This weekly newsletter pulls together summaries of the top ten most-read Insights across Equity Derivatives on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. Alibaba (9988.HK): Overheated Momentum and Shifting Sentiment – Constructing a Smarter Hedge

- Baba’s recent surge mirrors past rallies, with recent sideways price action raising a caution flag.

- Metrics from the options market suggest that sentiment that was overheated has begun to turn.

- We explore an alternative hedge that will not cap a continued rally but is less expensive than directly buying Puts in Baba.

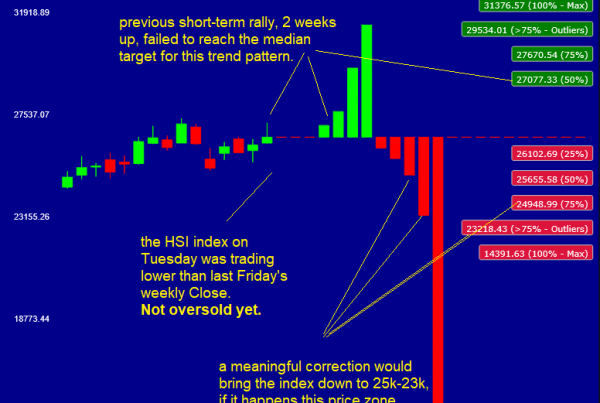

2. Hang Seng Index (HSI) Tactical Outlook: Small Pulback or Large Pullback?

- As suggested in our previous insight, the Hang Seng Index (HSI INDEX) rally was at risk of pulling back: a small correction began last week.

- The big question now: is this just a minor 1-week pullback (a buy-the-dip opportunity)? or a larger pullback, possibly directed towards 23k?

- This insight discusses the various tactical scenarios, including profit targets for a continuation of the rally from here.

3. Alibaba (9988 HK) Vs. Hang Seng Index (HSI INDEX): Relative Value Options Play with Leverage

- Context: Stat-arb models flag Alibaba (9988 HK) as overvalued versus the Hang Seng Index (HSI INDEX), with the difference between implied volatility and option premium at historically high levels.

- Highlight: An actionable trade setup — long HSI calls vs. short Alibaba calls — that captures relative value and introduces leverage through a ratio structure.

- Why Read: This is a timely opportunity to combine a directional view with favorable volatility dynamics, offering asymmetric payoff potential.

4. Baidu (9888.HK): Overheated Trading and Skew Dynamics Highlight a Distinct Hedge Opportunity

- There are multiple signs of overheating in Baidu trading including accelerating stock and option volumes.

- Skew has been driven higher by strong demand for up-strike Calls.

- We recommend a hedge that tilts the odds in the holder’s favor while establishing the position at a credit.

5. Volatility Cones Spotlight Hedging in Tencent (700 HK) And More

- Context: Volatility cones provide a straightforward framework to evaluate whether options are trading cheap or rich.

- Highlights: Implied volatility has broadly risen across most, but not all, HK stocks. Front-month expiries remain historically cheap amid a steepening curve. Opportunities endure, though fewer than in recent weeks.

- Why Read: Spot opportunities, assess regime shifts, and manage risk effectively — volatility cones turn complex data into actionable insights for traders and investors.

6. NVIDIA: An Options Strategy for Riding the AI Data Center Waves

- NVIDIA’s has a strong position in the AI industry, but global trade policies introduce short-term uncertainties. Strong revenues and cash position buffer against policy-driven obstacles, particularly concerning its China revenues.

- We highlight NVIDIA’s technological leadership, including its full-stack computing infrastructure and rapid platform transitions. External pressures weigh on projected revenues, including export restrictions and increasing competition from major tech companies.

- We see potentially overpriced implied volatility. This strategy aims to generate premium while managing risks associated with price movements, especially in the context of evolving geopolitical and competitive landscapes.

7. Softbank Group (9984 JP) Tactical Outlook: Momentum Strong but Stretched, Higher Targets Speculative

- Softbank Group (9984 JP) performed a strong 1-week rally 2 weeks ago, then went marginally higher. The stock is OVERBOUGHT according to our models, but the pattern is bullish.

- We see two possible scenarios: a) the stock stalls and pulls back this week or b) it keeps rallying towards 20850.

- The current pattern had rallies lasting up to 5 weeks in the past, so Softbank Group (9984 JP) could rally 2 more weeks, and get closer to 20850.

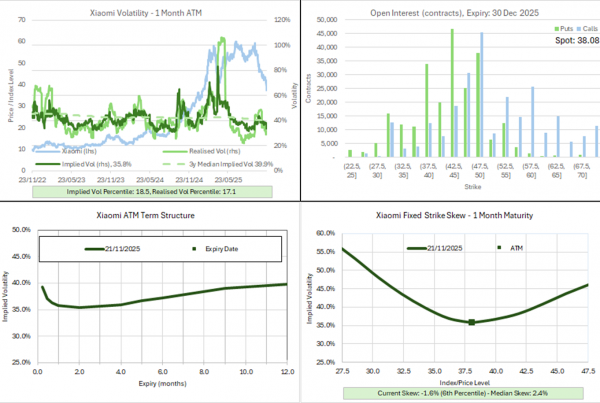

8. Kospi 200: Rally Echoes Pandemic Rebound

- Current gains echo past moves that required lengthy consolidation, suggesting risk management is prudent.

- Volatility trends remain middling, but skew steepness points to cost-effective downside structures.

- Rally momentum slows as Kospi reaches levels where past reversals have occurred versus SPX.

9. HSI: Extended Run Faces Hurdles, Hedge Strategies Recommended

- After a 33.9% rally off the April lows HSI is starting to flash caution across a variety of metrics.

- Weak breadth and option exuberance at the single stock level are additional areas of concern.

- We outline the technical backdrop and recommend hedge strategies given the current level of implied vols.

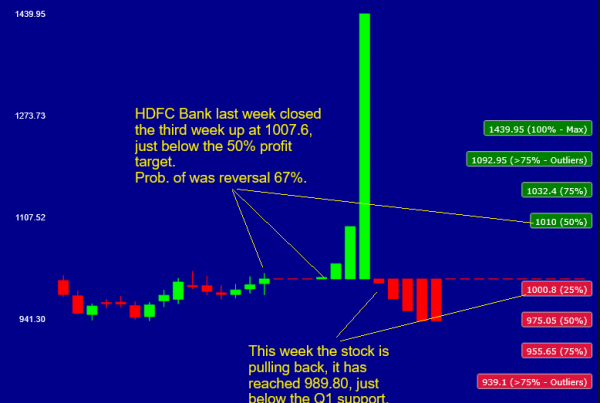

10. NIFTY 50 Tactical Outlook: Quantifying Downside Risk and Strategic Re-Entry Zones

- In our previousNIFTY Index insight published at the end of August we highlighted two possible scenarios before the Sep-30 rebalance: 1) risk-off pullback or 2) small rally.

- Scenario 2), the small rally is what came true, it lasted 3 weeks (we said 2 weeks), but it was a weak rally. The NIFTY however is not very overbought.

- 3-Week rallies not reaching higher highs usually indicate a weakness in the trend, but this could be a buy opportunity, so let’s have a look at our model’s BUY zones…