This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

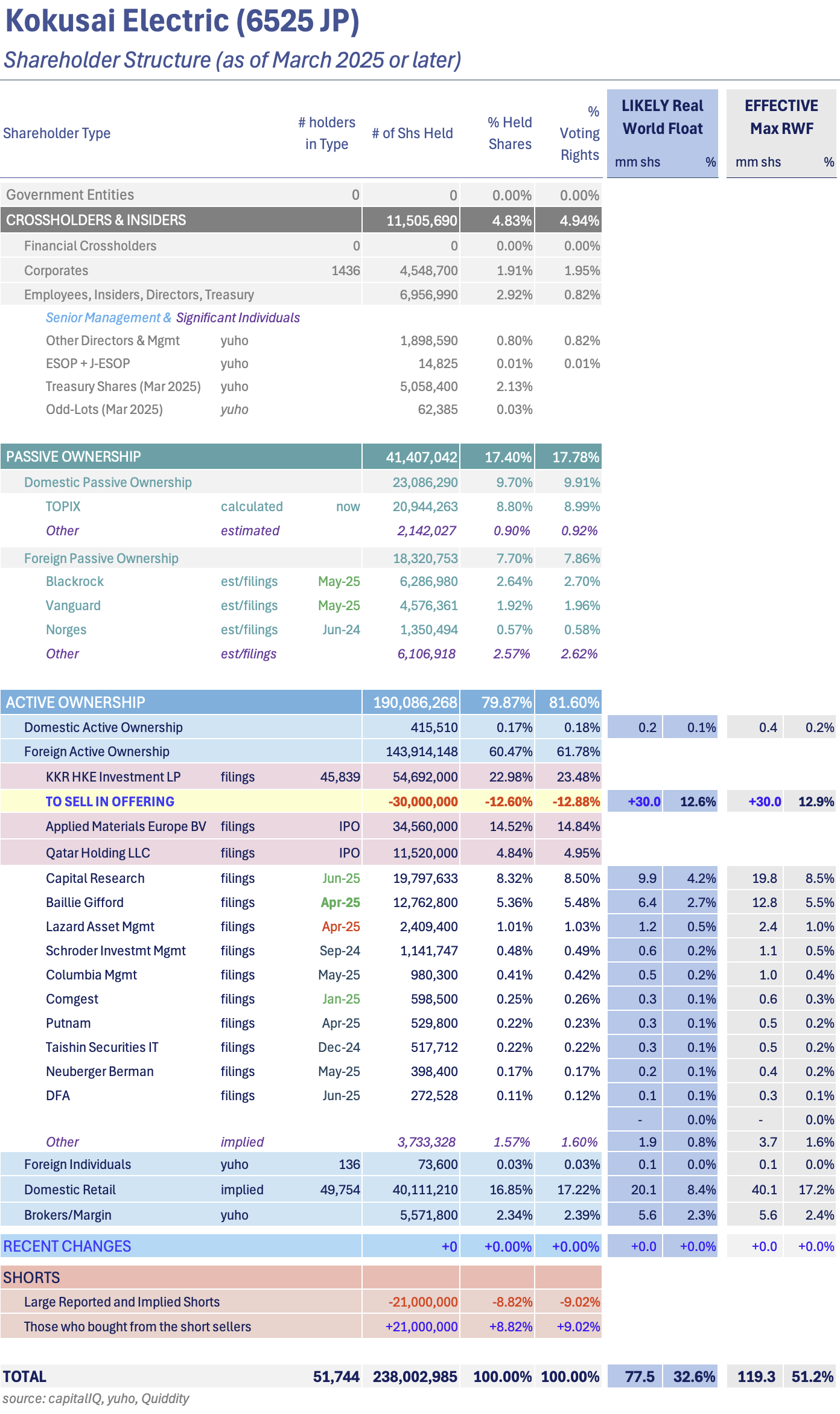

1. [Japan ECM] Kokusai Elec (6525) Offering – Expect It Very Well Bid, and the Back End Squeezy

- After the close today, Kokusai Electric (6525 JP) announced that large holder (and original PE owner) KKR HKE Investment LP would sell down 30mm shares or 12.88% of shares out.

- This is not expected, but also not unexpected – it’s exactly a year since the first selldown. There is a decent-sized short position, and it isn’t a huge offering.

- This changes two aspects of the future supply/demand balance. Both are important for how this trades in coming months.

2. FWD IPO Trading – Tepid Demand

- FWD Group Holdings (1828 HK), a pan-Asian life insurer founded by Richard Li, raised around US$442m in its HK IPO.

