons for the underperformance? 10 of the 19 stocks in the May screen were from Hong Kong, which saw the Hang Seng Index (HIS) decline 16% over the same period. The decrease seems due to concern over trade wars and doubts about the China economy. Our key approach to stock selection is to take a medium-to-long-term view as well as focus on quality ranked stocks relative to their peers. This is highlighted via the average stock rank of the group declining only 15.8% from 89.6 to 75.5 points.

- Our Q1 2019 screen selected only 9 stocks. Of the 9 stocks identified, the average PEG Ratio was 0.4x, the price to FCF yield was 11% and ROCE was 25%. Stocks were selected from Australia, New Zealand, India, Korea, Japan, Hong Kong, Taiwan and Singapore. Cowell Fashion Company from Korea was the only remaining stock from our May screening.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.