This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. GMO Internet (4784) – Squeeze-Able So Squeezing, Offering Likely Gets Pulled – AVOID LIKE THE PLAGUE

- GMO Internet (4784 JP) was created by the reverse takeover of a listed cad/media company by its parent company’s “internet infrastructure” business. GMO Internet Group ended up with ~98%.

- In the process, the stock rose 500%. Now, as part of its promise to the TSE allowing TSE Prime membership for the extraordinarily low-float target, the parent is offering shares.

- The squeeze has it at 180x Dec25e EPS, 111x EBIT, 70x book. The offering likely gets pulled and the stock isn’t shortable… so what next? Pain, and an ECLWO.

2. CATL A/H Trading – Strong Demand, Upsized, Included in Short-Sell List

- Contemporary Amperex Technology (CATL) (300750 CH), one of the world’s largest battery solutions providers, raised around US$5.2bn in its H-share listing.

- Contemporary Amperex Technology (3750 HK) is the global leader in new energy vehicle battery solutions, in China and globally, as per SNE Research. Its A-shares have been listed since 2018.

- We have looked at the company’s past performance and valuations in our earlier notes. In this note, we talk about the trading dynamics.

3. GMO Internet Placement: Extremely Overvalued at the Moment

- GMO Internet Group (9449 JP) is looking to sell its 33.4% stake in its subsidiary GMO Internet (4784 JP) to meet free-float requirements.

- Shares are very overvalued at the moment and should be worth a mere fraction of its current trading value.

- We have looked at the company’s deal dynamics in our earlier notes. In this note, we discuss the firm’s outlook as well as valuation.

4. Jiangsu Hengrui Pharma H Share Listing (1276 HK): Trading Debut

- Jiangsu Hengrui Pharmaceuticals (1276 HK) priced its H Share at HK$44.05 to raise HK$9,890.1 million (US$1.3 billion) in gross proceeds. The H Share will be listed tomorrow.

- The timing of the H Share listing is fortuitous, as the peers have materially re-rated since the prospectus was released on 15 May.

- Hengrui had the highest oversubscription rates among recent large AH listings. The AH discount implied by the offer is attractive.

5. CATL H Share Listing (3750 HK) IPO: Trading Debut

- Contemporary Amperex Technology (3750 HK) priced its H Share at HK$263 to raise HK$35,657.2 million (US$4.6 billion) in gross proceeds. The H Share will be listed tomorrow.

- The H Share listing price implies an AH discount of 6.6% at the A Share price of RMB63.51. This compares to Midea Group (300 HK)‘s AH discount of 4.7%.

- CATL had the highest oversubscription rates among recent large AH listings. Our valuation analysis suggests that the H Share listing price is attractive.

6. Eastroc Beverage A/H Listing – Energized – Fast Growth, Better Margins

- Eastroc Beverage Group (605499 CH) (EB), a China-based functional beverage company, aims to raise around US$1bn in its H-share listing.

- According to Frost & Sullivan (F&S), EB has been the largest functional beverage company in China in terms of sales volume for four consecutive years since 2021.

- In this note, we look at its past performance and other deal dynamics that might impact the listing.

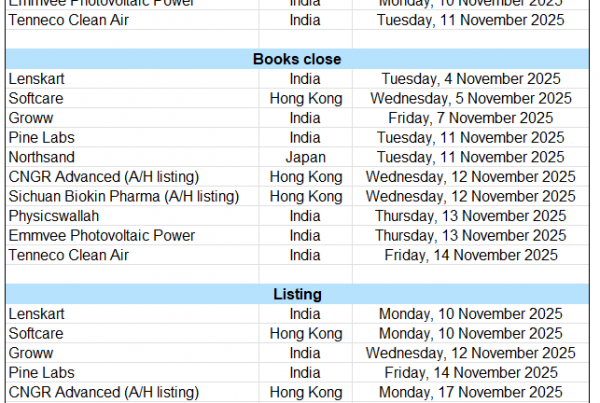

7. ECM Weekly (19 May 2025) – CATL, Hengrui, Green Tea, SMPP, Unisound, Renesas, Genda, GMO, PayTM

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Contemporary Amperex Technology (CATL) (300750 CH) and Jiangsu Hengrui Medicine (600276 CH) will remain in the spotlight in the coming week as well.

- On the placements front, Japan deals appear to be picking up again.

8. HD Hyundai Marine Placement – Very Well Flagged, Overhang Easing but Last Deal Didn’t Do Well

- KKR is looking to raise around US$410m via selling some of its stake in HD Hyundai Marine Solution (443060 KS).

- KKR had come out of its IPO linked lockup in Nov 2024 and had tried to launch a deal in Dec 2024 and finally undertook a deal in Feb 2025.

- In this note, we will talk about the placement and run the deal through our ECM framework

9. Hanwha Aerospace: Higher Rights Offering Price and Amount

- On 21 May, Hanwha Aerospace (012450 KS) announced that the rights offering price increased to 684,000 won (up 26.9% from 539,000 won previously) due to recent increase in price.

- Due to the higher rights offering price, the scale of the capital raise has increased from 2.3 trillion won previously to 2.9 trillion won (US$2.1 billion).

- Issue price is determined by applying a 15% discount rate to the one-month weighted arithmetic average price, one-week weighted arithmetic average price, and the closing price on the base date.

10. PegBio 派格生物 IPO: A Hardsell but Mostly Done Deal

- PegBio, a China-based near commercial stage biotech company, launched its IPO to raise up to US$39m via a Hong Kong listing.

- We have previously covered the company’s fundamentals and valuation. We highlight issues of the company.

- In this note, we look at the deal term. We think the valuation is demanding, but the company managed to get support from local government facilitate its listing.