This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

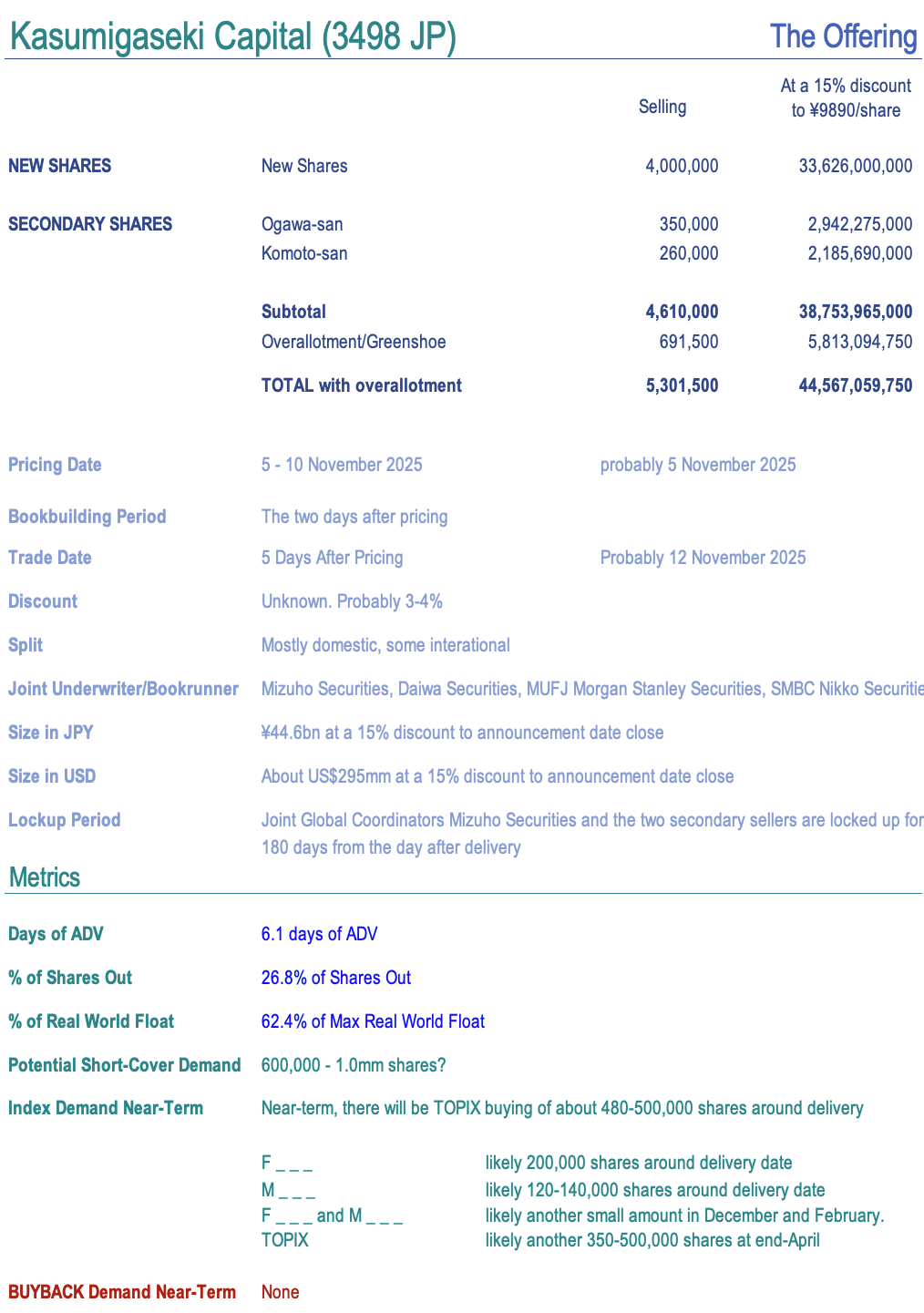

1. [Japan Offering] Kasumigaseki Capital (3498 JP) – BIG Primary for Big Plans

- On Friday, Kasumigaseki Capital (3498 JP) announced Aug-25 earnings and a combination ¥45-50bn primary+secondary offering worth 5.3mm shares, 6x ADV, and a float increase of 37%. Shares fell 15% today.

- 2yrs ago they did a large offering. It went well. They’d had a ridiculous plan to grow OP 6x from ¥3.5bn to ¥20bn in 2yrs to Aug-26. Then by Aug-25.

