Receive this weekly newsletter keeping 45k+ investors in the loop

1. HEM: Dec-25 Views & Challenges

- Volatile markets and policy guidance washed out, with pricing and forecasts little changed on the month.

- Bailey is biased to ease, but the BoE is awakening to its inflation problem. It should cut less than dovishly priced.

- Higher unemployment could move beyond a structural shift from policy to signal a less elevated neutral rate.

2. BoE Survey Says Stagflation Survives

- CFOs keep telling the BoE their prices will rise by 3.5% in 2026, with wage increases similarly substantial. There has been no significant break lower in over 18 months.

- Employment plans have also deteriorated, lending some support to the dovish case as well. But this side is an unreliable signal, while inflation has proved brutally accurate.

- Doves need the employment aspect to be true, but the transmission to prices not to be. This survey signals upside inflation risks that should discourage rate cuts in 2026.

3. HONG KONG ALPHA PORTFOLIO: (November 2025)

- The Hong Kong Alpha portfolio returned -2.89% in November versus +1.72% for its benchmark index. The HK Alpha portfolio has outperformed Hong Kong indexes by 33% to 45% since inception.

- The portfolio continues to generate 57% of its returns from alpha (idiosyncratic returns) while maintaining a Sharpe ratio of 2.19 YTD.

- We have sold positions in the materials and industrials sectors and added positions in telecom, gold, and insurance industries at the end of November.

4. HEW: Easing Before The Festive Storm

- The BoE FPC cut capital requirements in a surprise macroprudential easing that adds to the less-tight fiscal policy to lessen the need for BoE rate cuts, but one is coming.

- UK CFOs reveal no progress in breaking excessive inflation expectations for 18 months, EA inflation surprisingly rose, and the worst PMIs improved as resilience broadened.

- Another Fed cut is firmly priced, setting it up to be delivered, but members are likely to dissent against it and remain cautious in only forecasting one more cut in 2026.

5. Activity Thaws Into Winter

- The worst services PMIs thawed in November, broadening growth even as averages held steady. Activity in the US services ISM has trended up to exceed the PMI data now.

- A slight fading of stagflationary pressures in the latest US surveys probably balances out in the Fed’s policy trade-off. We still fear that it is easing excessively.

- Rising unemployment rates in the US and UK are concerns not experienced in most of the world. This theme feeds their recent divergence from the global surprise tendency.

6. Likely Increase In Mandatory Tender Offer from the Current 50% + 1 Share Requirement

- Korean government is likely to increase the mandatory tender offer from current 50% + 1 share requirement (minimum majority stake) to much higher levels (but below the maximum 100% requirement).

- There is an increasing probability that indeed the Korean government is likely to increase the minimum majority stake requirement to 60% to 75% of total shares in 1H26.

- If the minimum maximum stake rises to 60%-75% of outstanding shares, this would have a further beneficial impact on the minority shareholders.

7. Asian Equities: Southbound Zeal Dips; Some Established Themes Looking Tired, Others Rejuvenated.

- From the superlative September (US$24.2 bn net buy), onshore investors’ net Southbound buying dipped in October (US$11.9 bn) and November (US$15.7 bn). Xiaomi, Alibaba, PopMart and Meituan were bought most.

- The most sold stocks during October-November were SMIC, Hua Hong Semi, Innovent Biologics. Enthusiasm for semiconductor and biotech seems to be cooling off, though we believe biotech focus should revive.

- Investors’ sustained preference is for stocks catering to domestic consumption that are able to adopt AI to improve productivity and expand their cash-generating businesses. Internet platforms fall in this silo.

8. Late-Cycle Tension: Rising Volatility Signals a Critical Market Inflection into 2026

- US equities triggered key reversal signals as market breadth deteriorated, crowded AI leaders unwound, and indexes broke trend support, elevating near-term downside risk.

- Macro uncertainty, tighter liquidity, and shifting investor psychology are pressuring high-liquidity growth assets, while gold and quality balance-sheet exposures provide relative resilience.

- Multiple late-cycle timing models align into early 2026, raising the probability of episodic volatility and making disciplined positioning, selective risk-taking, and tactical hedging essential.

9. Asian Equities: Stupendous FII Selling in November; Long-Term Study Foreshadows Structural Recovery.

- In November, FIIs sold a stupendous US$22 bn Asian equities, the second highest in the past 6 years. Bulk of it was in Korea (US$9.7 bn) and Taiwan (US$12 bn).

- Concerns about sustainability of AI capex and doubts about Fed rate trajectory were the key drivers of FIIs’ worries. The latter also depressed the Asian currencies.

- Study of last 6 years cumulative buying/selling reveals massive selling in Taiwan/Korea. Flows in these markets should recover the most as FIIs play catch-up. India is a more difficult call.

10. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 5 Dec 2025

United States shows deepening slowdown with weak ISM manufacturing, falling employment, and declining private payrolls, signaling rising recession risk.

India and China exhibit relatively constructive economic prospects, contrasting with softness in advanced economies.

Asian indicators are mixed, with Indonesia struggling on trade and Hong Kong retail sales recovering gradually but remaining below pre-COVID levels.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK Backloads A Tax Trap

- The UK’s fiscal hole was even smaller than we thought (£6bn), allowing the government to backload a fiscal tightening that is unsurprisingly focused on tax increases.

- Delaying prudence to an election year is implausible. There will be a substantial deficit in 2029-30, not the current budget surplus in the OBR forecasts based on existing policy.

- Labour is setting up a tax trap for Reform and the Conservatives to say how they’d avoid tax increases, similar to the backloaded spending cuts they myopically ignored in 2024.

2. UK Labour Party: Damned If They Do…

- Whatever Rachel Reeves comes up with in her 26 November budget, she is bound to run into criticism from within her own parliamentary party.

- Bond markets seem set to react badly to this, especially if it seems likely that her overall objectives will be undermined by internal resistance to proposed measures.

