In today’s briefing:

- Global Medtech Trends: Readouts from Early Birds of Q3 Earnings Season- Positives and Negatives

- Can CSA SPAC Its Way Through a Commodity Crash?

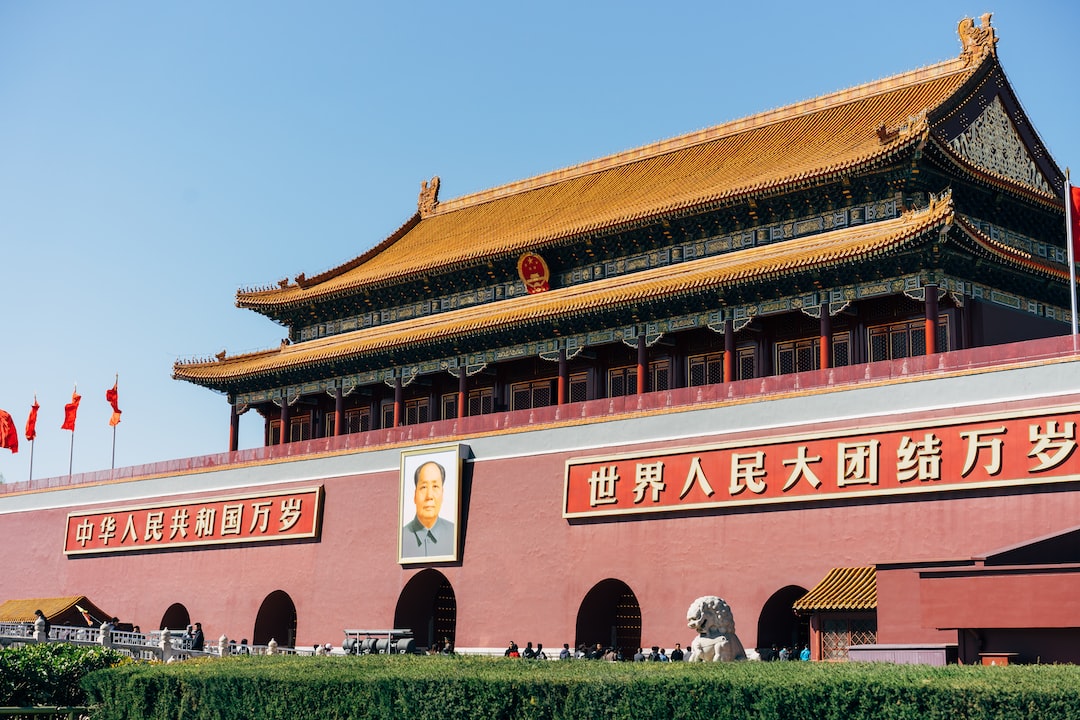

Global Medtech Trends: Readouts from Early Birds of Q3 Earnings Season- Positives and Negatives

- Despite the macroeconomic headwinds, Q3 results from the large medtech companies showed some encouraging signs including healthy procedure volume growth depicting recovery in the medtech sector globally.

- Amidst fear of recession, most of these companies reported healthy system placement and no order cancellation. Diabetes, with a large underpenetrated addressable population, remains one of the most resilient segments.

- Financial performances of APAC medtech companies are expected to be driven by healthy global procedure volume growth and Fx, partially offset by macroeconomic headwinds including inflation and supply constraints.

Can CSA SPAC Its Way Through a Commodity Crash?

- Commodities have had a wild rally over the last two years, incentivising miners to go public amidst heightened investor enthusiasm.

- Despite this, markets have slept through the announcement of Glencore’s CSA Copper Mine being spun off through a $1.1 billion SPAC merger with Metals Acquisition Corp.

- The deal price implies a 4.5x multiple of 2022 EBITDA, which is a breath of fresh air in SPACland, where valuations have hovered at many multiples of sales that are three or four years out.

💡 Before it’s here, it’s on Smartkarma

Sign Up for Free

The Smartkarma Preview Pass is your entry to the Independent Investment Research Network

- ✓ Unlimited Research Summaries

- ✓ Personalised Alerts

- ✓ Custom Watchlists

- ✓ Company Data and News

- ✓ Events & Webinars