This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

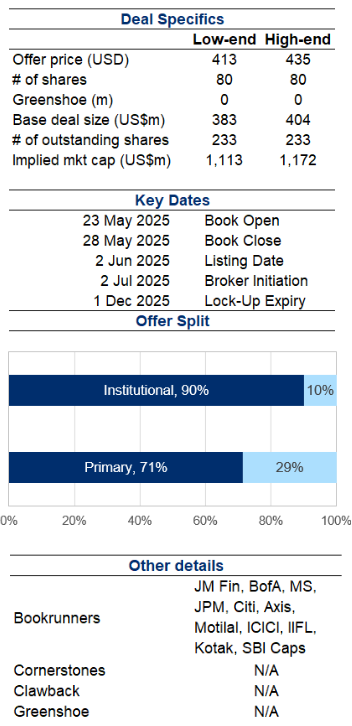

1. Schloss Bangalore IPO – Thoughts on Peer Comp and Valuation

- Schloss Bangalore Ltd (SCHBL IN) is looking to raise about US$409m in its India IPO. The deal has been downsized from an earlier size of around US$600m.

- It is a luxury hospitality company which owns, operates, manages and develops luxury hotels and resorts under ‘The Leela’ brand, through direct ownership and hotel management agreements with third-party owners.

- In this note, we will talk about the IPO valuations.

2. Curator’s Cut: Korea’s Value, CATL’s Charge and Copper’s Surge

- Welcome to Curator’s Cut, a fortnightly roundup of standout themes from the 1,200+ insights published over the past two weeks on Smartkarma

- In this cut, we look at Korea’s compelling valuation versus AxJ equities, CATL’s blockbuster Hong Kong listing and its market implications, and explore copper’s price surge amidst Chinese demand

- Want to dig deeper? Comment or message with the themes you think should be highlighted next

3. [Japan ECM] Financial Crossholders Offering Isuzu (7202) – Big Buyback Covers Most Of The Back End

- In line with the trend of financial institutions led by non-life insurers selling out of their cross-holdings, today we get an offering of shares held in Isuzu Motors (7202 JP).

- Today we got an announcement of 29.28mm shares being offered by a dozen financial institutions and a greenshoe for 15% more. At a 10% discount from here it’s ¥57bn/US$400mm.

- It is 16 days of ADV, which is big, but the company also announced a ¥50bn buyback from Pricing+6 to end of March 2026. That should stabilise things.

4. HK Strategy: Some Consumer IPO Pipelines and Their Proxies

- Hong Kong’s IPO market has gathered momentum lately, especially with the overwhelming response to CATL (3750 HK). Consumer IPOs are the next ones to gather interest.

- Foshan Haitian Flavouring & Food Co (FHF HK) is the most imminent one, potentially seeking up to US$1bn. Without significant peers in Hong Kong, it should attract good attention.

- The other interesting ones include Zhou Liu Fu Jewellery Co., Ltd. (1716396D CH), Three Squirrels (TRS HK), and Eastroc Beverage Group (EBG HK).

5. Interglobe Aviation (Indigo) Placement – Another US$800m+ Deal by Co-Founder

- InterGlobe Aviation Ltd (INDIGO IN)‘s co-founder, Rakesh Gangwal, aims to raise around US$803m via selling around a 3.3% stake in Indigo.

- He had earlier stated his intention to pare down his stake after a long drawn, and very public battle, with his co-founder Rahul Bhatia. He has sold many times before.

- In this note, we run the deal through our ECM framework and comment on deal dynamics.

6. Foshan Haitian Flavouring H Share Listing: The Investment Case

- Foshan Haitian Flavouring & Food (603288 CH), a leading Chinese pharmaceutical company, has filed its PHIP for an H Share listing to raise US$1 billion.

- Foshan Haitian Flavouring & Food Company (FHF HK) has been China’s leading condiments company in terms of sales volume for 28 consecutive years.

- The investment case rests on its market positioning, return to growth, industry-leading profitability, cash generation and strong balance sheet. However, the valuation of the A Shares is full.

7. Isuzu Motors Placement – Relatively Small Deal Along with Buyback

- A group of shareholders aims to raise around US$380m via selling around 4% of Isuzu Motors (7202 JP).

- Being another cross-shareholding unwind in Japan, it shouldn’t carry much negative connotations, in our view.

- In this note, we will talk about the placement and run the deal through our ECM framework.

8. Foshan Haitian Flavouring A/H Listing – PHIP Updates and Thoughts on A/H Premium

- Foshan Haitian Flavouring & Food (603288 CH) (FHCC), China’s leading condiments company, now aims to raise around US$1bn in its H-share listing.

- FHCC is China’s leading condiments company within its main product categories of soy sauce, oyster sauce, flavored sauce, specialty condiment products and other products.

- We have looked at the past performance in our earlier note. In this note we talk about the PHIP updates and likely A/H premium.

9. ECM Weekly (26 May 2025) – CATL, Hengrui, Eastroc, Haitian, Schloss, Aegis, Hyundai Marine, Pony

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Contemporary Amperex Technology (CATL) (300750 CH) and Jiangsu Hengrui Pharmaceuticals (1276 HK) performance has paved the way for a slew of A/H listings to follow.

- On the placements front, there was a large selldown in HD Hyundai Marine Solution (443060 KS) and a lockup release for Pony AI (PONY US) is coming up.

10. Capitaland Ascendas REIT Placement: DPU and NAV Accretive

- CapitaLand Ascendas REIT (CLAR SP) is looking to raise at least S$500M in a private placement, to fund the acquisition of some valuable properties.

- These acquisitions will expand the firm’s portfolio exposure to Singapore and data centers.

- In this note, we comment on the deal dynamics and run the deal through our ECM framework.