- She and the PM will probably survive this, but a market-unsettling change and slide to the left look increasingly likely by mid-2026, followed by defeat at the next election.

3. US Market: WALK TO THE EXIT NOW BEFORE EVERYONE STARTS RUNNING!

- The US market is weakening again as an interday reversal after Nvidia results foreshadows continued selling in the AI theme. Market breadth is weakening and stocks at 52-week lows surging.

- Volatility has reached levels last seen during the tariff tantrum in April. Insider sales of Nvidia have surged since June. Private credit and private equity markets are showing stress.

- US consumption has narrowed and is highly dependent on stock market gains. Household debt levels are at new highs, and consumer sentiment is lower than during the GFC in 2008/09.

4. Overview #42 – What a Difference a Day Makes!

- A review of recent events and data impacting our investment themes and outlook

- US interest rate expectations continue to whip markets around, even as more cracks emerge in the AI trade.

- Japan goes for broke with its latest budget and debt issuance.

5. HEW: Slow Shovels

- UK fiscal policy had an even smaller hole to fill than we expected, with the work to fill it in delayed until the election. There is no dovish pressure on the BoE from this.

- European data releases were relatively resilient again, with household lending and business sentiment broadly increasing. National inflation surprises were offsetting.

- Next week’s Euro area flash HICP is still tracking 2.1% in our forecast. Final PMI releases and the BoE’s decision maker panel survey results are our other release highlights.

6. 241: Europe’s Economic Comeback: What It Will Take for a Broad Resurgence

- Europe is experiencing an air of optimism in 2025 due to more flexible fiscal policy and increased government spending on infrastructure and defense.

- European defense companies and banks have seen significant growth year to date, indicating potential for further investment opportunities.

- Challenges to Europe’s long-term competitiveness include an aging workforce and underdeveloped capital markets, but progress is being made in areas such as harmonizing tax rules and increasing efficiency in capital markets.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

7. The Heat Is On: News Flow and Sentiment in CHINA / HONG KONG (November 27)

- Hong Kong market continues to consolidate during the early stage of its Secular Bull Market. Strength and momentum indicators show further weakness ahead.

- Materials and healthcare sectors have lost momentum with other sectors trendless. Analysts target 20% price gains in materials sector over the next year.

- China Taiping Insurance Hldgs (966 HK) shares fell on Thursday on concerns over the insurer’s estimated HK$2.6B exposure to a HK residential project at the center of a deadly fire.

8. How to Trade the AI Panic

- The recent market pullback may have been attributable to a combination of breadth deterioration and a highly bifurcated market.

- In the short term, technical price action and sentiment have become stretched to the downside that a bounce is more or less inevitable.

- We continue to believe stock prices will rally into year-end, but we are watching for signs of a bullish follow-through after the reflex rally for confirmation.

9. Japan Is at a Policy Crossroads, Yen Offers a Guide

- BOJ minutes from the October meeting show 8 of 13 members backing near-term hikes, raising odds of tightening in December–January as wage negotiations strengthen.

- Japan’s JPY 21.3T fiscal package and rising JGB yields highlight a growing policy clash, pushing the yen toward the prior 160 intervention zone.

- Historical patterns of rapid yen reversals indicate that a BOJ hike alongside emerging Fed cut expectations materially increases the probability of a near-term yen appreciation.

10. Japan: CAN TAKAICHI SURVIVE THE COMING TSUNAMI?

- Prime Minister Takaichi started a firestorm with her comments about attacking China over the Taiwan issue. Japan’s missile deployment near Taiwan further inflamed the situation.

- President Xi called President Trump on the matter, and Trump followed up with a call to Takaichi soon after. Takaichi’s miscalculation in provoking China may have led to U.S. concessions.

- PM Takaichi’s fiscally reckless budget is adding fuel to a fire as the yen, JGBs, and stock market are falling simultaneously. Inflation, currently at 3% is rising again.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK Disinflationary Kool-Aid

- UK disinflation relied on smaller utility price hikes and only went as far as the 3.6% forecast before September’s dovish surprise. It does not mean a path to 2% lies ahead.

- A broad rebound in price increases took the annualised median impulse above 4% to average 2.5% over two months, or 3% on the year, as the underlying problem persists.

- The BoE’s December decision pivots around the Governor, who seemingly needs upside news to avoid delivering a cut, so this outcome preserves that riskily dovish course.

2. Japan Picks a Fight with China!! What Happens Now?

- Japan has intentionally stepped into the middle of the geopolitical battle between the U.S. and China with Prime Minister Takaichi’s policy-changing Taiwan comments to Japan’s parliament.

- China’s retaliation has been swift and tactical, issuing travel warnings, high-level diplomatic reprimands, and conducting military exercises near the Senkaku Islands. China has promised a continuing substantial and broad-based response.

- We expect China’s response to include rare earth export and Japanese trade restrictions and targeted boycotts of Japanese goods on the mainland.

3. HEW: Micro Risk Off

- Risk assets have suffered, despite decent Nvidia results suggesting AI demand hasn’t turned yet, and the macro data remaining resilient. Fears are more theme-specific.

- US labour market activity entered the shutdown solidly, and low jobless claims suggest it survived fine. Meanwhile, UK inflation only lost a little excess, and our forecast rose.

- Next week’s UK Budget is the lowlight of our week, but it may struggle to live up to all the noisy hype. Sneaky backloaded tax hikes will close the latest forecast hole again.

4. EA: Unsatisfying disinflationary snack

- Slower food price inflation nibbled the EA rate down to 2.1% in October, while services increased to their fastest pace since April. Labour costs are still rising too fast.

- Underlying inflation metrics are broadly a bit beyond target, risking a slight overshoot in the medium term, but the median impulse is reassuring, weighed down by France.

- Energy prices are set to bump inflation around the target in 2026, averaging above the consensus in our view. The ECB would need tightness elsewhere to shift rates, though.

