Receive this weekly newsletter keeping 45k+ investors in the loop

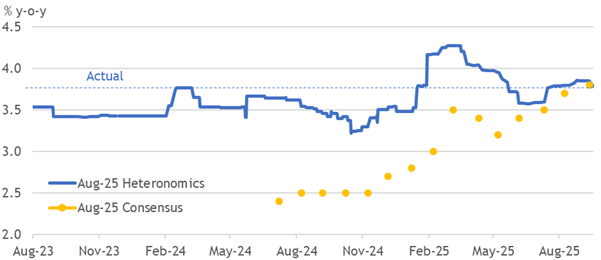

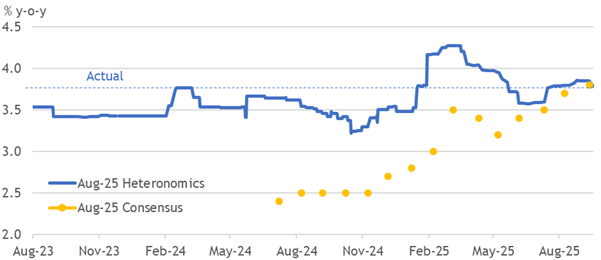

1. UK CPI Stickier For Longer

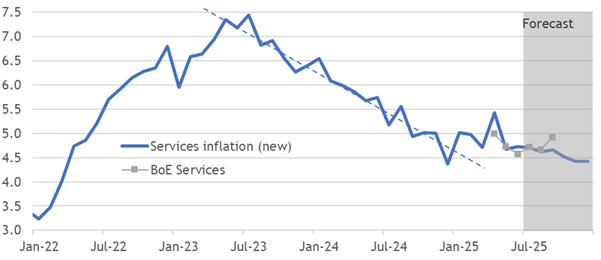

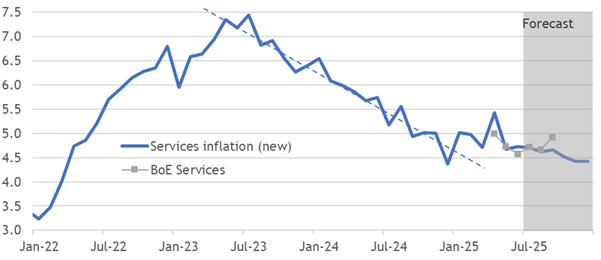

- UK inflation data confirmed the substantial upwards drift in the consensus, worth 0.6pp since May and 1.1pp over the past year, while matching final forecasts for August.

- The consensus has shifted further than usual over the past month. It now aligns with our hawkish forecast until April, when hope again dominates in dragging inflation down.

- Although the MPC won’t be shocked by this outcome, the persistent excess in underlying inflation still seems set to keep it holding rates. We do not expect cuts to resume.

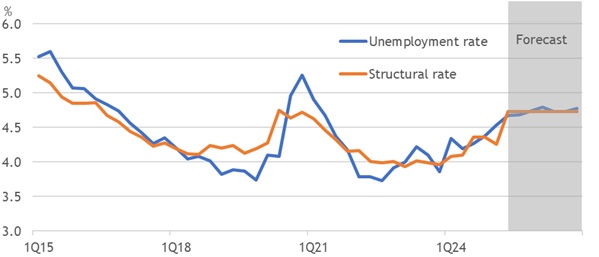

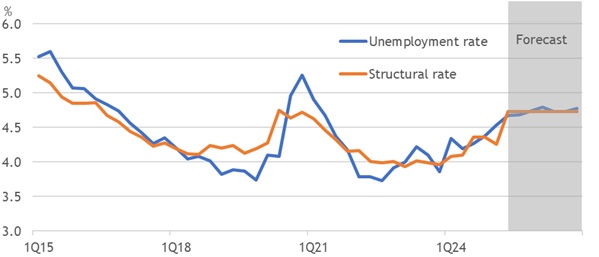

2. UK Jobs Find Their Floor

- Stability in unemployment at 4.66%, while payrolls only marginally decline, suggests the labour market has found its floor before disinflationary pressures accumulate.

- A narrative-breaking improvement could occur next month. Tax rises structurally explain the scale of the previous shock, with weakness seemingly not going beyond that.

- Excess supply is needed to break wage growth to a target-consistent trend. Without that, the MPC should hold rates before potentially reversing by raising them in 2026.

3. Emerging Markets Outlook and Strategy for September 2025

- Global growth has been better than expected, particularly in emerging markets, due to strong export performance and tech cycle strength

- China’s growth is expected to slip below 3% in the second half, with domestic demand slowing sharply

- Despite the growth resilience in EM, central banks are expected to continue their gradual cutting cycle due to weak domestic demand and disinflation trends

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

4. Generative AI in Investment Mgmt: Value Investor’s Perspective w/ Ehsan Ehsani | New Barbarians #035

- Ehsan Ehsani, executive director at Crescendo Partners and adjunct professor at Columbia Business School, joins the discussion with Harmonic Insights and will be organizing the Generative AI and Investment Management Conference at Columbia.

- Futures markets are predicting a 25 basis point cut with more cuts in the future, while volatility and factor returns continue to be influenced by macro factors.

- Quantitative investors typically do not make significant changes to their portfolios based on short-term data, instead focusing on longer-term trends and statistically significant moves.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

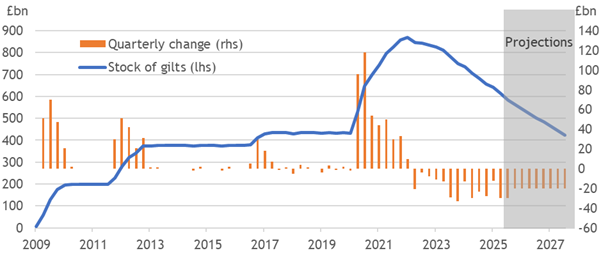

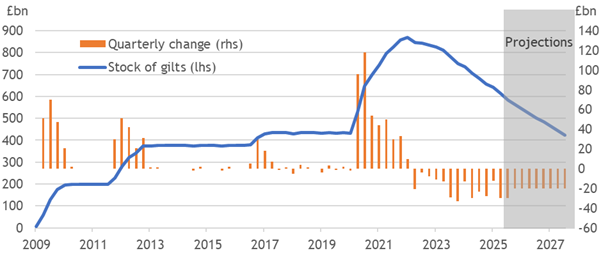

5. BoE Trims QT To Hold Policy Steady

- The MPC unsurprisingly held rates while seeking an answer to its key question around inflation risks amid elevated expectations and a possible structural shift.

- It also trimmed QT by £30bn to £70bn, keeping active sales of long gilts steady in the next three quarterly auctions while skewing QT towards short and medium gilts.