- FWD is a pan-Asia life insurer operating in ten markets including Hong Kong (and Macau), Thailand (and Cambodia), Japan, the Philippines, Indonesia, Singapore, Vietnam and Malaysia.

- We looked at the company’s past performance and valuations in our previous notes. In this note we talk about the trading dynamics.

3. Kokusai Electric Placement – Well Flagged but past Deal Didn’t Do Well

- KKR is looking to raise approximately US$620m through an accelerated secondary offering for around 13% of Kokusai Electric (6525 JP)‘s (KE) stock.

- KKR had sold in the IPO and undertaken an extended selldown in July 2024 as well. Hence, this deal is somewhat well flagged.

- In this note, we will talk about the placement and run the deal through our ECM framework.

4. Curator’s Cut: CC Vs DD, Singapore’s IPO Momentum and Pair Trade Ideas Galore

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,000+ insights published in the past two weeks on Smartkarma

- In this cut, we compare the top two Chinese ride hailing platforms, the recent momentum in Singapore IPOs and the flurry of pair trade ideas on Smartkarma

- Want to dig deeper? Comment or message with the themes you’d like to see highlighted next

5. SK Square Placement: Clean up by Kakao

- Kakao Corp (035720 KS) is looking to raise US$316m from a clean-up sale in SK Square (402340 KS) .

- The deal is a small one, representing 5.4 days of the stock’s three month ADV, and 1.7% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.

6. KRX Virtually Locks In Parentco Payout Rules for Spin-Off IPOs

- KRX is set to spotlight Philenergy’s 2023 IPO as the model, pushing spin-off deals to reward parentco holders—like Philoptics’ move to hand out IPO shares.

- Philoptics doubled pre-Philenergy IPO on crazy momentum, then round-tripped post-listing. Setups like this hint at bigger parentco moves ahead in future spin-off IPO plays.

- SK Enmove IPO is scrapped; but SK Plasma (SK Discovery) still live; LS E-Link (LS Corp) also likely to be an early test case for the new parentco compensation framework.

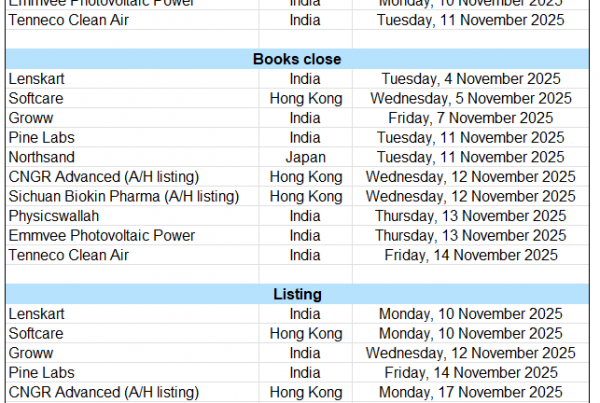

7. ECM Weekly (7 July 2025) – IFBH, HDB, Anjoy, FWD, Lens, Fortior, NTT DC, Daehan, Kanzhun, Nykaa, NH

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, next week will see a large number of listings across the region.

- On the placements front, given the HK and US holidays and approaching earnings season, there were only a few deals in the past week.

8. Travel Food Services IPO – RHP Updates & Thoughts on Valuation

- Travel Food Services Ltd (1450229D IN) is looking to raise about US$233m in its India IPO.

- Travel Food Services Limited (TFS) operates a network of travel quick service restaurants (Travel QSRs) and private lounges in airports.

- We have looked at the company’s past performance in our previous notes. In this note, we will talk about the RHP updates and IPO valuations.

9. Travel Food Services: $250M OFS, Niche Travel QSR but Valuations Seem Full Amidst near Term Weakness

- TFS operates QSRs and lounge in airports. They are present in the top 14 airports in India accounting for 26% of Indian-airport QSR and ~45% of the Indian-airport Lounge revenues

- FY26 performance is expected to be flattish as 1H results will lap impact of Adani operated airports being moved from TFS books to Joint venture with 25% stake.

- FY27 onwards growth is estimated at 15+% with EBITDA margins of 34-37%. We estimate FY27 revenues of ~2,000cr with PAT of 450-500cr implying the deal is being priced at 30-33x

10. Lens Technology A/H Trading – Decent Demand, Helped by A-Share Rally

- Lens Technology (300433 CH), a precision manufacturing solution provider, raised around US$700m in its H-share listing.

- Lens Technology (LT) is one of the leading players in precision structural parts and modules integrated solutions for both consumer electronics and smart vehicles interaction systems.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the trading dynamics.