5. The Dollar Is Smiling But It’s Not Happy 🙁

- The dollar has strengthened in the face of weakening equity markets, however it is not the Dollar Smile theory supporting its move this time.

- A more hawkish Fed signals a break with past conditioning for a Fed Put to bail out the stock market. Post-COVID inflation caused by Fed policies will constrain aggressive easing.

- Safe-Haven support for the dollar and Treasuries broke down during the April selloff, indicating a change in foreigners’ perception of holding USD assets and leading to significantly increased dollar hedging.

6. Japan: The New Takaichi Trade, SELL THE RIP!

- Sentiment in Japan has reversed sharply showing strains in the JPY and JGB markets. The Nikkei 225 has retraced all its gains since the election of Prime Minister Takaichi.

- The market is nervous about the size of Takaichi’s economic package, which will be ¥21.3 trillion; 27%. more than her predecessor pledged. It will increase bond issuance substantially.

- Tensions from Takaichi’s provocation of China show no sign of easing. China has started economic and other measures to respond. The US has removed a missile launcher from Japan.

7. US: Resilient Into Shutdown

- US payroll data revealed resilience going into the US government shutdown, with jobs growth the strongest since April and annualising to a pace capable of plateauing growth.

- Surging labour force participation drove unemployment up in the least disappointing way, with the employment to population ratio making a contradictory improvement.

- Jobless claims suggest stability into the shutdown’s end, besides noisy federal claims. The FOMC may not get the evidence it needs to cut again in December. It may not exist.

8. Asian Equities: A Correction, Not a Bear Market; Rates Still Falling and Earnings Are Catching Up

- Combination of concerns about Fed rate trajectory, AI capex monetization, Chinese growth slowdown and Japanese Yen carry trade unwinding brought the US and Asian markets 4-5% down since late October.

- Expensive valuations are now justifiably correcting. Notwithstanding worries about a December cut, the interest rate trajectory remains resolutely downwards. Asian disinflation offers several central banks further room for monetary easing.

- AI capex monetization worries will wax and wane. But Asian AI enablers’ cash flows seem safe and valuations inexpensive. Corporate earnings environment is solid in US and recovering in Asia.

9. Asian Equities: Policy Focus Reflected in Sector-Wise IPO Revival in Leading Markets

- Asian IPOs’ spike in 2025 (21% higher till October) has been driven primarily by HK/China. Indian IPOs are almost at the same level as in a very strong 2024.

- Policy thrust for “New Productive Forces” are driving capital raising from industrials, materials, technology and utilities and shall continue to do so. Healthcare should also be a buoyant capital raiser.

- India’s policy focus on manufacturing and listing of PE-funded companies should drive IPOs from industrials, materials and consumer discretionary. Financials shall also remain a large issuer sector.

10. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 21 Nov 2025

U.S. data releases are expected to clarify economic conditions while political pressure complicates monetary policy sentiment.

Japan’s new leadership has escalated geopolitical tensions with China through unnecessary provocative statements.

Asian growth remains mixed but resilient, led by strong performances in Vietnam, India, Taiwan, and Malaysia.

Receive this weekly newsletter keeping 45k+ investors in the loop

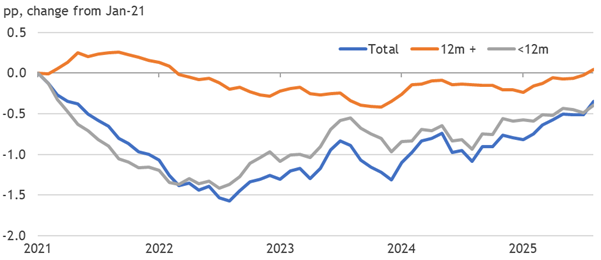

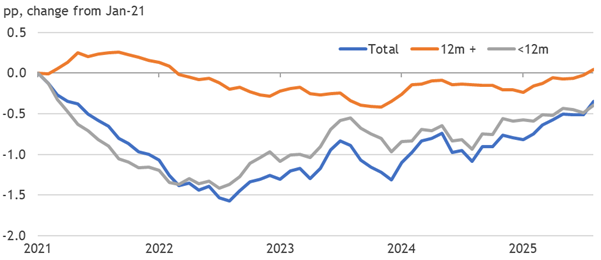

1. UK: Jobless Embolden Bailey’s Cut

- Another disappointing rise in the unemployment rate should embolden Bailey’s bias to cut rates in December. Falling net underemployment contradicts, but is easily ignored.

- Another step down in payrolls, matched by employment this time, could be blamed on fears for the Budget. Redundancies also spiked, although vacancies are stable.

- Headline pay growth is slowing as expected, while the monthly impulse remains excessively strong, so the hawks are unlikely to see inflation persistence as broken.

2. UK: Return To Residual H2 Gloom

- UK GDP disappointed in Q3 at 0.1% q-o-q after the ONS revised away August’s surprise resilience and led it into a slight September fall, setting up for a soft Q4 too.

- Residual seasonality in service sector growth has reasserted itself on the average post-pandemic path. So statistical stories seem more plausible than fundamental ones.

- Weakness in labour market activity is more relevant. The hawkish half of the MPC probably needs disinflationary news to support a cut, but the Governor seems swayed.

3. CHINA’S AI COMMODITIZATION: Can Global AI Valuations Survive?

- Chinese AI model downloads have surpassed those of the U.S. putting at risk the valuations of the large hyperscalers in the U.S.

- Chinese open-source AI models offer a more secure, efficient, and lower cost alternative to Chat GPT -5 , Claude 4.5 Sonnet, and other U.S. LLMs.

- We believe that there will be a turning point when investors will realize that the Chinese open-source AI models have undercut the premise of U.S. global dominance of AI.

