This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Horizon Robotics Placement – Momentum Is Strong but Raising Seems Opportunistic

- Horizon Robotics (9660 HK) raised around US$800m in its Hong Kong IPO in October 2024. It’s back again to raise another US$600m via a placement.

- Horizon Robotics (HR) is a provider of advanced driver assistance systems (ADAS) and autonomous driving (AD) solutions for passenger vehicles, empowered by its proprietary software and hardware technologies.

- In this note we talk about the deal dynamics and run the deal through our ECM framework.

2. [Japan ECM/Index] Azoom (3496) Offering to Enable Move to TOPIX

- On Friday 6 June, Azoom (3496 JP) announced it would conduct an offering (small issuance of new shares, some Treasury shares, larger selldown by the main shareholder).

- That comes in conjunction with a transfer to TSE Prime from TSE Growth, which itself leads to a TOPIX Inclusion trade next month.

- The company has decided to tack on a special dividend for this year, on top of growth and more liquidity. None of this is especially bad.

3. Zhejiang Sanhua Intelligent Controls A/H Listing – PHIP Updates and Thoughts on A/H Premium

- Zhejiang Sanhua Intellignt Controls Co., Ltd. (002050 CH) (ZSIC), a manufacturer of refrigeration and air-conditioning control components, aims to raise around US$1bn in its H-share listing.

- ZSIC is a market leader in a number of products, with commanding market share both domestically and globally.

- We have looked at the company’s past performance in our previous note. In this note, we look at the PHIP updates and talk about the likely A/H premium.

4. Xtalpi US$860m IPO Lockup Expiry – Last of the Lockup Release with Nearly All Shares in CCASS Now

- XtalPi Holdings (2228 HK) was listed in Hong Kong on 13th Jun 2024 after raising US$126m. Its one-year lockup will expire soon.

- QuantumPharm is a R&D platform, utilizing quantum physics-based first-principles calculation, advanced AI, high-performance cloud computing, and scalable and standardized robotic automation to provide drug and material science R&D solutions.

- In this note, we will talk about the lock-up dynamics and updates since our last note.

5. Sanhua Intelligent Controls H Share Listing: The Investment Case

- Zhejiang Sanhua Intellignt Controls Co., Ltd. (002050 CH), the world’s largest refrigeration and air-conditioning control component manufacturer, has filed its PHIP for a H Share listing to raise US$1.0-1.5 billion.

- Sanhua’s market share in the global refrigeration and air-conditioning control component market was 45.5% in terms of revenue in 2024, according to Frost & Sullivan.

- The fundamentals are good, with the positives (refrigeration and aircon rising growth, stable margin, and cash generation) outweighing the negatives (automotive declining growth, US tariffs overhang).

6. Keymed Bioscience Placement – Track Record Isn’t Great but Recent Performance Has Been Better

- Keymed Biosciences (2162 HK), along with its controlling shareholder, is looking to raise around US$112m to fund its R&D requirements.

- Keymed Biosciences, a China-based biotech company which focuses on therapeutic areas of autoimmune and oncology

- In this note, we will talk about the placement and run the deal through our ECM framework.

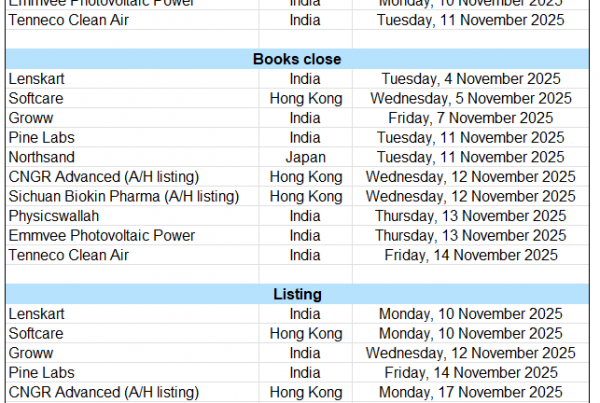

7. ECM Weekly (9 June 2025) – Haitian, Sanhua, Virgin Aus, Primo, Kitazato, Wistron, Kelun Bio, Mao Gep

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Foshan Haitian Flavouring & Food (603288 CH) and Zhejiang Sanhua Intellignt Controls Co., Ltd. (002050 CH) might launch their IPOs soon.

- On the placements front, Wistron Corp (3231 TT) launched its well flagged GDR, along with a few more deals this week.

8. Foshan Haitian Flavouring A/H Listing – Strong Cornerstone, Weak Momentum

- Foshan Haitian Flavouring & Food (603288 CH) (FHCC), China’s leading condiments company, aims to raise around US$1.2bn in its H-share listing.

- FHCC is China’s leading condiments company within its main product categories of soy sauce, oyster sauce, flavored sauce, specialty condiment products and other products.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the IPO pricing.

9. Everest Medicine Placement: Another Sell-Down by CBC, Some Caution Warranted

- Everest Medicines (1952 HK) aims to raise around US$150m in a secondary sell-down of shares conducted by CBC Group.

- This comes on the heels of a similar secondary sell down in Jan 2025, whereby CBC sold ~US$100m worth of stock, priced at a 10% discount.

- In this note, we comment on the deal dynamics and run the deal through our ECM framework.

10. Foshan Haitian Flavouring (3288 HK) IPO: The Valuation Perspective

- Fundamentals first, Foshan Haitian Flavouring & Food Company (3288 HK)‘s IPO is interesting given a positive growth outlook – 1Q25 growth accelerated to 14.8% with margin expansion.

- We value the H-share at HK$39.35, 8.4% higher than the high-end of the IPO price based on 28.2x FY25F PER to reflect its significantly stronger 3-year earnings growth.

- It equals 5.9x pre-money FY25F P/B, justified by ROE of 21.8-22%, sharply ahead of peers. Net cash equals 12.4% of its A-share market cap.