In this briefing:

- Monthly Geopolitical Comment: Redrafting of Global Map of Political Alliances to Continue in 2019

- Hotel Properties Ltd– Dissolution of Wheelock-OBS Partnership Could Pave Way for Privatization Offer

- Autonomous Driving. Waymo Leading The Charge With Ten Million Miles Driven And Counting

- 2019 Asia Selected Gaming Stock Outlook: Headwinds, Tailwinds and Our Top Picks for Entry Levels Now

- Are US Stocks Still Expensive?

1. Monthly Geopolitical Comment: Redrafting of Global Map of Political Alliances to Continue in 2019

The year 2018 has proven tumultuous for global markets. Rapidly changing geopolitical priorities of the US, an erstwhile hegemon, have played a role no less significant than the withdrawal of liquidity by leading central banks or US monetary policy tightening. The US has openly declared that it is in a state of “cold war” with China. Despite the recent truce, signs are abundant that the confrontation between the two global superpowers will continue into 2019 and beyond. In 2019, we expect more countries to find themselves in a position where they must choose who they want to side with, the US or China. There are other tectonic shifts, too, which are causing re-alignment of global geopolitical alliances.

2. Hotel Properties Ltd– Dissolution of Wheelock-OBS Partnership Could Pave Way for Privatization Offer

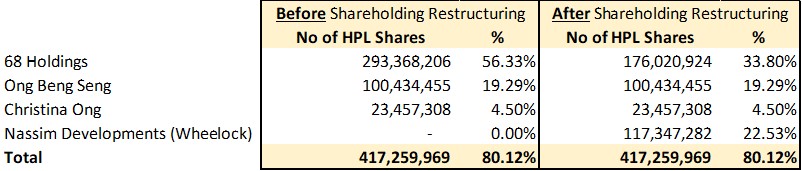

Hotel Properties (HPL SP) (“HPL”) announced on Friday evening a significant change in its shareholdings relating to the HPL shares owned by 68 Holdings Pte Ltd.

The restructuring of shareholding did not come as a surprise and was within expectations.

Now, Wheelock holds only a significant minority interest of 22.53% and without a board seat in HPL. Wheelock’s influence in HPL has been reduced significantly. Without control, Wheelock’s investment in HPL is as good as any other non-strategic investment in quoted securities.

In the event that Wheelock Properties decides to sell its HPL shares, Mr Ong will be a likely buyer of the HPL shares. This will present a very good opportunity for Mr Ong to successfully privatise and delist HPL.

3. Autonomous Driving. Waymo Leading The Charge With Ten Million Miles Driven And Counting

Waymo CEO John Krafcik made some bold decisions after taking the helm at Alphabet‘s self-driving project in September 2015. Chief among them was the fact that the company abandon its plans for Level 3 automated driving and focus exclusively on levels 4 & 5. Furthermore, he decreed that Waymo would no longer manufacture its own vehicles but would instead integrate their technology into those of other automakers. Three years later, those decisions would appear to be finally paying off.

On October 10 2018, Waymo reached a significant milestone having completed 10 million self-driving miles across 25 cities in the US. While their first million self-driving miles took 18 months to complete, Waymo now clocks up over a million self-driving miles per month. The company also recently announced the launch of its robo taxi service in Phoenix, Arizona and looks set to quickly follow suit in California. Plans to extend its self-driving technology beyond robotaxis, most notably for trucks and last-mile transportation solutions are also in the works. Furthermore, the company has begun laying down a framework of innovative B2B revenue models which should help accelerate the speed with which they can eventually monetize their technology.

It hasn’t been smooth sailing all the way for Waymo however. Earlier this year, the company was derided for the driving style of its autonomous vehicles and faced the criticism that its driverless cars continue to have safety drivers. There was also an embarrassing incident where one of those very safety drivers caused the self-driving car he was monitoring to hit a motorcyclist when he attempted to take control of the vehicle. According to Waymo’s own analysis of the vehicle log files, the accident would not have happened had he not intervened.

With ten million self-driving miles under their belt and a thoughtful, strategic approach to monetizing their technology beginning to emerge, Waymo remains firmly ahead of their peers in leading the autonomous driving charge.