4. 239: How Private Markets Could Reshape Portfolios and Investment Opportunities by 2030

- Private markets are investments into non-listed companies or assets, providing diversification and potentially higher returns for portfolios

- There is a significant trend of companies staying private for longer, leading to increased opportunities for private market investors

- Individual investors are increasingly looking to allocate to private markets, with the total alternative assets under management expected to reach $32 trillion by 2030.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

5. NPS Could Raise Allocation of Korean Stocks = KOSPI to 5,000 Soon

- One of the biggest stories in the Korean stock market in the past several weeks has been the discussions about NPS potentially increasing the allocation of Korean stocks.

- If NPS announces a meaningful increase in the allocation of Korean stocks for its AUM, then there could certainly be an acceleration to KOSPI reaching 5,000.

- Based on what we have gathered so far, there is a higher probability (70-80%) that NPS meaningfully increases the allocation of Korean stocks in the next several months.

6. Technically Speaking Breakouts & Breakdowns – HONG KONG (November 10)

- The Hong Kong market is consolidating with rotational buying into value and high dividend factor investments. Mainland buying has slowed and diversified away from tech into low volatility names.

- After leading the market for nine months, growth and momentum factors turned down sharply in October. The energy sector is showing increased strength and momentum, while tech and healthcare lag.

- Xinyi Solar Holdings (968 HK) had a technical breakout after forming a Golden Cross with a rebound off its 50 day-moving-average. The share price is benefiting from anti-involution policies.

7. Oil: Wisdom of (Mohammed bin) Salman

- Most analysis of Opec+’s 2 November decision is as overly simplistic as the cartel’s public justifications. Calling an unwinding ‘time out’ in 2026Q1 is by no means unwise.

- Most notably — and despite continuing economic and political uncertainty — it is very likely that the market will be awash with oil in any case for some months to come.

- In other words, the cartel may already have done enough to achieve its primary objective, i.e. clawing back market share at the expense of US shale producers.

8. Asian Equities: Earnings Estimate Upgrades Climbing, but Slowly and Selectively

- Midway through the 3Q25 result season, eighteen Asian market-sectors have reported consensus EPS estimate upgrades over past one, three and six months. A quarter ago, we identified 11 such sectors.

- Eleven of these sectors are from HK/China, Korea and Taiwan. Seven are from ASEAN markets, dominated by Thailand. India and Singapore are conspicuous by their absence.

- Among the notable sectors with EPS upgrades, Chinese base metals, HK/Chinese and Korean financials, Chinese pharmaceuticals, Korean and Taiwanese technology, Thai utilities and communication and Philippines transportation stand out.

9. HEW: Back To Business

- The US government reopened after some of those seeking to expand the state inevitably broke ranks to reverse some shrinkage, although the fight could resume in January.

- UK activity data were broadly disappointing as unemployment rose and GDP fell at the end of Q3, after downwards revisions helped realign with the residual seasonality.

- Next week’s UK inflation data will be more insightful for the BoE’s hawks and us. The belated release of US macro data will probably be more substantive market news.

10. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 14 Nov 2025

India delivers exceptionally low headline inflation while Japan and the United Kingdom face persistent price pressures and weak growth signals.

Vietnam undergoes political restructuring, yet I see improving economic prospects driven by potential domestic-demand reforms.

China’s seemingly weak October data reflect calendar effects, with monetary indicators instead pointing to strengthening momentum.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Agentic Finance: Building AI Analysts for the Debasement Trade Era — with Vlad Stanev of Quantly

- CEO of Quantly discusses market updates, geopolitical landscape, and trends in safe havens

- Focus on innovation and tech, AI, and bitcoin in the digital market

- Analysis of one year trends in safe havens, bitcoin, gold, and the impact of tariffs on the market.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

2. HEM: Nov-25 Views & Challenges

- Pushback by Powell and peers trimmed some excessively dovish pricing, but the BoE converged down on poor data.

- The BoE should also resist pressure as underlying issues are unbroken by relatively marginal recent payback.

- We now see markets overpricing easing most in the UK. More weakness is needed to signal a threatening trend.

3. BoE: Hawkish Surprise Set For November

- Markets have erroneously repriced a BoE rate cut as potentially imminent and repeated. Policymakers are tending to surprise hawkishly in the UK and elsewhere recently.

- Downside news on excess inflation is mild, while the activity data have, if anything, exceeded BoE forecasts. Pay growth signals remain strong, not disappointing the BoE.

- Six MPC members have favoured slower easing, inconsistent with a November cut. Fiscal consolidation is unlikely to frontload a shock large enough for the MPC to accommodate.

4. BoE: Bailey Leans Over December Fence

- Another 5:4 vote split broke the BoE’s run of quarterly rate cuts. Governor Bailey is revealed to be the pivotal member, with the others worried about inflation persistence.

- Bailey endorsed market pricing and a forward-looking Taylor Rule path that includes a cut this quarter. His verbal comments imply a presumption in favour of cutting then.

- Upside news over the next two monthly release cycles would be needed to block that December cut. Resistance to cutting should only grow stronger as time passes.

5. Rebound To Resilience

- The diverging services PMI and ISM resolved bullishly in October, with activity broadly back to 2024 averages. The ISM headline still looks lower because it is a composite.

- Price balances remain extremely elevated while employment’s weakness has become less acute, skewing the trade-off more hawkishly for any policymaker’s preferences.

- The broader global deterioration in PMIs and unemployment last month also recovered in the latest round of releases. These data are not screaming for any more easing.

6. HONG KONG ALPHA PORTFOLIO: (October 2025)

- The Hong Kong Alpha portfolio’s performance was -2.01% in October versus returns of -0.81 for the benchmark and -3.53 to -8.62 for Hong Kong indexes.

- The Hong Kong Alpha portfolio has captured most of the market gains and minimized drawdowns since inception. The portfolio’s outperformance is more than 40% since inception in October 2024.

- At month-end, we reduced materials and healthcare exposure. We had already reduced the tech exposure earlier in the month. We established positions in the utility, textile, and battery sectors.

7. Making Sense of the Gold Price Retreat

- We offer a plausible scenario that explains the recent surge and correction in gold.