- We still expect the MPC’s presumption of rate cuts resuming to fade out in early 2026 as hawkish pressures persist. Some offsetting fiscal space arises from QT being trimmed.

6. Japan Macro: Restarting Coverage

- Bank of Japan likely to remain on hold till January 2026 with risk of further delay

- Once BoJ resumes hiking cycle, it will likely follow twice a year pace till 1.5%

- With the Fed cutting rates, the long end of the JGB curve is firmly anchored

7. HEW: Cautious Cuts Through The West

- Economic data releases revealed more resilience in labour markets than feared, while inflation remained high. Yet Western central banks broadly cut rates, albeit cautiously.

- The BoE’s caution left only two dovish dissents to its on-hold decision, while it cut QT by £30bn to £70bn to reduce the likelihood of gilt market indigestion.

- Next week’s SNB and Riksbank decisions should join the BoE in holding steady, although they have already cut much further. Flash PMIs are the data focus in a thin calendar.

8. US: You Ain’t Seen Nothin’ yet on the Impact of the Trump Tariffs

- China’s share of US imports will halve in 2025 from Mar’18 peak of 21.8%, and ASEAN’s share (led by Vietnam) will rise to 14%. India, Korea, Taiwan’s shares gain too.

- There was a big surge in Asian exports to the US in Jun-Jul’25 to beat tariffs, but tariffs will alter patterns in 4Q2025, cutting export growth and reducing US disinflation.

- The rebound in US steel production (+4.6%YoY in Jun-Jul’25) and ISM manufacturing new orders suggests select American industries (metals, automobiles, electronics) will gain but downstream users will suffer steadily more.

9. Twilight of the AI Bull?

- The leadership of AI-driven stocks is starting to stumble from bubbly valuation levels, which brings up the warning from Bob Farrell’s Rule #4.

- The debate is ongoing as to whether the AI bull is evolving from hyperscaler leadership to the next phase of companies that can better exploit the technology.

- The lack of cyclical market leadership is concerning from a technical perspective. We are therefore tactically cautious about the short-term outlook for U.S. equities.

10. Dialling down the Noise

- Traders, Quants and Passive Investors have steadily crowded out most earnings signals for long term investors.

- Quarterly reports won’t be missed, and ironically their ending may help restore the role of fundamental analysis.

- However, narrative trading will simply go elsewhere and developments in AI, options and meme stocks are already creating a new asset class we might call ‘Equity as Crypto’.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. BoE QT: Pruning A Bad Policy

- The BoE’s annual Quantitative Tightening announcement in September should see it prune the targeted size, we expect by £20bn to £80bn, concentrated in the long-end.

- Fewer maturities in the year ahead would otherwise put too much pressure on active sales into a market that lacks appetite, especially with LDI demand disappearing.

- Pruning the size and duration delays costs crystallising by several billion a year, which the Chancellor will welcome, yet QT’s poor design remains an expensive fiscal disaster.

2. Fed: Politics Vs Fundamentals

- President Trump’s current preference for rate cuts is not unconditional. Higher-order logic suggests this would not override fundamental resilience or fairly prove “TACO”.

- Political pressure is state-dependent, with the messenger mattering more than the objective truth beneath any message. Trump’s Chair will have a stronger hand.

- Brazil suffered President Lula’s pressure, but he still supported his “Golden Boy’s” turn from dovish dissent to forceful rate hikes. Fed pricing ignores the potential for change.

3. France: Déjà Vu?

- Despite the near certainty that the Bayrou government will fall on 8 September, investors are wary, rather than spooked, reckoning that they have seen all this before.

- They are likely correct to judge that compromises will then be found, allowing the 2026 budget to be passed by a new centrist government.

- However, this would again only be putting off the day when a real crisis point is reached.

4. HEW: Crystalising Policy Divergence

- Spreads between ECB and Fed expectations widened again this week as the ECB held rates with a neutral bias while disappointing US labour market data drive dovish hopes.

- Underlying US services inflation was soft, and initial jobless claims spiked, albeit over Labor Day. We think US pricing has gone too far, and political pressure won’t dominate.

- Guidance with the Fed’s upcoming cut could start to correct that. The BoE will hold rates, after more hawkish macro news next week, and should trim its QT plan this year.

5. The Heat Is On: News Flow and Sentiment in CHINA / HONG KONG (September 11)

- HSTECH index is showing increasing strength as Hong Kong continues it Secular Bull Market. Continued strong market breadth indicates both rotational buying and new investors entering the market.

- Southbound buying from mainland investors remains strong after the “Liberation Day announcement. Mainland investor volume is now 20% of total volume in the Hong Kong market.

- China Biotech and Drug sectors were hit as the U.S. administration indicated it may begin restricting import of Chinese-made drugs and to cut off the pipeline of Chinese-invented experimental drugs.

6. Technically Speaking Breakouts & Breakdowns – HONG KONG (September 10)

- The Hong Kong secular bull market continues to broaden and has broken all long term resistance levels. The HSCEI has beaten Asian and global peers over the last 18 months.

- Growth and Momentum factors have been the best performers in the HSCI year to date. The Materials and Healthcare sectors continue to show increasing strength in their relative returns.

- Cloud Village (9899 HK) had a breakout pattern from a continuation triangle after reporting a deal to stream Korean drama series to Chinese market. The company’s profits grew in 1H25.

7. ECB: Balanced In The Good Place

- Staying in the ECB’s “good place” encouraged a neutral bias around its unanimous decision for no change, while being appropriately open to tackling future shocks.

- Staff inflation forecasts still undershoot the target, with recent upside news seemingly postponing passthrough rather than trimming the extent into something like our view.

- President Lagarde sounded relaxed about France’s spread widening, and the ECB did not discuss the TPI. We still expect no ECB easing against this, or further rate cuts.

8. Walker’s Weekly: Dr. Jim’s Summary of Key Global Macro Developments – 12 September 2025

US producer prices softened in August, but structural factors keep inflation pressures elevated despite Fed rate cuts.

Labour market revisions show weaker US job growth, raising doubts on monthly payroll data reliability.

Japan’s GDP growth headline looks strong, but weak domestic demand and lower business spending reveal fragile fundamentals.

9. Seasonal Weakness Ahead?

- We are seeing fundamental headwinds in the form of elevated valuations and earnings uncertainty from tariffs, which won’t be visible until Q3 earnings season.

- On the other hand, the technical outlook appears relatively benign.

- Our base case calls for some choppiness ahead. We are near-term cautious, but not bearish.

10. Waller’s Gambit

- Fed Governor Chris Waller is a leading candidate to be the next Fed Chair, and the issue of Fed independence is paramount.

- Our evaluation of his economic case for rate cuts should be whether the decisions are based on sound data, theory and solid judgment.

