This weekly newsletter pulls together summaries of the top ten most-read Insights across Event-Driven and Index Rebalance on Smartkarma.

Receive this weekly newsletter keeping 45k+ investors in the loop

1. WuXi AppTec (2359 HK) Placement: Strong Momentum & Index Flows

- WuXi AppTec (2359 HK) is looking to raise US$650m at a price range of HK$104.16-106.4/share, a 5-7% discount from last close.

- There will be passive buying from global index trackers around the time of settlement of the placement shares. Then there will be some Hang Seng Index buying in August.

- Short interest in WuXi AppTec (2359 HK) has spiked and some shorts could cover into the placement. The AH premium could move higher following the placement.

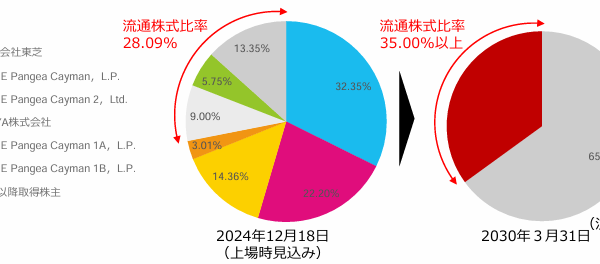

2. GMO Internet (4784) – GMO Internet Parent Has Been SELLING In The Market

- I have harped on the fact that GMO Internet Group (9449 JP) has to sell GMO Internet (4784 JP) shares with the goal to get 35% tradable shares by end-2025.

- I have written about it here, here, here, and here. The price needs to be lower so the parent can launch a HUGE block. The stock must be less squeeze-able.

- It turns out the parent started selling in the market the day after the Offering was cancelled. The setup is delicious now.

3. NSDL (NSDL IN) IPO: Offering Details & Index Inclusion Timeline

- NSDL (NSDL IN) is looking to list on the exchanges by selling up to INR 40bn (US$464m) of stock at a valuation of up to INR 160bn (US$1.85bn).

- The stock will not get Fast Entry to either of the global indices. The earliest inclusion in a global index should take place in November.

- Central Depository Services (CDSL IN)‘s stock price has dropped following the announcement of NSDL‘s IPO price band and the muted results could lead to further downside in the stock.

4. Korean Policy Tailwinds: Preferred Shares Rerating Play

- Most expect prefs to be in policy crosshairs soon—watch for tighter rules on dividends, discounts, and liquidity, plus likely incentives for redemption or cancellation ahead of commons.

- If Korea rolls out a pref stock overhaul, long-biased rerate plays could pop—focus on liquid, high-yield large-cap prefs trading at 35%+, yield north of 3%, and solid daily turnover.

- Korea Inv, Kumho Petro, CJ Cheil, CJ Corp prefs already screen well; Doosan and Hanwha 3PB could join if dividend hikes materialize on back of strong sub earnings.

5. [Japan Activism/M&A] Hogy Medical (3593) Reportedly Up For Auction – Totally Unsurprising

- Hogy Medical (3593 JP)‘s founder passed and there was a re-arranging of Hoki family deckchairs in 2021. In 2022 there was a BIG buyback from the family at ¥3,130/share.

- I discussed it here. I suggested that meant accretion, a family willing to sell, and an open register for a cheap company always heavily owned by value investors.

- The stock went nowhere for 18mos as activists dallied. In 2024 it ran from ¥3,500 to ¥5,000 as Dalton bought 20%. Then they got a board seat. Now takeover noise.

6. A/H Premium Tracker (To 25 July 2025): “Beautiful Skew” Raging Onward

- AH premia down again among liquid names but “beautiful skew” of wide premia converging more than narrow premia continues bigly. It still pays well to be long wide H discounts.

- This is the most significant 60-day AH pair average H outperformance in five years, maybe ever. Remarkable.

- The data tables below update on a daily basis in the Tools section of Smartkarma. The SOUTHBOUND Flow Monitor and AH Monitor are both there free for SK readers.

7. Merger Arb Mondays (28 Jul) – Shibaura, Abacus Storage, Insignia, Mayne, Santos, ENN, Smart Share

- I summarise the latest spreads and newsflow of merger arb situations we cover across Hong Kong, Australia, New Zealand, Singapore, Japan, Indonesia, Malaysia, Philippines, Thailand and Chinese ADRs.

- Highest spreads: Mayne Pharma (MYX AU), Yichang HEC Changjiang Pharma (1558 HK), ENN Energy (2688 HK), Pacific Industrial (7250 JP), Santos Ltd (STO AU), Smart Share Global (EM US).

- Lowest spreads: Bright Smart Securities (1428 HK), Hainan Meilan International Airport (357 HK), Humm Group (HUM AU), New World Resources (NWC AU), Nippon Concept (9386 JP).

8. ADR Arb on Korean Divvy Names: A Side Play Riding the Policy-Driven Liquidity Wave

- ETF rebalancing’s key, but still too early to front-run — both use FnGuide screens based on FY1 DPS and prices from 20 days before November-end.

- Beyond the rebalance noise, ADR-local spreads have been widening — KB hit +6%, Shinhan’s also drifting. Likely tied to the recent liquidity surge in dividend names.

- ADR arb’s more doable with NXT tightening slippage. With proper FX hedging, it’s a clean side play riding the policy-driven liquidity wave.

9. [Japan M&A] Pacific Industrial (7250) MBO Officially Being Done Dirt Cheap

- The MBO for Pacific Industrial (7250 JP) starts with the father+son Chairman and CEO, – combined stake 2.92% – putting nothing in to buy this, with help from banks.

- The Takeover Price is priced at 0.7x book, and a Net Debt to EBITDA of 2x (when adjusted for securities+pension assets+DTLs) and 5-6x average 2026-2030 FCF.

- This is being done too cheap: Toyota is the main customer, one third of revenues comes from Japan, and the company is set for a transition to EVs.

10. [Japan M&A] – KKR Launches Still-Too-Light Topcon (7732) Deal

- In December-2024, this deal was mooted and it came out as expected. But the implied growth in management forecasts was higher than expected so the price came in quite light.

- In March when the deal was announced, it seemed like a tough call, but three weeks later Value Act decided they would tender, but would reinvest in the back end.

- The deal is now approved, and launches tomorrow. It gets done, I expect, but it is not a model deal other than being one showing the loopholes available to buyers.