- The market misinterpreted the “Liberation Day” USD decline as a “Sell America” trade instead of a “Hedge America” trade and panicked out of USD and rushed into gold.

- We expect a bottom in gold in Q4 or Q1 as the new Fed Chair pivots monetary policy in a more expansionary manner.

8. HEW: Caution Echoes Outside the BoE

- The BoE resisted cavalier calls for a rate cut this week, but it is much less cautious than we expected. A December rate cut is now likely, absent significant upside surprises.

- All other central bank announcements this week fit the trend, with cautious holds in Australia, Sweden, Norway, Malaysia and Brazil, and a more careful cut in Mexico.

- Next week’s UK labour market (and GDP) data are one of the few things that could clear the evidential hurdle to block a cut, although we doubt good news will extend that far.

9. The Art of the Trade War: HE SAID, XI SAID….. WHAT WAS AGREED?

- The meeting in Busan between Presidents Trump and Xi reduced the tension between the two countries, but the detente may only be temporary and confusion on details persist.

- Tariffs were immediately reduced and potential future increases delayed by a year. President Trump offered to reduce the fentanyl tariff further to 0% after the meeting.

- The most critical issues of export restrictions on chips and Rare Earth Elements were dialed back with recent threatened restrictions delayed by a year.

10. Prepare for the Year-End Rally!

- A review of our Trend Asset Allocation Model reveals a broadly based momentum-driven global bull.

- The S&P 500 is also entering a period of positive year-end seasonality.

- In light of the bullish support provided by the intermediate trend, investors should be positioning for a rally into year-end.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Is Japan Back?

- Japan, a country big in ETFs, is discussed in the Trillions podcast with guest Jeremy Schwartz from WisdomTree

- DXJ, the WisdomTree Japan Hedged ETF, had a successful run in 2013 but later underperformed, potentially due to currency manipulation and changes in leadership

- Despite past fluctuations, Japan never left and DXJ has outperformed the S&P 500 since 2012, highlighting the potential for growth and investment opportunities in Japan

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

2. Credit For Inflation

- Credit and monetary holdings are booming in the UK, enabling consumers to spend their devalued pounds, supporting CPI inflation beyond the target.

- Falling rates have neutered the refinancing shock, facilitating the affordability of loan demand. Rapid ongoing wage growth further reduces the debt burden.

- The ECB also sees bullish monetary trends, but they only took it to a good place. The BoE is not in a good place, with policy accommodating above-target inflation pressures.

3. Ready for the Contrarian Gold Trade?

- We have been bull bulls, but point and figure charts of gold and gold miners show that they are either very near or have outrun their measured price objectives.

- Tactically, the contrarian trade would be to sell gold and buy bonds.

- However, a cycle analysis leads us to conclude that the market is undergoing a shift to a hard asset price leadership cycle.

4. China/US: Sauce For The Goose…

- Donald Trump and Xi Jinping’s 30 October summit will likely stave off, for now, any further escalation of trade tensions between China and the US.

- However, thanks to its monopoly on strategic minerals and Xi Jinping’s willingness to play a long game — even beyond ‘mere’ trade — China holds the stronger hand.

- Irrespective of whatever Mr Trump concedes this week to secure a ‘headline grabber’, Xi Jinping will therefore come back for more, not least on Taiwan.

5. HEW: Cautious Committees

- Central bankers broadly delivered on expectations this week, while cautioning that changes will likely be less than markets assume. The BOJ and ECB were also cautious.

- Flash EA inflation slowed, as expected, but services and core stoked hawkish pressure, while money and credit data in the EA and UK show accommodation of inflation.

- Next week’s BoE decision is no longer priced as a forgone conclusion, but the case to cut is weak. Like its peers, the BoE should cautiously damp dovish expectations.

6. CHINA HOUSEHOLD CONSUMPTION: Unlocking Growth Potential in Five-Year Plan

- China has announced that it will significantly boost the share of domestic consumption in its next five years, while maintaining tech and manufacturing as top priorities.

- The nation’s banks will be instrumental in providing consumption financing to spur a virtual growth driver for the economy. Easing monetary policies will be in addition to the trade-in programs.

- Consumer in service sectors like e-commerce, travel & tourism, healthcare, elderly care and AI will benefit from increasing consumption. Local brands stand to gain market share against foreign competitors.

7. EM Fixed Income: Reviewing the global & previewing the upcoming idiosyncratic

- EM markets trading with strong global beta, lack of US key data due to government shutdown affecting market direction

- EM currencies look okay, EM rates may be less favorable, EM credit suffering from tight spreads

- Key takeaways from IMF conference in Washington include focus on impact of AI-related investments on global growth and employment, overall mood on growth is flat with risks but no panic or euphoria

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

8. Time to Sound the All-Clear?

- The U.S. stock market’s technical conditions are turning more constructive.

- Market internals such as breadth and risk appetite indicators have stopped deteriorating and they are starting to heal

- Risks remain, and we would like to see the resolution of key event risks before sounding the all-clear signal.

9. The Art of the Trade War: U.S. ON THE HAMSTER WHEEL!

- The much hyped meeting between the presidents of the world’s two largest economies fell short of global expectations. Key issues were only delayed, not resolved.

- China has been steadfast in the face of U.S. hardball tactics, resulting in the U.S. reversal of announced measures, like the expansion of the restricted entity list.

- The effective tariff rate on Chinese exports to the U.S. will be approximately 30%, which is 20% higher than when President Trump took office.

10. Global Active Funds Struggle to Close the Gap in 2025

- Active Global funds averaged +15.5% YTD, trailing the SPDR ACWI ETF’s +18.8%, with 73% underperforming the benchmark.

- Value strategies led performance; Aggressive Growth funds lagged sharply, averaging just +10.15%.