- They got to ¥8.5bn in Aug-24 and now ¥18.9bn in Aug-25 and now guide to ¥26.5bn in Aug-26 (the original plan having been ¥20bn).

2. WeRide HK Listing: The Investment Case

- WeRide (WRD US), a provider of autonomous driving products and services, is seeking to raise between US$350 million through an HKEx listing.

- It was listed on the Nasdaq on 25 October 2024, raising US$120 million at US$15.50 per ADS. Since listing, the shares are down 31%.

- The investment case centres around accelerating revenue growth, progress towards mass commercialisation and valuation in line with historical averages. However, the path to profitability remains uncertain.

3. Seres Group H Share Listing (9927 HK): Valuation Insights

- Seres Group (601127 CH), a Chinese NEV manufacturer, has launched an H Share listing to raise US$1.7 billion.

- I discussed the H Share listing in Seres Group H Share Listing: The Investment Case.

- The proposed AH discount of 24.8% (based on the 24 October A Share price) is attractive, and I would participate in the H Share listing.

4. Seres Group Hong Kong IPO Preview

- Seres Group is getting ready to complete its IPO on the Hong Kong exchange in the coming weeks that could raise about US$1.7 billion.

- At the high end of the IPO price range of HK$131.50 per share, Seres would have a market capitalization of nearly HK$215 billion (about $27.6 billion).

- Seres Group is one of the largest new-energy vehicle makers in China. There are 22 cornerstone investors that have committed to purchase approximately 49% of the offer.

5. Pony AI Secondary HK Offering – Needs to Correct Some More

- Pony AI (PONY US) plans to raise around US$825m in its secondary listing in Hong Kong.

- We have looked at the deal dynamics in our previous note.

- In this note, we talk about the deal structure and updates since then.

6. SANY Heavy Industry H Share Listing (6031 HK): Trading Debut

- Sany Heavy Industry (600031 CH) priced its H Share at HK$21.30 to raise HK$13,453 million (US$1.7 billion) in gross proceeds. The H Share will be listed tomorrow.

- I discussed the H Share listing in SANY Heavy Industry H Share Listing: The Investment Case and SANY Heavy Industry H Share Listing (6031 HK): Valuation Insights.

- Sany’s international oversubscription rates were above the median of recent large AH listings. The AH discount remains reasonable.

7. WeRide Secondary HK Offering – Has Been Trading Up, Given the Valuation Gap

- WeRide (WRD US) plans to raise around US$325m in its secondary listing in Hong Kong.

- We have looked at the deal dynamics in our previous note.

- In this note, we talk about the deal structure and updates since then.

8. Seres Group A/H IPO Pricing – Thoughts on Valuations

- Seres Group (601127 CH), a Chinese NEV manufacturer, aims to raise around US$1.7bn in its H-share listing.

- Seres Group (SG) is principally engaged in the research and development, manufacturing, sales and services of new energy vehicles (NEV) as well as core NEV components.

- We have looked at the past performance and likely A/H premium in our previous note. In this note, we talk about the IPO pricing.

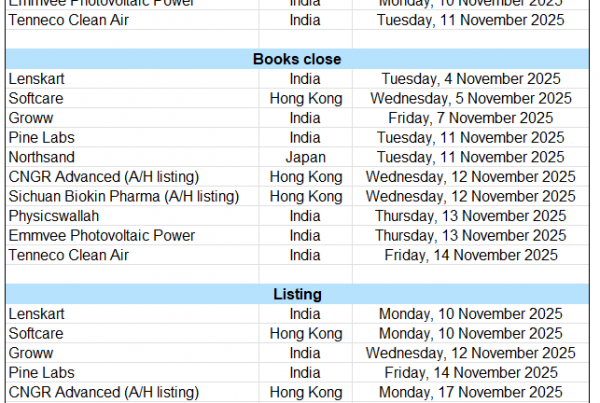

9. ECM Weekly (27 October 2025)- Sany, Seres, PonyAI, WeRide, CIG, JST, Lenskart, Horizon, CRB

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, Hong Kong and India markets appear to be gearing up for a year end rush.

- On the placements front, there were no large deals this week but we did have a look at the upcoming lockup expiries.

10. Samsung Electronics Placement: Inheritance Tax Paydown by Family, Widely Telegraphed

- Samsung Electronics (005930 KS) is looking to raise around US$1.2bn from a secondary placement.

- This represents 0.9 days of the stock’s three month ADV, and 0.3% of total shares outstanding.

- In this note, we will talk about the placement and run the deal through our ECM framework.