This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Capital Markets on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. [Japan ECM] Kokusai Elec (6525) – KKR’s Lock Up Expiry in 3 Weeks – $700mm Clean-Up Coming?

- Kokusai Electric (6525 JP) was IPOed too cheap in 2023 after a couple of years in the wilderness and an aborted private sale effort, blocked on antitrust grounds.

- It nearly tripled, there was an offering announced at ¥5,000+ priced ¥4,500+. Shares fell back to IPO price, then bounced, and we got a July follow-on offering at ¥3,000+.

- I suggested here the back end could be squeezy. It was for a hot minute, then it wasn’t. Now the stock is up 50% in 2 weeks. Watch out!

2. Zijin Gold IPO: Strong Cornerstone Book; Should Trade at Premium to Group

- Zijin Gold (2259 HK) is looking to raise US$3.2bn in its upcoming HK IPO.

- It s a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have looked at the company’s past performance in our previous notes. In this note, we talk about valuations.

3. Zijin Gold Pre-IPO: Superior to Peers; Should Trade at High End of Group

- Zijin Gold (2579355D HK) is looking to raise up to US$3.0bn in its upcoming Hong Kong IPO.

- It is a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have looked at the company’s past performance and done a peer comparison in our previous note. In this note, we will look at the firm’s valuation.

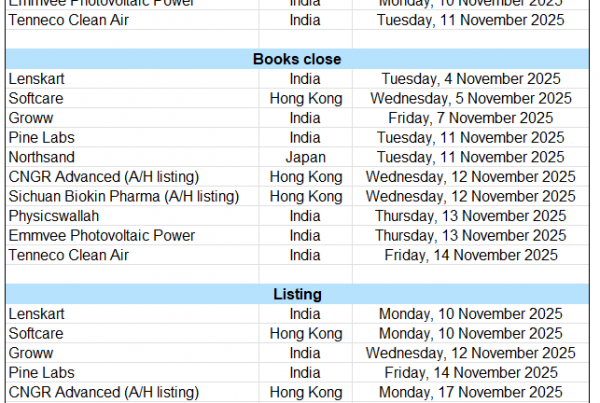

4. ECM Weekly (15 September 2025)- Chery, Zijin Gold, Hesai, Orion, Myungin, Urban, Nio, Kotak, Toei

- Aequitas Research’s weekly update on the IPOs, placements, lockup expiry and other ECM linked events that were covered by the team over the past week.

- On the IPO front, things are picking up going into the year end, as is usual, with multiple US$1bn+ deals said to go live over the next few weeks.

- On the placements front, as well, market remains receptive for both primary and secondary offerings.

5. Zijin Gold Pre-IPO: PHIP Update: Acquisition of Raygorodok Mine for a Song

- Zijin Gold (2579355D HK) is looking to raise up to US$3.0bn in its upcoming Hong Kong IPO.

- It is a global leading gold mining company formed by combining all of the gold mines of Zijin Mining, located outside of China.

- We have looked at the company’s past performance, and done a peer comparison in our previous note. In this note, we will provide a PHIP update.

6. Zijin Gold IPO: PHIP Updates Support the Investment Thesis

- Zijin Gold (2579355D HK) is a global leading gold mining company and the overseas gold segment of Zijin Mining Group (601899 CH). It is pre-marketing an HKEx IPO to raise US$3bn.

- I previously discussed the IPO and outlined my investment thesis in Zijin Gold IPO: The Investment Case.

- In this note, I take a look at the new information from the PHIP. The 1H25 results and latest developments underscore my previous bullish thesis.

7. Centurion Accomodation REIT IPO – New Asset Class

- Centurion Accomodation REIT (CAREIT SP) (CAREIT) plans to raise around US$600m in its Singapore listing.

- CAREIT plans to invest directly or indirectly, in a portfolio of purpose-built worker accommodation (PBWA), purpose-built student accommodation (PBSA) or other accommodation, located globally (excluding Malaysia).

- In this note, we look at the REIT’s portfolio and performance.

8. Pre-IPO Zijin Gold (PHIP Updates) – Thoughts on the Business, the Forecast and Valuation Outlook

- The spin-off of Zijin for an independent listing is equivalent to presenting a “pure gold business” to the market. Such “asset revaluation” can unlock the hidden value of gold business.

- For enterprises like Zijin in the upstream of gold industry chain, a sustained high and rising gold price is usually a significant positive factor. However, there are also potential risks.

- Zijin Gold has better growth potential than peers, so we think its valuation range could be P/E of 18-22x. If based on 2025 net profit forecast, valuation is US$36.9-45.1 billion.

9. Chery Automobile IPO (9973 HK): Valuation Insights

- Chery Automobile (9973 HK) is a Chinese automobile manufacturer. It has launched an HKEx IPO to raise up to US$1.2 billion.

- I previously discussed the IPO in Chery Automobile IPO: The Bull Case and Chery Automobile IPO: The Bear Case.

- In this note, I present my forecasts and valuation. My analysis suggests that the IPO price range is reasonable.

10. Hesai Secondary Trading – Decent Demand, Despite Lack of Correction

- Hesai Group (HSAI US) raised around US$530m in its secondary listing in Hong Kong.

- We have looked at the deal dynamics in our previous note.

- In this note, we talk about the ADS movement and trading dynamics.