In today’s briefing:

- Japan Department Stores: Sales Recovery but the Real Opportunity Is in Margin Growth

- Google in Japan – Infrastructure Investments Highlight Japan Growth and Forex Shift

- US Economy – Key Macro Events This Week

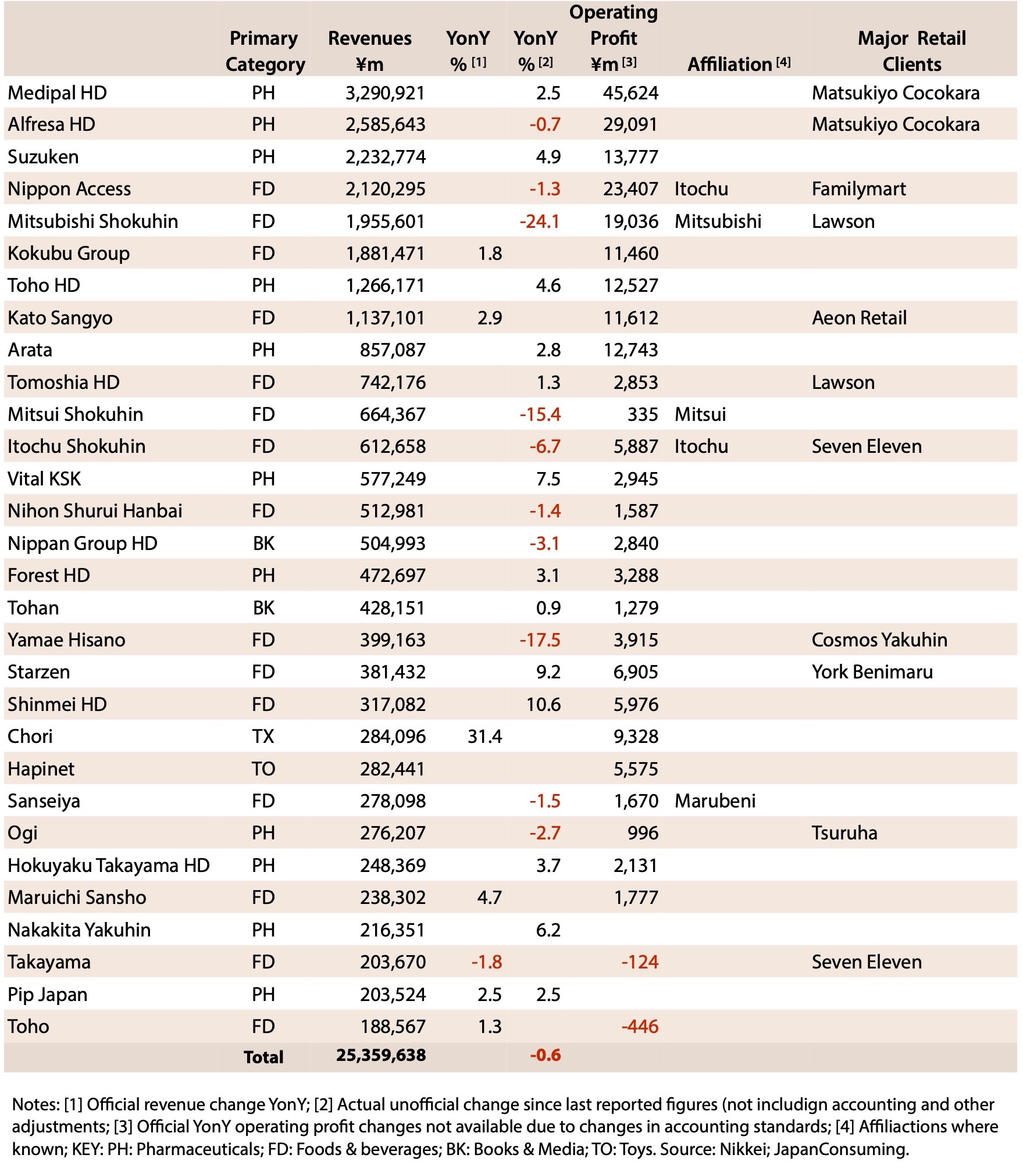

Japan Department Stores: Sales Recovery but the Real Opportunity Is in Margin Growth

- Department stores managed a partial rebound in 2021-22 but remain around 19% behind pre-Covid levels overall. As a result, profits remain elusive and the shake up in the industry continues.

- On the plus side, luxury sales continue to surge and management is now more engaged than for years.

- Although we remain negative on the sector overall, some companies will bounce back strongly as detailed in this in-depth review of the sector.

Google in Japan – Infrastructure Investments Highlight Japan Growth and Forex Shift

- Google will invest $735mn (¥105bn) through 2023 on Japan infrastructure including its first local data center and additional subsea capacity

- The Google CEO met with Prime Minister Kishida and the announcement scores political points but it also makes sense with a material JP business and the weak yen

- Google is probably Japan’s largest Internet advertising company with an estimated ¥685bn in FY21 sales

US Economy – Key Macro Events This Week

- At the September meeting, the FOMC raised their fed funds rate target by 75bps, or 3% in the last 7 months.

- Powell has been quite clear that his intention is to put the long-term health of the economy top of his mind in his effort to quash inflation before it gets out of hand; remarking that “I wish there were a painless way to do that. There isn’t. We have to get supply and demand back into alignment. The way we do that is by slowing the economy.”

- The last meeting demonstrated a hawkish shift in economic projections.

💡 Before it’s here, it’s on Smartkarma

Sign Up for Free

The Smartkarma Preview Pass is your entry to the Independent Investment Research Network

- ✓ Unlimited Research Summaries

- ✓ Personalised Alerts

- ✓ Custom Watchlists

- ✓ Company Data and News

- ✓ Events & Webinars