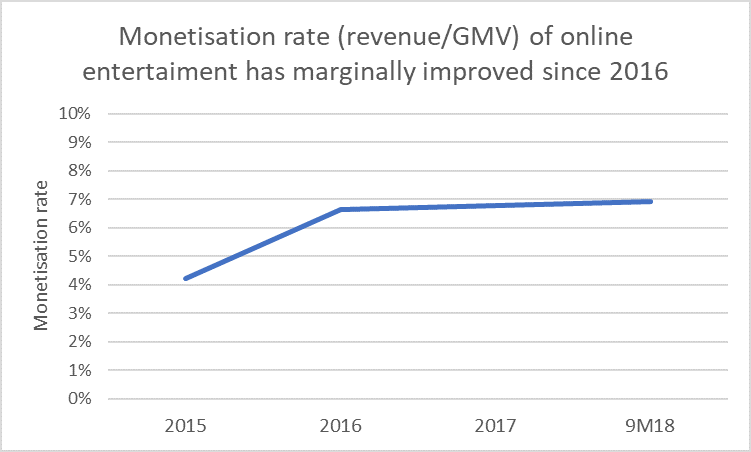

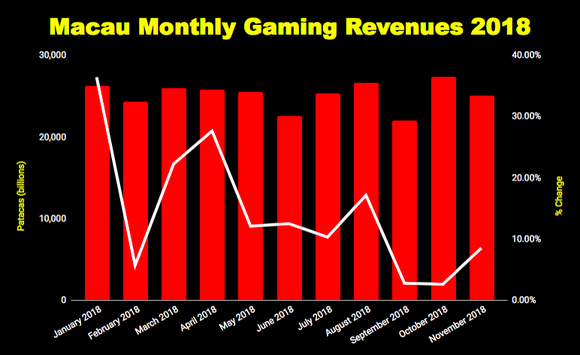

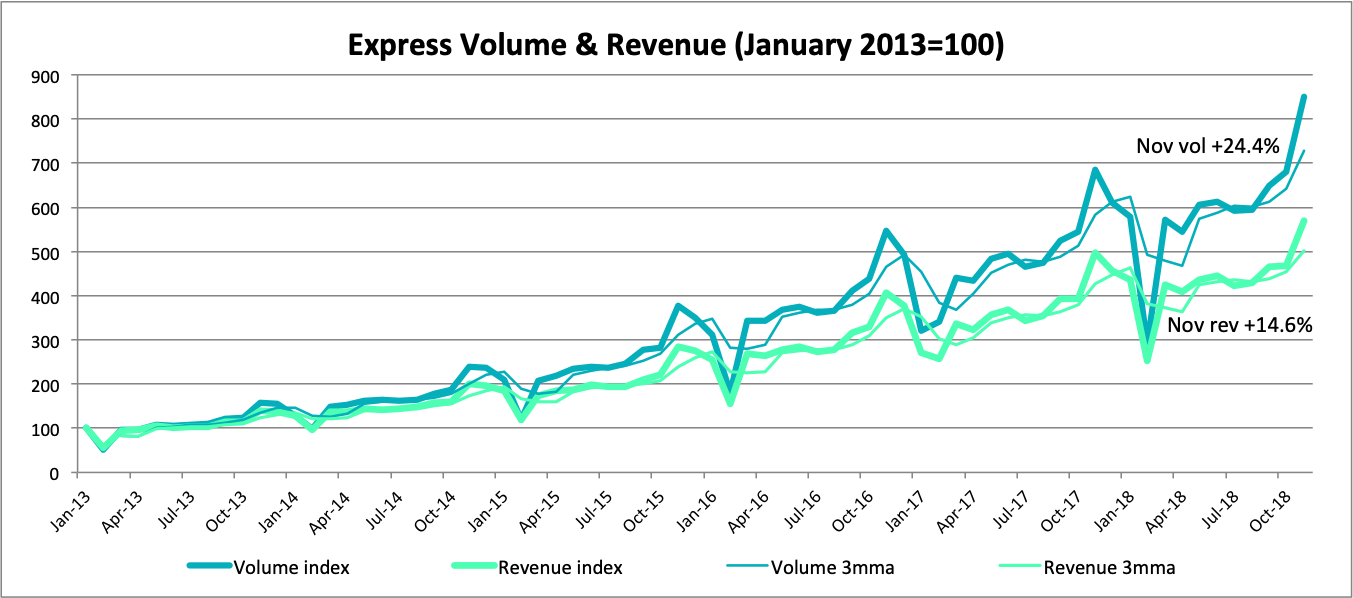

4. 2019 Asia Selected Gaming Stock Outlook: Headwinds, Tailwinds and Our Top Picks for Entry Levels Now

Our review of ten Asian gaming companies forward prospects for 2019 yielded our top five picks. Two of those comprise this insight. Three more will follow in Part Two. There is, in our opinion, some disconnect between continuing macro headwinds in both the VIP and mass sectors and a more bullish tone based on a recent upside trend in Macau, strong results in the Philippines and Cambodia. Given the battering of the market in general, the already 8 month old bearish tone to the sector and the current pricing of the two stocks noted here, we see significant upside opportunity as we near the beginning of 2019.

5. Are US Stocks Still Expensive?

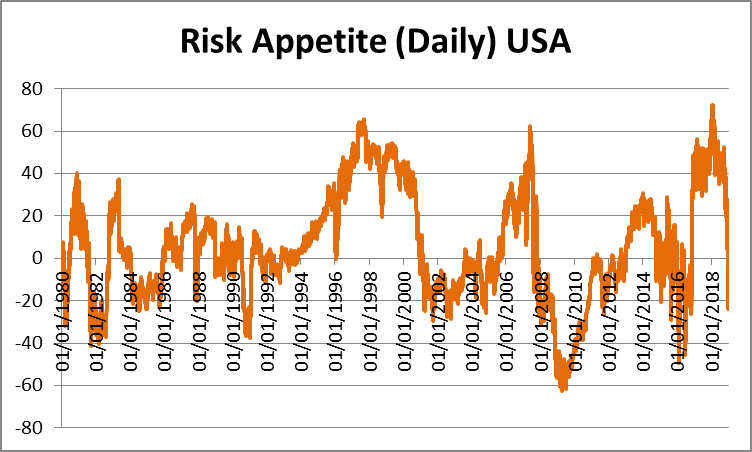

There are striking parallels between 1929 and 2018.

The 1929 crash put a halt to a nine-year bull run on the market.

Up until October 1929, same as this year, market consensus was that asset prices could only go up from their current level.

As we mentioned in When the Tide Goes Out, Dominoes Fall, a decade of building up excesses meant a painful burst, back 79 years ago: between October of 1929 and September of 1932, eighty-nine percent of the value of stocks was erased and the market didn’t recover to its former peak until 25 years later.

Are we in a similar situation right now?

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.