This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. BYD (1211 HK) Outlook Following Regulatory Pushback on Market Dominance

- As reported by Ming Lu, Chinese regulators are pushing back against BYD (1211 HK)’s dominance, which has strained smaller domestic EV competitors. Read his latest BYD insight for more details.

- In a recent insightwe signaled BYD was tactically overbought. The stock fell rapidly right after.

- The stock is currently mildly oversold according to our WEEKLY model: it could fall a bit more, but if this week closes in negative territory there could be a rebound.

2. Nikkei 225 Outlook And Profit Targets Amid Uncertainty Over Japan-US Tariff Negotiations

- Japan PM Ishiba says disagreements remain with US on tariff talk. This is probably the main catalyst that could slow down the current Nikkei 225 (NKY INDEX) rally.

- Our WEEKLY Nikkei 225 model signals a mildly overbought status, the index could go higher, but will face harder resistance in 1-2 weeks from now.

- We don’t see the Nikkei pulling back this week, we think it will close this week up.

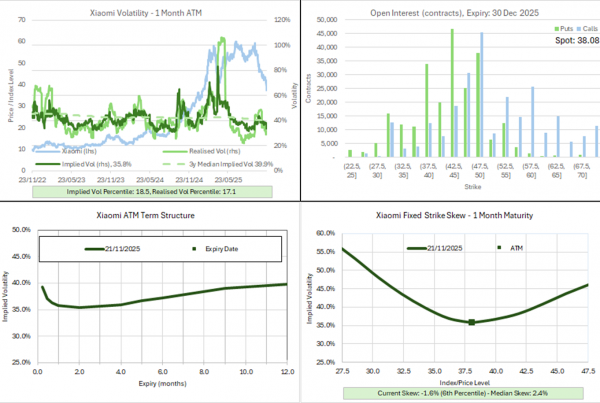

3. Xiaomi (1810 HK): Strategic Insights and Top Option Trades

- Over the past five trading days, Xiaomi Corp (1810 HK) multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Popular Strategies: Diagonal Spreads account for 27%of all strategies. This versatile strategy allows for many different profiles in terms of upfront premium (positive or negative), and time horizon.

- This Insight of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies.

4. Alibaba (9988 HK) Options Insights: Navigating Contango and Skew for Profitable Trades

- Context: Analysis of Alibaba’s (9988 HK) implied volatility surface as of June 20, 2025, examining implied volatility patterns, skew structures, and open interest distribution across various expiry dates.

- Highlights: One-month implied volatility at 31.6% is trading at historically cheap levels (13th percentile), while the skew shows a pronounced volatility smile favoring spreads.

- Why Read: Essential for options traders and volatility strategists looking to capitalize on the historical cheapness of current implied volatility levels, particularly given the favorable skew structure for spread strategies.

5. Alibaba (9988 HK): Top Trades and Strategic Insights from Options Trading

- Context: Over the past five trading days, Alibaba Group Holding (9988 HK) live multi-leg option strategies showcased a variety of approaches. Strategy highlights are provided.

- Highlights: Diagonal Spreads continue to enjoy popularity. Strategies tend to have a short-term horizon and exhibit a slightly bearish bias.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

6. Samsung Electronics (005930 KS) Outlook as Foundry Spin-Off Gains Momentum

- Sanghyun Park has reported in detail about what seems to be going on behind closed doors at Samsung in regard to the foundry spin-off: read his insight – highly recommended.

- We maintain our BUY recommendation for Samsung Electronics (005930 KS) and although we have not yet seen a strong rally, we see the stock slowly drifting upward from its bottom.

- Our short-term tactical perspective covering the next 2–3 weeks is presented in this insight.

7. HKEX (388 HK) Options: Unpacking the Top Trades of the Week

- Be inspired by sophisticated, live, multi-leg options strategies on HKEX (388 HK), executed over the period from 9 to 13 June.

- Highlights: Discover a range of noteworthy strategies, for example a self-financing Diagonal Put Spread using weekly options, or a Diagonal Call Spread generating 3.9% upfront yield.

- Why read: This breakdown of complex option strategies sheds light on market sentiment and positioning. Detailed examples provide actionable insights that could inspire similar strategies,

8. Hong Kong Oil Stocks: Surge in Oil Volatility Creates Opportunity

- Oil has surged on geopolitical headlines, with a sharp increase in both price and implied volatility.

- Implied vols in Hong Kong-listed oil names have lagged sharply behind the move in Oil.

- The relative dislocation in volatility opens the door to tactical pair trade and hedging ideas.

9. KOSPI 200 Tactical Warning: OVERBOUGHT

- The KOSPI 200 INDEX has been rising > 30% since its 303-low in early April 2025: a vertical rally after Lee Jae-myung’s won the Presidential Elections in South Korea.

- Our most extreme profit target set in our latest insight was 392. The KOSPI 200 reached 394 on June 16th. It is now ultra-overbought.

- Our short-term WEEKLY tactical view is the following: the index could go maybe a bit higher or it could pullback soon (more likely). Not bearish, will be a buy opportunity.

10. Hong Kong Single Stock Options Weekly (June 16 – 20): Breadth Erodes, Vol Slips, Hedges Worth a Look

- Single stocks were softer on the week, with breadth continuing to weaken.

- Put volumes surged to their highest levels since April; Put open interest continues to rise.

- Implied volatility declined on the week despite elevated demand for downside protection.