- He has shown solid thinking on employment, but his justification for rate cuts based on the Fed’s inflation mandate is weaker and shows signs of wishful thinking.

Receive this weekly newsletter keeping 45k+ investors in the loop

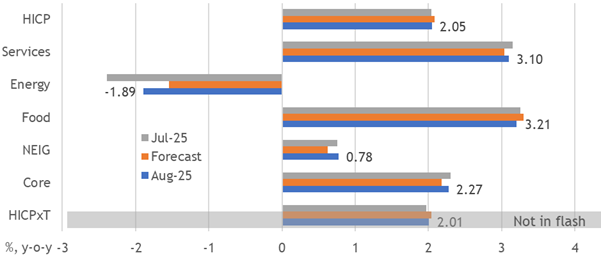

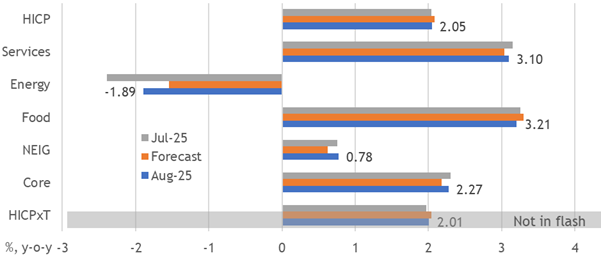

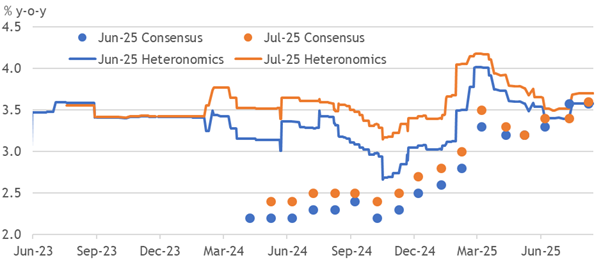

1. EA: Defying Disinflationary Narratives

- Dovish hopes for EA disinflation continue to be disappointed by resilient outcomes. The rise to 2.1% in August amid sticky core pressures is opposite to the dovish narrative.

- Euro appreciation’s disinflationary shock is being offset by domestic resilience, which was most surprising in Northern Europe. Our errors were relatively small and balanced.

- Ongoing upside surprises have defied recent consensus expectations of a drift down to 1.8%. The ECB faces broad upside news that should reassure it against cutting again.

2. Cutting After Pauses

- The BoE and Fed rarely resume cutting cycles after a pause, yet the Fed seems set to break its hold with a cut just as the BoE and ECB enter their own pauses.

- 2002-03 is the best historical parallel for the Fed, which signals potential cuts should be shallow and are likely to be reversed. Politics is no match for the fundamental need.

- Persistently excessive UK pressures should prevent the BoE from cutting in November or beyond, with a quarterly pause historically unlikely to resolve in another rate cut.

3. HEW: Pauses On And Off

- Another disappointing payroll release provides the fundamental cover needed for the Fed to end its pause with a rate cut on 17 September without being too political.

- The BoE is starting its own pause, and if it goes a quarter without cutting, historically, it’s not resumed the cycle. Its DMP survey confirmed inflation’s persistent problem.

- Another upside inflation surprise seems set to keep the ECB on hold amid record low unemployment. We also expect it to preserve its view that policy is in a good place.

4. Liz Truss on the ‘Doom Loop’ Engulfing the UK Economy

- Legacy systems can’t handle usage-based billing, slowing down product launches

- Metronome allows for quick roll out of new pricing models in minutes

- Guest interview with Liz Truss discussing economic challenges and the need for policy shifts

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

5. BoE Survey Says Inflation Persists

- CFOs are telling the BoE that they plan to keep raising prices by more than 3% in 2026. The BoE should take notice, as this survey’s previous warnings have proven accurate.

- Expected increases reflect the passthrough of further wage increases beyond a pace consistent with the target. They exceed even our already hawkish forecasts.

- The BoE is unlikely to realise the sharp drop in wage growth it expects by year’s end, without a shock to break the current regime, bolstering our call for no more rate cuts.

6. HEM: Politicised Policy Pricing

- Persistent inflationary pressures pared dovish guidance and pricing for the BoE and ECB, but Fed pricing is stuck.

- Blocking a rare resumption of Fed easing looks unlikely, but history suggests cuts would be shallow and reversed.

- Peer pressure is weak during a policy mistake. The BoE faces domestic problems that prevent further easing.

7. HONG KONG ALPHA PORTFOLIO (August 2025)

- Hong Kong Alpha portfolio gained 11.34% in October outperforming its benchmark and HK indexes. The portfolio’s Sharpe ratio increased to 2.91 and the beta and correlation to its benchmark decreased.

- The Hong Kong Alpha portfolio is generating significant alpha (idiosyncratic) returns since launch, with 40% of returns represented by superior stock selection, with the remaining due to sector weighting.

- At the end of August, we bought Luk Fook Holdings Intl (590 HK) for the portfolio as retail demand for gold products in mainland China increases.

8. 182: Private Credit: Hype, Hazard, or the Next Big Thing in Long-Term Growth? With Huw Van Steeni…

- Private assets, gold, and real estate are recommended for investment to recreate what our parents had financially

- Private credit is reshaping wealth portfolios, with a shift towards insurance companies funding the majority of assets in private credit

- The role of private credit has grown significantly post-financial crisis, with a focus on higher quality, lower risk assets and loans to hard assets such as infrastructure.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

9. Everything is a bit Brown

- We often talk of people wanting things to be Black and White and being disconcerted when they realise that they are in fact always Grey, but we would extend that metaphor to the full colour spectrum.

- We want things to be clear and bright and in vivid colour, but in fact everything is, well, basically a bit brown, the colour you get when all the other paints are mixed together and thus, to us at least, it represents the current and pervading sense of muddle and confusion.

- Politically, we see Red socialists embracing Green issues as their central policy, while Greens are pursuing Red Marxism (the author James Delingpole wrote a great book about this called ‘Watermelons’ as in Green on the outside, Red on the inside. But we would just merge the two colours and get brown.)

10. We Know More Than We Can Say Precisely

- The current and expected deterioration of the underlying fiscal trend is troubling

- But the empirical and theoretical relationships between fiscal variables and longer-term interest rates are complex

- My decomposition of longer-term rates and econometric estimates can potentially add to the available research on this

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Russia/Ukraine: What Now?

- A week after the event, it is clear that the Trump/Putin summit presented the latter with a big win at little, if any, cost.

- Donald Trump is unlikely to come up with anything that will bring Mr Putin to the negotiating table in good faith once his latest two-week ‘deadline’ expires.