- Underweights in US Tech names like NVIDIA and Palantir, plus 2.4% cash holdings, drove relative losses.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK CPI Trips Into The Fall

- UK inflation’s march higher ended early as expectations tripped over a drop in airfares to slow slightly in September, ahead of slightly falling back through the Fall seasonal.

- Weakness elsewhere cut the annualised median rate below 2% for the first time since March. That is likely to be a small soft spot relative to the worrying cumulative upside.

- Our forecasts remain close to or below the consensus until June, after other forecasts rose in last month’s survey. We still see wages stoking an excessive underlying trend.

2. Credit Cockroaches Incubating

- Write-downs at two regional banks follow the cockroaches of First Brands and Tricolor bankruptcies, and should not be dismissed as isolated idiosyncratic events.

- Overly accommodative monetary conditions are stimulating markets to incubate cockroach eggs that may spawn as private credit malinvestment in the next recession.

- It is too early for these eggs to hatch, aided by the warm support of further Fed rate cuts. So, risk assets will probably keep on rising in the void of economic data releases.

3. EMERGING THEMES: China’s Next 5 Year Plan

- China will roll out its 2026 – 2030 five-year plan this month, which outline the economic and social roadmap until the end of the decade.

- Historically the five-year plans have been a roadmap for investors to look for tailwinds for economic sector performance. We believe the high-tech industries will remain the main focus for investment.

- Exporters of high-end equipment and machinery will continue to benefit with the consumption sector being a focus for international investors.

4. A Sharp Increase in Short Selling Balance in the Korean Stock Market Past Seven Months

- The net short selling balance in KOSPI reached 12.6 trillion won as of 20 October. This is the largest amount ever.

- The top 5 companies in KOSPI with highest short selling balance/market cap ratio include Kakaopay, L&F, Hanmi Semiconductor, Cosmax, and LG H&H.

- Net short position In KOSDAQ as a percentage of total KOSDAQ market cap more than doubled from 0.5% as of 31 March to 1.1% as of 21 October 2025.

5. A Fragile Bull

- The narrow U.S. market leadership presents fragility challenges for investors.

- The economy is becoming increasingly dependent on the top 20% of consumers, and the market is dependent on Magnificent Seven and AI stocks to lead the market.

- While there are no signs that these trends are about to break, the market is overextended in the short run and can correct at any time.

6. The Heat Is On: News Flow and Sentiment in CHINA / HONG KONG (October 20)

- The materials sector continues its outperformance in Hong Kong, however the recent sharp pullback showed a weakening in strength and momentum.

- Mainland investors continued to buy Hong Kong listed stocks heavily during the market pullback earlier this month.

- Zhejiang Sanhua Intelligent Controls (2050 HK) quashed market rumors about a large robotic order from Tesla (TSLA US); however, it continues discussions on cooperation opportunities.

7. Technically Speaking Breakouts & Breakdowns – HONG KONG (October 18)

- Hong Kong has pulled back this month as the U.S. trade war intensifies, however it remains in a Secular Bull Market.

- Materials and Healthcare sectors continue to outperform YTD, with Technology coming in a distant 3rd place.

- Hengan International Group (1044 HK) had multiple breakouts relative to MSCI Asian indexes and on an absolute basis. Analysts’ recommendations are split as the shares trade at their target price.

8. The Art of the Trade War: THE END OF THE BEGINNING

- The meeting next week between Presidents Trump and Xi will mark the beginning of a resolution to trade and other issues between the two countries.

- The most difficult tech and rare earth elements issues will probably not be resolved. Increased tariff rates will be delayed again.

- TikTok and Taiwan are key issues and will set the tone for the U.S.-China relationship during President Trump’s remaining term.

9. EM Active Funds: What’s Driving Performance in 2025?

- Active EM funds average +26.0% YTD, their strongest year since 2017, though still underperforming the benchmark by -1.8%. Fewer than 40% have outpaced the iShares MSCI EM ETF.

- Style and regional positioning drove dispersion. Value managers and South Korea exposure supported gains, while Aggressive Growth styles and India-heavy allocations weighed on returns. High Active Share strategies also trailed.

- Active EM outperformance remains consistent long-term. Active funds have beaten the benchmark in 14 of the past 22 years, with the ETF often ranking near the peer group median.

10. HEW: Heavy Hitters Pulling Punches

- Sentiment stabilised this week as credit issues are realised to be more of a long-term problem than an imminent issue. Indonesia and Korea hawkishly held their policy rates.

- Inflation undershot final expectations in the UK and US, yet constitutes less excess rather than outright weakness, and merely aligns with slightly earlier forecasts.

- Next week’s release calendar has some heavy hitters, but pulling their punches. The Fed cut and ECB hold are widely expected, as is a marginal slowing in EA inflation.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK: Mixed Messages On Labour Market

- Most narratives can find some support in the latest labour market report, preserving uncertainty that should keep the BoE on hold at least until some clarity emerges.

- Unemployment has increased (LFS) or stabilised (payrolls), while pay is shockingly resurgent (inc-bonuses), slowing as expected (ex-bonus) or stagnating (private pay).

- Weakness isn’t as clear as the consensus and press sometimes make out, but concerns aren’t invalidated. We still expect resilience to preserve excess inflation hawkishly.

2. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 17 October 2025

- China: Monetary & Trade Indicators Strengthen: September data show broad-based monetary growth

- Korea: Early Signs of Trade Softness: The first 10 days of October show exports down 15% YoY, imports down 22.8%.

- India: Inflation Trends Favor Rate Cuts: Wholesale prices up just 0.1% YoY in September — a stark contrast to >10% in 2022 and flat in 2023.

3. UK: Unseasonably Resilient In Q3

- Slight growth in August sustains an above trend level of activity and is tracking to a 0.2% q-o-q pace for Q3, matching our forecast and the consensus, but disappointing the BoE.

- The ongoing slowdown in service sector activity repeats residual seasonality that would leave a trough in two months, but there is slightly more resilience this year.

