In this briefing:

- CCL Products Q2 FY19 Results Update- Moving up the Value Chain as Expected

- Hansae Yes24 Holdings Stub Trade: Macy’s Lowered Guidance Will Revert Back 5Y High Holdco Discount

- Accordia Golf Trust (AGT SP): MBK + ORIX + AGT = Time for Outperformance? 9.5% Dividend Yield

- ZOZO – Buying a Stairway to Heaven

- GER Upcoming EVENTS Calendar

1. CCL Products Q2 FY19 Results Update- Moving up the Value Chain as Expected

Ccl Products India (CCLP IN) Q2 FY19 results were beyond our expectations. Although the revenues declined by 2% YoY in Q2 FY19 due to lower realization as the green coffee prices have declined by near 20% YoY in Q2 FY19, PAT increased by 41% YoY (against our expectation of 20% YoY growth) due to higher capacity utilization and improving share of value added products in the revenue mix.

We analyze the results.

2. Hansae Yes24 Holdings Stub Trade: Macy’s Lowered Guidance Will Revert Back 5Y High Holdco Discount

- Hansae Yes24 Holdings Co, Ltd. (016450 KS) is a small cap holdco stock in Korea. Hansae Co Ltd (105630 KS) takes up half of Holdco NAV. Sub is Korea’s largest clothing OEM company. Holdco is currently at a 50% discount to NAV. This is the highest in 5 years. Discount was up nearly 10%p in the last 2 months.

- Sub is taking a hit today. The share is down 5.56% now. Holdco is down only 1.21%. Macy’s unpleasant guidance revision is pulling down Sub price. We are now a little above -1 σ on a 20D MA. Sub shares have rebounded lately with the expectation on improving margins in the US. But weak holiday sales numbers in the US would be more than enough to kiss off this expectation.

- I’d initiate a stub trade even though the duo has narrowed the gap today. It is still a long way to get reverted back to where they were two months ago.

3. Accordia Golf Trust (AGT SP): MBK + ORIX + AGT = Time for Outperformance? 9.5% Dividend Yield

Accordia Golf Trust (AGT SP) has not been a great success story since its IPO in August 2014. The stock went to market at a unit price of 0.97 SGD and was recently traded at 0.53 SGD. If we include the dividends received since the IPO (0.2387 SGD) the ‘real‘ adjusted price is still only 0.76 SGD.

In the past we have attended several management meetings and the 2017 company AGM but were disappointed on multiple occasions by management that either 1) did not care, 2) did not know how or 3) was held back by other corporate Japanese factors from creating shareholder value.

Over the last six months several new developments are potentially creating a cocktail that could finally create sustained value for AGT unitholders:

- Appointment of new CFO who assures investors no repeat of “membership deposit debacle”

- New five-year funding secured from two lenders

- MBK Partners buys ORIX Golf Management

- Value investor Hibiki Path Advisors buys 6.2% of the company

- Clear focus on acquisitions and using its balance sheet strength

With its 2019 financial year ending in March, investors can be hopeful that its dividend in FY20 can grow to a minimum of 5 SGD cents suggesting a yield of 9.5%. If management injects assets a higher DPU is possible.