- Furthermore, Mr Trump remains philosophically inclined to favour Russia, a leaning that probably poses a greater risk to Kyiv than Mr Putin himself does.

2. HEW: Policy Under Pressure

- President Trump’s attempt to fire Governor Cook, potentially gaining a supportive majority on the Fed, raises the risk that US policy overstimulates the economy.

- Policy peers should not be pressured to mirror mistakes. The ECB faces data that keep accumulating hawkish pressures, but others are more susceptible, like the BOK.

- Non-farm payroll data provide the last hope of blocking a Fed rate cut in September. Meanwhile, a rise in EA inflation to 2.1% should help rule out another ECB rate cut.

3. DeFi, On-Chain Truth, and the Petrodollar 2.0

- Founder of the DeFi Report and Web3 Strategist, NATO, shares his journey, advice for innovators, and trends shaping asset tokenization, venture capital, and AI convergence.

- Inflation report and Fed’s monetary policy decision discussed, with core inflation increasing 3.1% year over year and market pricing in a 92% chance of a rate cut in September.

- Summary of market performance, with crude falling, value rally in US equities, and Ray Dalio’s recommendation to invest in non US equities in local currency.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

4. A Monetary View on US Inflation

- The current neglect on the role played by money supply and the monetary base is, in our view a serious analytical gap

- In a nutshell, we think private money growth – defined as M2 minus monetary base- is right now in a Goldilocks phase. This augurs well for US inflation

- With the Fed inclined to ease rather than tighten, and with inflation shocks likely to prove one-off, risk assets remain supported

5. ECB Easing Transmits Need To Hold Rates

- ECB rate cuts are stimulating a trend rise in lending growth to levels consistent with no change in policy, as the monetary transmission mechanism delivers the easing.

- Activity surveys are less bullish, but reflect stagnant supply-side potential that can’t be fixed by stimulating demand, which would merely stoke the inflation problem.

- Potentially inappropriate Fed easing does not raise peer pressure like fundamental US weakness would. Domestic news dominates and supports our ECB call for no change.

6. Late 1990s Bubble Comparison to Current Cycle Requires Nuanced Analysis

- Despite the growing chorus of comparisons, the backdrop to the late 1990s equity bubble was fundamentally different from the current environment, notably in the manner of Fed policy conduct.

- During the late 1990s, Fed policy conduct was characterised by pivots, particularly after the Asian financial crisis and bailout of Long Term Capital Management, helping to prolong the equity bubble.

- Forward P/E multiples on US equities were more elevated in the late 1990s compared with current levels. Valuations have been more volatile in the current cycle, courtesy of Fed policy.

7. Proposed GST Reforms: Double Diwali Bonanza or Double Whammy?

- GST reforms are set to change with centre proposing a two-rate structure of 5 and 18 per cent

- The announcement is aimed at boosting consumption in the mid-long run, curtailing effects of current higher tariffs.

- However, timing is of utmost importance. Any delay or adverse stance on the rollout could have significant ramifications for the overall economy and the festive season.

8. To Tariff or Not to Tariff, That Is Not the Question

- How should investors judge Trumponomics? The question isn’t whether tariffs or anti-immigration policies should be imposed, but to judge their long run effects on growth, inflation and productivity.

- While it’s too early to render a full judgment of Trumponomics and his policies, it may be a case of short-term pain for long-term gain.

- The preliminary report card is mostly a case of pain and not gain.

9. Asian Equities: Eleven Robust Earnings Gainers Post Reporting Season

- Near the end of the earnings reporting season, our earnings estimate tracker identified 11 robust earnings estimate gainers – with consensus EPS estimates up across 3-month and 6-month time horizons.

- Onshore China communications and financials, HK technology, Korean and Singapore financials are the prominent “winner” sectors. Five other ASEAN sectors also figure on the list.

- Earlier, in June, we detected 16 “consistent winner” market-sectors. The earnings environment has deteriorated slightly. Of the prominent stocks, Tencent, Hana Financials and DBS Group figure in our Model Portfolio.

10. China Economics: Policy Confusion Risks Worsening Demand Slump

- Transitory factors that drove China’s stronger-than-expected growth in the first half of 2025 are starting to fade, with hits to investment and consumption demand imminent in 2H25.

- But Beijing is in a bind on its policy response: it is rolling out demand-supporting measures but it is also keen to cut excess capacity and enforce public sector frugality.

- The net impact is that economic growth to decelerate significantly in 2H25. More stimulus measures will be dribbled out but its impact will be stymied by conflicting aims and adverse

Receive this weekly newsletter keeping 45k+ investors in the loop

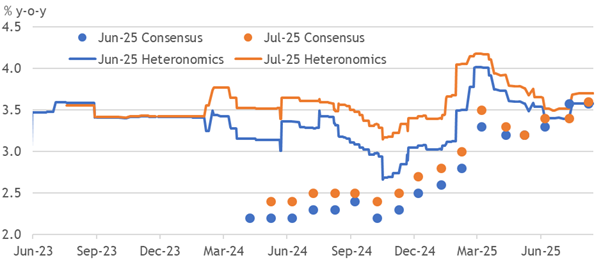

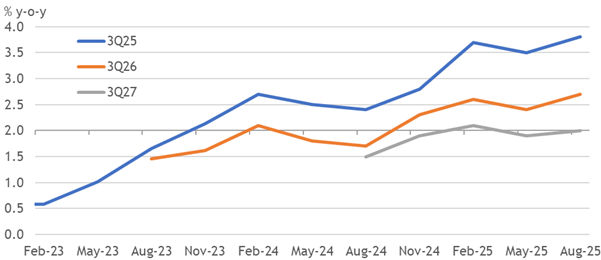

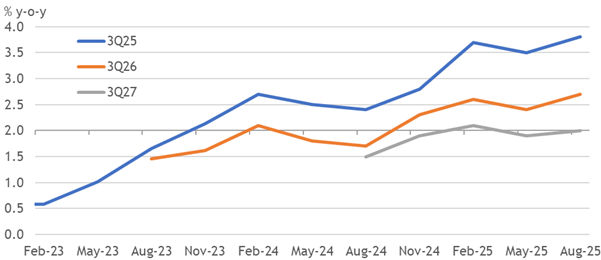

1. UK Excess Inflation Expectations

- The upwards trend in consensus inflation forecasts reflects persistent excess effective expectations supporting wages amid policymakers’ failure to re-anchor at the target.

- Easing on the assumption of success predictably negated the required conditions, so we forecasted the problem. Nonetheless, expectations were also stickier than we assumed.

- Without renewed progress, wage growth should keep trending above the BoE’s forecast, discouraging further rate cuts. Hikes may even be needed in 2026 to break excesses.

2. UK CPI Trend Extends Excess In July

- Another upside surprise in UK CPI inflation extended the accumulated drift to 1.3pp over the past year, yet was only 0.2pp above our old call.