- Policymakers shouldn’t react to statistical noise, and are unlikely to amid ongoing excesses in underlying inflation that a stabilising labour market wouldn’t break.

4. The Art of the Trade War: PAIN THRESHOLD FOR THE TACO TRADE!!

- Tensions between China and the U.S. have increased. Last week’s tit-for-tat exchanges culminated with President Trump threatening China with higher tariff rates and a cancellation of his meeting with Xi.

- Trump’s Friday post on social media immediately caused U.S. markets to swoon with the S&P breaking support levels. In a TACO trade moment, Trump reversed his harsh rhetoric on Sunday.

- Anyone can speculate on what the next few weeks will look like for markets, but we believe the market may start pricing in more long-term risk.

5. HEW: Cockroaches Startle Pricing

- Losses on bad and fraudulent US loans raise the risk that more cockroaches will emerge, nourished by monetary policy stimulating asset prices outside of recessionary regimes.

- Market rates fell on this, while macro data didn’t offer direction as UK Q3 GDP kept tracking 0.2%, EA inflation was confirmed, and UK labour market data were mixed.

- Next week’s UK inflation data should reveal a rise, with the CPI reaching 4%. Delayed US CPI data will provide a rare signal more relevant to the Fed’s likely decision to cut.

6. EA: Inflation Rises Briefly In The Fall

- Inflation’s rise to a high 2.3% in September was confirmed in the final print, although some payback remains likely in October. We doubt it goes fully back to the target then.

- Underlying inflation metrics were broadly stable again at about 2.5%, with little progress in most statistical measures for over a year.

- There is little cause for alarm at this stage, so the ECB can keep waiting in a good place, but we still see a greater risk of hikes than cuts in 2026.

7. The Return of Tariff Man

- We’ve been warning forweeks that the U.S. equity market advance was extended and it could pull back at any time.

- President Trump’s threat to impose high tariffs on China seems to be the bearish trigger.

- Our base case calls for a 5-10% pullback, and we regard any correction as a welcome pause and opportunity to add to equity positions at lower prices.

8. The AI Bubble Debate

- Are we in an AI bubble? Probably, but much depends on what stage we are in the bubble.

- On one hand, headline M&A deals like the one concluded with AMD is supportive of further gains.

- On the other hand, the recent Oracle earnings report casts doubt about the profitability of AI cloud computing sustaining elevated valuations.

9. US Equities: Maintaining Elevated Leadership Valuations Will Require Upside Surprises

- Hype surrounding the benefits of artificial intelligence (AI) has increased in 2025, despite a slowing economy. While new economy sectors have contributed to growth, not all is AI-related.

- There are valid comparisons between the current environment and the late 1990s surrounding hype about the beneficial impact of technological innovation on corporate performance. S&P500 leadership is priced to perfection.

- Current US equity leadership valuations are exposed to threats over the next 9 months, including stress in credit markets due to high bond issuance by companies in AI-related activity.

10. Asia Cross Asset Podcast: Japan – The New LDP Leader: Implications for policy and markets

- Ayako Takashi advocates for responsible expansionary fiscal policy, focusing on income distribution rather than aggressive fiscal expansion.

- Takashi’s comments on the relationship between the government and the Bank of Japan do not necessarily indicate clear intervention, but may put pressure on the central bank.

- The BOJ may need to deliver rate hikes every six months to combat elevated inflation, with market expectations of a terminal rate around 1%. Timing of rate hikes may be tricky, especially with fluctuating exchange rates.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. From Buyers to Builders: Assessing the U.S. Housing Market

- Market sentiment on rate cutting and its impact on the housing market in 2026 is largely optimistic

- Home prices are up two and a half percent through June but have been declining month-over-month

- Housing supply at a national level is back to pre-Covid levels, transitioning to a buyer’s market from a seller’s market with strong mortgage credit but affordability challenges due to higher rates

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

2. HEM: Oct-25 Views & Challenges

- Hawkish inflation and policy rate pricing shifts toward our UK/EA view did not stop US rates frontloading more cuts.

- We still see markets overpricing easing, with UK inflation expectations stuck above target, and neutral rates high.

- A break in activity data, especially unemployment, and underlying price/wage inflation, would threaten our view.

3. US Shutdown: A Means To An End

- The Democrats opted for a US government shutdown despite the Administration being well prepared for what it sees as an opportunity to promote its longer-term agenda.

- While they hold out, the president’s ‘grim reaper’, OMB Director Russell Vought, will have a free hand to cut the size of government and pursue his unitary executive vision.

- Some of his actions will undoubtedly be challenged in the courts, but the signs are that the Supreme Court will continue to side firmly with the Administration.

4. UK: Poor Productivity Paradigms

- The OBR looks likely to trim its productivity trend assumption to 1%, which would still be a bullish break from the current stagnation. Trends rarely break outside recessions.

- High taxes are squeezing the most productive and being transferred to the inactive. It should not be surprising that the UK’s political choices have stalled productivity.

- We see no reason to think the UK will pull off an internationally exceptional jobs-light boom from here. Ongoing stagnation would extend the UK’s rule for fiscal slippage.

5. EM Fixed Income: Is better growth worse for EM?

- Recent data has shown better-than-expected growth globally, leading to a shift in the macro landscape.

- The US economy has shown signs of weakness, particularly in the labor market, but overall growth forecasts have been revised upwards.

- Emerging markets have maintained a positive bias, with inflows steadily coming in, but there are concerns about potential vulnerability in EM currencies and local rates markets if the US growth environment remains strong.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

6. US: Steady As She Shuts

- The US government shutdown causes vital economic data to go dark, leaving the Fed facing market pressure to blindly cut rates as priced, creating risks of policy error.

- Both parties see strategic value in prolonging the shutdown, risking disruption that lasts well beyond historical norms. But levels will rebound when it inevitably ends.

- In the interim, private surveys signal weakness, and this picture is unlikely to improve significantly enough to block cuts in 2025, but that won’t drive more Fed cuts in 2026.

