This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Zijin Gold IPO (2259 HK): Trading Debut

- Zijin Gold (2259 HK) priced its IPO at HK$71.59 per share to raise gross proceeds of approximately US$3.2 billion. The shares will begin trading on September 30.

- The IPO was discussed in Zijin Gold IPO: The Investment Case and Zijin Gold IPO (2259 HK): Valuation Insights.

- The market sentiment of the peers has increased since the IPO launch. My analysis suggests that the IPO price range is attractive.

2. Tekscend Photomask (429A JP) IPO: Valuation Insights

- Tekscend Photomask (429A JP) is a global leader in semiconductor photomasks. It is seeking to raise up to JPY123 billion (US$828 million). Pricing is on 30 September.

- I previously discussed the IPO in Tekscend Photomask (429A JP) IPO: The Bull Case and Tekscend Photomask (429A JP) IPO: The Bear Case.

- In this note, I present my forecasts and discuss valuation. My analysis suggests that Tekscend is attractively valued at the IPO price range compared to peer multiples.

3. Tekscend Photomask IPO – Thoughts on Valuation

- Tekscend Photomask (429A JP) (429A JP), a manufacturer and distributor of semiconductor photomasks, aims to raise around US$830m in its Japan IPO.

- TP is a global provider of photomasks and related support services. It has been the leader in the merchant photomask market in terms of sales since 2016.

- We have looked at the company’s past performance in our previous note. In this note, we talk about valuations.

4. LG Electronics’ BOD Gives the Green Light for LG Electronics India IPO in 2025 – Updated Valuation

- LG Electronics’ BOD finally approved a plan to sell a 15% stake in LG Electronics India in an IPO to be completed in 2025.

- According to local media, LG Electronics India is now valued at about US$13 billion which is higher than LG Electronics’ market cap of US$8.8 billion.

- Our base case valuation of LG Electronics India is implied market cap of 1,280 billion INR or US$14.4 billion.

5. [Japan ECM] MIGALO Holdings (5535 JP) Offering to Raise Capital, Generate Interest

- Migalo Holdings (5535 JP) is one of the rare TSE Prime-listed companies which got the boot from TOPIX, stayed in Prime, and is clawing its way back.

- As of end-March-25, it met all the criteria to stay in Prime and rejoin TOPIX. Now they are launching a primary offering, and this may presage an effort to rejoin.

- They are adding float and 10% of shares to the pile, in this ¥4.4-5.0bn offering. But instos are net short this stock.