- This outcome matched the BoE’s latest call, with airfares driving the rise, and median pressures holding slightly above a target-consistent pace, so there is less policy impact.

- The MPC was finely balanced in its support for August’s cut, and this rise will not lead dissenters to support past action, let alone another cut, which we still doubt occurs.

3. EA: Sticky Inflation Survives Euro’s Surge

- Inflation’s surprise stickiness at 2% was confirmed in the Euro area’s final print, with pressures broad based and slightly above a target-consistent pace in most countries.

- There has been little progress in inflation’s latent trend or our persistence-weighted measure, despite the Euro’s substantial and sustained appreciation.

- Without dovish second-round effects, the ECB can look through a potential slowing in headline inflation to a tight labour market and persistent pressures, then not cut rates.

4. India-China Economic Relations: Navigating Massive Imbalances and Strategic Dependencies

- India’s $101B trade deficit with China highlights strategic economic vulnerabilities across key sectors.

- Regulatory barriers since April 2020 sharply limited Chinese FDI, leading to negligible investments and shelved deals.

- India’s import dependency is profound, spanning pharmaceuticals, electronics, chemicals, and railway components, exposing multiple strategic sectors to supply risks.

5. India Economics: Choppier Waters Ahead?

- After a strong showing in the first quarter of 2025, the Indian economy is likely to see growth normalise. Key drivers of demand are showing mixed performance.

- Across consumption and investment, performance remains uneven across key sectors, leading to signs of softening momentum based on non-GDP demand indicators.

- Trump’s latest tariff threat against India poses tough questions on the long-term outlook. With its “China+1” strategy in doubt, the economy needs a new playbook to fortify growth.

6. EA: Re-Balance Of Payments

- An end to the Euro’s bullish trend is now revealed to have coincided with a reversal of two critical supports. Frontloaded export levels have normalised without payback.

- International portfolio investment into the EA during April fully unwound between May and June, revealing no investor appetite to hold higher allocations to EA assets.

- The Euro is not benefiting from a structural shift towards it, so we doubt the bullish trend will resume. Belated payback in goods inventories could also eventually weigh.

7. HEW: Dovish Bias Dominates

- The evidential hurdle formally shifted in support of a Fed rate cut in September. Still, the data may yet discourage it, or embolden the market to price it as mistaken.

- Flash PMIs broadly reinforced the resilience narrative, while another upside UK inflation surprise sets the BoE up to resist cutting amid persistently excessive expectations.

- A quieter, bank holiday-shortened week leaves the BOK and BSP decisions as monetary policy highlights. Euro area M3 and some national flash HICP prints are our data focus.

8. Asian Equities: FIIs Selling Asia in August; Only Taiwan Still Being Bought

- After buying Asian equities for three months, FIIs sold Asia in the three weeks of August: notably India (-$2.53bn) and Korea (-$298m). Taiwan (+1.6bn) was the only large market bought.

- It’s too early to call a trend change. Our FII gauge of 6-month cumulative buying as percentage of the market’s capitalization indicates that most markets are neither overbought nor oversold.

- Even though FIIs have bought the large Asian markets lately, none of them are overbought. Taiwan’s FII gauge is relatively closer to the upper limit. Indonesia is unequivocally oversold.

9. Separate Dividend Tax Plan in Korea: A Push for a 25% Rate for Top Bracket

- Democratic Party lawmaker Kim Hyun-jung has introduced a revised Income Tax Act that would lower the top tax rate on dividend income from 35% to 25%.

- Given that this proposal is coming from the ruling Democratic Party, there is a fairly high probability that this could be passed into law in 3Q 2025.

- We provide a list of 28 mid-cap/large cap stocks in Korea with more than 35% dividend payout and 3% or more dividend yield that could benefit from this new proposal.

10. Asian Equity: As the Result Season Nears Its End, Asian EPS Estimates Suffer a Surprising Downgrade

- As the earnings reporting season nears completion, our EPS estimate tracker reveals a downgrade to Asian EPS. AxJ EPS declined only 0.5%-0.8%. But several constituent markets’ EPS declined much more.

- Asian EPS estimates were supported by China and somewhat surprisingly, Thailand. Indian estimates continued to decline. Even Korea and Taiwan, the recent earnings outperformers, were downgraded during this season.

- Unlike Asia, US EPS estimates rose during this season. Japan’s and Europe’s declined. In a subsequent note we shall track the estimates of all the sectors in each Asian Market.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. BoE: Policy Mistake Diagnosis

- Inflation expectations have been persistently too high, while productivity trends poorly, driving wage and price inflation forecasts to grind higher in recent years.

- The BoE’s cutting cycle contributed to reversing the trend decline in expectations, and in turning a slight overshoot into a massive one, with a 3.2pp revision since Feb-23.

- We forecasted this excess for these reasons, so it was predictable and therefore a policy mistake to cut so soon. Further surprise should prevent the MPC from cutting again.

2. US Inflation Skips Several Months

- July’s US inflation print reversed all of the increase built in from tariffs over the past several months, despite matching expectations prevailing into the release.

- Core goods inflation eased slightly, suggesting ongoing corporate success in avoiding the tariff shock. But service inflation is stuck too high to be consistent with the target.

- Anti-avoidance measures and belated pass-through will drive further rises. We doubt they will be as severe as many fear, yet still not create much space to cut rates.

3. UK: Slowdown Softened In Q2

- June’s remarkable rebound compounded the resilience revealed by April’s upwards revision, which also broke flimsy fundamental stories blaming tariffs for a slowdown.

- IP no longer declined in April, but the broader growth profile still matches the residual seasonality that spuriously drives GDP dynamics in our forecast. H2 will be weaker.

- The BoE discounts headline GDP volatility without blaming seasonality, so another surprisingly strong quarter will be hard for hawks to ignore, reducing the rate cut risk.

4. US/Taiwan: Xi Calls The Shots

- In stark contrast to its dealings with other trade partners, Washington is firmly in the position of supplicant in its dealings with Beijing.

- This reflects not only Xi Jinping’s carefully prepared and strong hand but also Donald Trump’s seeming determination to strike a deal with China at more or less any cost.

- Increasingly, therefore, Taiwan stands to be “a pawn in a bigger game”.

5. UK Jobs Suggest Summer Stabilisation

- Unemployment broke a four-month streak of increases at 4.66%, with favourable cohort effects risking a fall soon. Payrolls may also be revised to grow again from July.

- The structural hit from tax increases is matched by the cumulative fall in payrolls so far. Fundamental explanations for its divergence from the LFS aren’t supported yet.

- Ongoing resilience in wage growth stokes unit labour cost pressures alongside taxes that are beyond the target. We still expect the MPC to resist cutting rates again.