7. Beyond The Blue Chips: A Look At SGX’s iEdge Singapore Next 50

- SGX iEdge has launched the SGX iEdge Singapore Next 50 indices to track the 50 largest and most liquid SGX Mainboard companies beyond the 30 companies featured in the Straits Times Index (STI).

The Next 50 index has the highest weighting in the Real Estate sector, comprising ~47% of the index by weight. Other meaningful sectors are Financials, Industrials, and Consumer.

- By utilizing the new index in conjunction with the Straits Times Index (STI), investors and asset managers can more effectively construct tactical asset allocation strategies that aim to enhance portfolio performance.

8. Turning tides: a new dawn for capital flows

- Shift in capital flows and rise of domestic emerging market investors

- Discussion with experts in UAE and Singapore on their experiences and perspectives

- Impact of global events like financial crisis and COVID on emerging markets and expat communities

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

9. Q4 Outlook for Our Investment Themes Part 2 – Asian Equities

- How have our major investment themes performed so far in 2025?

- Review of the performance of the major markets and asset classes we focus on

- We revisit our outlook for each of those asset classes for Q4 25

10. RARE EARTH ELEMENTS: China Plays Its AI Trump Card!

- China has implemented extensive restrictions on its export of Rare Earth Elements, which will affect critical parts of the AI supply chain including semiconductor equipment and chips, and data centers.

- The restrictions were in response to recent actions by the U.S. to broaden restrictions on semiconductor equipment exports to China and Secretary Bessent’s comments regarding Argentina’s future relationship with China.

- President Trump responded with a social media post threatening a 100% increase in tariffs on Chinese imports and export controls on critical software.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. HONG KONG ALPHA PORTFOLIO: (September 2025)

- Hong Kong Alpha portfolio gained 8.45% in September and 60.89% and 62.80% YTD and since launch one year ago. The portfolio has outperformed Hong Kong indexes by more than 40%.

- The portfolio has a Sharpe ratio of 3.23 YTD and has generated more than 40% of its returns from stock-picking (alpha). Its beta is low at only 1.17.

- At the end of September, we increased exposure to AI and robotics and sold positions in the consumer and finance sectors.

2. UK: Lending Looks Stimulated

- Lending activity is sustaining beyond the levels prevailing before the stamp duty tax hike distortion. Only housing transaction volumes are down, but by less than before.

- New loan rates have fallen by 23bp since then, for a 110bp cumulative fall. New rates are close to the outstanding stock. Many borrowers are refinancing for similar deals.

- Past tightening has broadly passed through, but the strength in broad money growth signals that monetary conditions are settling at a slightly stimulative setting.

3. EA: Core Excess Revealed In Sep-25

- Inflation’s break above target to 2.23%, within 1bp of our forecast, came as past energy price falls dropped out to reveal the more resilient underlying pressures.

- Small upside surprises in large countries, like Germany and Italy, were balanced in number and contribution by larger surprises in small ones, like Greece and Estonia.

- We expect less negative payback in October and January, preventing our profile from languishing below the target through 2026, like the consensus view does.

4. UK: Government Leads Imbalances

- Household saving and inflation have eroded their debt burden while corporates remain prudent. A lack of imbalances to correct starves the UK of fuel for a recession fire.

- Persistent fiscal and current account deficits highlight where the UK’s primary risk lies. If the market regime focuses on fiscal issues, the corrective pressures could be fierce.

- We don’t expect that correction to occur, but the Chancellor should tread carefully, while doves need not worry about a recession arising from healthier other UK sectors.

5. Australian Equities: Where are we now, and what’s next?

- Australian economy remains sluggish, but some positives include recovery in small caps and resilience of Australian consumers

- Market volatility and narrow leadership driving unhappiness among active investors

- Resilience of Aussie consumer and strong retail results stood out in recent reporting season, with small caps and US housing exposure also notable themes

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

6. HEW: Watching What Didn’t Happen

- The US government shutdown removes the potential for official statistics to damp dovish concern, raising the likelihood of October’s cut, especially with other weak data.

- EA unemployment’s rise reflected rounding rather than substance. UK national accounts revealed healthy balance sheets, aside from the government, and bullish lending stats.

- Next week’s calendar stays thin with US releases suspended and Europe’s cycle focusing on the following week. The RBNZ, BoT, BSP and Peru announce rates next week.

7. Gold Mania, Niobium Dreams, and Antimony Nightmares (Datt)

- US monetary policy is accommodative and markets are buoyant, especially in commodities

- Investors need to be cautious about being overly bullish in current environment

- Similarities seen with 2006-2007 period, particularly in disruptions in copper supply and new technologies in metal recovery; investors should be wary of hype and potential risks involved

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

8. Get Ready to Buy the Dip, But Not Yet

- We remain intermediate-term bullish on stocks, but the market is at risk of a correction.

- If last week’s weakness is the start of a pullback, short-term trading indicators point to further downside potential.

- Investors should be prepared to buy the dip, but not yet.

9. Indian Market: WANT TO BUY THE DIP, THINK AGAIN !!

- India’s markets continue to underperform Asia since our insight last November recommending investors to “Fade the Market”.

- Foreign investors continue to exit the market this year with the largest net outflow since COVID.

- The Trump administration is pressuring India in trade negotiations with reciprocal tariffs (25%), additional tariffs for importing Russian oil (25%), pharma tariffs (100%), and new restrictions on H-1B visas.

10. EA: Rounding Jobs For Migrants

- A surprise rise in EA unemployment reflects rounding rather than alarming weakness, with labour supply and demand still surging. Finland’s woes are more idiosyncratic.

- Supply has trended much faster post-pandemic, sustaining demand at its old trend without extreme capacity constraints. Migration has more than accounted for the rise.

- Ukrainians are dominating the flow and complicating the read through to disinflationary spare capacity. Wage growth is an even more critical signal when supply is uncertain.