4. ZOZO – Buying a Stairway to Heaven

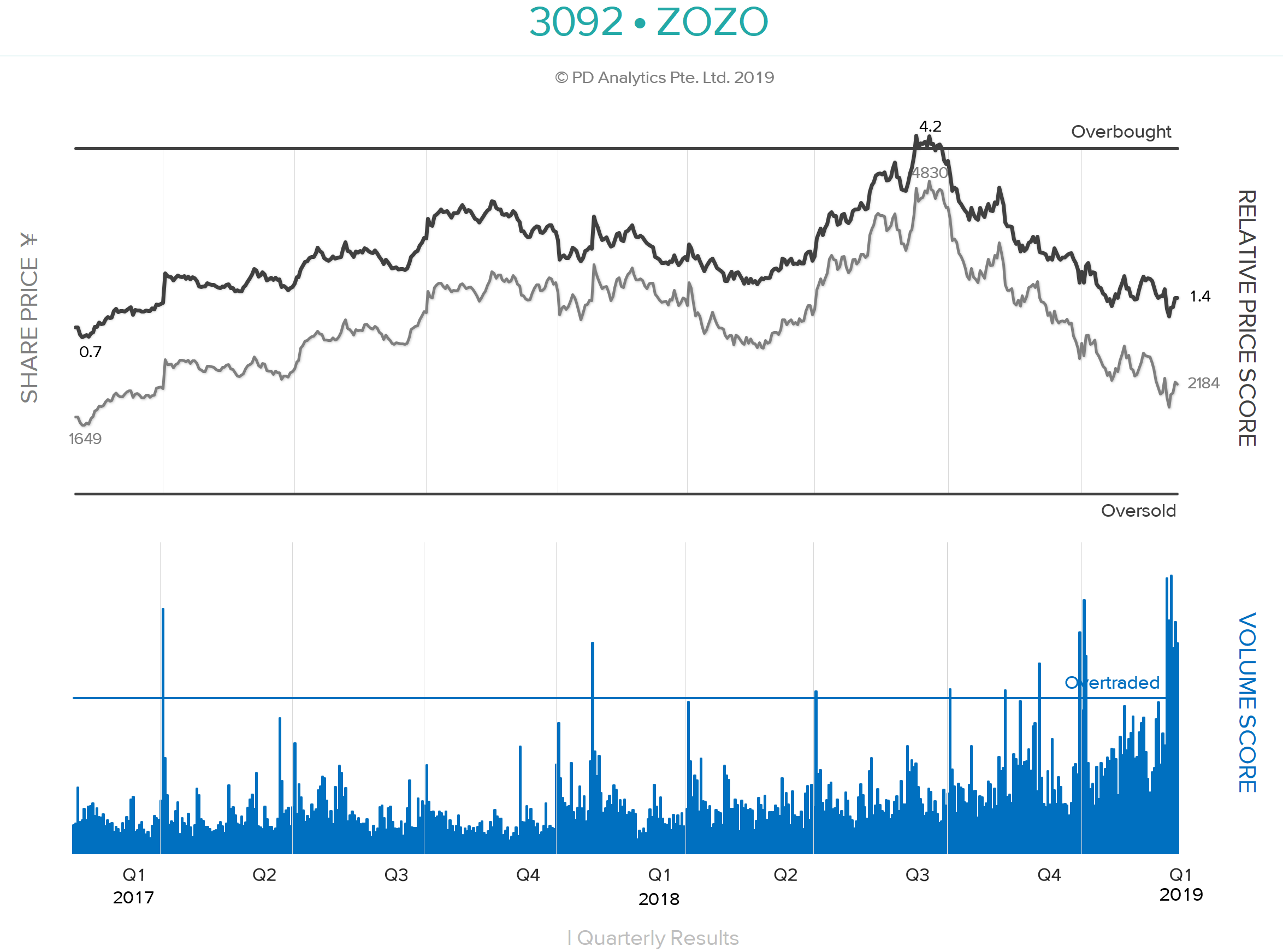

ONWARD AND OUT – ZOZO (3092 JP), formerly Start Today, has been the sixth-most-traded large capitalisation stock over the last ten trading days after Benefit One (2412 JP), Rizap (2928 JP), Takeda Pharmaceutical (4502 JP), Hoshizaki (6465 JP), and Workman Co Ltd (7564 JP). According to Nikkei XTECH, on 25th December apparel maker Onward (8016 JP) suspended selling of its products on ZOZOTOWN and will leave the platform altogether. Although Onward products are estimated to account for less than 3% of total transactions on the site, there are concerns that other apparel makers will follow suit as a result of the emerging direct competition on the site from ZOZO’s private label. Since reaching our 4.0 ‘Overbought’ threshold on 9th July 2018, ZOZO shares have corrected by 57% – the worst performance of any large cap from that date – as concerns mounted over the private brand strategy and the behaviour of CEO Yusaku Maezawa. Since bottoming on 4th January, the shares have risen by 18% following positive comments from the CEO about sales over the New Year holiday period.

PRIVATE-LABEL STRETCH GOALS– The ‘teething problems’ of ZOZO entering the private-label apparel business have been well-documented by Michael Causton in a recent Insight on Smartkarma. Michael rightly questions the feasibility of the company scaling a ¥200b apparel business within the next three years while targeting an additional incremental ¥400b in e-commerce revenue, particularly as it has taken ZOZO twenty years to reach the first ¥100b in annual revenues. In the DETAIL section below, we shall examine ZOZO’s current and possible future financial condition as it strives to become one of the top-ten global fashion retailers.

‘ZOSO’ & THE STAIRWAY TO HEAVEN – In addition to some notable purchases of modern art at record-breaking prices, CEO Maezawa also last year booked himself on Space X’s first flight to the moon. With apologies, the lyrics of the peerless song from Led Zeppelin’s untitled fourth album – known by fans as ‘Zoso’ after the symbol designed by Jimmy Page for the inner sleeve – come to mind:-

There’s a lad(y) who’s sure

All that glitters is gold

And (s)he’s buying a stairway to heaven

When(s)he gets there (s)he knows

If the stores are all closed

With a word (s)he can get what (s)he came for.

5. GER Upcoming EVENTS Calendar

We have received requests to provide a calendar of upcoming catalysts for near-term M&A, stubs and erstwhile event-driven names. Below is a list of catalysts over the near-term for such names as below. If you are interested in importing this directly into Outlook or have any further requests, please let us know.

Kind regards, Rickin Arun and Venkat

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.