6. Tradesmen’s Collective: Fixing the Trades with Tech, Transparency & Boots-on-the-Ground

- Discussion between Jonathan, CEO of Tradesmen Collective, and Ed, Director of Investor Relations, on tech startups and market trends

- TTC USA’s integrated platform addresses industry inefficiencies with cutting edge software, escrow services, and legal support

- Insight on leading assets like gold, Bitcoin, and Nvidia; mentions of success stories like MicroStrategy integrating Bitcoin and Nvidia integrating software for business growth

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

7. Poised for a Volatility Spike

- We remain long-term bullish on equities. In the short run, realized volatility declined since the “Liberation Day” panic, but conditions are setting up for a near-term volatility spike.

- Uncertainty over Fed policy and government credibility are possible catalysts for a disorderly increase in volatility and market correction.

- As well, the signs of narrow leadership, weak breadth and stretched risk sentiment elevates the risks of a pullback.

8. Another View of American Exceptionalism

- We believe global equity investors should adopt a barbell strategy of overweighting U.S. large cap growth and non-U.S. value stocks in their global equity portfolios

- The trend is your friend: Both are undergoing multi-year uptrends in relative performance.

- The key question is the length and sustainability of U.S. AI leadership.

9. HONG KONG ALPHA PORTFOLIO (July 2025)

- The Hong Kong Alpha portfolio outperformed its benchmark and all Hong Kong indexes in July. The portfolio achieved these results while increasing its Sharpe ratio and reducing beta and volatility.

- The shift to the healthcare and materials sectors since Liberation Day in April has aided the portfolio’s performance. The consumer staples sector lost momentum, and we exited some positions there.

- The HSI now trades above its long-term resistance levels for the first time since 2022. This signals a good time to rotate back into market leaders in tech.

10. HEW: Wrong Policy Turnings

- As soon as a data point calms nerves around a theme, a hawkish challenge seems to appear. This week, that was US CPI into PPI and UK unemployment into GDP.

- A bias to ease, triggered by a one-touch round of bad news, has consequences when not sustained. The BoE’s early start to its easing cycle has proved to be a policy mistake.

- Next week is a prime opportunity for Chair Powell to calm dovish excitement about Fed easing. UK inflation seems set to rise by another tenth, while the EA rate sticks at 2%.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. The Week Ahead – Is Trump Winning?

- Recent tariff announcements reflect cautious optimism on the US Dollar and inflation risks

- Tariff rates of 16-17% could lead to gradual pass through to prices, impacting inflation in the coming months

- Q2 GDP growth rebounded, but domestic final demand slowed, suggesting a gradual economic slowdown in the US, while Canada faces economic challenges and BoC takes a dovish stance

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

2. BoE Cut Proves Finely Balanced

- Four MPC members refused to back the rate cut in August, and only one favoured a 50bp cut, but he was forced to vote for a 25bp cut to break the balanced 4:4 split.

- The group favouring a slower pace of easing may have expanded from 5:4 to 6:3, raising the hurdle to another cut. Four don’t even support the prevailing level.

- Inflation forecast revisions keep trending the profile higher. Rolling resilience in the broader data should keep the BoE on hold in November and beyond, like the ECB.

3. Briefing. Massive Jobs Restatement, Rates Go Nowhere, Apple M&A?, Earnings Updates

- New newsletter format called “The Briefing” provides quick market synopsis and company information, also available in podcast form on speedwellmemos.com

- Recent market events include S&P 500 reaching all-time high before job report and new tariffs cause market to drop, Fed considering rate cut in response to softening economy

- President Trump criticizes Fed Chair Powell for not lowering rates, Powell cautious on rate cuts to avoid inflation, history of rate mistakes highlighted

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

4. Jung Chung-Rae (New Head of Ruling DPK) – Likely To Push for CGT Changes, How About Other Taxes?

- Jung Chung-Rae, a four term lawmaker, has been appointed the new head of the ruling Democratic Party of Korea (DPK) in the past week.

- His appointment as the head of the DPK party signals that there could be some changes to the 2025 Tax Reform Plan announced by MOSF last week.

- The highest probability event is that the lower threshold for major shareholders for stock capital gains tax may NOT be lowered from 5 billion won to 1 billion won.

5. EA: Resilient Retail Rebound

- Consumers need to drive activity growth as tariffs and Euro strength harm export competitiveness. Reassuringly, retail sales returned to their trend after a trimmed fall.

- Growth was broad across countries and categories, taking the annual pace 0.5pp above consensus expectations. Non-food retail is critical and the strongest of them all.

- Surveys are gloomier, especially about the future, but rarely right. Resilient real wage and employment growth can sustain brisk retail trends, preserving economic expansion.

6. HEM: One-Touch Easing

- Payrolls revisions challenge the rolling resilience seen in most other hard data releases, but seem over-weighted.

- Underlying price and wage inflation mostly track >2%, especially in the UK, which doesn’t need more rate cuts.

- Policymakers biased to ease will deliver it on a batch of bad outcomes, even if the evidence proves fleeting.

7. Separate Dividend Tax Plan in Korea: Devil Is In the Details

- A closer look at MOSF’s Tax Reform Plan for dividends suggests that it may not have a material impact on most listed companies unless the National Assembly drastically improves it.

- According to MOSF, it currently estimates that approximately 350 of the 2,500 listed companies, or 14%, could meet these requirements (two main dividend tax reduction requirements).

- We provide a list of 70 companies in the Korean stock market with 40% or higher dividend payouts (excluding companies with smaller market caps).

8. 80% Of Our 2025 Calls Are Working

- Only one of our non-consensus macro calls are not working and eight of eleven markets are moving our directions.

- Our latest business cycle indicator assessment points to a better second half.

- 2025 Investment Strategy maintained. We are overweight equities and underweight government bonds.

9. This Will Not End Well, But When?

- The U.S. stock market is undergoing a frothy advance. The intermediate trend is bullish but some technical warnings are appearing.

- We can’t predict the exact nature or timing of a possible market disruption.

- Investors may find it prudent to opportunistically take advantage of the relatively low implied volatility environment to buy cheap downside protection.

10. Rising Ringgit, Eroding Fundamentals

- BNM’s heavy reliance on FX forwards created $29 billion in off-balance sheet liabilities, masking true reserve strength and exposing future repayment risks if inflows weaken.

- This is further compounded by a narrowing current account surplus, while capital outflows and rising foreign currency deposits reflect persistent financial account weakness, undermining long-term support for the ringgit.