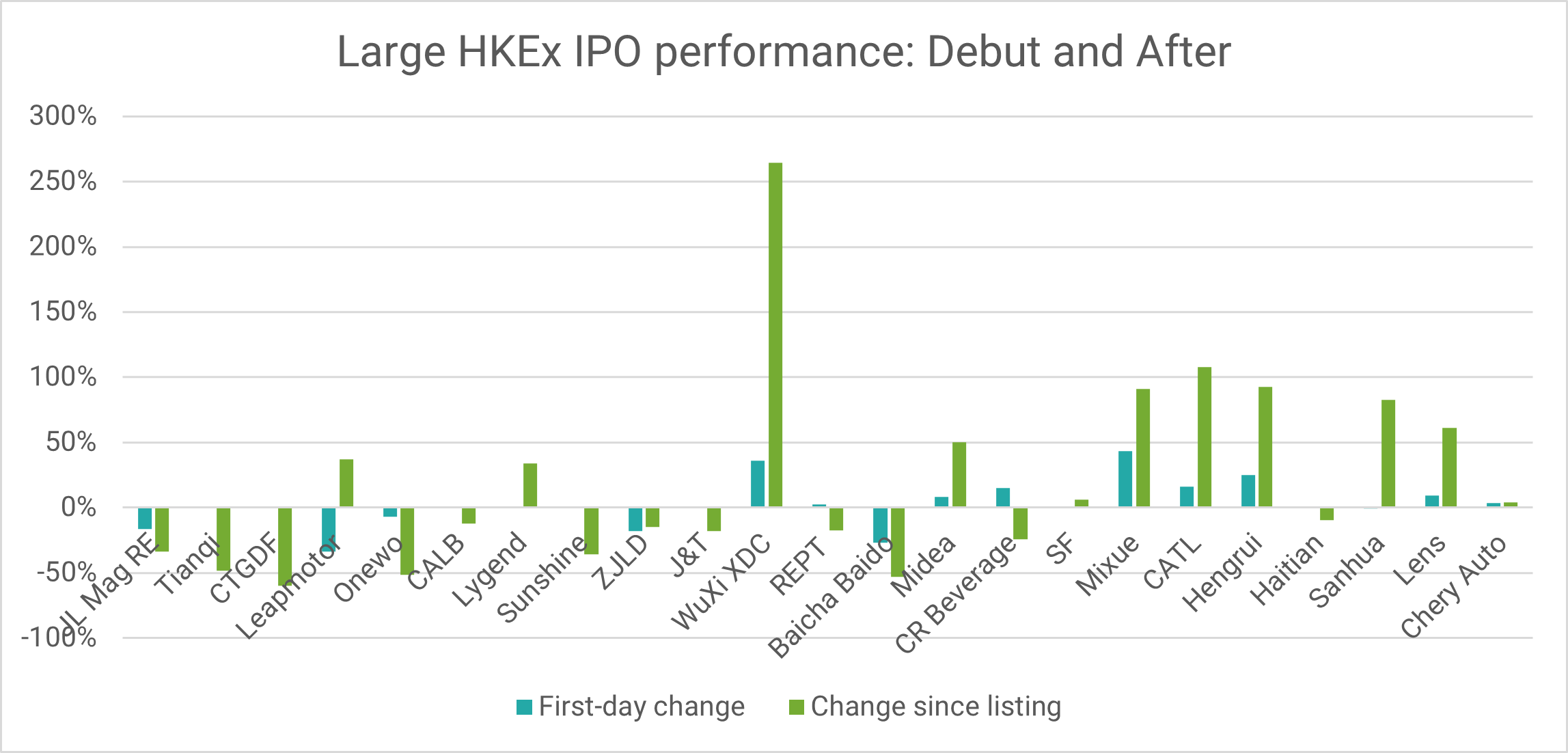

6. ECM Weekly (29 September 2025)- Zijin, Chery, CAREIT, Orion, Butong, Victory Giant, Northern Star

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, this week saw a few good listings across the region while the spotlight will be on Zijin Gold (2259 HK) in the coming week.

- On the placements front, it was a relatively quiter week, as compared to some of the more recent weekly flows.

7. Zijin Gold : Listing Pop Likely. Know Your Thresholds. Avoid Valuation Pitfalls.

- Riding on strong investor demand, Zijin Gold (2259 HK) has exercised its over-allotment option, boosting the total IPO size to USD 3.7 billion from USD 3.2 billion previously.

- As Hong Kong’s only pure-play gold miner with global exposure, Zijin Gold may command a premium, though any sharp price gains still depend on sustained gold price strength.

- Investors should define their medium- to-long-term gold price thresholds to shape a clear post-IPO strategy for Zijin Gold.

8. Tekscend Photomask IPO – Peer Comparison

- Tekscend Photomask (429A JP), a manufacturer and distributor of semiconductor photomasks, aims to raise around US$830m in its Japan IPO.

- TP is a global provider of photomasks and related support services. It has been the leader in the merchant photomask market in terms of sales since 2016.

- We have looked at the company’s past performance in our previous note. In this note, we will undertake a peer comparison.

9. Zijin Gold (2259 HK) IPO Debut – Some Points Worth the Attention

- Based on DCF model, valuation is about US$28.4 billion. We think this is the valuation bottom line. Conservative investors can take profits at this valuation level.

- Valuation has the potential to reach US$34-42bn (or 18-22x P/E ) if based on 2025 forecast.Optimistic investors can choose to wait for stock price to fall within this valuation range.

- Considering better profitability/shareholder resources, Zijin Gold has more advantage than Shandong Gold Mining. Therefore, market value of Zijin Gold will widen the gap with Shandong Gold Mining in the future.

10. Zijin Gold IPO Trading: Decent Retail but Strong Insti Demand

- Zijin Gold (2259 HK) raised around US$3.2bn in its Hong Kong IPO.

- It is a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have covered various aspects of the deal in our previous note. In this note, we will talk about the demand and trading dynamics.