This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

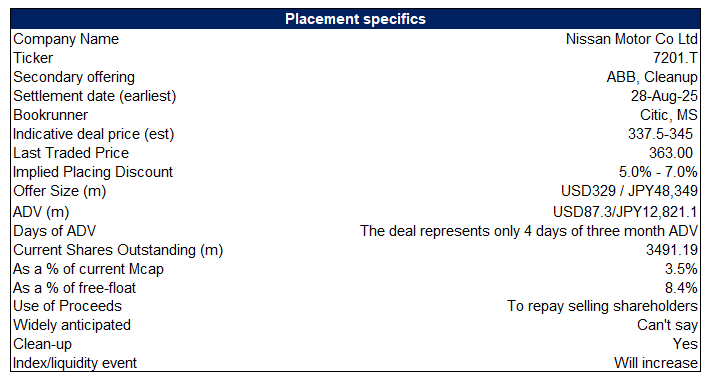

1. Nissan Motor Placement – Discount Is Enticing but Track Record and Momentum Aren’t Great

- Mercedes-Benz Pension Trust aims to raise around US$330m via selling its 3.8% stake in Nissan Motor (7201 JP).

- The discount seems enticing, however, the company’s recent share performance and longer term track record aren’t great.

- In this note, we will talk about the placement and run the deal through our ECM framework.

2. Akeso Inc Placement – Another Opportunistic Raise, Mixed past Deal but Is Relatively Small

- Akeso Biopharma Inc (9926 HK) is looking to raise around US$460m from a mix of primary placement and selldown by its founders.

- Past deals in the name have been mixed, but the shares have been doing well and the deal size remains small.

- In this note, we talk about the deal dynamics and run the deal through our ECM framework.

3. Laopu Gold Placement – Relatively Small Deal, past One Did Well

- What seems to be the controlling shareholder of Laopu Gold (6181 HK), aims to raise around US$250m via selling 1.6% of the company.

- The shares have done very well since its listing and the previous deal in the name did well too.

- In this note, we talk about the deal dynamics and run the deal through our ECM framework.

4. Metaplanet Placement: US$1bn Punt; Dependent on Bitcoin Performance

- Metaplanet (3350 JP) is looking to raise around US$1bn from a primary placement.

- The deal is a relatively small one, representing 4.4 days of the stock’s three month ADV, despite being 23.7% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

5. MIXUE IPO Lockup – US$480m Cornerstone Lockup Release

- Mixue Group (2097 HK) raised around US$450m in its Hong Kong IPO in March 2025. The lockup on its cornerstone investors is set to expire soon.

- MIXUE Group (MIXUE) is a freshly-made drinks company providing affordable products to consumers, including freshly-made fruit drinks, tea, ice cream and coffee, typically priced at around one USD per item.

- In this note, we will talk about the lockup dynamics and possible placement.

6. Aux Electric IPO: Smallest Player but Superior Growth and Margins

- Aux Electric (2580 HK) is looking to raise up to US$460m in its upcoming Hong Kong IPO.

- It is one of the global top five air conditioner providers, with capabilities covering the design, R&D, production, sales and related services of household and central air conditioners.

- In this note, we examine the IPO dynamics, and look at the firm’s valuation.

7. Aux Electric IPO (2580 HK): Valuation Insights

- Aux Electric (2580 HK) is the fifth-largest air conditioner provider globally as measured by volume. It has launched an HKEx IPO to raise up to US$462 million.

- I discussed the investment case in Aux Electric IPO: The Investment Case.

- In this note, I present my forecasts and valuation. My analysis suggests that the IPO price is attractive.

8. Ganfeng Lithium Group Co Placement – Past Deals Record Isn’t Great but Deal Is Small

- Ganfeng Lithium (1772 HK) is looking to raise upto US$152m via a primary placement of 40m shares. There is also a concurrent CB offering for ~HKD1.3bn along with the placement.

- The company intends to use the proceeds towards repayment of loans, capacity expansion and construction, replenishment of working capital and other general corporate purposes.

- In this note, we will talk about the placement and run the deal through our ECM framework.

9. Robotis – Rights Offering of 100 Billion Won

- On 28 August, Robotis (108490 KS) announced a rights offering capital increase of 100 billion won.

- Rights offering plan is to allocate 1,349,528 new shares (10% of outstanding shares) to existing shareholders, and then conduct a public offering for general investors once forfeited shares are issued.

- The expected rights offering price is 74,100 won per share (12.8% lower than current price). We are Negative on this rights offering.

10. Interglobe Aviation (Indigo) Placement – Second US$800m+ Deal by Co-Founder This Year

- InterGlobe Aviation Ltd (INDIGO IN) co-founder, Rakesh Gangwal, aims to raise around US$802m via selling around a 3% stake in Indigo.

- He had earlier stated his intention to pare down his stake after a long drawn, and very public battle, with his co-founder Rahul Bhatia. He has sold many times before.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.