- While China is Malaysia’s largest trade partner, the U.S. is the main source of trade surpluses. Worryingly, the U.S. recently imposed a 19% tariff, threatening this critical surplus engine.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. The art of the turnaround: investing in companies at a crossroads

- Magellan in the Know podcast discusses consumer sector turnaround opportunities

- Definition of a successful turnaround and examples of companies that do and do not meet the criteria

- Importance of consistent investment philosophy and focus on protecting against permanent capital loss

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

2. EM Fixed Income: Summer catch-up as spreads catch-down

- EM sovereign credit markets are a key focus

- Overall risk environment for EM is being closely monitored, with a more neutral stance on EMFX rates and corporates

- Tariffs and ongoing tariff uncertainty are major drivers in the coming weeks, with markets having ground better despite potential downside risks in growth

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

3. Opec: Twist Or Stick?

- The further acceleration by ‘Opec+ eight’ in unwinding the second package of voluntary output cuts was a surprise, albeit one that left markets unmoved.

- The cartel now appears to be firmly on track to complete its unwinding in September, even though its stated justifications for increasing output remain highly questionable.

- Despite downside global growth risks, the Saudis in particular may press to start unwinding the first package, a move which may be announced as early as next week.

4. Ep. 318: Brad Setser on Trump Tariffs, China’s Surging Surplus and Dollar Policy

- Brad Setzer is an expert in global trade, capital flows, and sovereign debt restructuring

- He has been involved in various government positions related to international economic analysis

- Setzer discusses the rapid rollout of tariffs under the Trump administration and their potential impact on the economy

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

5. ECB Job Tightened By Jobs

- The EA labour market proved tighter than the ECB expected in Q2 as the unemployment rate held at a downwardly revised 6.2%. That is hawkish news to its neutral stance.

- Most countries still face falling unemployment, suggesting monetary conditions were slightly loose, and avoiding pressure to lower underlying inflation further.

- A hawkish domestic surprise should keep the ECB on hold, especially with the US trade policy risk fading. Passthrough of past cuts may mean the ECB needs to hike later.

6. EA: Sticky Summer Inflation

- The ECB’s victory party can continue for another month, as inflation proved surprisingly sticky at the target. But the hangover is disappointing, amid broad-based upside news.

- Two-thirds of national outcomes exceeded our expectations, with a slight skew higher, and pressures concentrated in services. Seasonal travel parts would be payback-prone.

- Another upside surprise to the ECB’s forecast makes the profile likely to shift higher in September. The news is the opposite of what is needed for another rate cut.

7. Activity’s Tariff Hangover In Q2

- GDP growth broadly beat expectations again in Q2 on both sides of the tariff disruption. Euro area growth slowed by less, while the US rebounded vigorously.

- Temporal distortions to demand didn’t open up slack as European supply growth stays stagnant. Surveys suggest it won’t appear in Q3 either as demand growth rebounds.

- Underlying US GDP growth may have slowed, but the extent is modest and questionable. Rolling resilience should keep delaying rate cuts, preventing them from occurring.

8. Disappointing New Korean Tax Policies (Dividends, Capital Gains, and Corporate Taxes)

- The Korean government announced disappointing new tax polices for dividends, capital gains, corporate, and higher transaction taxes on securities transactions.

- The new tax policies announced today is likely to have the biggest negative impact on the Korean financials with high dividend yields.

- They will also likely to negatively impact other high dividend yielding stocks in Korea.

9. HEW: Atlantic Jobs Divide

- Depressing revisions to US payroll data clash with the resilience seen in other data, and compare poorly with the bullish revisions to the Euro area’s labour market.

- Jobs data challenge the Fed’s patient posture, while the Euro area’s sticky inflation and tighter labour markets should encourage it to keep rolling rate cuts later.

- Thursday’s BoE decision sets unemployment’s rise against inflation persistence, leaving the outcome uncertain, yet it is likely to yield another split vote for a rate cut.

10. UK: Loans Secured Despite Tax Hike

- Credit extended its rebound far beyond expectations in June. Reformed stamp duty raises costs and housing tenure, but it hasn’t broken the housing or mortgage markets.

- Demand for loans looks more resilient than banks expected amid easing monetary conditions. Refinancing may not have much effect on cash flow anymore.

- Higher transaction costs probably won’t break expectations into a downwards spiral, but are now widely cited as a major hurdle, contributing to slower UK activity growth.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK Structurally Unemployed

- Higher employment taxes can entirely explain the fall in payrolls as the tax wedge hits its highest since 1987, raising our structural unemployment rate estimate by 0.48pp.

- That could understate the structural shift amid a substantial drop in the threshold, rise in the minimum wage (jobs ban) and benefit rates. Some will go ‘inactive’ on disability.

- The unemployment rate must rise more than its natural rate to deliver disinflationary pressure sustainably. Our structural estimates suggest it won’t break excess inflation.

2. UK Fiscal Slippage Rules

- The UK’s de facto fiscal rule is slippage, with a £50bn to £100bn increase in borrowing between initial official forecasts and outcomes. 2025-26 made another slippery start.

- Politicians spend any space in the OBR forecasts, skewing surprises to higher spending. Yet tax hikes keep failing to raise the hoped revenue, motivating further increases.

- Investors should not be fooled by forecasts for consolidation when the failed strategy driving the fiscal slippage rule survives. Issuance may stay near £300bn in 2029-30.

3. US Politics: ‘As Ye Sow…’

- The Epstein files row has intensified deep splits in the MAGA movement and triggered persistent demands for accountability.

- Trump’s recent pivot towards supporting Ukraine and critical foreign policy shifts have fuelled further rifts among his traditional base.

- Despite controversies, the key midterm factor remains Trump’s economic agenda, as tariffs and fiscal changes may hit his core supporters hardest.

4. ECB: Watching the Good Place

- The ECB kept its description of the policy setting as in a good place, and wants to watch the news in the next few months. Lagarde refused to emphasise September’s meeting.

- Euro strength is depressing inflation below target in the near-term forecasts, but the ECB remains relaxed about this. It sees the outlook as broadly unchanged since June.

- We still see rolling resilience in the economy and doubt US trade policy will break it. More rate cuts are inappropriate without demand destruction, so we don’t expect any.

5. The Trade War Is Dead! Long Live the Trade War!

- Despite all of the dire headlines about tariffs on Canada, Mexico and the European Union, the only trade war that matters is effectively over. China has won.

- In the short run, economic policy uncertainty is receding but it’s not fully normalized. It’s time to adopt a risk-on posture.

- In the long run, equity investors should not expect the S&P 500, which trades at forward P/E of 22, to continue to outperform global stocks in the next expansion cycle.

6. New Barbarians Podcast | Episode #029 | Recap & Reset: Macro Shifts, Ethereum’s Spike, MicroStrat…

- Podcast has been running for almost seven months with recent guest episodes

- Discussion on recent global asset trends and market news, including inflation, Fed rate cuts, and Trump’s tariff threats

- Mention of interns from CUNY City Tech helping with macro database analysis and highlighting Ethereum’s strong performance in the market.

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

7. Potential Change in Capital Gains on Stocks & Securities Transaction Taxes: Impact on Korean Stocks

- The capital gains tax on stock sale gains and securities transaction taxes could be raised in 2H 2025, which could negatively impact the Korean stock market, especially small caps.

- Combination of higher securities transaction tax and capital gains on stock sales could result in local retail investors selling their shares in 4Q 2025, before these changes come into effect.

- Although many small caps in Korea have performed well this year, the potential changes on these two important taxes could put some damper on the recent excellent share price performances.

8. HEW: Trade Deals & Fiscal Slippage

- Market narratives were driven by US trade pacts, critically with Japan, the ECB watching data from a good place, and further evidence of UK fiscal problems.

- Tariff uncertainty eased slightly, but it is still fierce ahead of the 1 August deadline. PMIs remained resilient, and UK retail sales rebounded into growth again for Q2.

- Next week brings Fed, BoC and BoJ meetings (broadly on hold), US and euro-area GDP growth for Q2, US payrolls, euro-area unemployment and slower flash HICP data.

9. BUY/SELL/HOLD: Hong Kong Market Update (JULY 21)

- HSI poised to break 25k for first time since 2022. Next resistance 27100. Hong Kong market outperforming global markets by wide margin since our BUY was initiated in March 2024.

- Financial, materials and healthcare sectors leading the market higher as tech sector consolidates. China shares still offer the best valuation metrics in Asia.

- Alibaba Pictures (1060 HK) , renamed Damai Entertainment has seen increased analyst attention as the company becomes the Live Nation Entertainment, Inc (LYV US) of China.

10. Stay Overweight Japanese Equities

- Despite the Upper House election result we are overweight Japanese equities and a buyer of the yen.

- Business cycle indicators are positive; the profit and investment cycles in upswing. Companies are highly diversified – foreign sales account for 40% of sales and 37% of production is abroad.

- They are hedging their bets by expanding in the US and India while scaling back in China. These factors contribute to the resilience of corporate earnings growth.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. UK CPI Lifts Hawkish Case in June

- UK inflation surged 0.2pp beyond the consensus again in June, with underlying inflation measures broadly inconsistent with the target and headlines moving the wrong way.

- The consensus is failing to learn the lesson of intense underlying pressures. The CPI rate rose 0.6pp since Jan instead of falling 0.4pp and is 1.4pp higher than called a year ago.

- Policymakers seem infected with dovish fear about the labour market ahead of August’s meeting. CPI is 0.9pp higher in our year-ahead forecast, and we were right a year ago.

2. UK Jobs Data And The Muddled MPC

- UK payroll revisions removed most of May’s weakness, while wage and price inflation is too fast, yet the BoE probably won’t back down from an August cut as the UR rises.

- Fewer payroll inflows explain its downtrend, with <24yo suffering sustained pain, but the 25-64yo endure the taxation hit, structurally raising unemployment by ~0.5pp.

- Wage growth isn’t showing signs of new disinflationary demand pressures, so we expect excessive underlying wage and price trends to persist, not helped by an August BoE cut.

3. Asia Cross Asset: Liberation Day 2.0 and Asia

- Not surprised by recent events in the equity market, as it aligns with forecasted growth trends in Asia

- Transitory factors such as front loading and transshipment contributing to expected decline in H2 growth

- Expectation for central banks in the region to potentially ease rates in response to current economic conditions

This content is sourced through publicly available sources and has been machine generated. Information displayed is for general informational purposes only.

4. US Inflation Creeps In Quietly

- Rebounding headline and core US inflation in June understated the underlying growth, with shelter rising at its slowest pace since August 2021. Tariff pain crept in belatedly.

- Commodities, less food, energy and car prices grew by 0.3% m-o-m, the fastest since Feb-23, and services (ex-shelter) hit 0.4% m-o-m, both inconsistent with the target.

- Less than half of the post-election surge in expectations has survived so far. Further rises remain likely, even if sustained avoidance smooths and reduces the full impact.

5. HEW: Inflation Persists, But Cuts Loom

- Persistent upside inflation surprises and sticky wage growth are lifting hawkish market narratives, defying central bank and consensus hopes for a quick return to target.

- UK inflation jumped well above forecast in June, strengthening the hawkish case, while US core inflation shows tariffs adding to excessive underlying price pressures.

- Next week, attention turns to the ECB decision, July flash PMIs, and UK public finances, as markets weigh central banks’ willingness to ignore resurgent inflation.

6. The Bullish Elephant in the Room

- We have been fairly cautious on equities in the past, but that’s changing. There is a bullish elephant in the room that is becoming evident and can’t be ignored.

- Market psychology had panicked and became overly concerned about left-tail risk. . Better, or less bad, news emerged and price momentum became dominant.

- Our base case scenario calls for the rally to continue into the August–September time frame.

7. Tuning Tariff Impact Estimates

- President Trump’s tariff policy seemingly follows a random walk with a drift towards deals. Path dependency raises risks and uncertainty around his volatile whims.

- Corporate avoidance measures have spared their customers from most of the pain, but Vietnam’s deal as a template could belatedly bring more of the pain to bear.

- We assume most countries stay at 10%. The impact of others rising to 20% may be smaller than the anti-avoidance hit, with the total now worth less than 0.4% to UK GDP.

8. Hong Kong Alpha Portfolio (June 2025)

- The Hong Kong Alpha portfolio has significantly outperformed the Hong Kong indexes in June and since inception. Outperformance range is 17% to 23% since inception.

- At the end of June, we sold positions in the tech sector after substantial gains. The portfolio’s exposure to the consumption sector was also trimmed, both discretionary and staples.

- The portfolio added exposure to the metals refining sector and initiated positions in conglomerates Shanghai Industrial Holdings (363 HK) and Citic Ltd (267 HK) .

9. Korea: Short Selling Data Analysis: 3Q 2025

- We are introducing a new regular series called “Korea: Short Selling Data Analysis.” We will try to provide this insight on a quarterly basis.

- Net short balance ratio for top 20 stocks in KOSPI averaged about 1.7% three months ago, much lower than current levels (3%).

- The average short interest ratio of these top 20 stocks in KOSPI with the highest short balance ratio was 2.6x as of 10 July 2025.

10. Korean Government’s New Task Force for Inclusion in a Major Global Index + IBKR Korea Trading Signal

- In this insight, we discuss Korean government’s new task force for Korea to be included in a major global index.

- Prior to this major market moving event, there will be some important signals.

- One of the most important signals could be major global securities companies (such as IBKR/TD Ameritrade) allowing trading of Korean stocks to customers world-wide.